-

ETH dropped below $3k amidst greater outflows from ETFs

Some analysts are now predicting a drop below $2k for the altcoin

As a seasoned researcher with over two decades of experience in the financial markets, I’ve seen my fair share of bull and bear cycles. The recent downtrend in Ethereum (ETH) has caught my attention, given its dramatic drop below $3k amidst greater outflows from ETFs.

Due to significant fluctuations in the cryptocurrency market, particularly Bitcoin‘s instability, altcoins are taking a hit. Amidst this downward trend, Ethereum (ETH) has been hardest hit over the past week, falling below $3k on the charts. This decline has sparked concerns among analysts about potential adverse effects of Spot ETFs on Ethereum since their introduction two weeks ago.

The persistent decrease has led several analysts to foresee a continued drop. To begin with, the founder of Schiff Gold, Peter Schiff, anticipates that ETH could dip below $2k currently. In a post on his official platform, he stated this explicitly.

As a seasoned cryptocurrency investor with over a decade of experience in the market, I can confidently say that Ethereum is currently trading below the $3K mark and it seems only a matter of time before it breaks the $2K barrier. This prediction is based on my observations of the crypto market’s trends and my understanding of Ethereum’s potential for growth. On the other hand, gold has shown a steady increase this week, rising 2%. This upward trend in gold could be a sign of economic uncertainty and instability, which often leads to investors turning towards safe-haven assets like gold. As always, it is essential to stay informed and make investment decisions based on research and analysis rather than emotions.

After ETH experienced a 10.74% decrease over recent months, this pessimism emerged. This is significant because the introduction of Spot ETH ETFs was met with optimism within the community. Yet, these ETFs appear to have had minimal impact on Ethereum’s price as seen on charts.

