- Ethereum funding rates set to hit 0.015 level

- Altcoin’s on-chain data seemed to point to growing market confidence

As a seasoned analyst with over two decades of experience in the crypto market, I’ve seen my fair share of bull and bear cycles. The current state of Ethereum (ETH) has me intrigued and optimistic, to say the least.

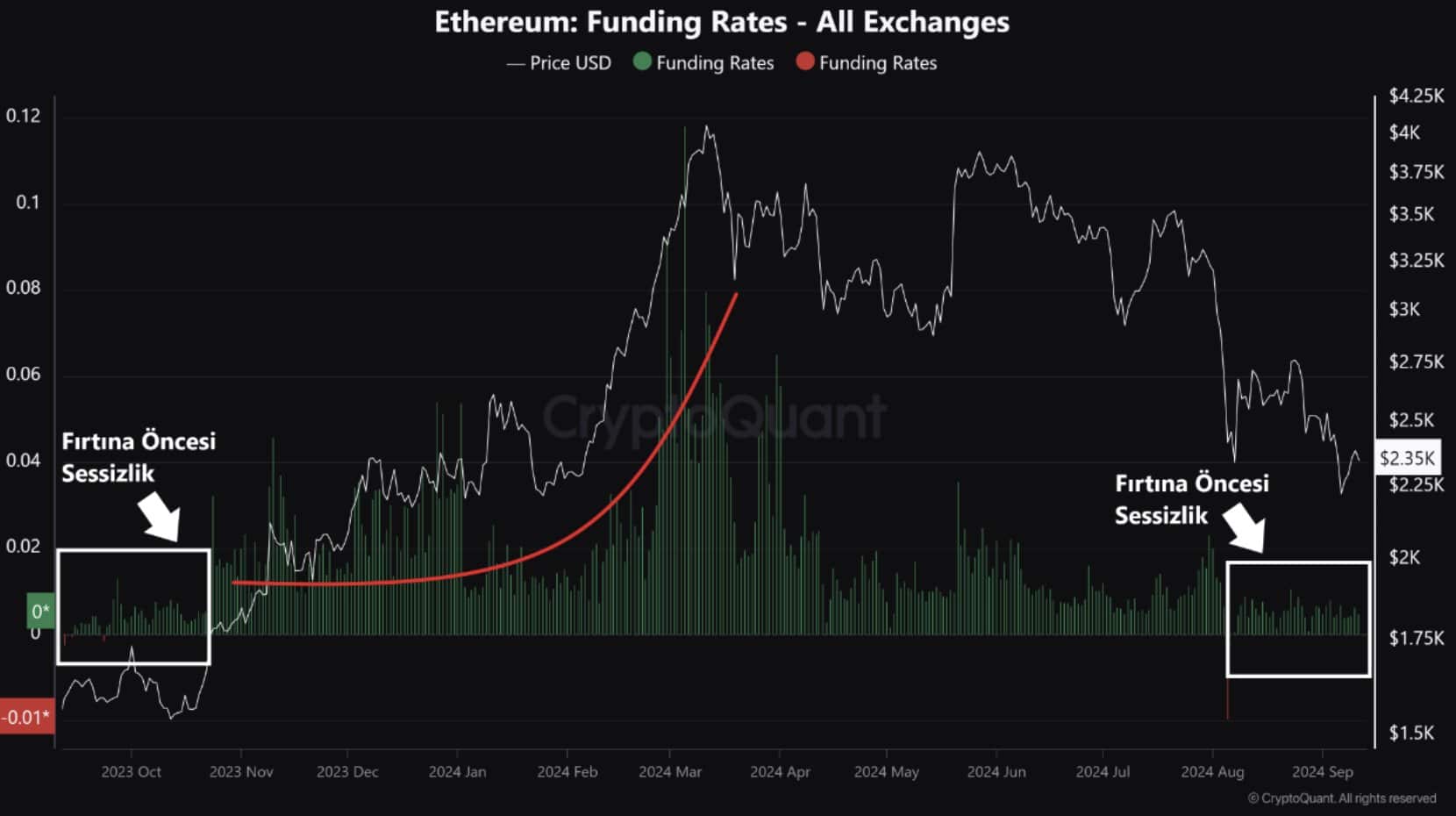

It appears that Ethereum (ETH) could be preparing for an increase in price, as current funding rates suggest a period of tranquility preceding a potential price spike. In the past, when funding rates were relatively low, Ethereum has experienced substantial price rises on its graphs.

