-

Ethereum whale has instilled fear among stakeholders following the release of approximately 19K ETH.

However, a deeper pullback may still be on the horizon.

As a seasoned researcher with years of experience navigating the ever-changing crypto markets, I’ve seen my fair share of whales causing ripples – and sometimes tsunamis! The recent activity of the Ethereum [ETH] whale selling 19,000 tokens is no exception. While it might seem like a minor blip on the radar for some, I can tell you that such moves have a profound impact on market sentiment.

In a significant turn of events for Ethereum [ETH], one influential investor, often referred to as an “ICO Ethereum whale,” sold approximately 19,000 tokens, equivalent to around $47.5 million. This massive sale occurred over a span of merely two days, causing a noticeable stir in the market.

Although ETH began October with a series of daily candlesticks indicating decreases, preventing it from hitting $2.7K, the anticipated selling pressure due to the whale’s activities did not occur as predicted.

Instead, ETH surged approximately 2% from the previous day, capturing AMBCrypto’s attention.

Ethereum whale activity signals a market top

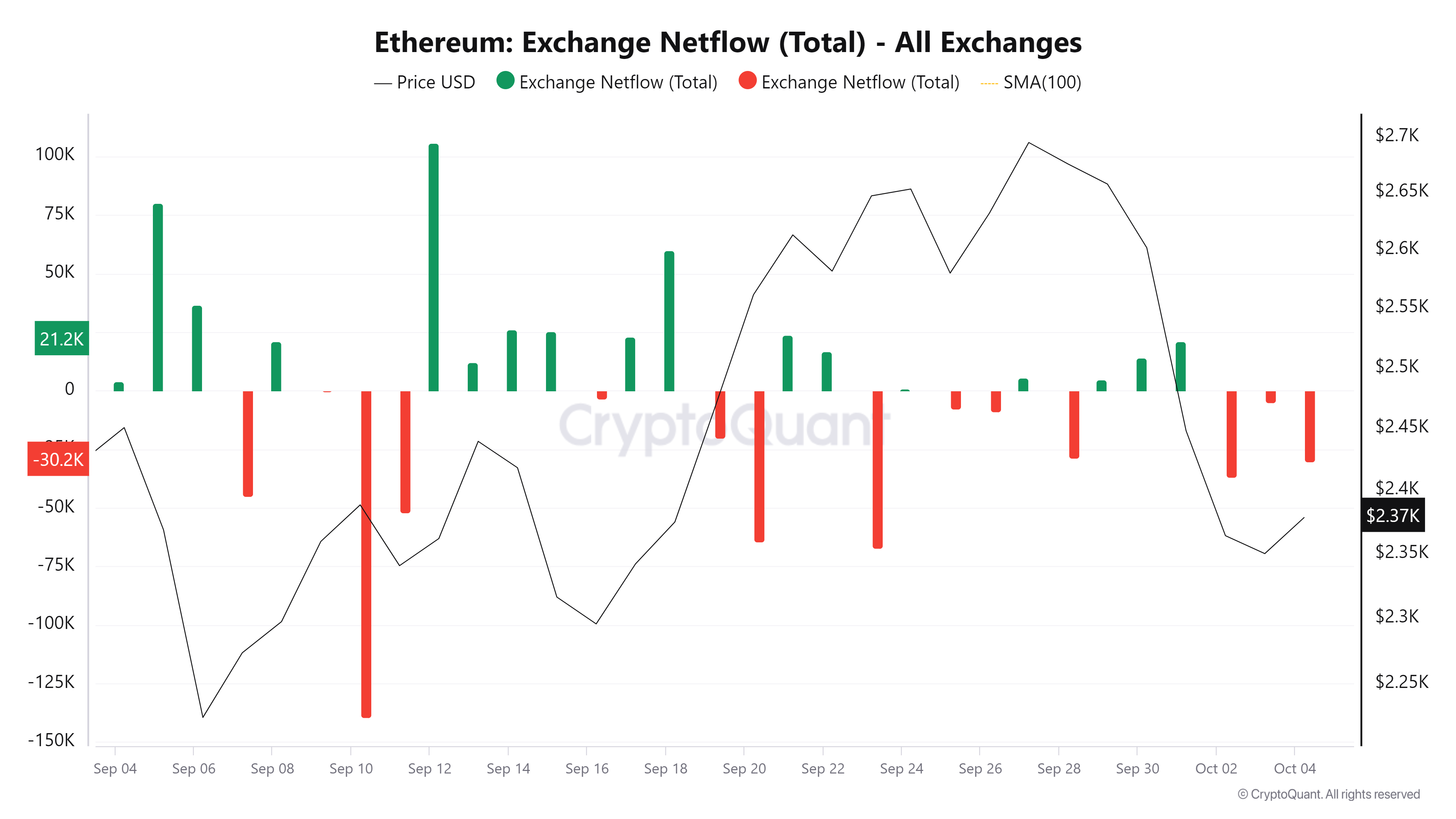

