- Ethereum whale withdraws 5160 tokens worth $20 million.

- ETH has made a moderate recovery rising by 3.7%.

As a seasoned crypto investor with a knack for spotting trends and a penchant for Ethereum (ETH), I find myself intrigued by recent developments. The whale withdrawing 5160 ETH tokens worth a cool $20 million from Binance is a clear sign that the big players are accumulating, taking advantage of this market pullback. This move shows confidence in Ethereum’s long-term potential, especially considering the rising profits for long-term holders.

For about a month now, Ethereum (ETH) has been moving upwards in its trading pattern. Starting from its lowest point at around $2,355, it has significantly increased and reached $4,096.

After hitting this level, there’s been a correction and it has dropped back down to around $3,501. At the moment, Ethereum is being traded at $3,899, which represents a 0.6% decrease compared to its previous day’s closing price on charts.

This temporary market decline offers a prime purchasing chance, particularly for significant investors, as ‘whales’ are now seen taking advantage of the price drop by buying at lower costs.

Whales continue accumulating ETH

Based on information from the on-chain monitor Lookonchain, it appears that large investors (often referred to as “whales”) have been purchasing Ethereum (ETH) following its price decrease. Specifically, one of these whales established a new digital wallet and moved 5160 ETH tokens valued at approximately $20 million out of Binance.

As more whales amass Ethereum (ETH), this trend demonstrates a significant level of trust among major investors, particularly since the long-term holders’ earnings are steadily increasing.

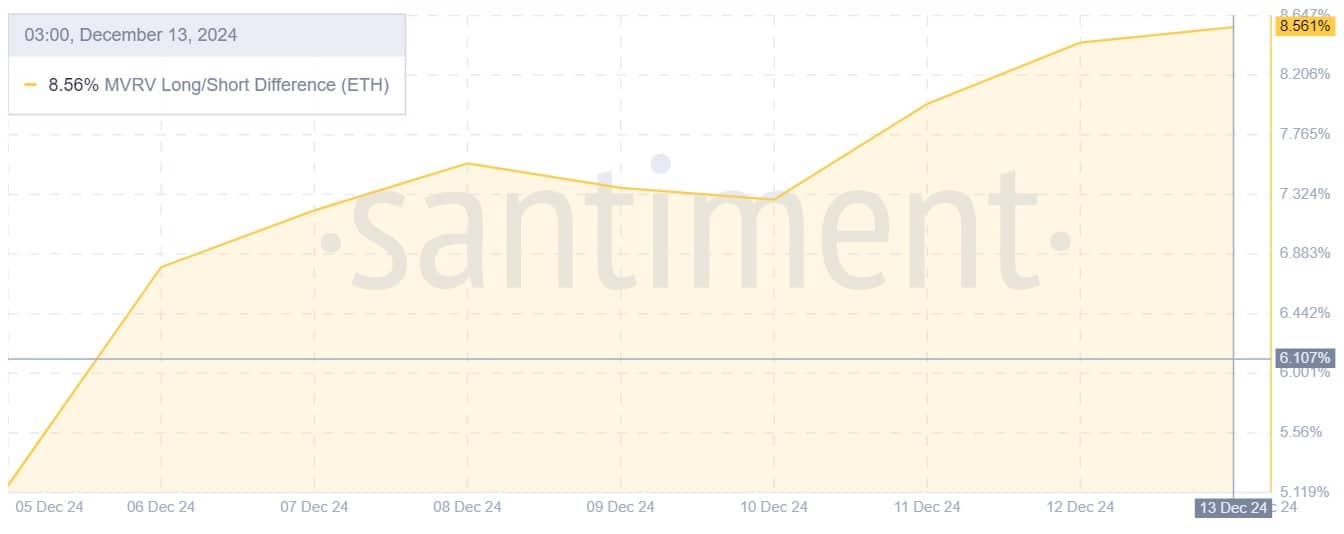

Over the last week, the gap between Ethereum’s MVRV long/short ratio has been steadily growing. This metric started at 5.17% and has now reached 8.56%. This growth suggests both increasing investor confidence in the market and a rise in profitability.