ETH ETFs’ high outflows

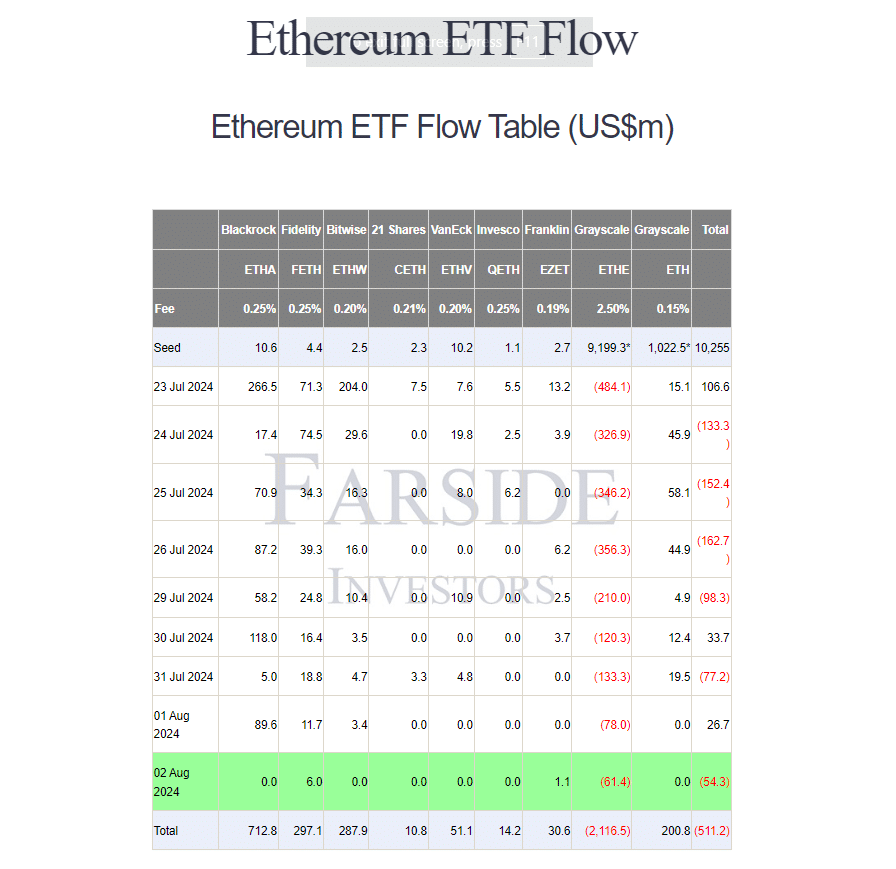

Significantly, since the debut of Spot Bitcoin Exchange-Traded Funds (ETFs) on 25th July, these funds have experienced substantial withdrawals. Specifically, ETHE recorded a peak outflow of approximately $2.1 billion since its launch.

Over the last few days, specifically from August 2nd onwards, I’ve noticed that Ethereum spot ETFs collectively experienced net withdrawals exceeding $54.3 million. This includes the likes of ETHE, which saw a single-day outflow of approximately $61.4 million, while Fidelity and EZET recorded inflows of $6 million and $1 million respectively. In simpler terms, since these products hit the market, there’s been a consistent trend towards investors pulling their funds out, suggesting a degree of caution and perhaps a lack of confidence in these offerings.

Peter Schiff, a known crypto-skeptic, was quick to point this out, adding,

“Ether-based exchange-traded funds (ETFs) have only been active for two weeks, yet they’ve dropped by 15%. These ETFs ended their first full week at record lows. Meanwhile, the price of Bitcoin decreased by 10% during the same period.”

What do the price charts say?

Currently, Ether (ETH) is being exchanged for $2985.86 following a 5.29% drop in its daily value. Over the past month, it has seen a decline of 8.88%. However, there’s some positive news as its trading volume increased by 20.10% within the last day.

As an analyst, I’ve observed a significant downtrend in Ethereum (ETH) based on AMBCrypto’s analysis. At the moment of writing, the Chaikin Money Flow stands at -0.02, suggesting that ETH is closing near the lower end of its daily price range. This indicates a higher level of selling pressure compared to buying pressure, potentially signaling a continuation of the current downtrend.

Furthermore, the MACD (Moving Average Convergence Divergence) was situated below the zero line at -62, suggesting that the short-term Exponential Moving Average (EMA) was falling below the long-term EMA.

These results imply that the market could be experiencing significant bearish trends, as buyers seem to be outnumbered by sellers.

