- Ethereum’s RSI was in oversold territory, signaling a potential bullish reversal.

- CryptoQuant’s Ethereum exchange inflow was at its lowest point in the last 30 days — a buy signal.

As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by the current state of Ethereum [ETH]. The recent whale activity suggests that the ‘buy the dip’ sentiment is alive and well, which aligns with my personal philosophy: “Whales know the tides better than anyone.”

The price of Ethereum (ETH), the world’s second-largest digital currency, has experienced a substantial drop after the debut of the U.S.-based Spot Ethereum Exchange Traded Fund (ETF).

In the midst of market declines, on the 2nd of September, two large investors saw the drop in Ethereum (ETH) prices as a potential opportunity. They obtained stable coins valued at approximately $19.22 million from Aave [AAVE] and used them to purchase 7,767 ETH.

Whale activity signals buy the dip sentiment

On X (previously known as Twitter), Lookonchain highlighted that the whale wallet “0x761d” recently bought approximately 3,588 ETH, valued at around $8.8 million, and another user acquired a staggering 4,180 ETH worth about $10.42 million in the past day.

This significant ETH accumulation during the market downturn signals potential buy opportunities.

Ethereum technical analysis and upcoming levels

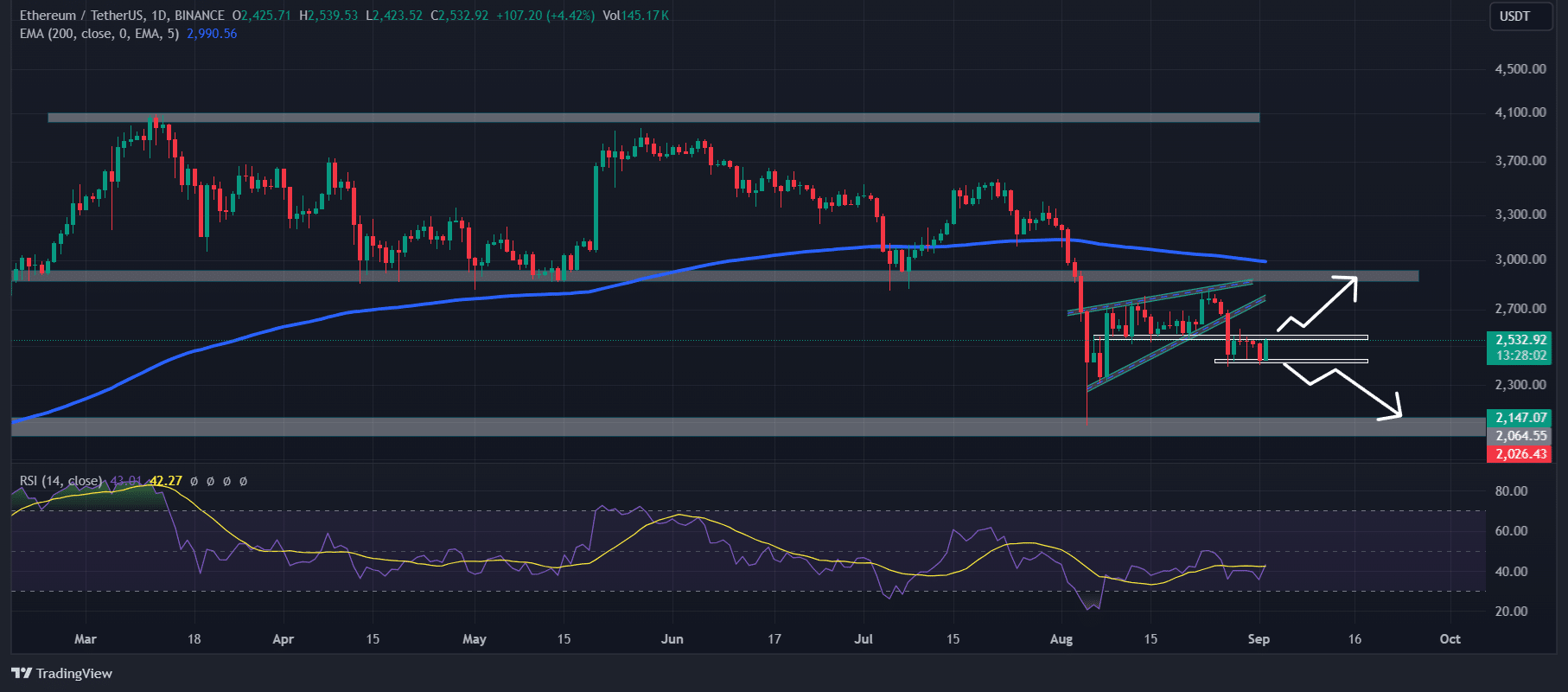

Based on the technical assessment by experts, Ethereum (ETH) has been moving downward because its price is currently lower than the 200-day Exponential Moving Average (EMA), as observed on a daily chart.