Currently, the funding rate for Ethereum is quite low, ranging from 0.002 to 0.005. Historically, such low levels have often been a precursor to price surges.

Should the rate exceed 0.015, akin to its past bull market performances, Ethereum’s value might increase further. In fact, when ETH‘s funding rate reached this level previously, it skyrocketed from $1,500 to $4,000.

As we approach the final three months of this year, there’s a likelihood that the Ethereum market might exhibit substantial activity, similar to patterns observed in past years.

In the anticipated price increase, it’s likely that the Futures market will have a significant impact, as funding rates could serve as a crucial sign to monitor for rising prices.

ETH technical analysis starting to look good

The technical analysis for Ethereum suggests a positive trend. Recently, Ethereum has been contained within a widening triangle shape, and its Relative Strength Index (RSI) shows a robust bullish divergence.

In simpler terms, it appears likely that the value of ETH could reach or even surpass $3,500 to $3,600 in the short term. If Ethereum manages to break past this threshold, there’s a potential for it to climb towards $5,000 within the next few months.

As an analyst, I’m observing a significant pattern in the Ethereum market – it seems to be rebounding from its lower trendline and moving steadily upward. This suggests potential for increased value in Ethereum, especially if current market circumstances align with its historical performance.

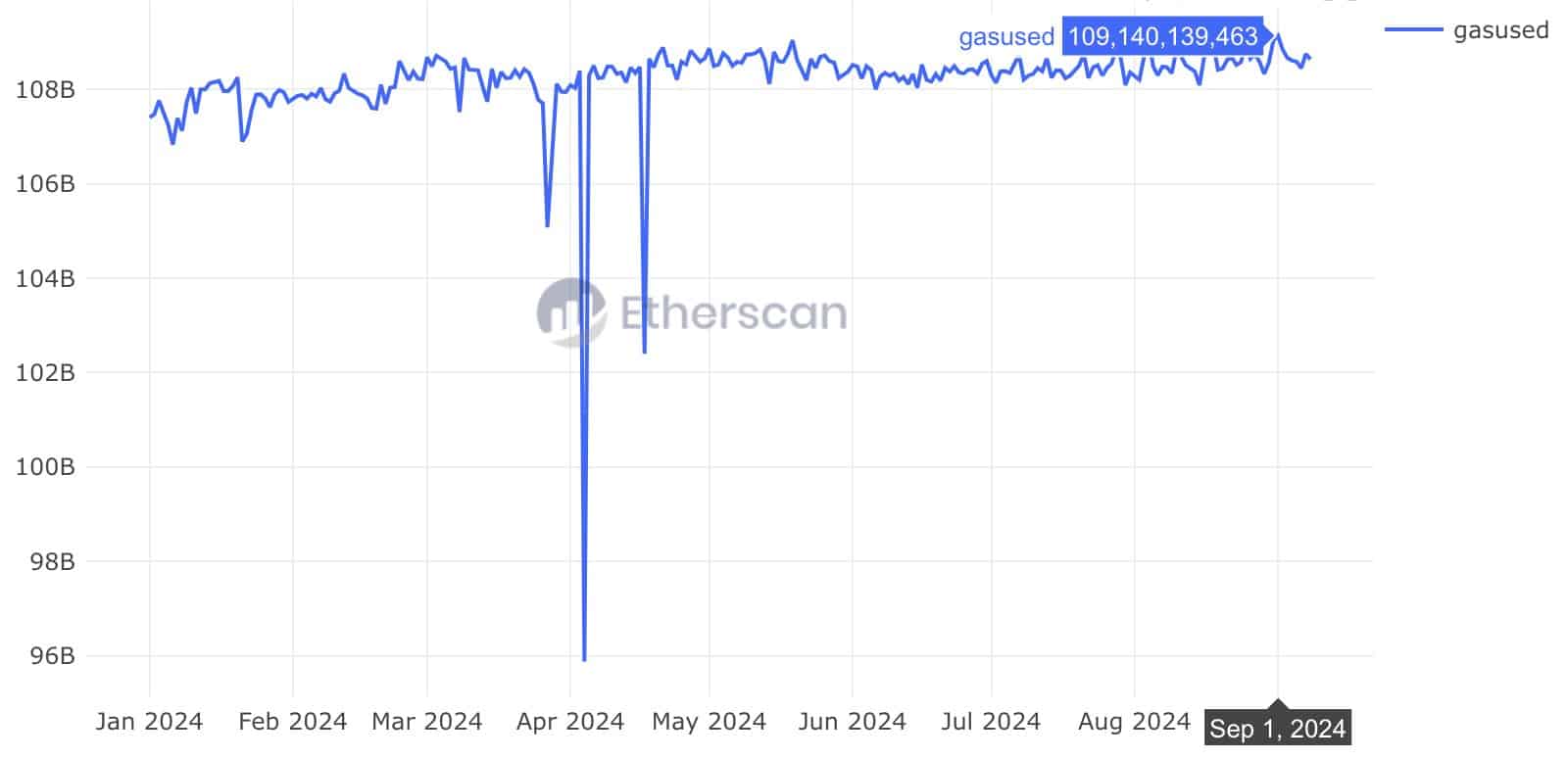

Daily gas usage hits an ATH

