-

A whale strategically sold 15K ETH into an exchange, responding to current market dynamics.

However, a reversal could be on the horizon for ETH.

As a seasoned crypto investor with over a decade of market experience under my belt, I find myself both intrigued and cautious regarding Ethereum (ETH) at the moment. The recent surge in ETH price, combined with the bullish performance of Bitcoin (BTC), has certainly caught my attention, but the strategic selling by a whale has raised some red flags.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastThis week, Ethereum (ETH) saw a rise of approximately 14%, currently trading at $2,641. The potential future price target for ETH stands at around $2,769. Simultaneously, Bitcoin supporters are striving to keep the price above $62,000.

Generally speaking, when Bitcoin (BTC) encounters resistance at crucial levels, it might suggest a growing preference for alternative cryptocurrencies, or altcoins.

Nevertheless, a significant ETH investor, known as a “diamond hand,” has raised worries among others by moving 15K ETH to a prominent trading platform.

Fear has reached ETH whales

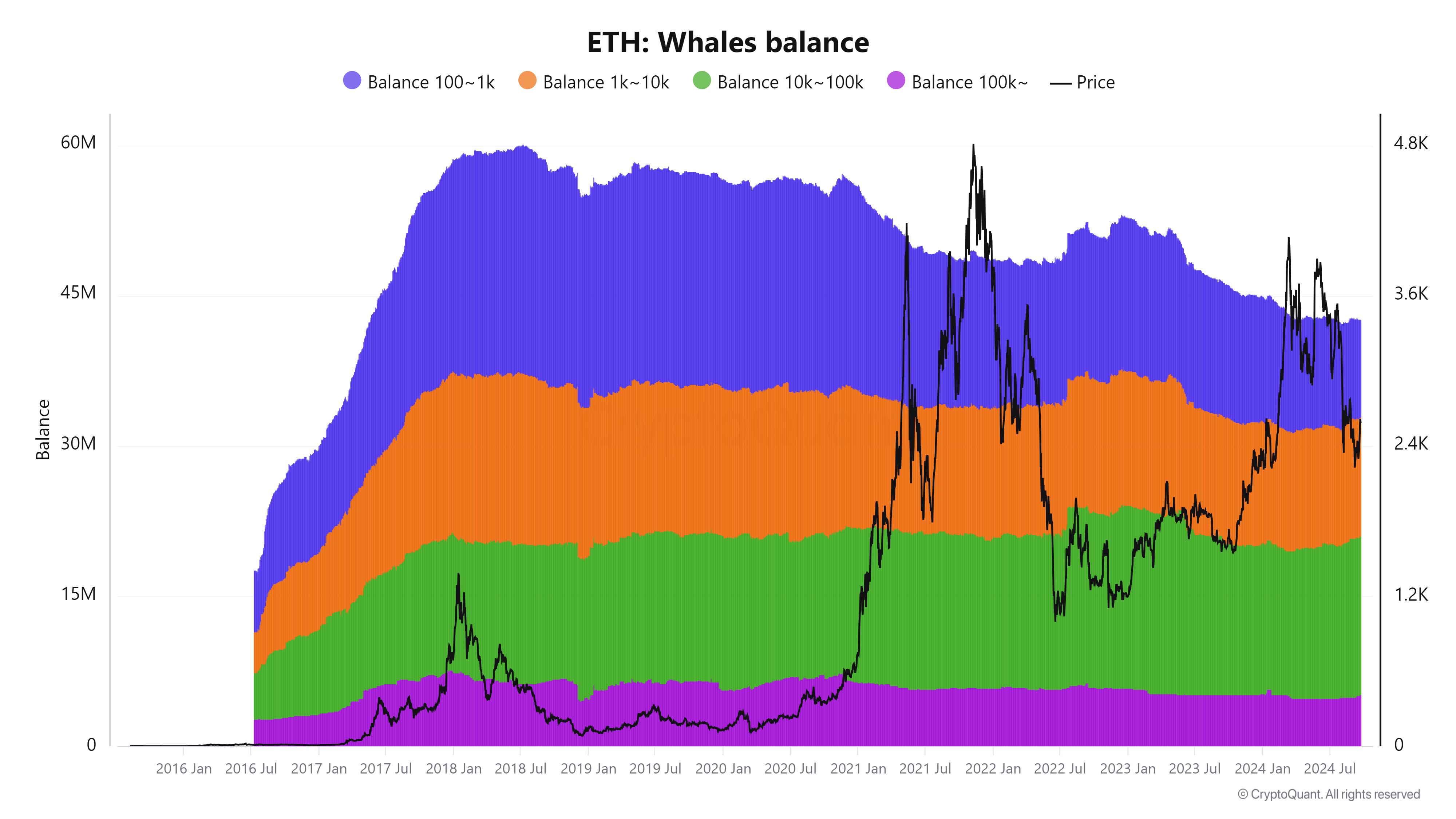

Examining the graph provided, it shows that the group of whales owning between 100 and 1000 Ether has been decreasing steadily since its peak in early 2021, whereas the remaining whales appear optimistic about potential future increases.

However, a recent X post revealed that an anonymous whale sold ETH valued at $38.4 million from their wallet into Kraken.

Remarkably, this whale was likened to an investor known as a “long-term holder” – an individual who maintains ownership of their assets for prolonged durations, with no immediate intention to dispose of them.

It’s understandable that their decision to sell might cause concern among investors. If this selling persists, it could potentially drive the price of the altcoin down below $2,600 due to increased selling pressure.

Normally, when faced with this scenario, many investors usually aim to break even – a tactic that appears to be the case for this particular investor too.

