-

ETH attempted a recovery, but a rally could be subdued amid evidence of low demand.

Assessing the impact of surging exchange reserves and the state of exchange flows.

As a seasoned crypto investor with battle scars from more than a few market cycles, I must admit that the recent recovery of Ethereum [ETH] has me cautiously optimistic, but not jumping for joy just yet. The weekend rally was a welcome sight after the massive sell-off last week, but the money flow indicator’s downward reversion in the last 24 hours is a red flag.

Ethereum [ETH] finally managed to recovery slightly from last week’s massive wave of sell pressure.

While it showed a slight improvement over the weekend, indications point towards a potential bumpy road ahead for its recovery this week.

Following a bearish trend at the end of September, the selling pressure for ETH noticeably lessened on Thursday, following a 15% price drop.

Over the weekend, there was a brief period of optimistic market activity, which resulted in a 7% rebound from the lowest points reached the previous week.

At the moment of reporting, Ethereum was being traded at approximately $2477. Notably, its price movement adhered to a rising short-term trendline, marked in yellow. This suggests that there may have been some gathering or accumulation, as the general trend indicates a slight increase so far.

Initially, it might appear that the weekend’s surge in the market is a sign of good health and could point towards further growth in the near future.

In the past 24 hours, ETH‘s Money Flow Indicator has moved downward, implying that there might be a shift in liquidity towards other assets rather than ETH.

As a researcher studying market trends, I hypothesize that the recent market surge could be underpinned by waning demand, as indicated by the MFI. Consequently, this implies that the potential upward momentum for Ethereum might be somewhat restrained.

However, this is subject to changes in supply-demand dynamics during the week.

Will low excitement for ETH hinder its upside?

The results we’ve seen are consistent with a decrease in popularity for Ethereum as a cryptocurrency. This could suggest that, if you’re seeking high short-term profits, Ethereum might not be your optimal choice.

Moreover, it was observed that Ethereum (ETH) exchange reserves experienced a significant surge in the following days. This trend might align with anticipations of increased selling activity.

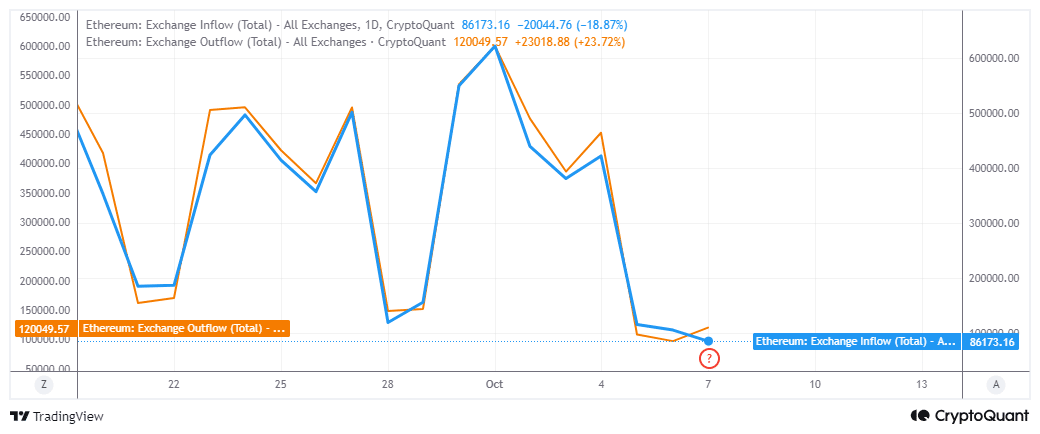

What insights do exchange flows provide regarding the present circumstances? As per CryptoQuant’s analysis, Ethereum’s exchange flows experienced a shift at the beginning of the month, resulting in reduced trading activity.

At the beginning of October, the highest point for Ethereum being sent into exchanges reached approximately 621,000 ETH, whereas the Ethereum transferred out from exchanges was slightly less at around 599,778 ETH.

Moving on to the current situation, the total incoming transactions equaled approximately 86,173 ETH. On the other hand, outgoing transactions surpassed this figure, amounting to more than 120,000 ETH.

In simpler terms, this indicates that the overall request for Ethereum (ETH) amounted to approximately 33,827 units, which is equivalent to around $83.5 million in total value demanded.

Read Ethereum’s [ETH] Price Prediction 2024–2025

From the given information, it appears that Ethereum (ETH) is seeing a demand, though this demand is currently at a moderately small level.

Essentially, the enthusiasm or anticipation for cryptocurrencies was minimal, leading to a possible underwhelming result.

Read More

2024-10-07 21:44