-

There is a high chance that ETH could reach $3,000 or more in the coming days.

ETH’s Open Interest has jumped by 5.5% in the last 24 hours, indicating increased interest from investors.

As a seasoned crypto investor with more than a decade of experience in this volatile yet exciting market, I must say that the recent surge in Ethereum [ETH] has caught my attention. Having weathered multiple bull and bear markets, I’ve learned to read between the lines and interpret the signs correctly.

14th August saw a notable boost in the cryptocurrency market as a whole, with the upward trend stemming from a significant 4.5% increase in the value of Bitcoin [BTC].

In the midst of a rising market sentiment, Ethereum (ETH), the world’s second-largest digital currency, has drawn increased interest from the cryptocurrency community, particularly due to its impressive price increase and recent breakthrough.

Ethereum: Upcoming levels

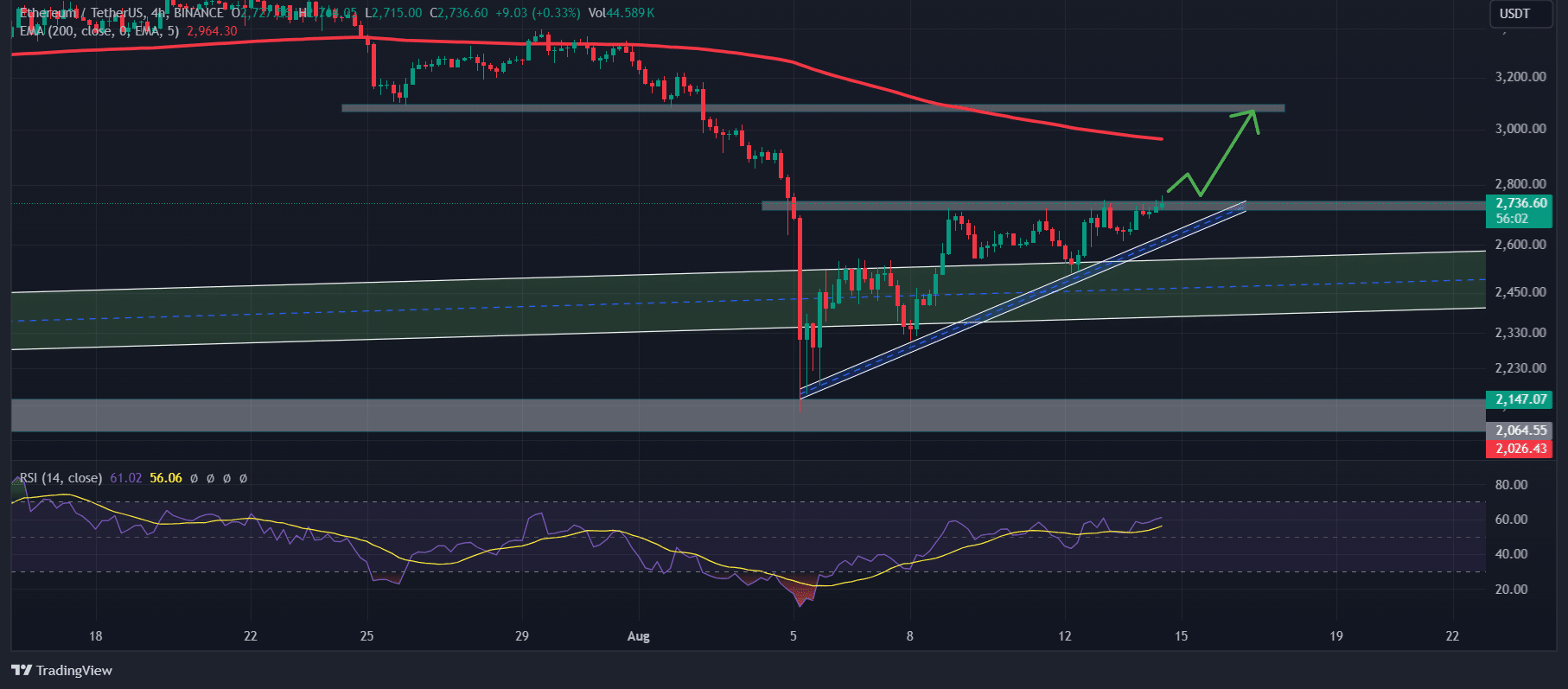

Based on the technical evaluation by experts, Ethereum appears optimistic due to its recent breakout from an ascending triangle pattern within a 4-hour chart.