What ETH charts say

Based on AMBCrypto’s examination, there’s a robust optimistic momentum for Ethereum right now, driven by significant purchasing activity from major investors.

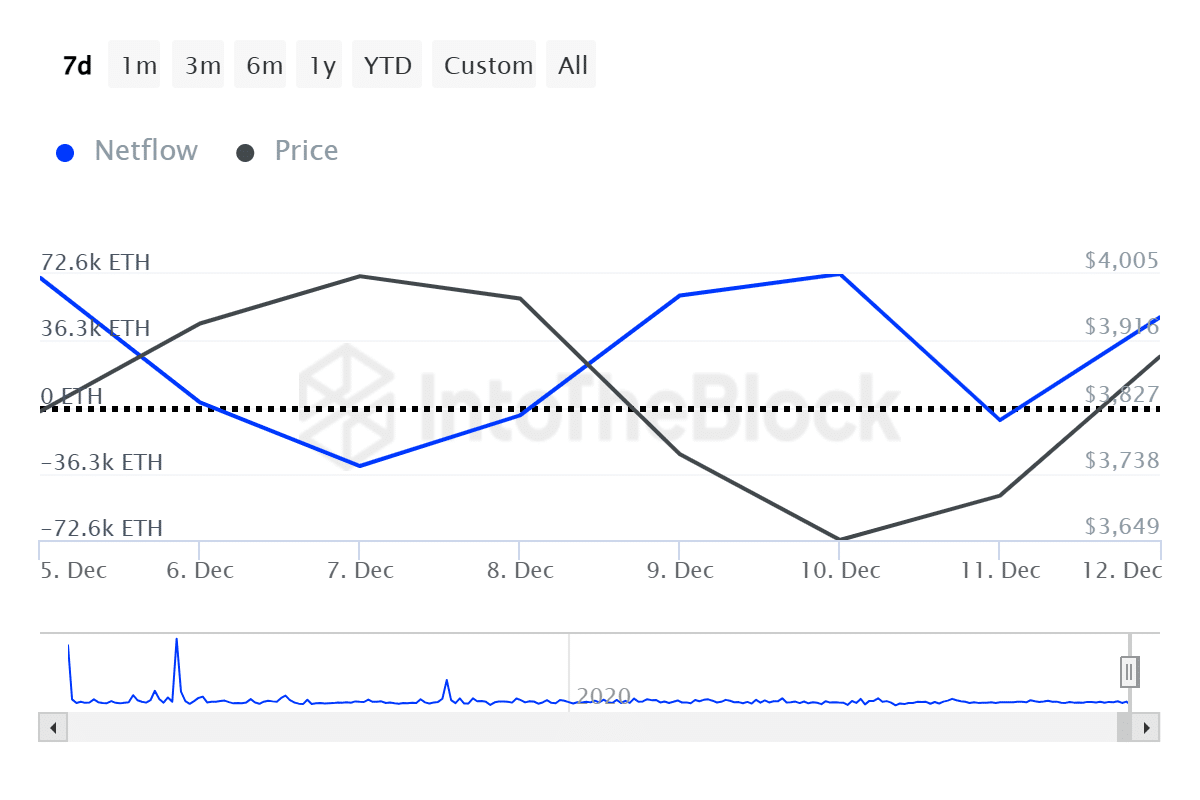

In essence, it appears that Ethereum investors are increasingly holding onto their assets, as indicated by an increasing outflow of the asset, suggesting a buildup or accumulation trend.