The chart below revealed an intriguing development. Typically, a significant spike in net outflows signals active buying, indicating traders’ confidence in a potential price correction.

Over the past three days, ETH netflows have stayed negative, hinting at growing optimism.

Source : CryptoQuant

However, this optimism contrasts sharply with the recent Ethereum whale activity, which signals $2.6K – the price at which the sell-off occurred – as a potential market top.

If it turns out to be true, there could be a potential drop in ETH‘s price from its current value of $2.37K down to the previous resistance level of $2.23K.

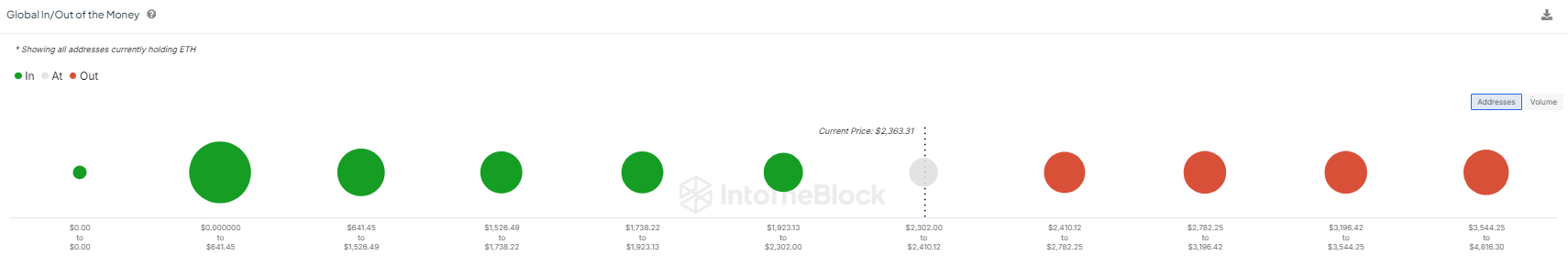

On top of that, the chart presents an opposite perspective. Investors who bought Ethereum (ETH) three days ago when its opening price was $2.6K, with expectations of a bull run, are currently experiencing a net loss instead.

Source : IntoTheBlock

This scenario showcases how the actions of large Ethereum investors (whales) have significantly impacted smaller investors, potentially placing them in disadvantageous situations due to the whales’ recent activities.

As a result, the extensive selling among traders might make it less probable for the market to turn around, since their confidence decreases significantly due to intense selling activity.

