-

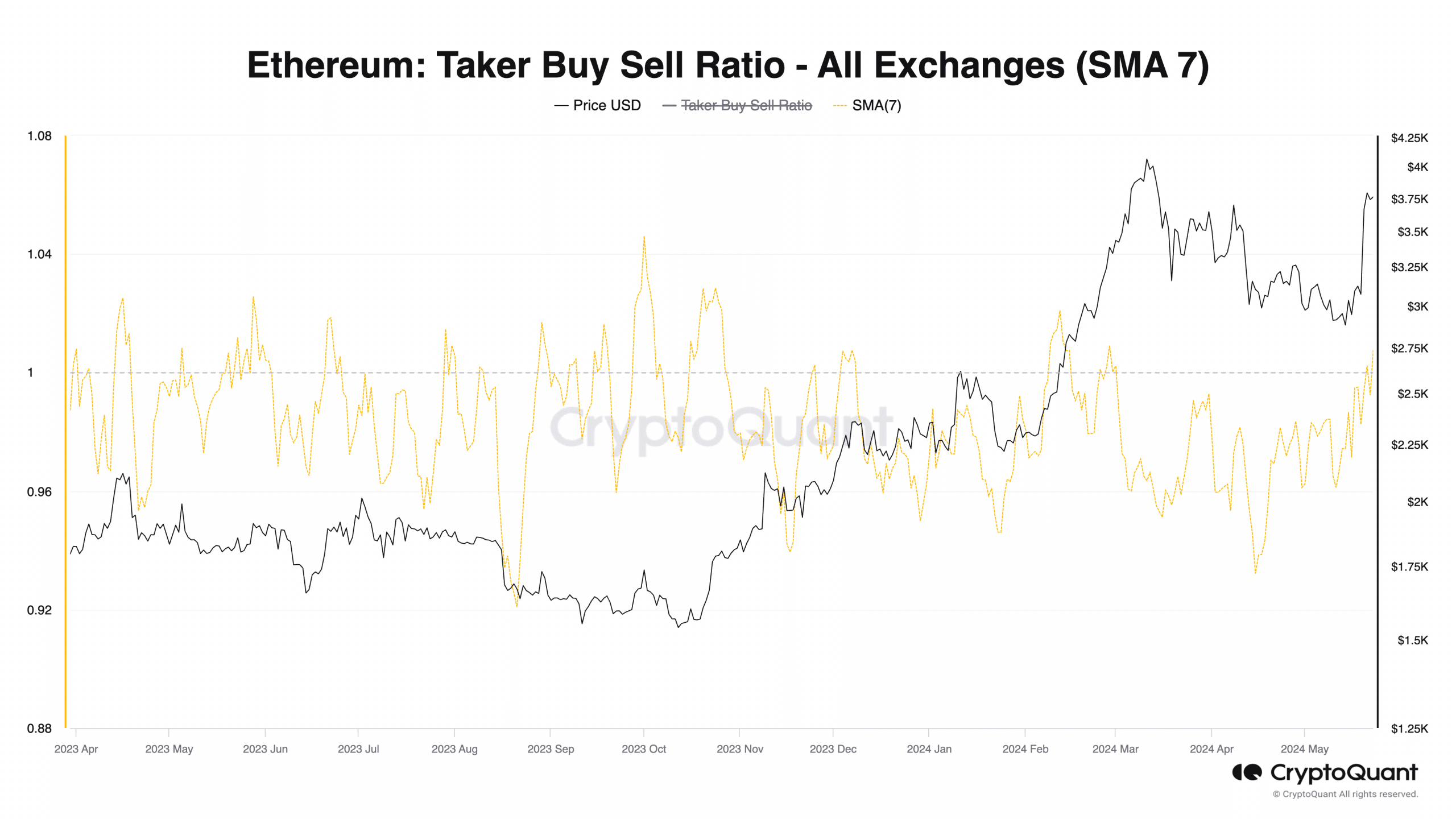

ETH’s Taker Buy Sell Ratio rallied toward 1.

This suggested a decline in selling pressure in its Futures market.

As a seasoned crypto investor with a keen interest in Ethereum’s [ETH] market dynamics, I find the recent trend in its Taker Buy Sell Ratio particularly encouraging. The ratio’s climb toward 1 and subsequent rise above its 7-day simple moving average (SMA) is an indication of reduced selling pressure in ETH’s Futures market. This could be a potential shift in market dynamics, as suggested by CryptoQuant analyst ShayanBTC.

At the present moment, the Taker Buy Sell Ratio of Ethereum‘s [ETH] seven-day moving average (SMA) on CryptoQuant’s platform was about to surpass its one-center line based on their data.

This suggested a decline in sell orders in the coin’s perpetual Futures market.

The Taker Buy Sell Ratio for Ethereum in its Futures market represents the comparison of the amount bought and sold, expressed as volumes.

As a researcher studying market trends, I would interpret a metric approaching 1 or exceeding that value as an indication of higher buying activity compared to selling activity in the market. On the other hand, a metric with a value less than 1 suggests that there is more sell volume than buy volume.

From my analysis as of now, Ethereum’s taker-to-maker buy-sell ratio stands at 0.99, representing a 3% increase compared to the start of the month.

Before making my analysis, I’d like to point out that this metric had been on a downward trend previously. In a recent publication, an anonymous cryptocurrency analyst using the pseudonym ShayanBTC highlighted Ethereum’s Taker Buy-Sell Ratio as a noteworthy observation.