Furthermore, the recent collapse of the bearish ascending triangle in Ethereum’s price movement suggests it might drop towards $2,200 in the near future. However, if Ethereum manages to finish a daily chart above $2,600, this trend could potentially be reversed.

Yet, the Relative Strength Index (RSI), a technical indicator for Ethereum, indicated it was in an oversold state, suggesting a possible price increase in the approaching days.

On-chain metrics support bullish outlook

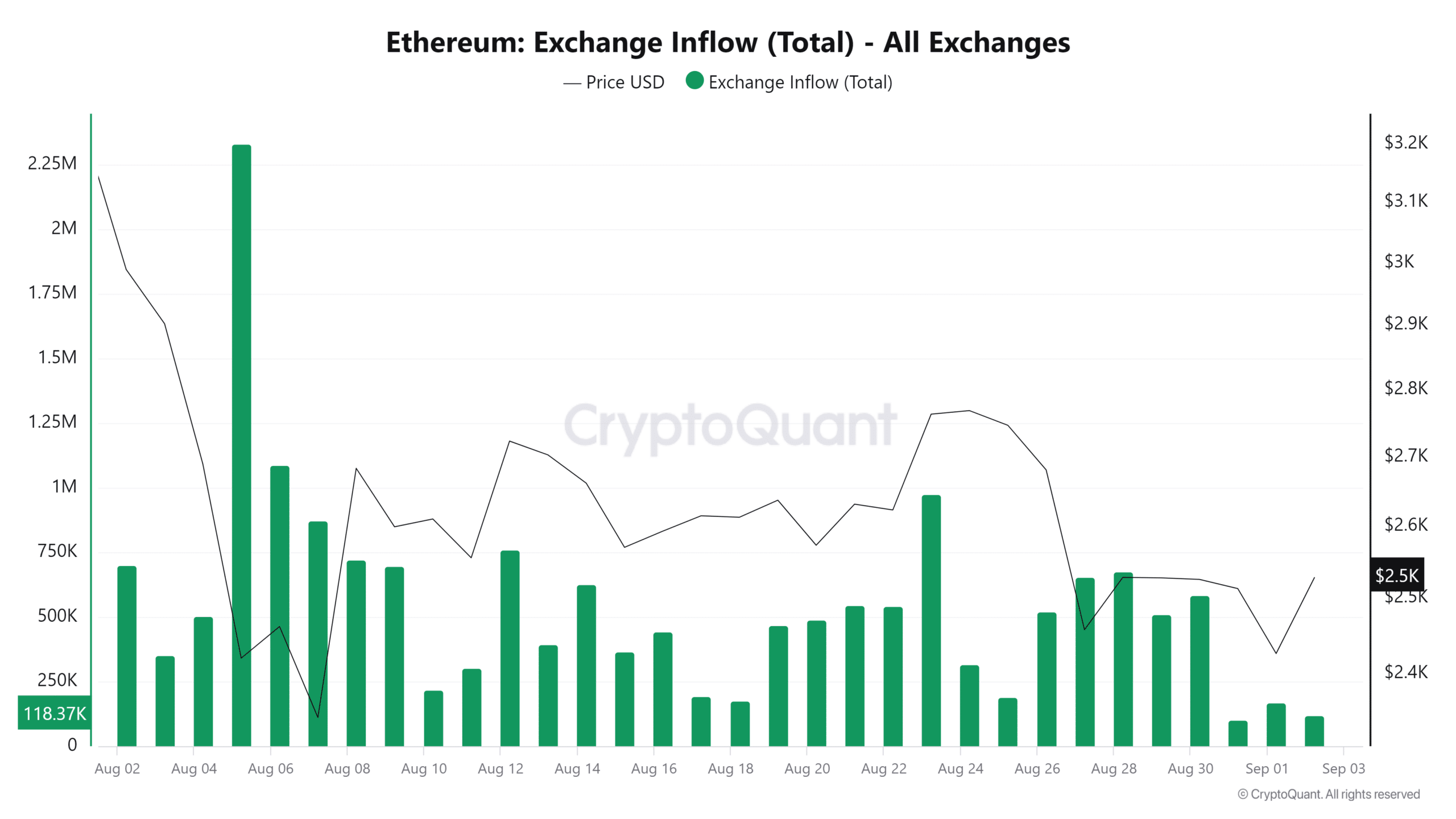

Based on the on-chain indicators, Ethereum’s positive trend seems reinforced. The inflow of Ethereum into exchanges, as monitored by CryptoQuant, is now at its lowest level in the past 30 days – a sign that could be interpreted as a buying opportunity.

