- Ethereum’s volume has surged 85% in under two weeks, reaching $7.3 billion.

- However, a consolidation phase appears more likely before ETH bulls can target $4K.

As a seasoned analyst with over a decade of experience in the cryptosphere, I’ve witnessed countless bull runs and bear markets. The recent surge in Ethereum’s volume has piqued my interest, given its 85% increase in under two weeks. However, based on historical trends and the current market dynamics, I believe we are looking at a consolidation phase before ETH bulls can target $4K.

In 2024, the trading volume of Ethereum’s ETH token on the blockchain generally mirrored that of the overall cryptocurrency market, exhibiting a consistent decline interspersed with brief periods of increased activity, notably during the second and third quarters.

In November, there was a notable change in trend. A mix of elements such as increased investments into Bitcoin [BTC] and Ethereum Exchange-Traded Funds (ETFs), along with the unforeseen victory of Trump in the U.S. Presidential election, ignited this transformation.

Over a two-week span, the on-chain volume for Ethereum grew significantly by 85%, rising from approximately $3.84 billion on November 1st to $7.13 billion on November 15th. This substantial increase suggests a possible change in its previous decline trend.

Despite ETH currently being significantly lower than its record peak of $4,891, the recent surge in activity offers an optimistic outlook. Yet, certain signals imply that a possible rise to $4,000 might be postponed beyond the end of this quarter.

Keeping volatility in-check would be the first step

During the first week of the election campaign, the price of ETH exceeded $3,300 and peaked at an impressive 5% increase most days, except for the day of the election results, when there was a remarkable jump of 12%.

Quick advancements over a brief period can frequently indicate an upcoming adjustment or correction.

Over the next seven business days, the price of Ethereum underwent a significant change, returning nearly to $3,000. This shift largely undid the impressive advancements in value that had been accumulated during the previous surge.

In the world of cryptocurrency, every decline offers a chance for investors to identify the lowest point and purchase at a discount. Seizing this opportunity, Ethereum enthusiasts saw a nearly 10% increase the next day, which drove the token’s price up to $3,357 (at the time of writing).

Even though it appears that Ethereum is showing positive signs (bullish), it’s important to note that its price fluctuations have been more unpredictable and erratic compared to most other cryptocurrencies (altcoins).

Instead, it’s worth noting that compared to others, notable cryptocurrencies such as Ripple [XRP] and Cardano [ADA] have displayed remarkable robustness, making them the clear frontrunners as “crypto stars of the month.

It’s worth noting that this change happened during a period where Bitcoin has been holding steady around $90K for about five consecutive days.

Generally speaking, when there’s a shift in sentiment towards Bitcoin at deeper emotional levels, investors often move their funds towards Ethereum, which is the biggest alternative coin.

As a researcher, I’ve noticed that Ethereum (ETH) seems to be lagging behind its competitors, which could hint at an emerging trend that might pose a threat to ETH’s capacity to surpass the critical $3,400 resistance level. This level has historically held significant importance.

Surge in Ethereum volume might not be enough

Four months back, around mid-July, Ethereum last attempted to reach the $3,400 price zone on its daily chart. However, since that time, it has been experiencing a downtrend, with trades happening between $2,200 and $2,600.

After the election period, it seems like Ethereum (ETH) is primed for a significant increase beyond $3K, given the substantial growth in Ethereum trading activity that was previously mentioned.

