-

Ethereum witnessed a more severe correction last week than Bitcoin.

Metrics suggested that selling pressure was high on BTC and ETH, but ETH had an edge.

As a seasoned crypto investor with a knack for deciphering market trends and a dash of humor, I must say that last week was quite the rollercoaster ride. Bitcoin, the king of cryptos, took a tumble from its $70k peak to $66k, while Ethereum, the smart contract pioneer, faced a more severe correction.

Over the past seven days, Bitcoin (BTC) garnered significant attention, nearing $70,000, only to subsequently drop down towards $66,000. In contrast, Ethereum (ETH) experienced a more challenging week with a steeper correction.

As a analyst, I’ve recently observed an uptick in Ethereum’s (ETH) volatility with its latest update. This might suggest it could be prudent to strategize on accumulating ETH, given the potential for increased price fluctuations.

Weekly performance

According to information from CoinmarketCap, Bitcoin’s price dipped after failing to break through the $70,000 barrier. As of now, it’s being traded at approximately $66,491 and boasts a market cap exceeding $1.31 trillion.

Last week, Ether (ETH) experienced a 3% decrease in price. Currently, ETH is worth $3,325 per coin, and it has a total market value exceeding $399 billion.

According to QCB Broadcast’s analysis, Bitcoin’s price began to drop when U.S. stock markets opened, and another factor contributing to this decline was the U.S. government selling off approximately $2 billion worth of Bitcoin.

Based on my personal experience, I have found that investing in cryptocurrencies can be a rollercoaster ride, full of excitement and uncertainty. As someone who has been observing the market for several years now, I believe it’s worth taking a closer look at Ethereum. Recently, I’ve noticed it showing signs of volatility, which is often an indicator that it might be preparing for some significant price movements in the near future. In my opinion, it could be wise to consider accumulating Ethereum if you have a moderate risk tolerance and are looking to diversify your investment portfolio. However, keep in mind that cryptocurrency markets can be highly volatile, so always do thorough research before making any investment decisions.

It’s possible that Ethereum could grow stronger imminently, since the market may be growing resistant to the impact of negative news about outflows, as a result of investors shifting towards less costly ETFs instead of ETHE.

Ethereum vs Bitcoin

After considering a comparison, AMBCrypto aimed to determine if Ethereum could surpass Bitcoin’s performance during the current week.

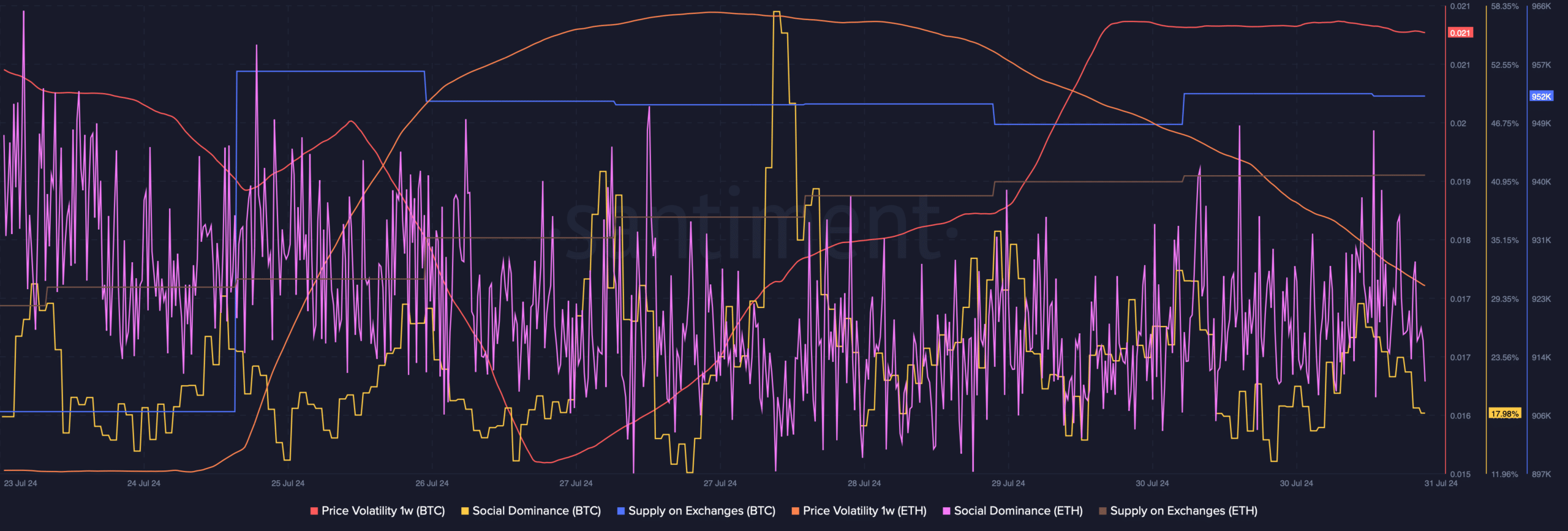

According to our examination of Santiment’s findings, Bitcoin’s influence in social discussions stayed generally more substantial compared to Ethereum. Notably, both Bitcoin and Ethereum experienced a rise in the quantity available for trading on exchanges.