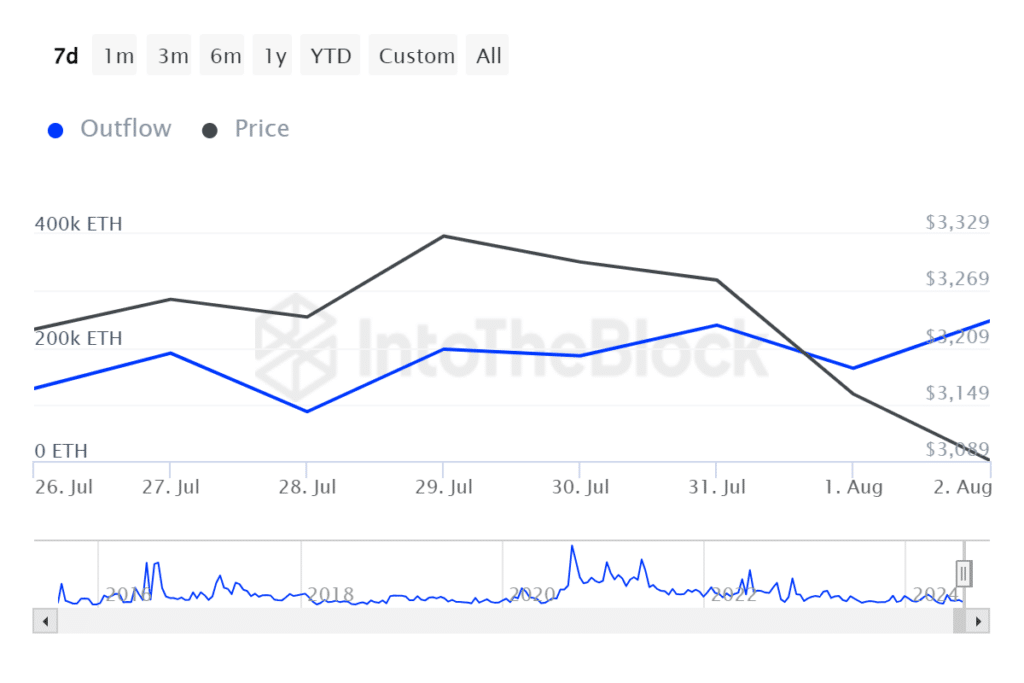

Glancing ahead, data from IntoTheBlock indicates an uptick in the number of large-scale withdrawals in recent times. These outflows surged significantly, rising from a minimum of 127,790 to 246,000.

In simpler terms, a significant number of major investors are unloading their Ethereum tokens, which increases the supply available for purchase and, consequently, puts more pressure on the price to decrease.

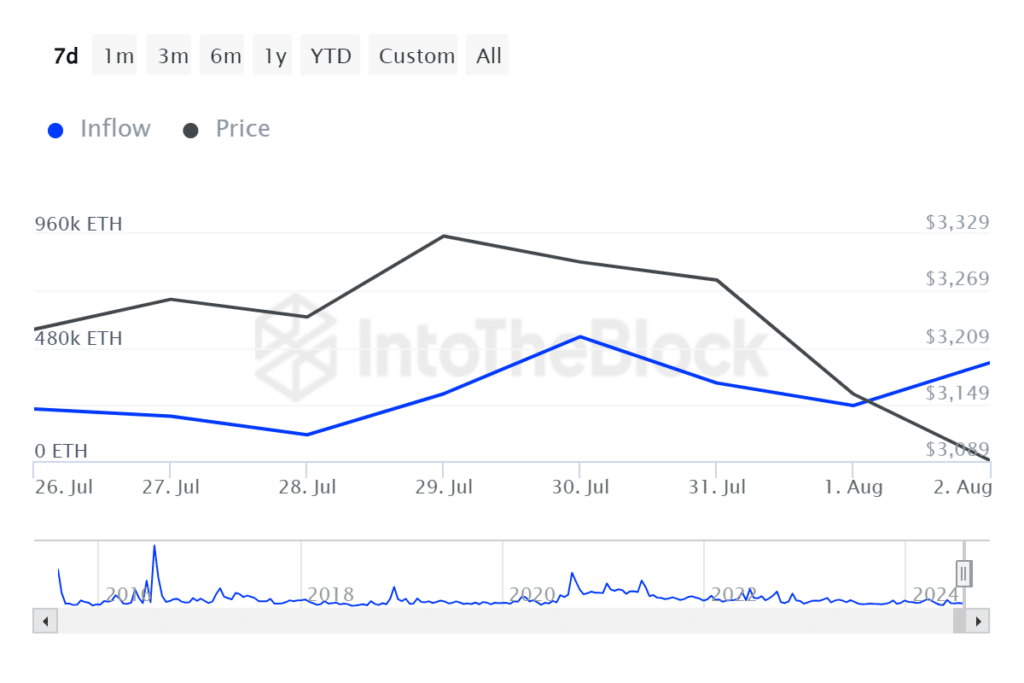

Concurrently, inflows decreased significantly, falling from a peak of 525,820 to a trough of 234,620. This decrease suggests that sellers are in control of the market, which is often interpreted as a bearish indication.