Understanding THIS strategy might combat pressure

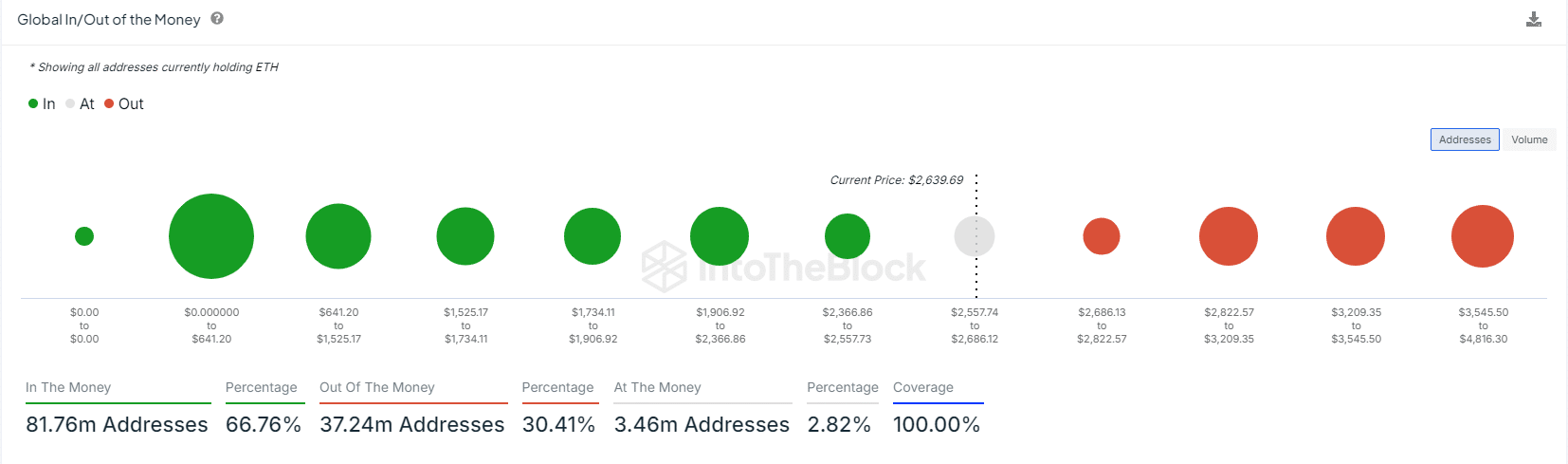

At present, Ethereum (ETH) supporters find themselves in a position where they need to hold the line at around $2,600 to counteract the selling force. Previously mentioned, a potential bearish downtrend could take place if this level gets tested again.

If this situation occurs, around 4 million Ethereum (ETH) addresses might find themselves owing more than they have, as the value of their combined holdings drops below the 8 million USD mark.

In the day-to-day price graph, ETH reached its highest point of $2,700 on the 23rd of September. Since then, this particular level has sparked debate, as it was previously tested in mid-August before the bears caused ETH to dip below $2,200.

Prior to any comparable pattern arising, when Bitcoin stabilized beneath $64,000, the whale chose to liquidate its position to achieve a break-even point.

If more whales adopt similar strategies, other investors might find themselves facing losses, which could initiate a downward trend – or “bear market” – making it challenging for buyers to push prices beyond the $2,700 mark.

The bulls are regaining control

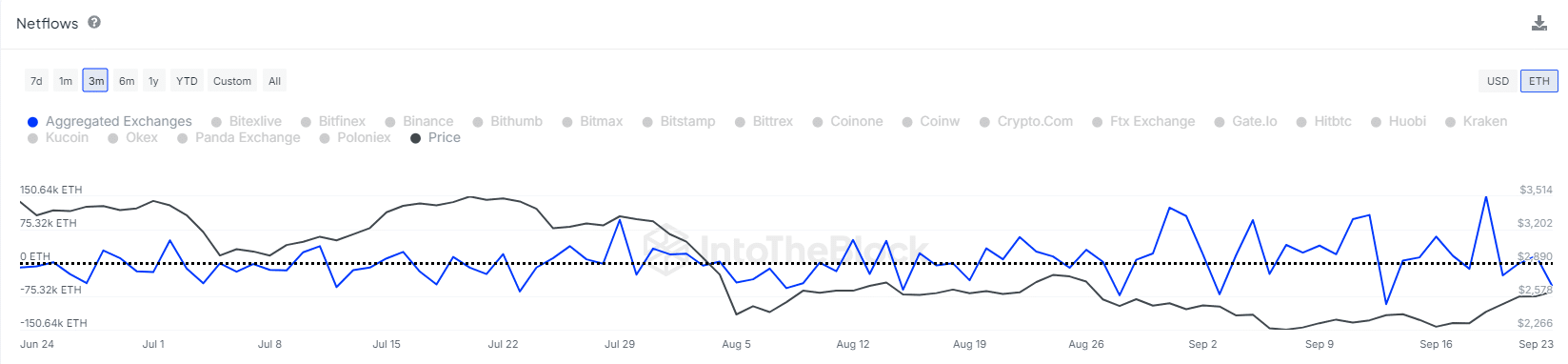

Although the whale strategy prevents an immediate breakout, investors are preparing for a bullish turnaround, as shown by the chart that follows.

Read Ethereum’s [ETH] Price Prediction 2024-25

As an analyst, observing a rise in net outflows gives me a hint of an impending correction. This suggests that investors are proactively trying to alleviate selling pressure by purchasing more Ethereum (ETH).

If the current pattern continues, it’s possible that we might see a rise surpassing $2.7K soon. However, it’s essential to stay alert about the actions of large investors (whales), as they can significantly influence the market. On the other hand, if this upward movement turns out to be short-lived, there could be a reversal leading back to around $2.2K.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-09-25 10:16