- BNB’s funding rate has been mostly negative since the beginning of the month.

BNB accumulation remains steady in the coin’s spot market.

The cryptocurrency Binance Coin (BNB) is exhibiting vulnerability in the perpetual futures market as evidenced by the largest negative funding rates among the top five digital assets, according to Coinglass’ statistics for this month.

During the time frame of April 4th to 8th, the coin’s funding rates on various exchanges showed a cost to hold the position, instead of earning a fee.

In simpler terms, funding rates in eternal futures agreements help keep the price of a contract aligned with the current market price for the underlying asset.

If an asset’s contract price exceeds its current market price, it means that buyers of a price increase (long positions) must compensate sellers of a price decrease (short positions). In such cases, the asset’s funding rate becomes positive.

In simpler terms, when the contract price is less than the current market price (also known as the “spot” price), short sellers must pay a fee to those who have bought the asset (long positions). This situation leads to negative funding rates. When an asset has a negative funding rate, more traders are betting that its price will decrease rather than increase.

Ethereum vs BNB

In comparing Ethereum and BNB, particularly in the volatile arena of crypto futures this April, several key differences emerge. Firstly, Ethereum’s funding rates have remained more stable compared to BNB’s dramatic shift from negative to positive within days.

Coingeasily reports that the sentiment in Binance Coin’s futures market has brightened over the last four days based on Coinglass’s data. This improvement is indicated by a continuous positive funding rate and an increase in open interest for BNB futures contracts.

At $747 million at press time, BNB’s futures open interest has increased by 29% since 8th April.

The market steadies

At present, the price of BNB is $611 according to current reports. Over the past week, there has been a 5% increase in its value as indicated by CoinMarketCap’s statistics.

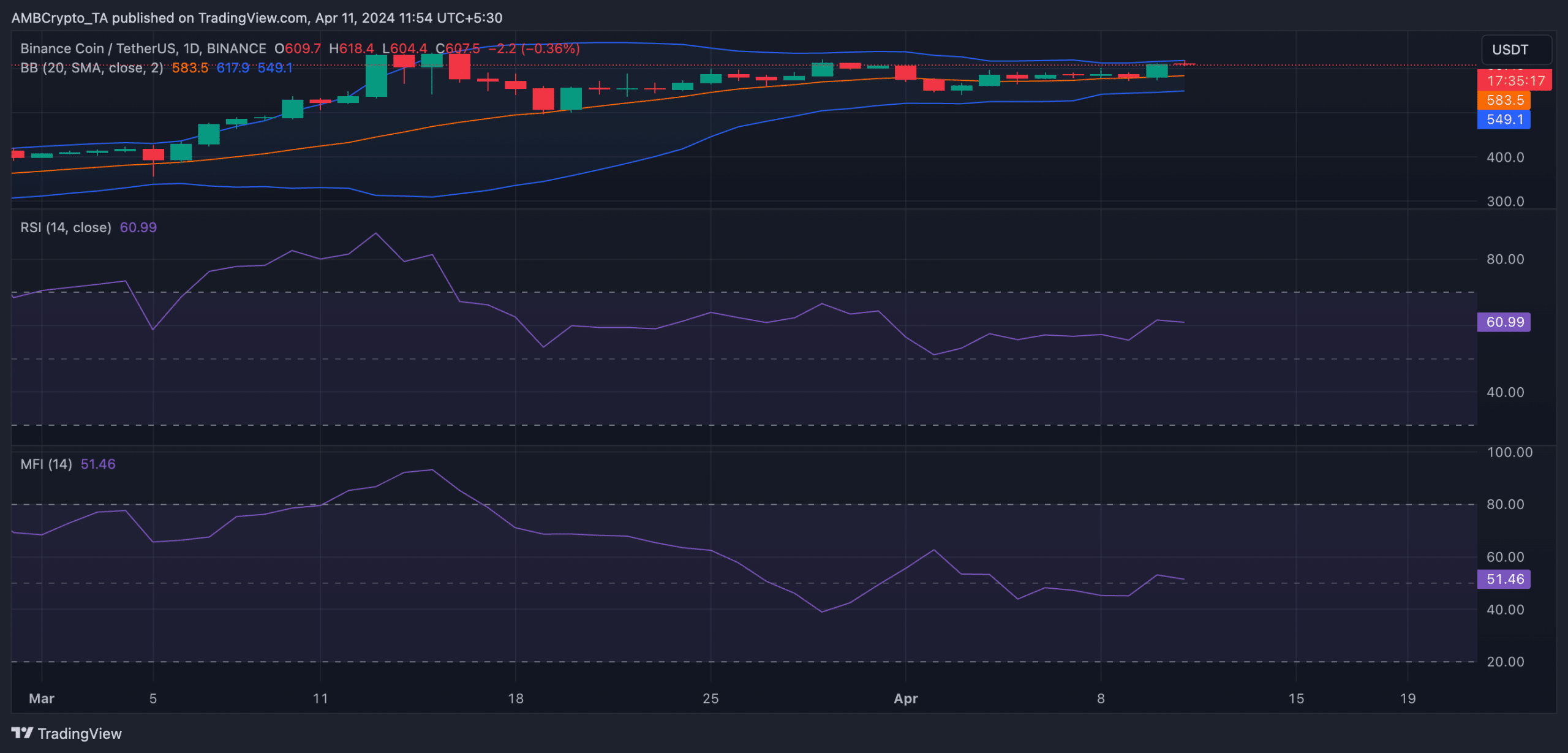

The coin’s price is stabilizing within a narrow range recently, leading to a noticeable decrease in market turbulence. A look at Binance Coin (BNB)’s Bollinger Bands reveals a small difference between the upper and lower bands of this technical indicator.

When the difference between the two bands on the chart is small, the market tends to have minimal price fluctuations. This situation is often seen as a potential sign by traders that a major price shift or breakout could take place soon.

Read Binance Coin’s [BNB] Price Prediction 2024-25

Additionally, the important momentum signs for BNB were above average when this message was composed. The Relative Strength Index (RSI) stood at 61.19, and the Money Flow Index (MFI) was 51.44.

These values showed that BNB accumulation persisted among market participants.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-04-11 18:15