Fear might trigger panic selling

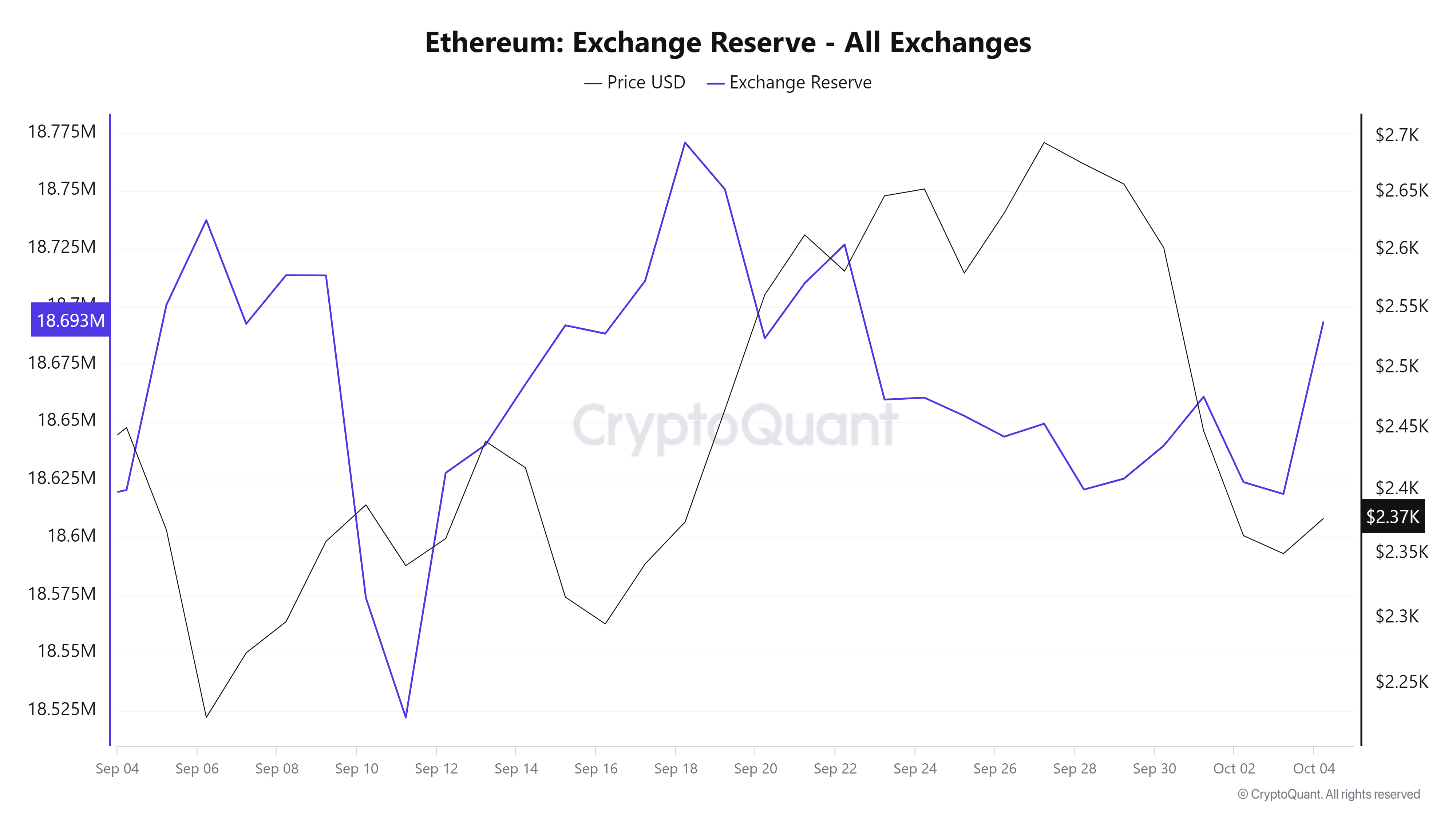

It’s evident that the large Ethereum investor (the “whale”) played a substantial role in shaping ETH market movements. This influence has, in turn, impacted the faith of investors regarding a potential ETH price rebound, as suggested by the chart presented below.

There’s been an unexpected increase in the amount of Ethereum held in exchanges, as around 18.7 million Ether has recently been transferred to them.

Source : CryptoQuant

The rise in value can be attributed directly to the anxiety felt by investors after a significant sale of Ethereum (ETH) by large investors, totaling approximately 19,000 ETH.

Typically, a state of intense fear can provide the perfect moment for purchasing at a discount, often referred to as “dipping”. The slight 2% rise you previously noted, even amidst a substantial decline in prices, could be suggesting exactly such an opportunity.

As per AMBCrypto, a stronger acquisition strategy might counteract the present downtrend by neutralizing the selling pressure instigated by the Ethereum’s significant investors, also known as whales. This action could potentially establish conditions for a market low point, enticing buyers drawn to lower price levels.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Yet, for this turnaround to succeed, it’s crucial that investors experience intense apprehension. In the absence of such dread, the likelihood of a sustainable recovery becomes slimmer.

Given my findings, it appears that the impact of the Ethereum whales could potentially be a factor contributing to its potential dip. However, before a substantial surge, there might be a more pronounced downtrend first.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-10-05 01:12