-

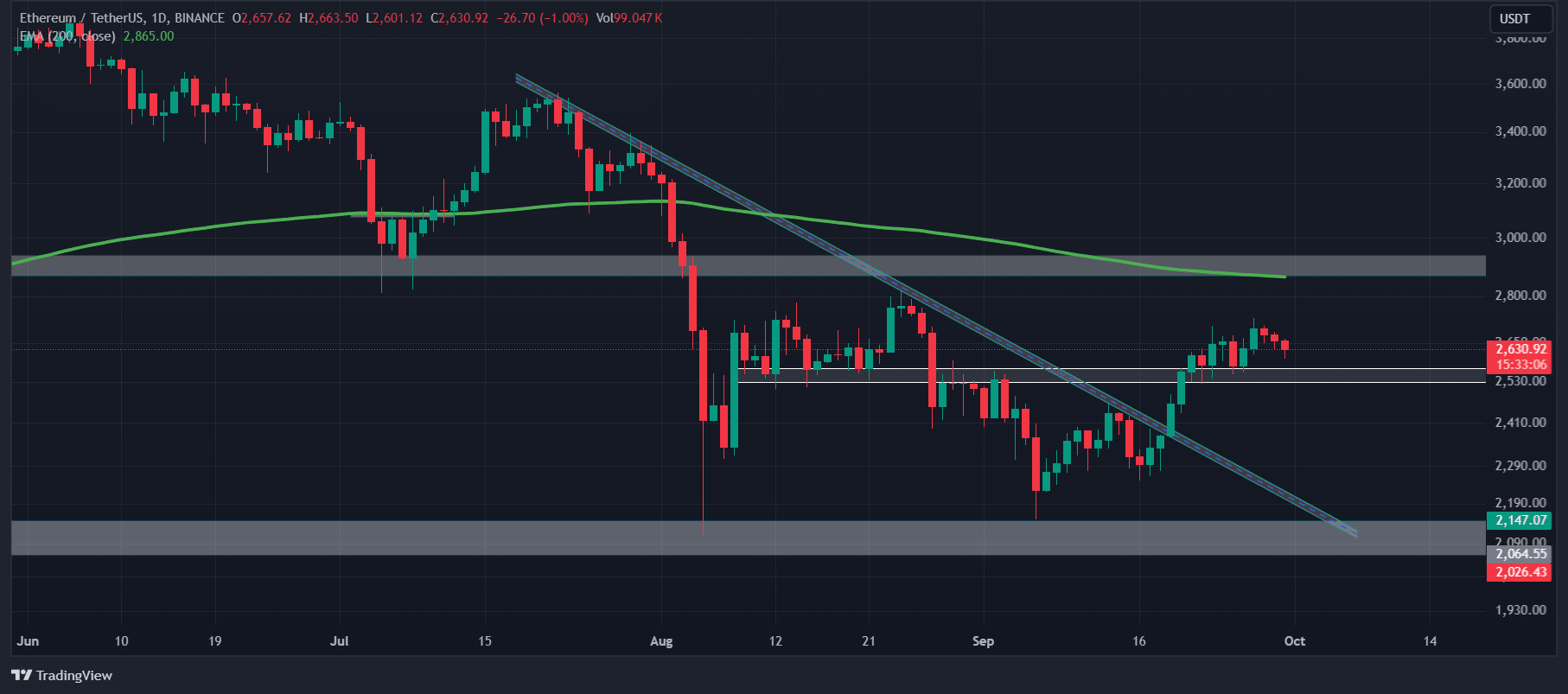

ETH could reach the $2,900 level if it closes a daily candle above the $2,700 level.

ETH’s Long/Short Ratio stood at 0.927, indicating bearish sentiment among traders.

As a seasoned researcher who has navigated through numerous market cycles, I find myself cautiously optimistic about Ethereum’s [ETH] potential price movement. The technical analysis suggests that if ETH manages to close a daily candle above the $2,700 level, it could potentially reach the $2,900 level in the coming days, as per AMBCrypto’s analysis. However, the recent dump of 1.72 million dollars worth of ETH by a wallet linked to Vitalik Buterin might shift the market sentiment towards bearishness.

Amidst the turbulent crypto market, a digital wallet connected to Vitalik Buterin, one of the co-creators of Ethereum [ETH], sold a substantial portion of his Ethereum holdings.

Based on data from Spotonchain, it was reported that the Ethereum address associated with Vitalik Buterin (wallet “0x556”) transferred approximately 649 ETH, equivalent to around $1.72 million USD, to Paxos on September 29th.

