- TVL and stablecoin market cap inflows indicate a confidence uptick.

- Ethereum could be on the verge of a DeFi revival after weeks of declining demand.

As a seasoned analyst with years of experience navigating the tumultuous seas of the cryptocurrency market, I find myself intrigued by the recent developments in Ethereum [ETH]. The TVL and stablecoin market cap inflows indicate a confidence uptick, which could be a sign that Ethereum is on the verge of a DeFi revival after weeks of declining demand.

Over the past few months, the level of activity on the Ethereum network has significantly decreased, mirroring the current state of DeFi markets where demand is relatively low.

Historically, Ethereum’s network has shown high levels of activity and involvement within its Decentralized Finance (DeFi) environment, particularly when the market is on an upward trend.

Has the market, up until now, demonstrated a bullish trend during this week, propelled by rate cut announcements? Will these moves stimulate renewed curiosity within the Ethereum Decentralized Finance (DeFi) sphere?

To date, the Ethereum network has shown signs of revival as indicated by its active usage. The capitalization of its stablecoin market could provide a useful insight into the current state of affairs.

The value of Ethereum’s stablecoin reached a high of approximately $82.154 billion in April, but it has been decreasing since then. At the beginning of August, it hit a low of $78.20 billion. However, it has shown some recovery and currently stands at around $83.84 billion as of the latest update.

The value locked (TVL) on Ethereum dropped significantly from its $66.91 billion high in June to below $43 billion at one point, but it’s now rebounded to approximately $47.79 billion. This recent increase suggests that investors may be regaining faith in the Ethereum network once more.

Is Ethereum out of the woods yet?

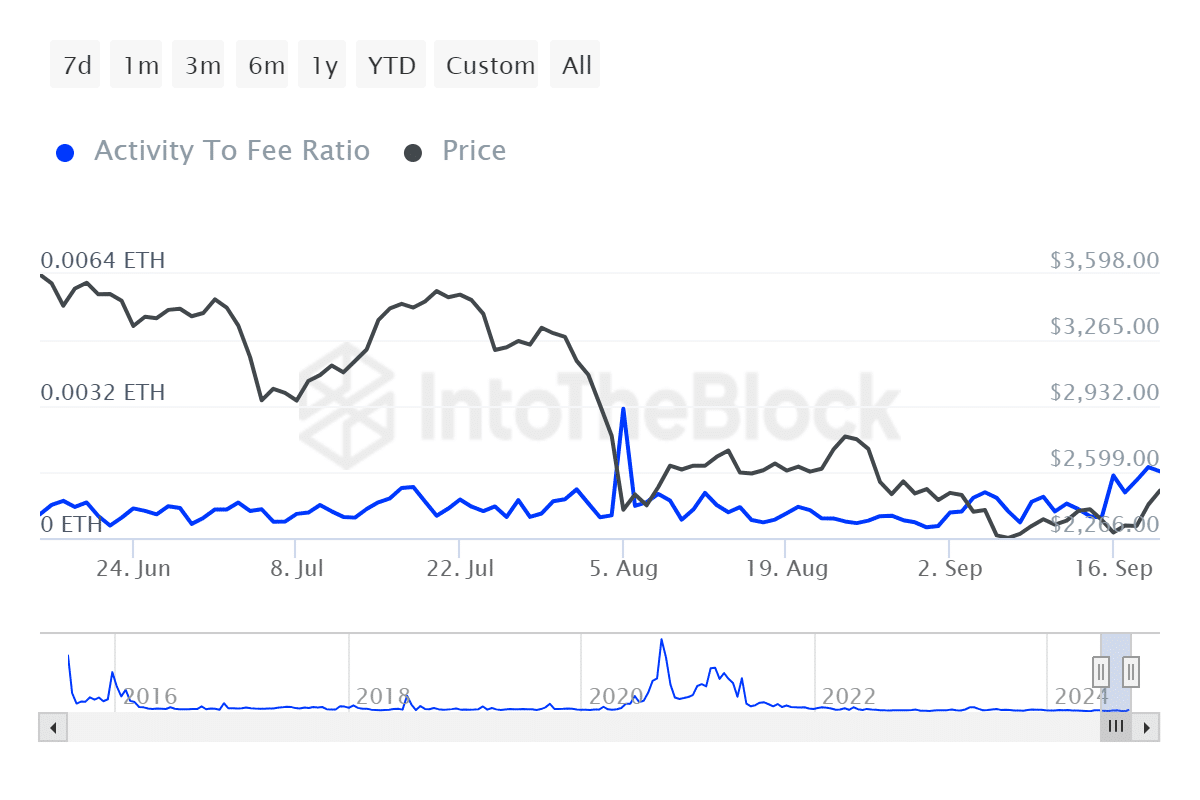

Since mid-September, there has been a significant increase in Ethereum’s network fee to transaction ratio. This is the second most substantial rise in this metric we’ve seen over the past three months. It underscores the fact that fees are on the rise due to an uptick in network activity.

This spike indicates a connection between Ethereum’s recent rise in value and a more positive atmosphere in the cryptocurrency market overall. However, it might not accurately reflect the functioning of Ethereum’s decentralized finance (DeFi) system.

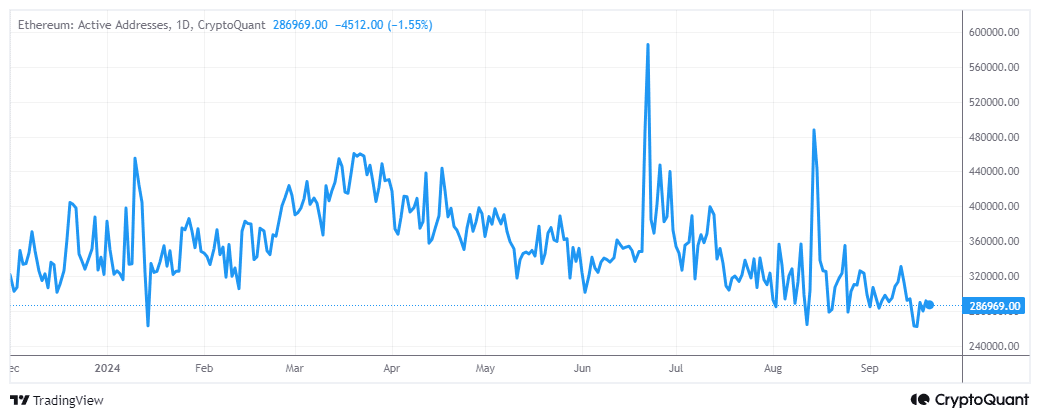

Despite some enhancements evident in the Ethereum system, it’s clear that there are areas needing further development. To illustrate this, let me point out that the number of active Ethereum accounts remains relatively close to its year-to-date minimum levels.

Essentially, even though there’s been an increase in network activity recently, overall excitement or hype about it remains relatively low. This could potentially lead to unfavorable movements in the price of Ethereum. For instance, as per recent assessments, both whales and institutions appear to be pessimistic regarding Ethereum.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The study indicates that the surge in ETH prices lately is primarily driven by retail interest. This could potentially mean that the current price increase might not last, particularly if big investors maintain their bearish stance for an extended period.

Also, it may take weeks or months for robust liquidity to flow back into the crypto market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-09-21 22:15