The activity within the Ethereum network continues to be robust as well. Notably, on September 1st, daily gas consumption peaked at a record high of 109 billion, even with relatively low gas prices over the past few weeks.

This significant event indicates that Ethereum’s network continues to buzz with activity, contradicting assertions that its relevance is decreasing. In actuality, the elevated gas consumption suggests that the desire for Ethereum persists unabated.

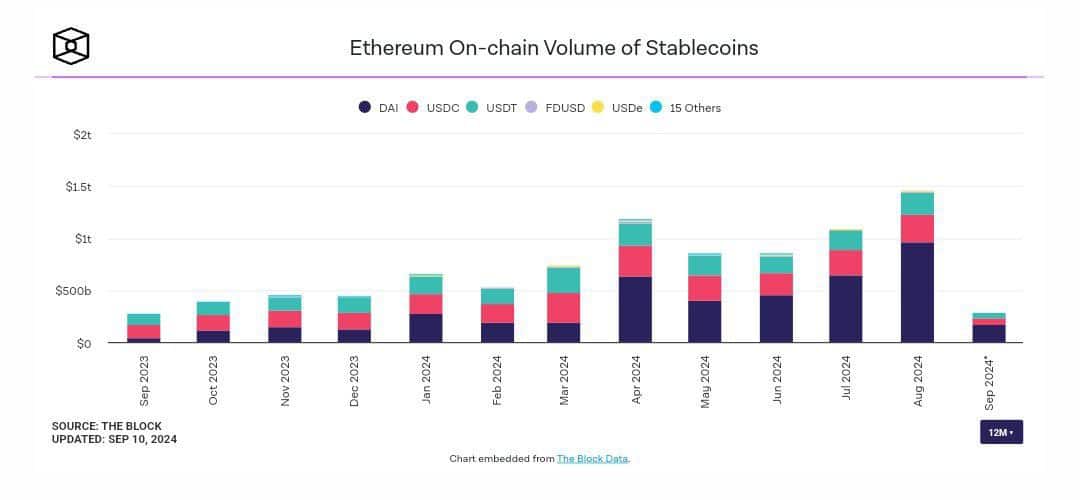

ETH on-chain stablecoin volume hit a record

Besides the amount of gas consumption, the trading volume of Ethereum’s built-in stablecoin has also surged to an all-time high. This volume peaked at a staggering $1.46 trillion, nearly doubling its earlier figure of $650 billion in the first part of this year.

In the stablecoin market, DAI held the top position, handling a massive volume of $960 billion, yet USDT and USDC also maintained their strong presence.

The hike in stablecoin volume is being fueled by greater DeFi demand and the growing involvement of traditional finance. An example is PayPal’s PYUSD, which has now risen to $2.4 billion.

L2 adoption cracking new highs

Lastly, it’s worth noting that the use of Layer 2 (L2) technologies is reaching unprecedented levels, which bodes well for Ethereum’s future development and expansion.

Layer 2 platforms such as Arbitrum, Base, Optimism, and Mantle are significantly boosting Ethereum’s ability to handle more transactions and gaining wider use. This trend strengthens the argument that the value of ETH could increase substantially in the future.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-09-13 09:11