- Solana outperformed Ethereum in active addresses and trading volume.

- Despite Solana’s growth, Ethereum’s network activity and security position it as superior.

As a crypto investor with some experience in the market, I’ve been closely following the developments of Ethereum (ETH) and Solana (SOL). While both have shown positive growth in recent days, the more intriguing trend is Solana’s outperformance in terms of active addresses and trading volume.

In line with the broader market’s upward momentum, Ethereum (ETH) and Solana (SOL) displayed robust trading activity over the last 24 hours. Ethereum saw a gain of 1.4%, while Solana recorded an impressive surge of 4.64%.

As I conducted further investigation into their statistics, I uncovered an intriguing finding: Solana now outpaces Ethereum in terms of activity, with more active addresses and greater trading volumes.

The number of active addresses on Solana has exceeded one million, marking a significant increase, in contrast to Ethereum’s relatively unchanged figure, indicating a substantial distinction between the two platforms.

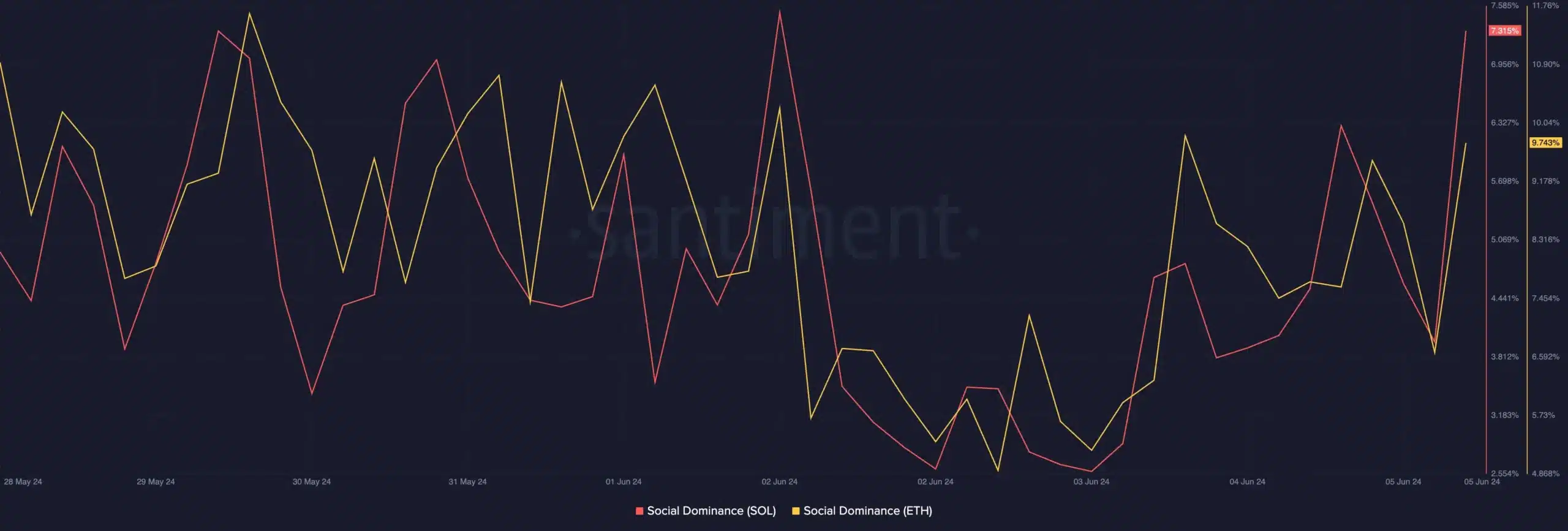

As an analyst, I can affirm that my examination of Santiment’s data reinforces the observation that Solana (SOL) surpassed Ethereum (ETH) in terms of social prominence.

The impressive performance of Solana’s crucial indicators raises an intriguing query: Which blockchain will come out on top between Ethereum and Solana in the years 2024 and beyond?

Ethereum vs Solana: The debate

In a lively discussion on the “Bankless” podcast, Ethereum Researcher Justin Drake and Solana Co-Founder Anatoly Yakovenko exchanged perspectives, each presenting their unique views on the merits of Ethereum and Solana.

Shedding light on what’s good about Solana, Drake noted,

“In my opinion, Solana poses a beneficial challenge to Ethereum. This isn’t just due to excellent implementation but also because of its contrarian nature.”

Yakovenko commended Ethereum for putting a greater emphasis on security than scalability in their approach.

“The public perception may be that Ethereum’s progress is sluggish, but considering its extensive network and worth, I’d find any modifications to Solana’s scale downright terrifying.”

He further went ahead and added,

Ethereum has reached a stage that other L1s (Layer 1 blockchain platforms) should aspire to attain at great speed. This achievement makes Ethereum stand out and even surpass Bitcoin in my perspective.

Ethereum currently holds the upper hand in the L1 (Layer 1) market due to its significant advantages in terms of network effects, liquidity, maturity, and security. These factors make it a strong contender to eventually outshine Bitcoin and take the top spot.

On the contrary, Drake argued that Solana has the potential to be referred to as the “internet of value,” thereby justifying its substantial $100 billion valuation.

SOL’s developers have prioritized creating user-focused products over infrastructure development, a decision that has significantly contributed to their achievement of success.

SOL a competitor to ETH?

Contributing to the ongoing discourse, Raoul Pal, the CEO of Real Vision and Global Macro Investor, has pointed out similarities between Ethereum’s 2020 price surge and Solana’s rising prominence as a formidable Ethereum rival.

He best put it when he said,

Looking back to 2020, Ethereum displayed a stable performance in the initial months, but around the summer, it surpassed other cryptocurrencies in growth. Towards the end of that year, its value significantly increased. By 2021, Ethereum experienced remarkable growth, almost resembling an overripe banana in terms of price surge. I anticipate a similar trend will recur.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-06 08:07