- Ethereum is repeating 2016 pattern.

- Geopolitical tensions impact the broader crypto market.

As an analyst with over two decades of experience in the financial markets, I must say that Ethereum’s current trajectory seems eerily reminiscent of its 2016 pattern. This is a red flag for me, as it suggests a possible bearish turn in Q4 of this year.

⚡ URGENT: Trump's Tariff Threats Shake EUR/USD Forecasts!

Will the euro survive the next Trump move? Find out the latest analysis now!

View Urgent ForecastAs we enter the final quarter of the year, Ethereum [ETH] is sending ambiguous signs. Typically, a bullish end in September signals favorable market activity, yet Ethereum appears to be taking a distinct path.

In simple terms, Ethereum ended up with gains in September and seems to be mirroring its behavior from 2016. This could suggest a possible downturn for Q4 this year. If this trend persists, Q4 might experience a drop, followed by an improvement in the first quarter of 2025.

The changing value of Ethereum is fascinating, as it’s important to keep an eye on its past patterns to determine if it strays from established trends.

Whales taking profit and unstaking

The current trend in Ethereum’s pricing seems to follow the path it took in 2016, hinting at a potential downturn in the last quarter of this year. This prediction is strengthened by significant investors, often referred to as “whales,” who are withdrawing their ETH and locking in their profits.

As an analyst, I’ve noticed a significant movement within the Ethereum ecosystem. Specifically, a whale has decided to liquidate a substantial portion of their ETH holdings, transferring 29,480 ETH to Coinbase. This action, based on current market prices, appears to have netted them a profit exceeding $2 million.

Such conduct generally hints at major participants foreseeing a decline, thereby heightening the chances of a negative Q4 for Ethereum. These moves exert strain on Ethereum’s value, as investors keenly observe for any signs of drops.

ETH ETF flow and market movements

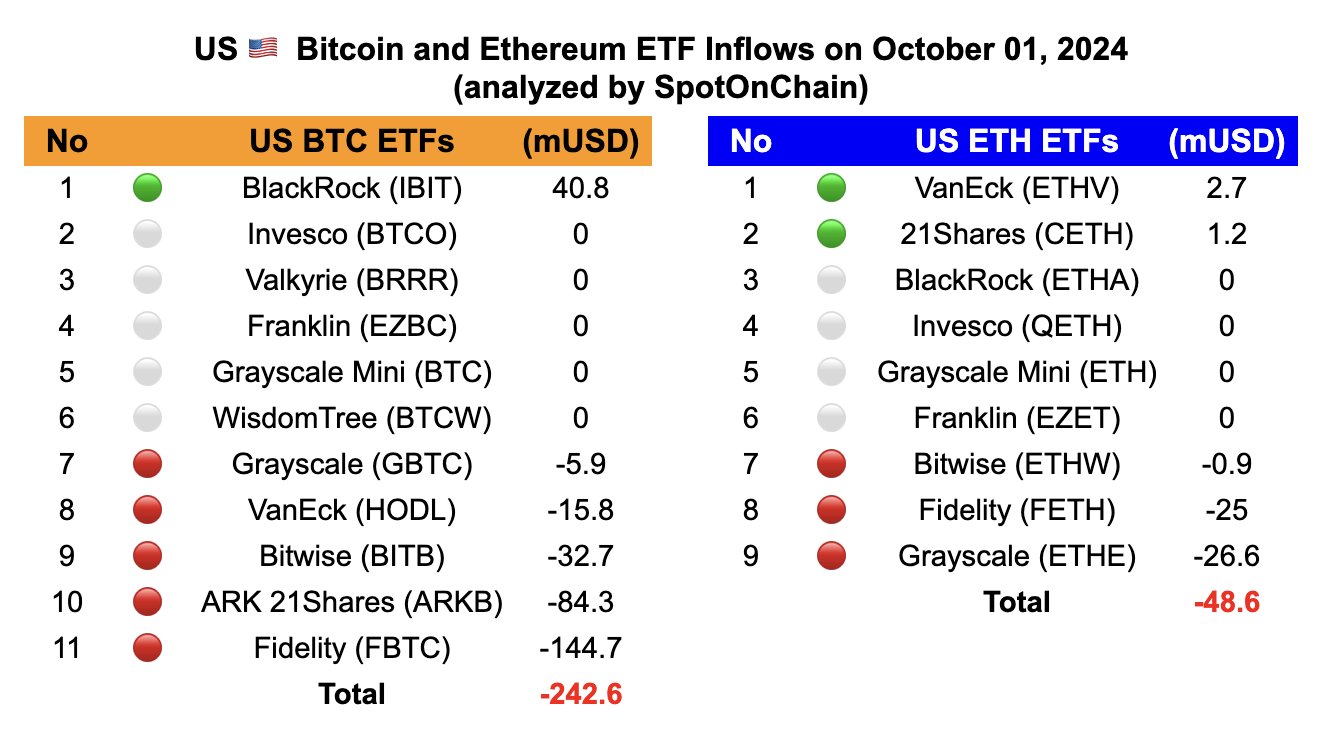

The flow of funds from Ethereum’s exchange-traded funds (ETFs) has significantly decreased as well, adding to a more reserved perspective. From September 3 onwards, the market has witnessed its largest collective outflows for Bitcoin (BTC) and Ethereum ETFs.

In simpler terms, a total of $48.6 million was withdrawn from Exchange Traded Funds (ETFs) tied to Ethereum (ETH), with significant withdrawals observed from prominent players such as Grayscale and Fidelity. While some smaller ETFs attracted investments, these inflows were not enough to counteract the overall trend of investors pulling their money out.

It seems like institutional investors could be preparing for a possible drop in the value of Ethereum during Q4, aligning with the general market’s pessimistic outlook.

Geopolitical tensions impacting prices

The unresolved conflicts in the Middle East have had ripple effects on the global cryptocurrency market as well, impacting not only Bitcoin but also Ethereum. In fact, both Bitcoin and Ethereum saw significant drops, with Ethereum’s value dipping below $2,500.

Over just the last day, a staggering 155,000 trading accounts were closed, resulting in a massive $533 million being withdrawn. Notably, around $451 million of this total was due to long positions.

The liquidation events, particularly within Ethereum, provide more supporting data for the theory that Ethereum could potentially resemble its 2016 trend by experiencing a quarter with decreased value in Q4.

Considering the patterns in whale activities, the trends in ETF withdrawals, and the escalating geopolitical pressures, it seems likely that Ethereum could encounter some difficulties in the last quarter of this year.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As a crypto investor, I’ve been observing the steady growth of Ethereum (ETH), but I can’t help but notice some patterns from its past performance and current market trends. These indicators suggest that ETH might face a dip in the near future. However, if these signs hold true, it could bounce back strongly in early 2025 for potential recovery.

As an analyst, I advise maintaining a watchful eye on upcoming trends regarding ETH, as deviations from the current pattern might unveil potential risks and prospects for this cryptocurrency over the coming months. It’s essential to stay vigilant and ready to adapt strategies accordingly.

Read More

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-10-02 19:04