As a seasoned researcher with over a decade of experience in the cryptocurrency market, I find myself constantly intrigued by the dynamic nature of Ethereum [ETH]. The latest data suggests that ETH is leading the pack in active addresses with a 43% dominance, and it has surged by 3.74% over the past week.

After reaching its lowest point at $2,379, Ethereum [ETH] has shown substantial price increases as depicted on the charts.

The altcoin has also attempted to clear the previous losses to reach a high of $2721.

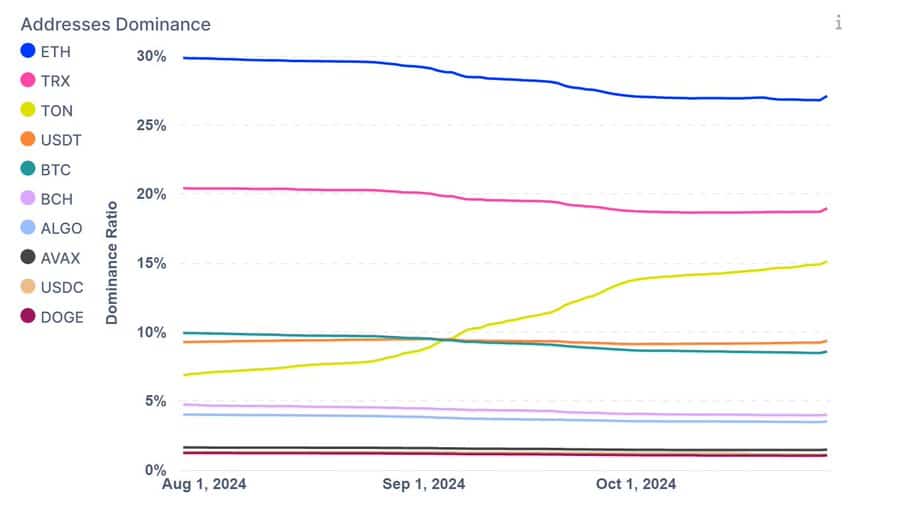

Based on data from IntoTheBlock, the current upward trend might be fueled by a rise in on-chain transactions. Consequently, Ethereum (ETH) has experienced a significant growth in participating addresses, outperforming many other alternative cryptocurrencies.

Ethereum leads in active addresses

Based on data from IntoTheBlock, Ethereum currently has the highest share of significant addresses in the cryptocurrency space. This means it has a dominant 43% lead over other altcoins when it comes to active user addresses.

In the midst of expansion, Tron holds the second spot with a 27% control over addresses, indicating an increasing number of users adopting the platform.

Other coins like Tether’s USDT and Toncoin follow with significant engagement in transactions.

The strength of Ethereum’s network activity and widespread adoption serves as a foundation for future price increases, mirroring a pattern where prices tend to rise as market foundations solidify.

The examination shows that at present, Ethereum is seeing the highest level of activity across decentralized applications (dApps), DeFi, and Non-Fungible Tokens (NFTs). This activity implies a continuous desire and curiosity among users.

Can ETH finally rally?

Typically, an increase in active Ethereum addresses tends to push up its value. Over the last seven days, this trend has been evident. Given this pattern, the current market circumstances might pave the way for further price increases in Ethereum.

