- Evaluating Ethereum vs Solana to find out which one has a more competitive edge.

- The tokenomics may even out the score, leading to a surprising conclusion.

As a seasoned researcher with years of experience in the cryptocurrency market, I have witnessed the rise and fall of numerous digital assets. The Ethereum vs Solana face-off is one that has piqued my interest due to the dynamic growth of both networks.

As an analyst, I find myself at the center of an exciting comparison: Ethereum [ETH] and Solana [SOL]. For quite some time now, Ethereum has reigned supreme as the top-tier altcoin. However, the stage is set for a riveting showdown between these two heavyweights in the cryptocurrency world.

Although Solana has shown remarkable progress recently, the question remains: Which of these two networks will yield the greatest returns?

Over the past year, Solana significantly expanded within the Decentralized Finance (DeFi) sector, creating a more meaningful contrast when comparing it to Ethereum. Previously, Ethereum held a commanding position in the DeFi market.

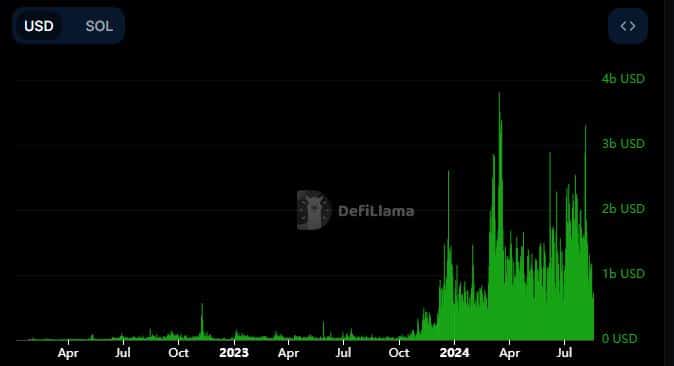

Initially, the on-chain transaction volume for Solana has experienced significant expansion since October of the previous year. Its peak daily volume reached approximately 3.4 billion dollars.

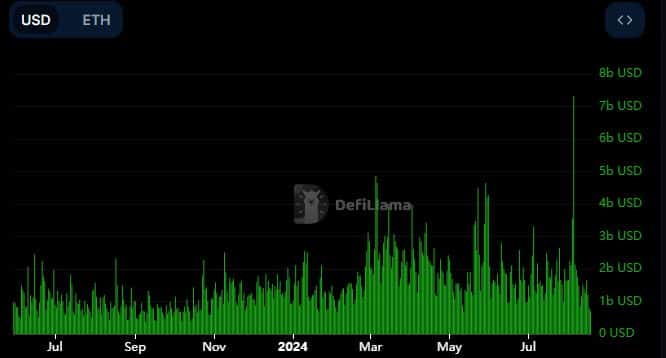

During the same time frame, Solana and Ethereum have both consistently recorded substantial daily trading volumes. These figures for Ethereum are generally similar to those of Solana.

On the 5th of August, amidst the recent market downturn, Ethereum managed an impressive $7 billion in daily transactions at its peak.

Although the graphs seem to show an advantage for Ethereum, they underscore the significant strides made by Solana over the past couple of months. Particularly when comparing the two networks based on transaction volume, Solana appears to be rapidly catching up to Ethereum.

Instead of focusing on comparing the two networks directly, let’s examine them based on user activity or growth. For instance, Ethereum boasted approximately 454,000 active users within the past day, whereas Solana outperformed with more than 979,000 active addresses over the same period.

In comparison, Solana executed a staggering 33.08 million transactions over the past day, outpacing Ethereum’s 1.03 million transactions for the same timeframe.

Ethereum versus Solana tokenomics

In terms of market capitalization, Ethereum has been consistently outperforming Solana. To put it into perspective, Ethereum’s market cap stood at approximately $311.9 billion, which is nearly five times larger than Solana’s market cap of around $66.7 billion.

Interestingly, when we align them side by side, we noticed that Solana’s market capitalization is expanding more quickly than Ethereum’s.

Given these results, it’s clear that Solana holds the greatest promise for future growth. However, does this imply the same for their native cryptocurrencies?

The market capitalization of Ethereum is four times greater than that of Solana, however, Solana’s individual coin price is less expensive and it boasts a more vibrant Decentralized Finance (DeFi) environment. From the token supply perspective, Ethereum has significantly fewer tokens in circulation, with only 120.28 million coins.

Conversely, there are approximately 466.2 million Solana (SOL) coins circulating. This is roughly three and a half times less than the number of Ethereum (ETH) coins in circulation.

Is there a clear winner?

From our comparison between Ethereum and Solana, it’s evident that Solana is holding its ground quite well. However, when considering their token economics, we didn’t find a significant edge for either side as Solana currently has a larger amount of tokens in circulation.

Read Ethereum’s [ETH] Price Prediction 2024-2025

In the short term, it seems that the price movement of Solana (SOL) could be more advantageous compared to Ethereum (ETH), considering the network’s activity and development progress.

If Ethereum continues to maintain strong decentralized finance (DeFi) activity and high demand for its Ether (ETH), its future prospects may look promising. This is due to the fact that while Solana experiences a 30% inflation rate, Ethereum operates on a deflationary basis.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PGA Tour 2K25 – Everything You Need to Know

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- `SNL’s Most Iconic SoCal Gang Reunites`

2024-08-20 10:16