However, this breakout occurred near a strong support level of a rising trendline.

As a crypto investor looking back at Ethereum’s (ETH) price trends since 2022, I’ve noticed an intriguing pattern: every time ETH has touched this trendline, it’s been followed by a significant upward surge in its value.

Consequently, the recent surge in price has led to an optimistic outlook, and it’s quite likely that Ethereum might touch $3,000 within the near future.

If the bullish momentum continues, it has the potential to hit the $3,200 level.

At this moment, I find Ethereum being traded under its 4-hour Exponential Moving Average (EMA).

ETH’s technical analysis

Over the past day, a 5.5% surge in open positions for Ethereum (ETH) can be observed following the event, signaling growing investor and trader interest.

Currently, Ethereum (ETH) is close to the $2,750 mark, witnessing a significant rise of approximately 4.5% in its value over this timeframe.

Currently, the trading volume has dropped by 24%, indicating a decrease in involvement from both traders and investors.

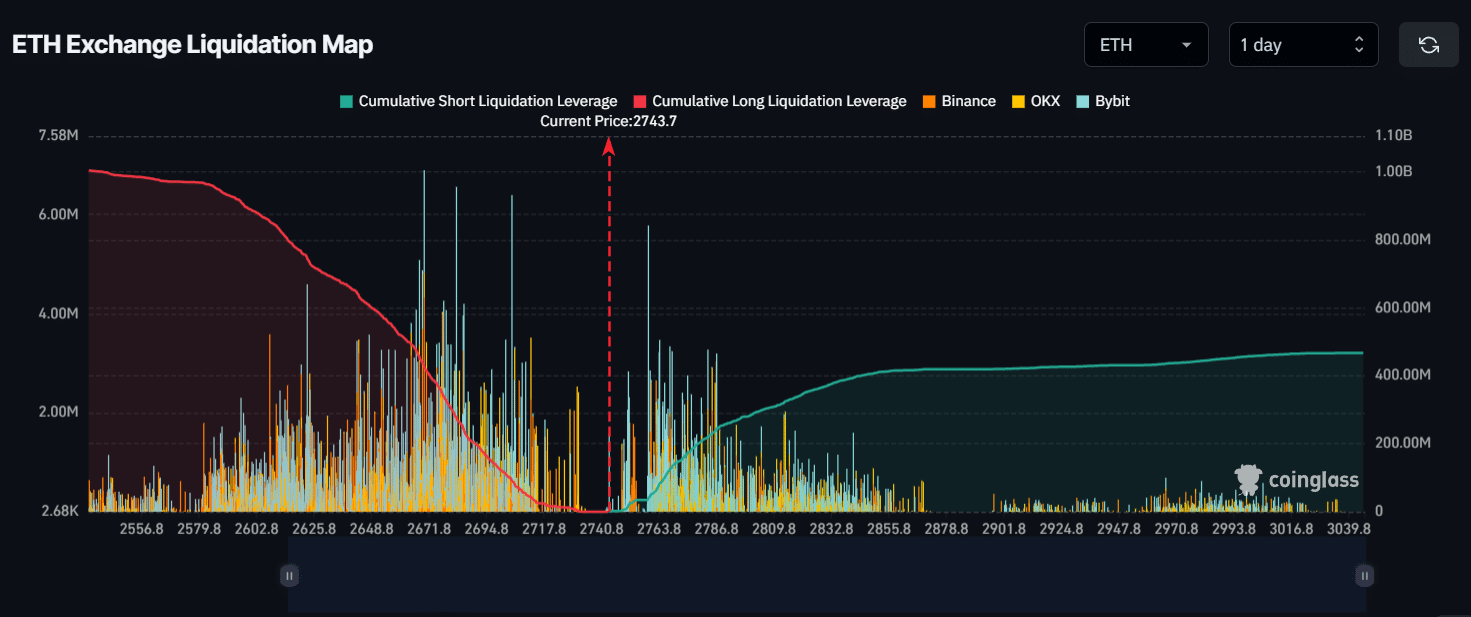

Furthermore, significant support and resistance points were found at approximately $2,670 (lower) and $2,760 (higher), as reported by the cryptocurrency analytics company Coinglass.

Should the optimistic outlook continue and the price climbs up to $2,760, approximately $34.75 million worth of short positions will be closed out.

If the sentiment changes and Ethereum’s (ETH) price drops to approximately $2,670, it could lead to the liquidation of around $430 million worth of long positions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-08-14 15:37