- Ethereum’s bullish structure hinges on holding the critical support level at $1,721.40.

- Large investors shift to Ethereum ETFs, boosting transaction volumes and market interest.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I find myself cautiously optimistic about Ethereum (ETH) at this juncture. The recent price action has been intriguing, to say the least, with ETH retesting key support levels and showing signs of resilience.

Ethereum [ETH] has experienced a price decline of 3.60% over the past seven days, underperforming the global crypto market, which saw a modest increase of 0.70%.

As of now, Ethereum was being traded at $3,316.71 per unit, having exchanged hands for a total of $13,185,794,355 within the past 24 hours. This represents a decrease of 0.73% over the same period.

Ethereum: Key support and resistance levels

In simpler terms, the crucial price point for Ethereum, where it might find strong resistance to falling further, is approximately $1,721.40. This figure corresponds to a significant Fibonacci retracement level and is essential in preserving the overall positive trend of the market.

As someone who has closely followed the cryptocurrency market over the past few years, I believe that a key resistance level to keep an eye on is at $3,600.00 for Ethereum (ETH). With my personal experience of trading and analyzing various assets, I can confidently say that a break above this resistance could potentially pave the way for ETH to reach its all-time high of $4,867.81. This represents a significant opportunity for potential gains, given the current market conditions and the overall trend of the cryptocurrency market. Keeping this in mind, I would strongly recommend keeping a close eye on this level and being prepared to make strategic moves if the price breaks above it.

In simpler terms, Ethereum’s price movement recently tested a range between $2,896.74 and $3,036.62 (known as the Fair Value Gap), which led to a significant surge of approximately 20.42%.

Despite reaching the weekly resistance point of $3,545.90, the price experienced a decline of 7.62%, dropping to $3,086.13. Notably, the FVG aligns with the 50% Fibonacci retracement level, creating a strong support area.

If this level holds, there is potential for a 57.87% rally to retest the all-time high.

As a researcher examining financial markets, I observe that at this moment, the Relative Strength Index (RSI) on my weekly chart surpasses the neutral level of 50. This suggests a bullish trend, as prices are climbing higher than their average. Furthermore, the Awesome Oscillator (AO) shows positive values above zero, implying a predominantly optimistic market sentiment.

If Ethereum holds its present position without dipping beneath significant support thresholds, these signs point towards an ongoing upward momentum.

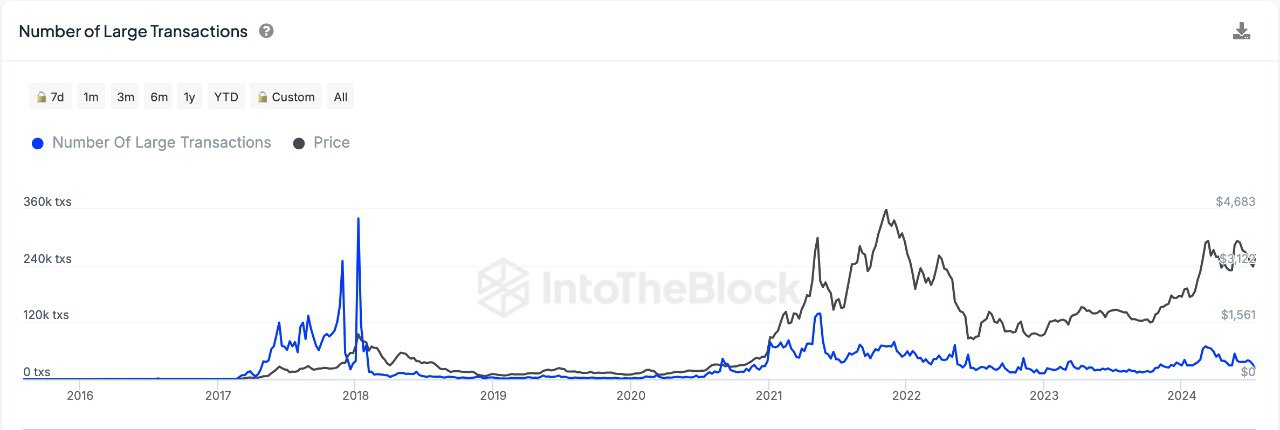

Whale activity and ETF influence

It appears that Ethereum is experiencing a significant increase in larger transaction amounts, which suggests more active participation from high-value investors, often known as “whales.” This trend might be connected to the recent introduction of ETH Exchange Traded Funds (ETFs).

As an analyst, it seems that large-scale investors are noticeably engaging in active trading of Ethereum, potentially transitioning their involvement from direct blockchain interactions towards Ethereum Exchange Traded Funds (ETFs).

This movement suggests a preference for the regulated and potentially more accessible investment vehicle provided by ETFs.

As reported by DefiLlama, a combined worth of approximately $59.414 billion is currently locked in the Ethereum network, showcasing the overall hustle and worth within the Ethereum system. Meanwhile, the market cap for stablecoins existing on Ethereum amounts to around $78.742 billion.

Read Ethereum (ETH) Price Prediction 2024-25

In the past 24 hours, ETH generated $3.61 million in fees and $2.29 million in revenue.

To add to that, we saw a significant level of user interaction over the past day, with a total of 368,579 active addresses.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

2024-07-31 19:04