Wallet-linked to Buterin dump $1.72M of ETH

The company pointed out that during the previous 11 days, a significant amount of 1,300 Ether (valued at approximately $3.35 million) had been deposited into the wallet, with an average value of each ETH being around $2,581.

Furthermore, it’s worth noting that the wallet in question received approximately 1,300 Ether on September 19th. This Ether came from a wallet that had previously been funded by Vitalik Buterin in 2022.

This massive deposit of ETH has the potential to shift the market sentiment to a bearish side.

Ethereum technical analysis and key levels

Based on AMBCrypto’s technical assessment, Ethereum (ETH) appears to be gathering strength within a narrow band after surpassing an essential resistance point at approximately $2,590.

If the value of the asset increases significantly and ends its daily trading period above the $2,700 mark, it’s quite likely that Ethereum (ETH) might climb up to the $2,900 range within the near future.

Currently, I find myself observing that Ethereum’s trading price is positioned beneath the 200-day Exponential Moving Average (EMA), suggesting a descending trend in the day-to-day market scenario.

The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

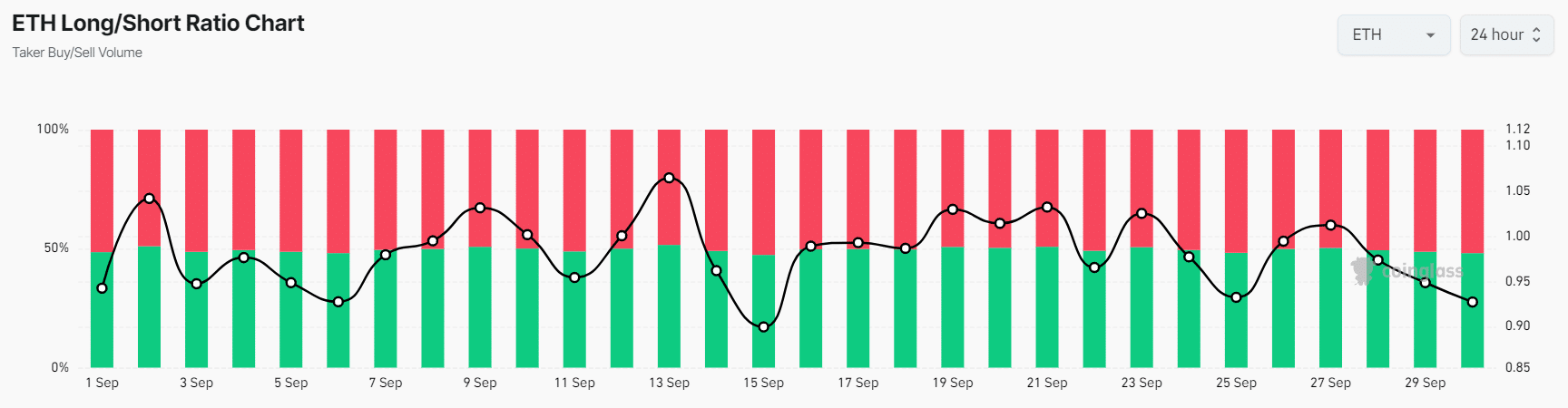

Mixed-sentiment by on-chain metrics

In addition to the technical analysis, on-chain metrics signal mixed sentiment.

As an analyst, I’ve observed that, according to the data provided by Coinglass, a firm specializing in on-chain analysis, Ethereum’s (ETH) Long/Short Ratio stands at approximately 0.927. This ratio suggests a dominant bearish sentiment among traders, as it indicates more short positions are being taken compared to long ones.

Moreover, the Futures Open Interest has stayed constant over the last 24 hours, suggesting that traders continue to hold onto their positions, with potential newcomers showing reluctance to establish fresh ones.

Read Ethereum’s [ETH] Price Prediction 2024-25

Approximately half (48.11%) of the leading traders are currently taking long positions on Ethereum, while slightly more than half (51.89%) have opted for short positions. As we speak, Ethereum is being traded around $2,635 and has kept a steady course over the last day.

Over the corresponding timeframe, its trade activity surged by 22% significantly, suggesting increased involvement from both traders and investors. This uptick in participation could be a promising sign, reflecting potential optimism towards Ethereum (ETH), given the ongoing consolidation.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- PlayStation Believes Competition from Xbox is “Healthy and Pushes Us to Innovate”

2024-10-01 05:11