This suggested that investors were considering selling BTC and ETH.

Additionally, Bitcoin’s price volatility over the past week has significantly risen, whereas Ethereum’s price volatility decreased. At first glance, this may seem unfavorable for Ethereum, but the situation could be quite different in reality.

A decrease in price fluctuations over a week could suggest that the downward price trend for this token may be ending, potentially leading to a change in the trend towards upward movement (bullish).

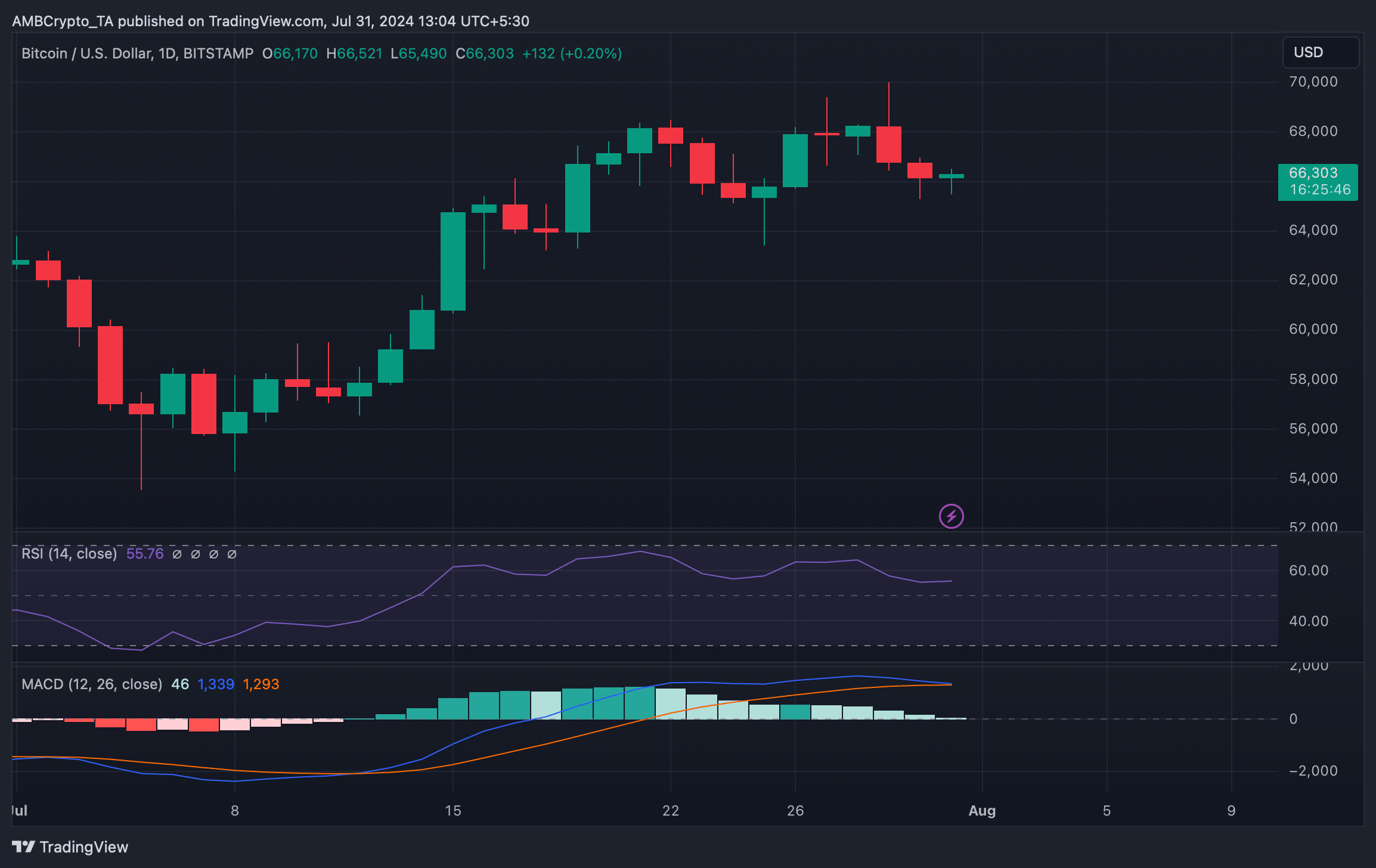

Later, we examined the day-to-day graphs of Bitcoin (BTC) and Ethereum to get a clearer idea of their direction. Our analysis revealed that BTC’s Moving Average Convergence Divergence (MACD) showed a bearish trend as it crossed over.