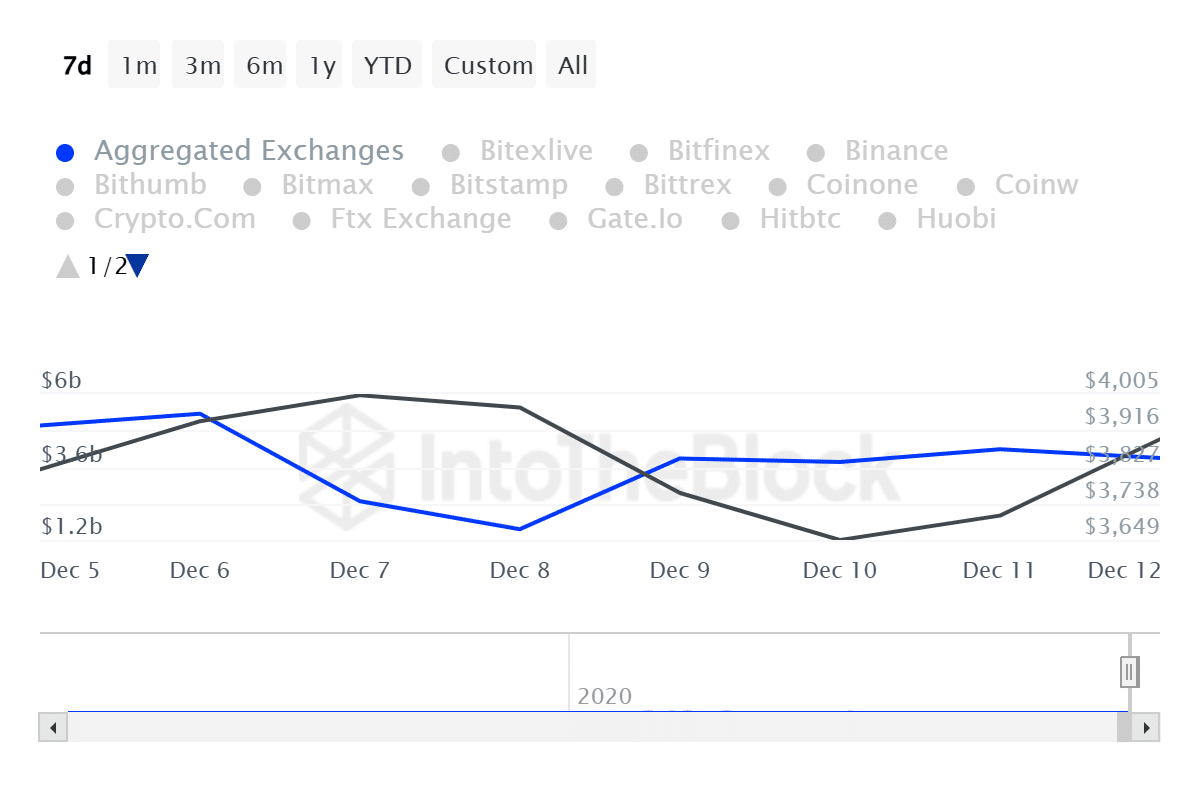

Based on data from IntoTheBlock, the amount of Ethereum tokens being moved out of exchanges has significantly increased from approximately $1.56 billion to $3.89 billion over the last week. This trend suggests that a higher number of investors are choosing to store their ETH in personal wallets rather than on exchanges.