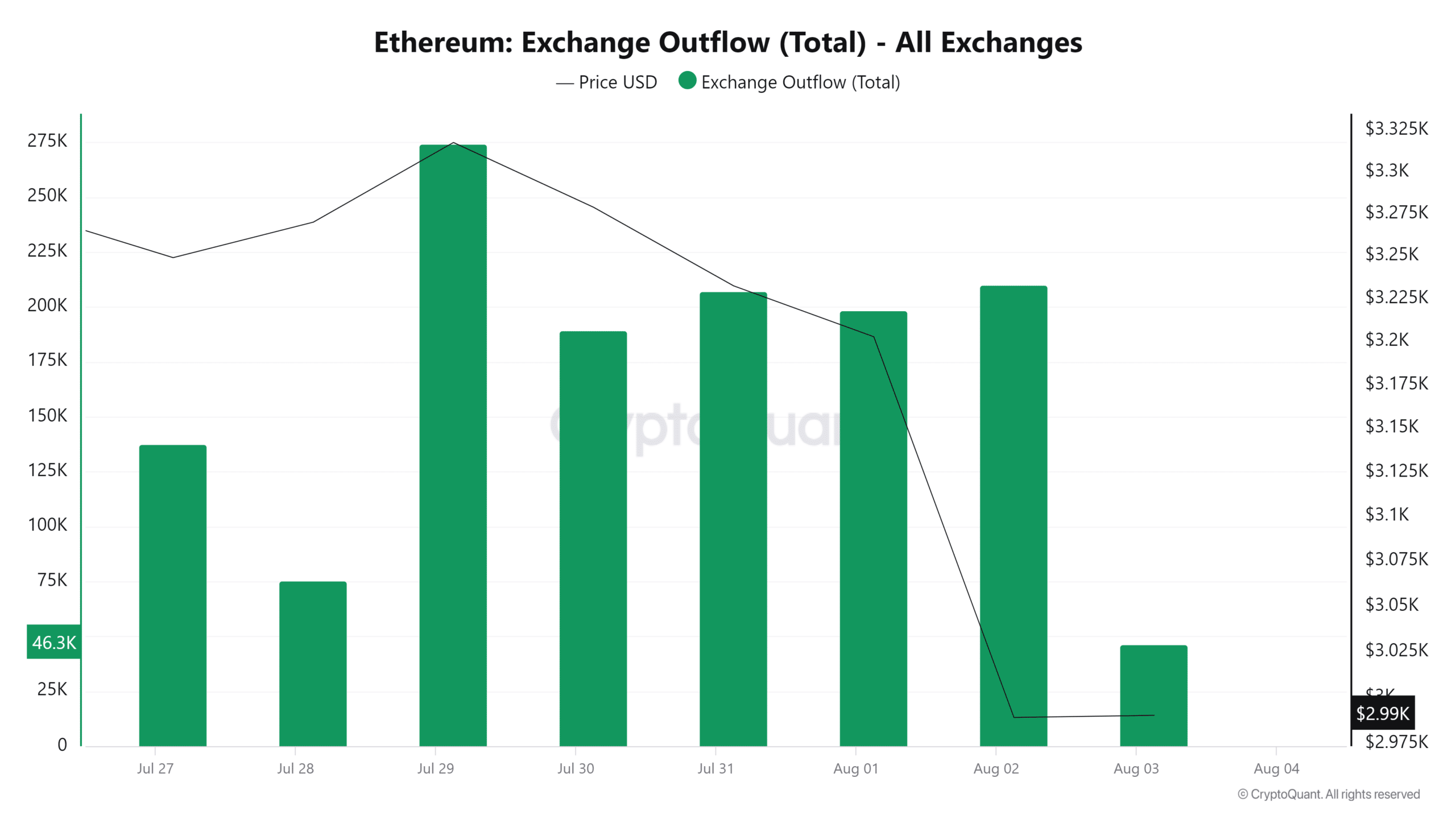

In summary, the decrease in Ethereum (ETH) outflows from exchanges indicates less investor confidence that the price will surge significantly in the near future.

Given the current market trends and circumstances, it’s likely that Ethereum (ETH) might drop to a crucial support point approximately $2810.87. Previously, testing at this level has often led Ethereum’s value to rise to around $3560.

Similarly to how Bitcoin dropped when ETFs were introduced initially, it’s possible that ETH will follow a similar trend and recover afterwards.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-04 01:12