-

Analyst claims ETH will eclipse BTC in crypto summer.

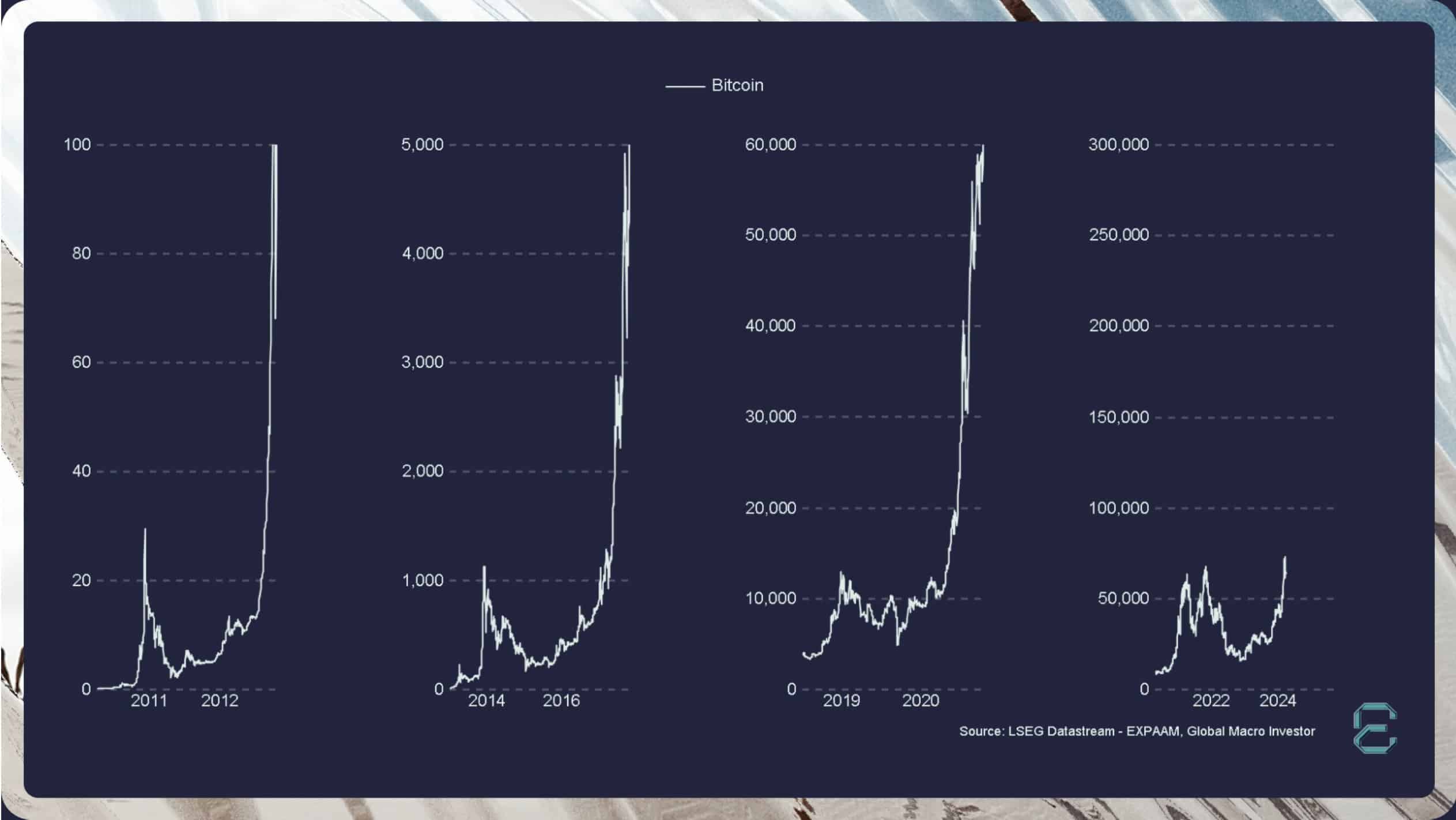

The US liquidity injection could boost the market in the second half 2024.

As an experienced financial analyst, I believe that Ethereum [ETH] has a strong chance of surpassing Bitcoin [BTC] in terms of market dominance during the upcoming crypto summer season. This projection is based on historical trends, but it’s essential to note that past performance does not always dictate future outcomes.

According to Raoul Pal, the founder of Real Vision and a well-known commentator in the crypto market, Ethereum [ETH] might surpass Bitcoin [BTC] in significance as we approach crypto summer.

In an X post, Pal underscored that crypto summer is an altcoin season that shifts attention from Bitcoin to others. Part of his post read,

During the Crypto Summer, which marks the beginning of the altcoin season, things really heat up and become quite exciting, reaching a peak of bubble-like conditions in the fall. It’s during this time that Ethereum starts to surpass Bitcoin in terms of performance, while Solana significantly outperforms both Ethereum and Bitcoin.

Adding a timeline to his projection and how “crazy” things can get, Pal highlighted that,

After the markets have recovered, around this time is typically when The Banana Zone becomes active, peaking with intense activity towards the end of the year and continuing strong into 2025.

The US liquidity factor

Expert: Pal’s prediction is solely reliant on historical trends. Nevertheless, it’s important to remember that past events don’t automatically determine future occurrences. Therefore, what might serve as the significant trigger for Pal’s audacious forecast?

As a researcher studying market trends, I would express it this way: One plausible contributor to the current market dynamics is the easing monetary policy front, specifically the US’s liquidity injections. According to QCP, a leading crypto trading firm based in Singapore, such actions could significantly impact markets.

During our recent weekend update on Telegram, we acknowledged the persisting high inflation rates in the US. Nevertheless, we remain optimistic that the US Treasury will introduce additional liquidity into the market in the second half of the year.

At the current stage, the impact of monetary policy may be overshadowed by fiscal policy. This is because fiscal policy, through government spending and taxation, holds greater influence over liquidity and asset market trends.

The firm added that,

As a researcher studying financial markets, I would express it this way: “The upcoming Quarterly Refunding Announcement (QRA) on May 1st may lead to larger issuances of short-term US bills. Consequently, the Reverse Repurchase Agreement (RRP) pool, which currently holds approximately USD 400 billion, will experience a significant reduction. This decrease in RRP holdings could boost liquidity within the financial system.”

As a researcher studying financial markets, I’ve come across an interesting perspective from Arthur Hayes, the founder of BitMEX. Last week, he shared his prediction about the upcoming US elections. According to him, there will be increased liquidity injected into the economy during this period.

Having more liquidity available translates to an increase in the overall funds circulating in global or local financial markets. Central banks reducing interest rates contributes significantly to this condition. In turn, this environment becomes favorable for riskier investments to surge ahead.

It’s yet uncertain if Ethereum will surpass Bitcoin in terms of performance. A significant portion of the recent crypto market surge might be attributed to external factors rather than traditional market cycles.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-04-30 10:15