For the past several months, the Ethereum futures market has seen seller activity prevail, as indicated by a persistently low reading below the 1 mark.

The analyst notes that the ratio shifted direction upon the start of the recent Ethereum price surge and has been on an upward trend ever since.

As a crypto investor observing market trends, I’ve noticed an uptick in the Taker Buy Sell Ratio. This could be a sign that market dynamics are changing. If this ratio keeps climbing higher, it might mean less aggressive selling pressure in the market.

ETH is in good hands

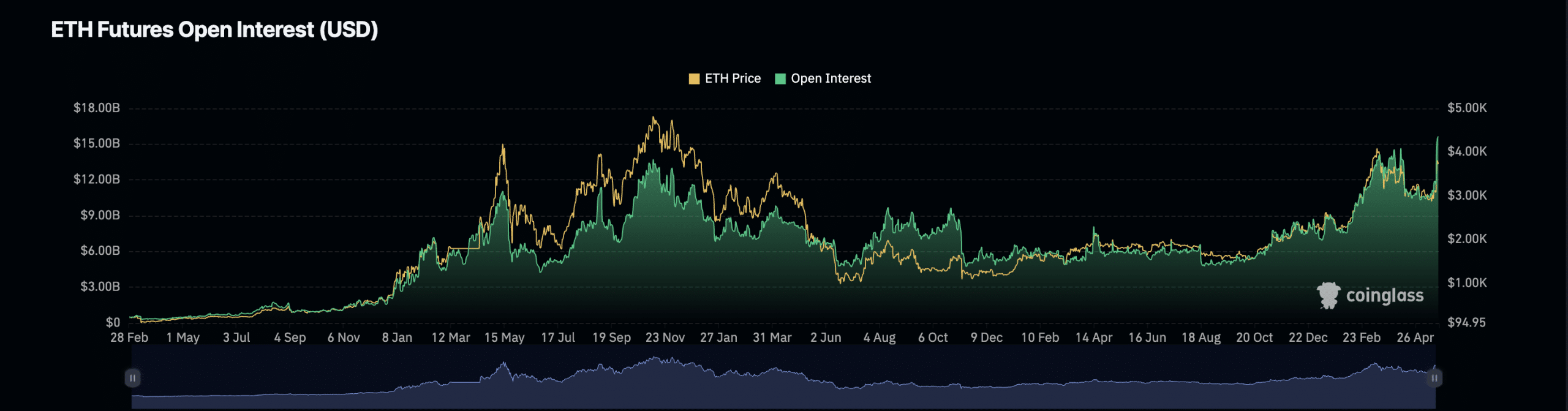

Examining Ethereum’s Futures market more closely reveals that the coin’s price increase may persist. Based on information from Coinglass, Ethereum’s Futures Open Interest has reached a new peak of $16 billion.

The Open Interest for Futures represents the current count of unfilled contracts in the Futures market, indicating the quantity of positions yet to be closed or realized.

When it rises like this, it suggests that more market participants are opening new positions.

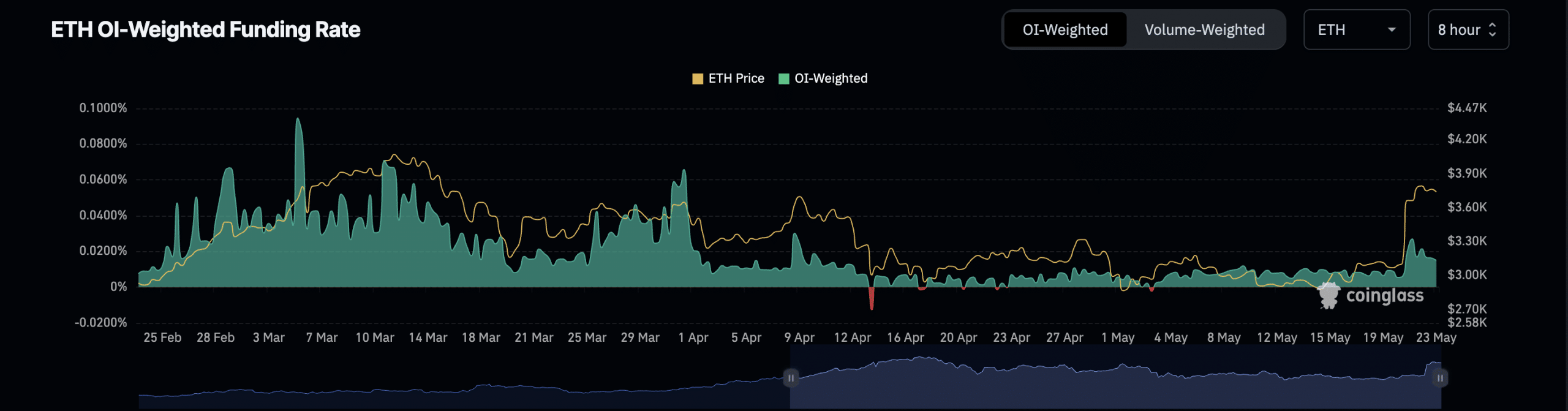

Additionally, the funding rate for the coin has continued to be favorable. This mechanism is employed in perpetual futures agreements to keep the contract’s price aligned with the current market price.

When the funding rates for Ethereum’s futures contracts are positive, it signifies robust interest in holding long positions. This bullish indication suggests that the Ethereum price is likely to keep rising.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-24 00:08