-

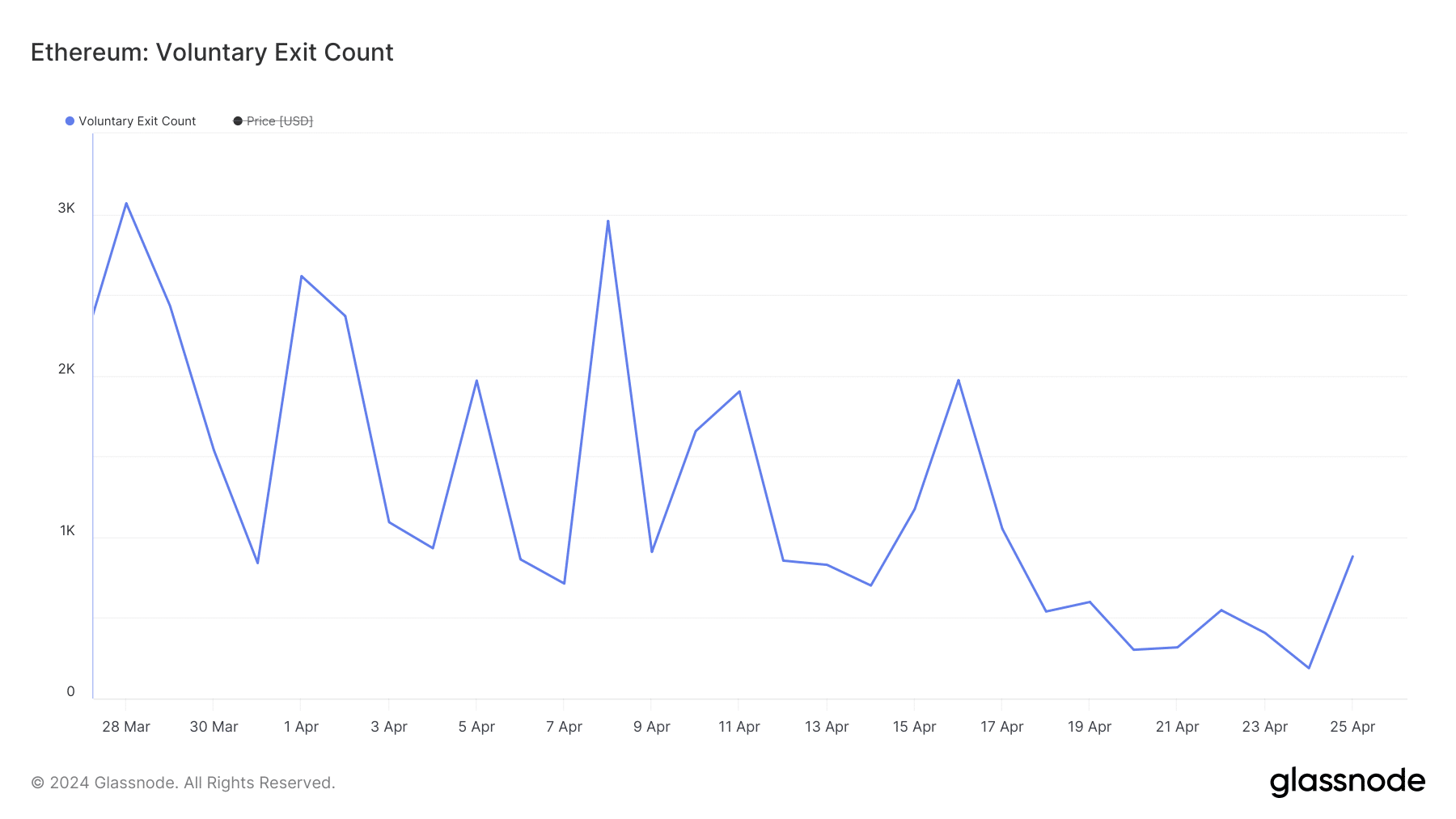

Voluntary exit on Ethereum fell to a one-month low.

Despite last week’s price rally, bearish sentiments remain significant in the ETH market.

As a researcher with a background in blockchain technology and market analysis, I find the recent trend in Ethereum (ETH) network participation and price action intriguing. The daily count of validators exiting Ethereum dropped to a one-month low, which is an indicator that demand for the PoS network has waned. This decline in demand has resulted in lower ETH burn rates, making the coin inflationary once again.

As a crypto investor closely monitoring Ethereum’s [ETH] ecosystem, I’ve noticed that the number of active validators hitting a 30-day low based on recent data from Glassnode is cause for concern.

The decrease in demand for the proof-of-stake (PoS) network, specifically Ethereum, has resulted in this situation. Previously, AMBCrypto reported a downturn in Ethereum’s user activity during the last month.

As a researcher studying Ethereum’s economy, I observed that the low Ether (ETH) burn rate led to an increase in its supply. Consequently, Ethereum became inflationary once again.

As a researcher studying the cryptocurrency market, I’ve observed that when Ethereum (ETH) starts to experience inflation, its price tends to face substantial downward pressure. Based on CoinMarketCap’s data, I’ve noticed a 13% decrease in ETH’s value over the past month.

Because Ethereum’s price remains low, validators on the Ethereum network haven’t been motivated to withdraw their coins for further transactions.

When the price of Ethereum rises, validators on the network often choose to leave, aiming to take advantage of the increased value of the ether they had previously staked.

The number of active validators on the network has increased significantly, reaching a peak in the past month as more have joined and fewer have departed.