Read Ethereum’s [ETH] Price Prediction 2024-25

Furthermore, the stock’s Relative Strength Index (RSI) showed a decrease followed by stability, which hinted at a possible adjustment or reduced volatility in its price movement.

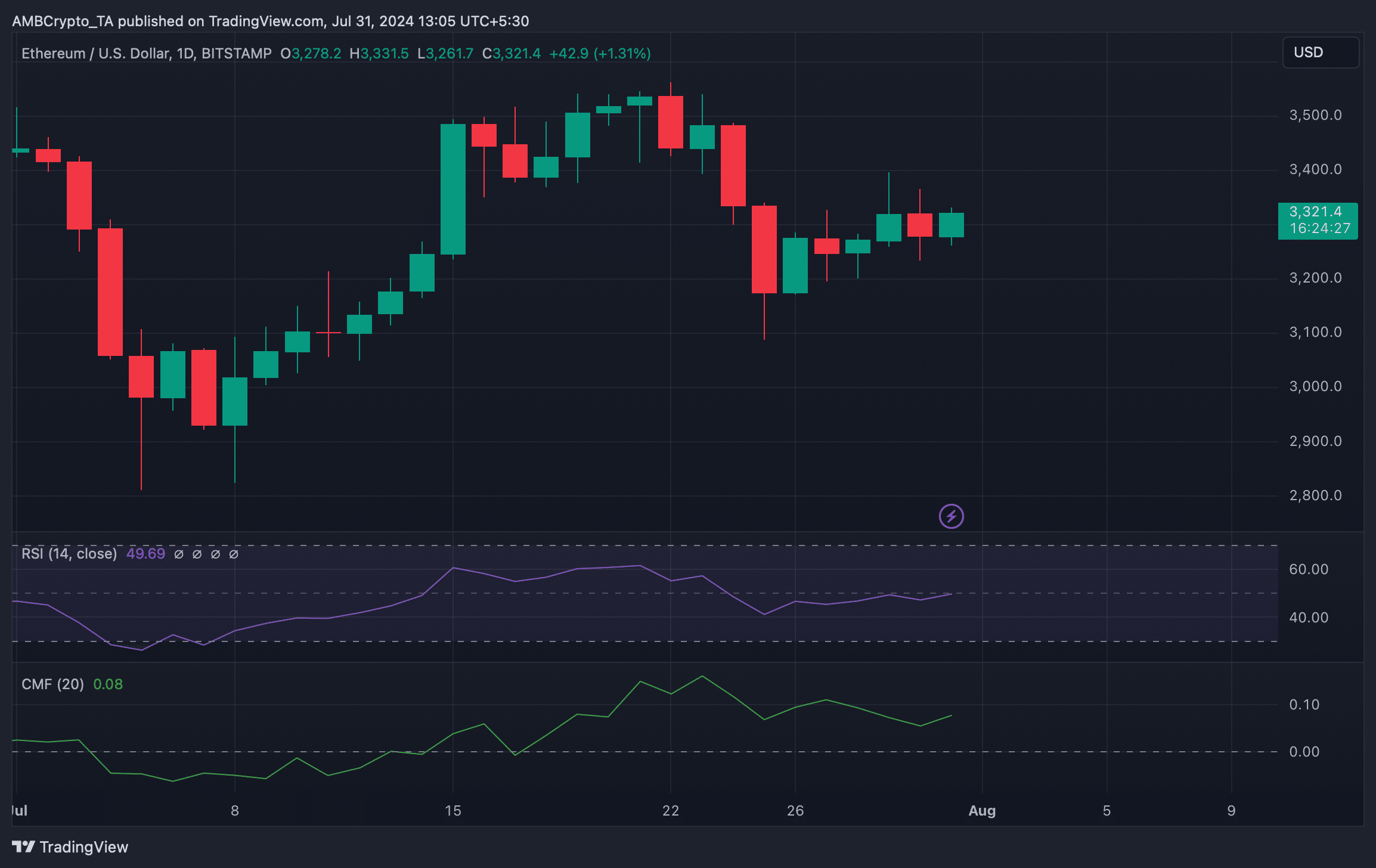

Instead, it appears that Ethereum’s Relative Strength Index (RSI) is building up bullish energy. Similarly, its Chaikin Money Flow (CMF) is exhibiting a parallel pattern, suggesting that Ethereum could potentially experience a surge in bullish sentiment prior to Bitcoin.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- ANKR PREDICTION. ANKR cryptocurrency

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- 2 Astronauts Stuck in Space After 8-Day Mission Goes Awry

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-07-31 18:16