High inflow indicates higher selling pressure in the spot exchange or vice versa.

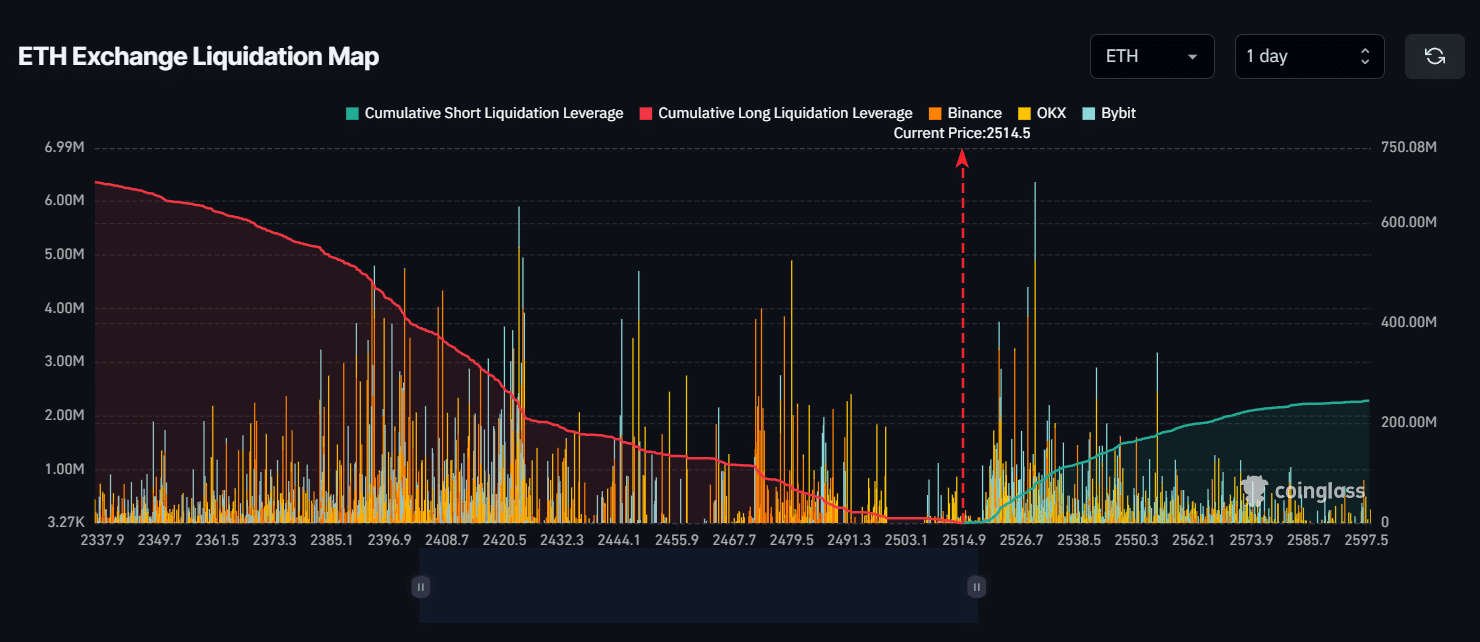

Simultaneously, CoinGlass’s Ethereum trading platform showed a trend where long (buy) positions seemed to be overwhelming the market, possibly forcing out short (sell) positions.

At approximately $2,420 and $2,530, significant selling points were observed due to a high level of trader leveraging in those areas.

Should the outlook continue to be pessimistic and the Ethereum price drops to around $2,420, approximately $230 million in long positions may need to be closed out.

In a reversal, should the price reach around $2,430, it’s estimated that about $70 million from short positions will need to be closed out.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Currently, Ethereum (ETH) is close to $2,510 per token due to a 1.3% increase in price over the past day. Simultaneously, its Open Interest has climbed, with a 1% rise observed within the past hour and a 1.5% uptick during the last four hours.

This rising Open Interest signals growing investor and trader interest amid the recent price drops.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Masters Toronto 2025: Everything You Need to Know

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-09-02 17:44