As a dedicated Ethereum investor, I understand the importance of validators in keeping our network running smoothly. By actively participating as a validator, I contribute to the overall health of the Ethereum ecosystem. A high level of participation from validators translates to reliable node uptime, fewer missed blocks, and ultimately, more efficient use of blockspace.

As of this writing, the validators’ participation rate on the network was 99.6%.

ETH gains, but at what cost?

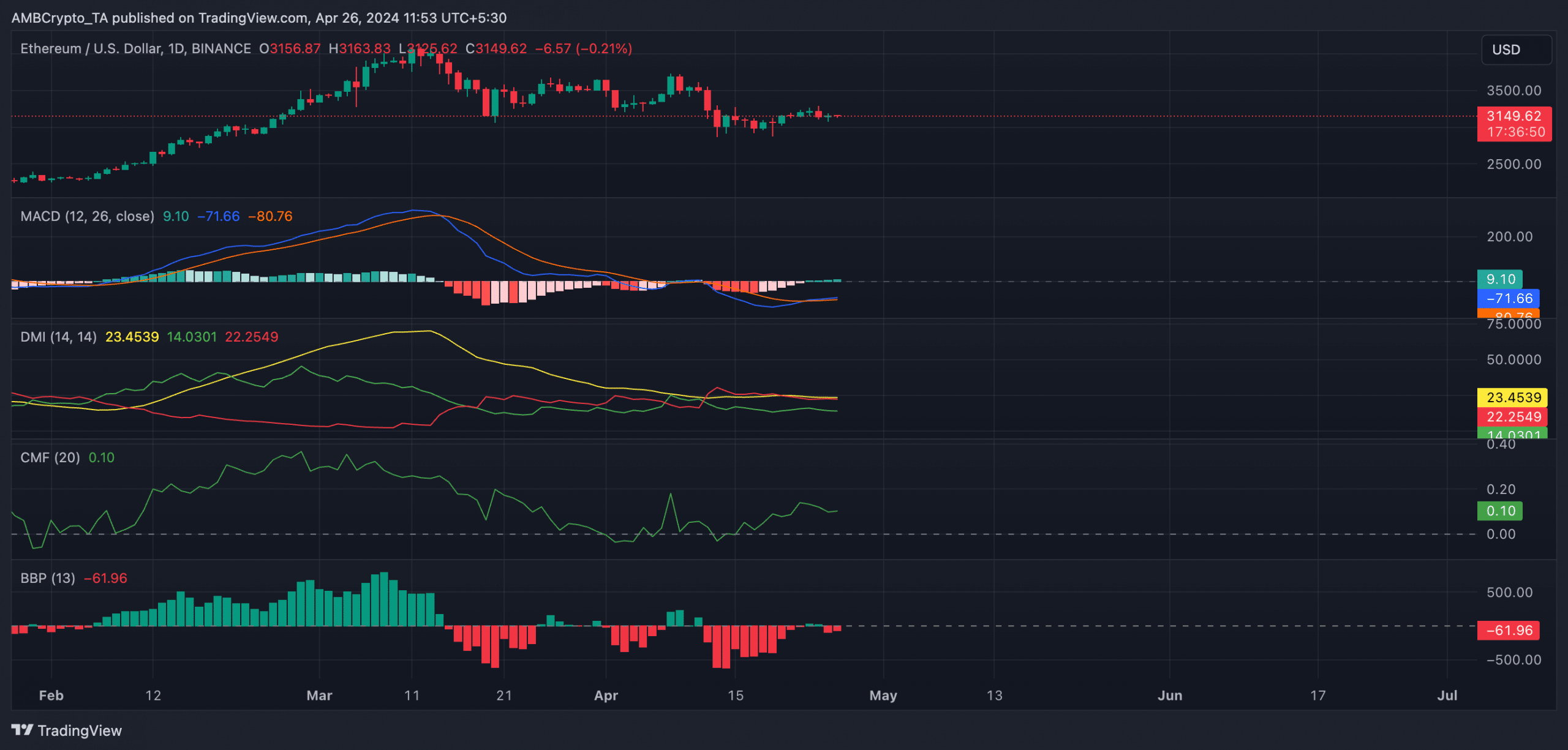

I’ve noticed an exciting development in the crypto market as of late. At the moment, Ethereum (ETH) is being traded at approximately $3,150 – marking a 5% increase in value over the past week. This price surge can be attributed to renewed optimism among investors and traders. Based on my analysis of Ethereum’s technical indicators on a one-day chart, AMBCrypto has detected this positive shift in market sentiment.

At the current moment, the MACD line of the Ethereum coin was sitting above its signal line. This implied that the short-term moving average for Ethereum was higher than its long-term moving average. Generally, this is considered a bullish sign and can be interpreted as a suggestion to open long positions while considering closing short ones.

At the current moment, the Chaikin Money Flow (CMF) indicator for Ethereum’s coin signaled a net inflow of funds into the market, registering a positive value. This finding implies that Ethereum’s market was experiencing a consistent level of liquidity.

I analyzed the market sentiment and noticed a prevailing bearish attitude. At the moment of analysis, the Elder-Ray Index for the coin stood at a value of -61.96. This index reflects the balance between buying and selling pressure in the market.

Is your portfolio green? Check the Ethereum Profit Calculator

When its value is negative, bear power is dominant in the market.

In simpler terms, the red indicator representing ETH‘s bearish trend was more dominant than the green indicator representing its bullish trend. This implies that there were more sellers than buyers in the Ethereum market.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Battle Royale That Started It All Has Never Been More Profitable

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- ANKR PREDICTION. ANKR cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

2024-04-26 20:09