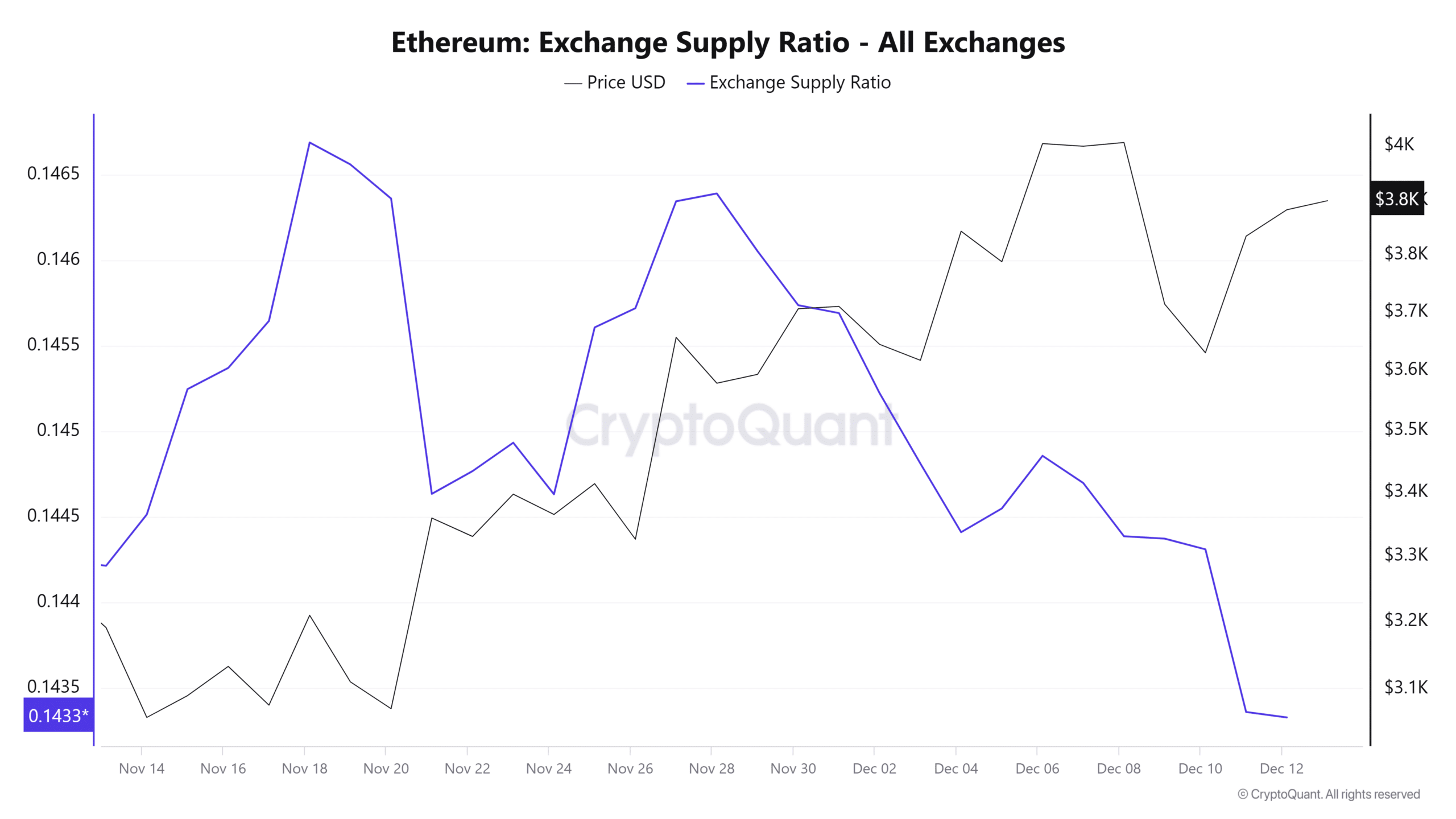

As an analyst, I’ve noticed that the downward trend in this market is reinforced by a decreasing exchange supply ratio. Specifically, it has fallen from 0.1468 to 0.143. This decrease suggests that an increasing number of investors are adopting a bullish stance and are choosing to hold their assets outside of exchanges.

To put it simply, the optimism among major investors (whales) is shown by an increasing number of large holders entering the market. In fact, this increase has gone from a net decrease of 7,160 to 48,960 over the last day. When we see such a significant rise in net flow, it means that more money is flowing into the asset than leaving it, suggesting increased interest and investment.

Read Ethereum’s [ETH] Price Prediction 2024–2025

It appears that major Ethereum holders are expressing optimistic feelings right now. This might lead to an increase in accumulation and investment, potentially causing Ethereum’s price to rebound on its charts.

If these feelings persist, it’s possible that Ethereum might surge back towards $4000 in the near future. Conversely, if purchasers don’t manage to regain control of the market, Ethereum could dip down to around $3713.

Read More

2024-12-14 05:11