Ethereum, that fickle creature, has once again dared to flirt with the $3,000 mark after a period of…shall we say, unenthusiastic selling. The recovery, however, possesses all the robustness of a dandelion in a gale. Momentum, like a forgotten promise, continues to fade. The air is thick with apprehension, and the little people-the retail traders, bless their optimistic hearts-have lost much of their nerve. One almost feels sorry for them… almost. 😉

The so-called analysts, those seers of the digital age, are muttering darkly about bulls losing their grip and even hinting at a potential bear market. A bear market! As if we haven’t enough to worry about. Ethereum currently trades a rather ignominious 40% below its August zenith, and every upward twitch is greeted with the suspicion it deserves. The overall atmosphere remains… unsettled, to put it kindly. Honestly, it’s all rather tiresome.

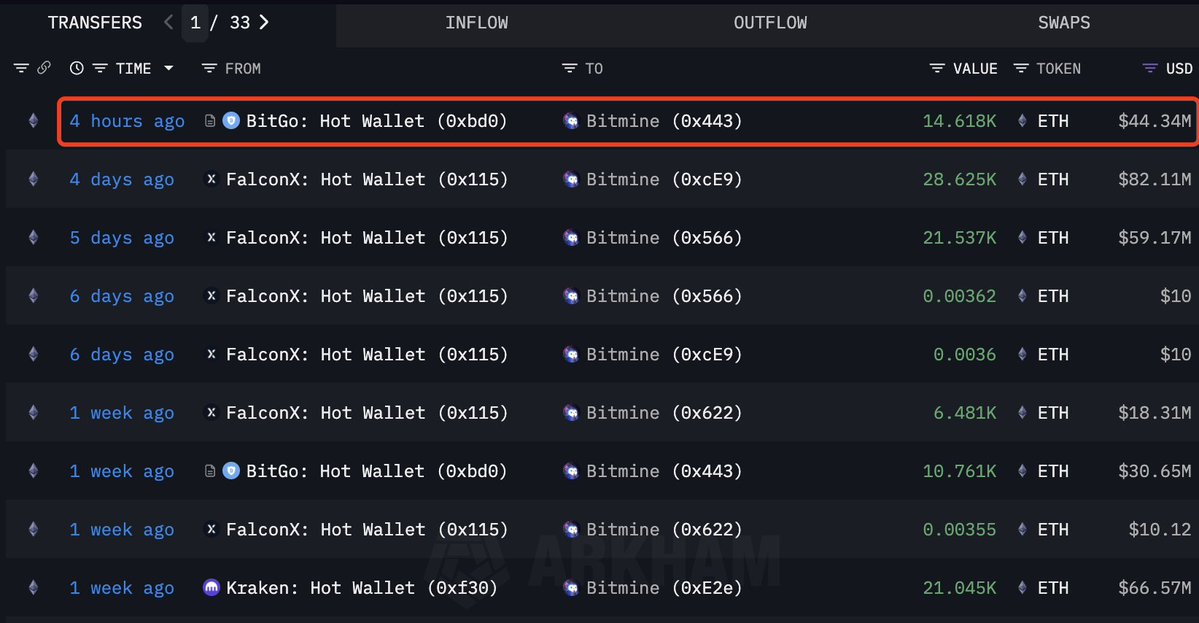

Yet, amidst this gloom, a curious phenomenon occurs. The substantial players-the leviathans of the crypto seas-continue to accumulate ETH. A decidedly contrary signal, wouldn’t you agree? A little bird (Lookonchain, to be precise) informs us that Bitmine has been steadily, almost stubbornly, adding to its Ethereum hoard, showing no inclination to pause. One wonders if they know something the rest of us don’t-or simply have far too much money to know what to do with. 🤷

This rather determined interest from the well-heeled suggests a belief in some long-term value, even as the short-term traders flail about like… well, like traders in a distressed market. It’s all frightfully predictable, really.

Bitmine Deepens Accumulation as Ethereum Struggles for Momentum

Lookonchain reveals that Bitmine, with the dedication of a diligent stamp collector, has purchased another 14,618 ETH-roughly $44.34 million, a sum that would comfortably fund a small principality. This acquisition expands Bitmine’s already impressive Ethereum empire to a staggering 3.436 million ETH. At today’s prices, that’s approximately $10.39 billion worth of digital ether. One can only assume they have excellent accountants. They certainly have conviction, however misguided it may be! 😂

Such unabashed accumulation stands in stark contrast to the prevailing market sentiment. Retail investors are understandably wary. Many analysts are quick to pronounce Ethereum’s failure to soar above $3,000 as a sign of impending doom. But Bitmine, it seems, operates on a different plane. A plane of…fundamentals? Perhaps.

Experienced, discerning buyers often capitalize on market weakness, viewing low prices as opportunities. Bitmine’s behavior fits this pattern. It could presage higher prices, but then again, it could be a spectacularly expensive error in judgment. One never knows, does one? 🧐

Still, even Bitmine’s confidence requires Ethereum to stabilize and establish a firmer foundation. The next few weeks will determine whether this whale demand can counteract the broader selling and finally propel ETH out of its current doldrums.

ETH Attempts Recovery but Faces Strong Resistance

Ethereum is attempting a recovery – a valiant, if somewhat pathetic, effort – having briefly touched $3,000, but struggles to maintain any substantial forward progress. The chart shows ETH bouncing from the recent trough around $2,600, where a modest amount of buying interest temporarily stayed the decline.

However, alas, Ethereum remains tethered below its three major moving averages-the 50-day, 100-day, and 200-day. These now serve as formidable resistance barriers. The 50-day SMA is pointed downwards, and crossed below the 100-day SMA. A most unpromising sign, indeed! Meanwhile, the 200-day SMA looms overhead, reminding everyone that ETH is still rather fragile. Price movements are erratic and form lower highs, indicating that those pesky bears retain control. It’s enough to give one a headache.

Volume patterns corroborate this pessimistic outlook. The recent bounce showed a slight increase in buying enthusiasm, but very feeble in comparison to the flurry of selling that marked the November capitulation. For a genuine reversal, ETH must breach $3,300-$3,400, reclaim its moving averages, and establish a higher low. A tall order, to be sure. A very tall order. 🙄

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Fishing Guide in Where Winds Meet

- Pumuckl and the Crown of the Pirate King announced for Switch, PC

2025-11-29 04:16