- Ethereum to potentially go back to being deflationary next year.

- ETH/BTC has been experiencing some fluctuations.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, and I must say that the Ethereum [ETH] story is one that piques my interest. The recent rate cut has led to a significant slowdown in the growth of ETH’s supply, potentially setting the stage for it to become deflationary by early 2025.

Over the past six months, the Ethereum [ETH] supply has been increasing by approximately 60,000 ETH each month. But after the recent reduction in interest rates by 50 basis points, this growth rate has decreased substantially, now ranging between 30,000 and 40,000 ETH per month.

Should the current trend persist, Ethereum’s supply may once again become scarce (deflationary) as early as 2025, preceding even its pre-merge levels. With additional reductions in interest rates on the horizon, inflation could decrease even more, potentially paving the way for future price increases.

The amount of Ethereum available significantly impacts its market behavior. After the recent reduction, it’s been observed that the inflation rate for Ethereum has decreased, implying that the current supply might return to its pre-merger amounts by the year 2025.

The shift towards deflation might spur higher interest in Ethereum (ETH), given that the monetary policies are still developing and changing.

With lower interest rates, there could be a rise in people and investors turning towards Ethereum’s network. This increase in interest might lead to a surge in overall demand, which could in turn drive the price upwards.

A decrease in the available amount, paired with a consistent or increasing desire from buyers, might foster a positive, long-term perspective for Ethereum.

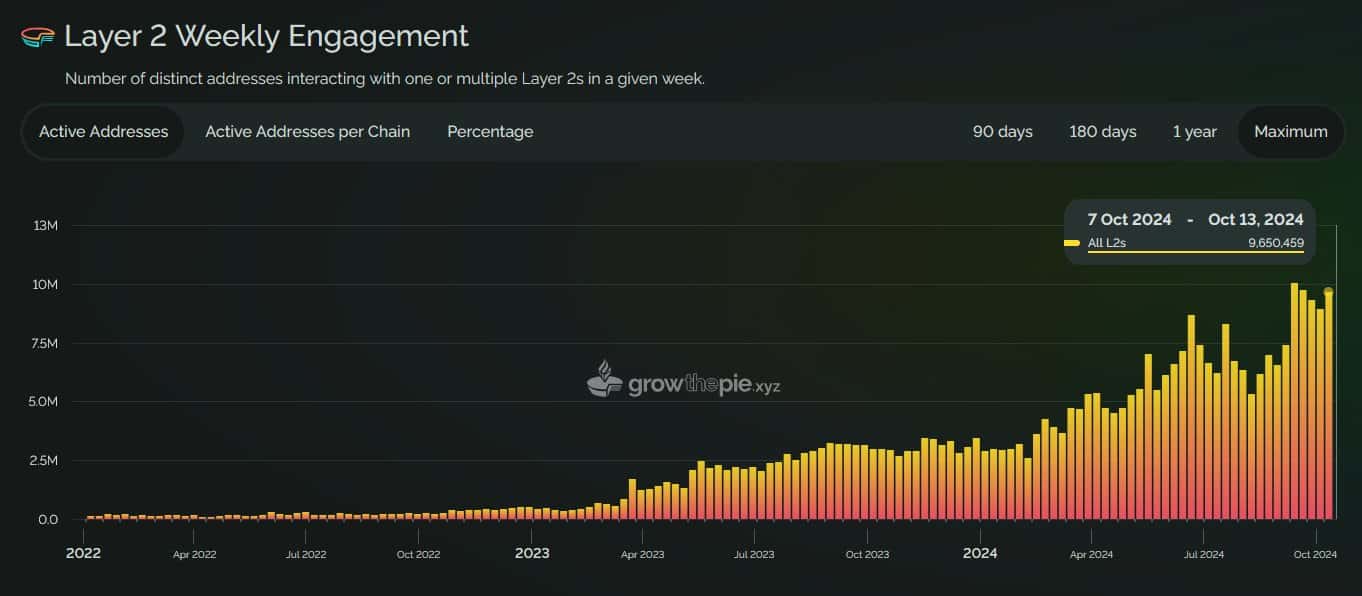

On top of supply changes, weekly active addresses on Ethereum’s Layer 2 networks are skyrocketing.

At present, we’re seeing approximately 9.65 million active addresses, and predictions indicate a potential 10-fold increase in the coming years, given the anticipated growth of Web3 usage.

The rising use of Layer 2 networks indicates a growing need for quicker and more affordable transactions within Ethereum, enabling the network to expand while preserving its decentralized structure.

Increased user interaction often leads to increased transaction fees, which in turn get destroyed (or “burned”) via mechanisms such as EIP-1559, thereby decreasing the total amount of Ether (ETH) in circulation.

Impact on ETH price

The changes taking place are having a substantial influence on Ethereum’s value. With a lower current inflation rate and heightened activity on Layer 2 networks, there is an optimistic long-term perspective regarding Ethereum’s pricing.

Should the downward price trend for ETH persist up until 2025, we might observe a rise in its value, given that the demand stays robust even as the available supply gradually diminishes.

Translating this financial jargon into simpler terms:

Currently, there’s a bit of volatility with Ethereum (ETH) compared to Bitcoin (BTC). Over the past few months, Ethereum has trailed behind Bitcoin, leading some experts to predict a potential drop in the ETH/BTC ratio in the near future.

As an analyst, I’m observing that the current trading range for this pair is between 0.03 and 0.04. There are indications that a potential bottom could form around 0.038 or even as low as 0.036. However, it’s important to note that a drop to 0.03 is generally considered the worst-case scenario, though it seems unlikely we’ll see such a drastic fall.

Read Ethereum [ETH] Price Prediction 2024-2025

2024 might see Ethereum (ETH) lagging behind Bitcoin (BTC), but from my perspective as an investor, I firmly believe that the long haul holds a brighter future for ETH/USD. The year 2025 seems poised to witness a comeback for Ethereum.

Although there might be temporary fluctuations in the Ethereum (ETH) to Bitcoin (BTC) exchange rate this year, the strong underlying factors of ETH indicate a potential increase in its value by 2025, making it an attractive long-term investment opportunity for investors.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-18 21:12