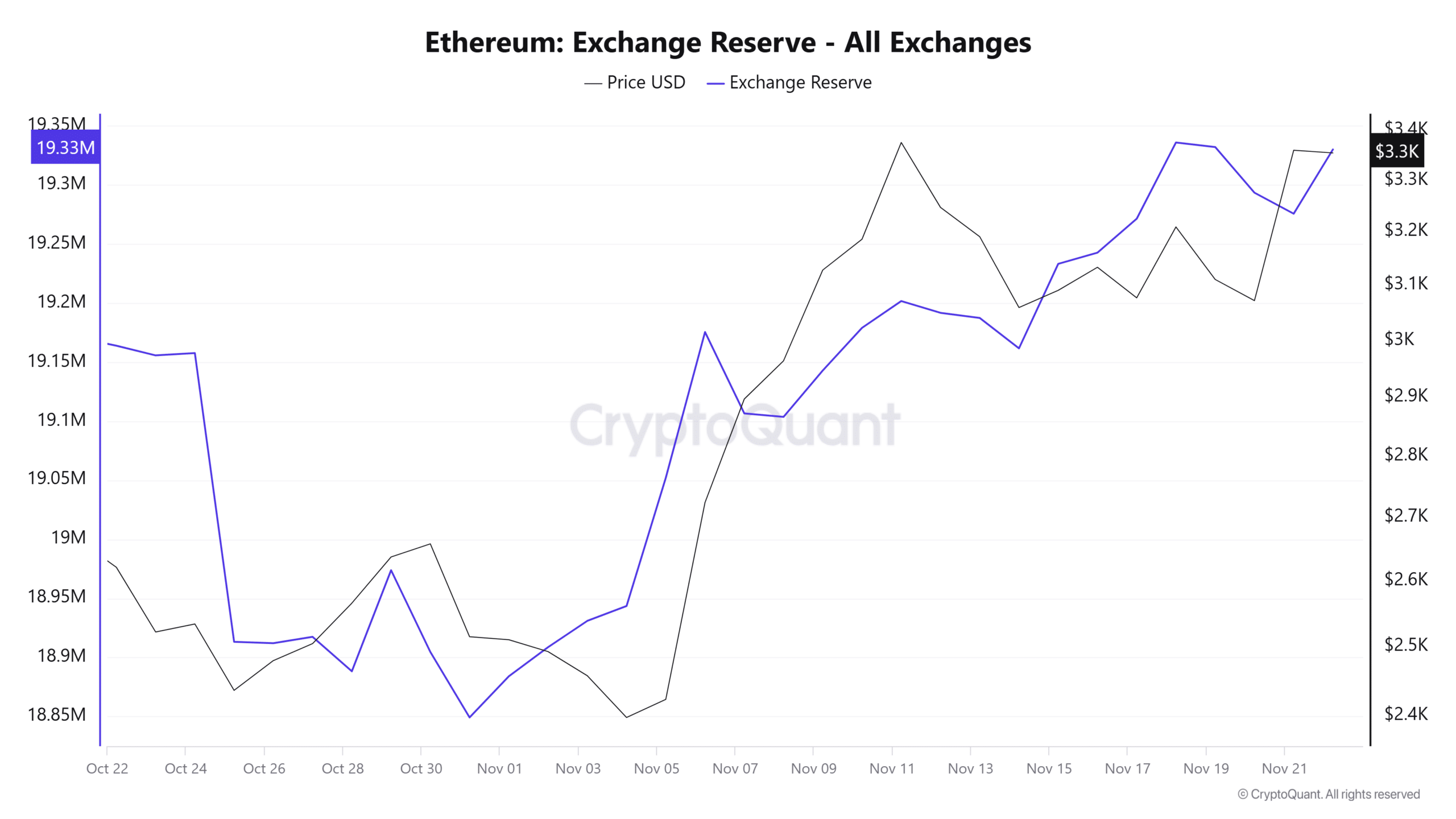

Nevertheless, even with the ongoing positive trend, it seems that Ethereum’s reserve holdings on exchanges are gradually growing, suggesting an increase in sellers. This might result in a potential phase of market stabilization or consolidation over the next few days.

Source : CryptoQuant

The reasoning is clear: consolidation happens when buying and selling activity balance each other out, often pushing a coin into a neutral zone.

In less than two weeks, the on-chain trading volume of Ethereum has soared to an impressive $7.3 billion. This increased activity is now being met with growing signs of sellers trying to offload their holdings, which might indicate that Ethereum could be entering a potentially challenging phase.

Read Ethereum’s [ETH] Price Prediction 2024–2025

In other words, it appears that a period of consolidation could be beneficial for Ethereum prior to any potential surge, but this scenario may not materialize if certain crucial factors don’t fall into place.

Initially, significant investors should start amassing more Bitcoin to counteract the selling momentum. Additionally, for Bitcoin to rebuild investor trust on a larger scale, it must surpass the $100K price barrier.

As the trading volume spikes suggest more network action, if this growing demand persists, Ethereum might head towards the $3,400 mark.

On the other hand, it appears that a period of consolidation leading up to a potential rise towards $4K is more probable, unless the following circumstances materialize.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-24 10:16