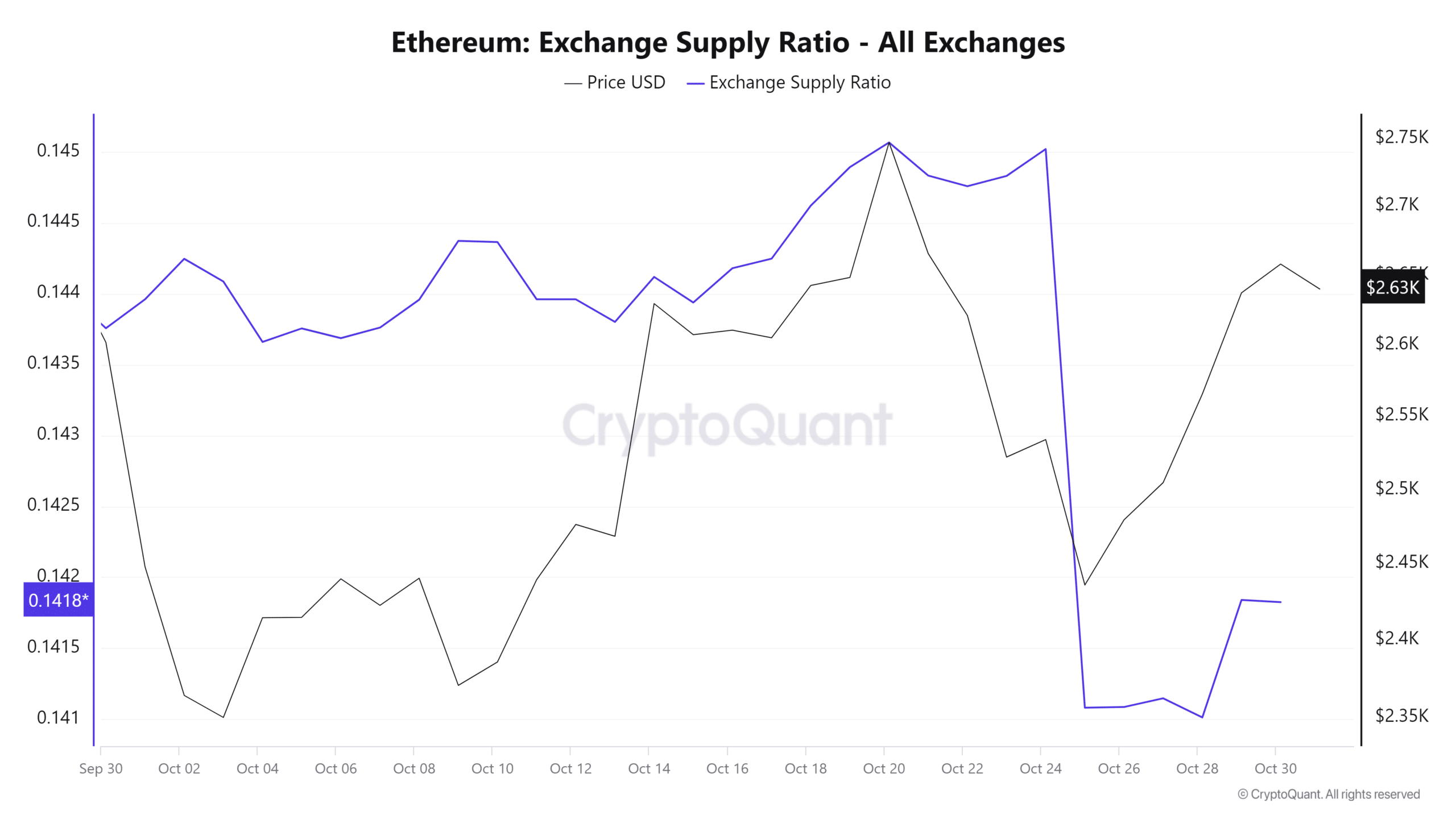

To begin with, the Exchange Ratio for Ethereum reached a monthly low last week, decreasing from a peak of 0.145 to 0.141. This decrease indicates an increase in accumulation by investors.

As a result, investors are transferring their funds from digital platforms into offline storage (cold wallets), which suggests increased faith in the market.

Additionally, Ethereum’s MVRV Long/Short difference has remained negative over the past week.

Holding onto an altcoin over a long period suggests confidence in its future, and it also indicates that the ‘accumulation’ stage has begun.

What next for Ethereum

According to AMBCrypto’s analysis, Ethereum was currently building a strong upward momentum.

This strong uptrend is evidenced by a declining ADX, while +DI had increased to 26.

As I pen this analysis, Ethereum is currently being transacted at approximately $2643 – a noteworthy 3.74% growth compared to its value a week ago.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Just as anticipated, an increase in active Ethereum addresses indicates growing interest in the altcoin. If this trend persists and bolsters its underlying strengths, it’s likely that Ethereum will see further price increases.

Given its robust upward trajectory, Ethereum seems poised to test the $2800 resistance barrier.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-11-01 05:12