-

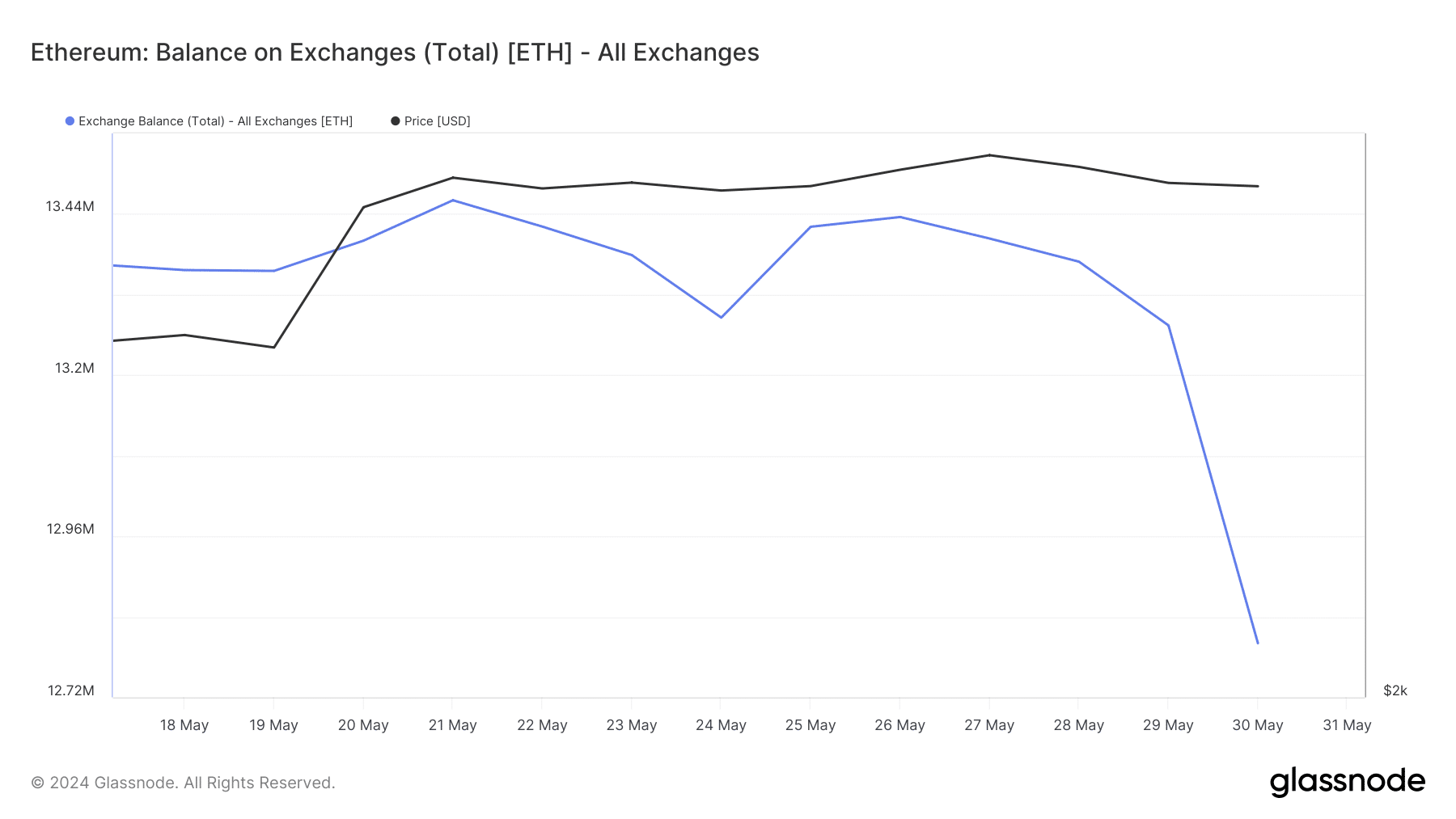

Ethereum’s exchange reserve declined sharply on the 30th of May.

Metrics suggested that ETH was in an overbought position.

As a seasoned crypto investor, I’ve seen my fair share of market fluctuations, and Ethereum’s recent price action has been no exception. The sharp decline in Ethereum’s exchange reserve on the 30th of May and the overbought position suggested by metrics were red flags for me.

Last week, the price of Ethereum [ETH] surpassed $3,900, sparking enthusiasm among its supporters. However, ETH failed to sustain this growth and subsequently dropped from that peak. During this time, large investors or “whales” seized the moment to accumulate even more Ethereum.

Interest in Ethereum is growing

Last week, ETH experienced significant price fluctuations. On May 27th, it reached a peak of over $3,900. However, this upward trend was short-lived as the bear market reemerged, causing a decline in its value.

As a researcher, I found it intriguing that the approval of the ETH ETF didn’t significantly boost the coin’s growth during the past week.

Based on data from CoinMarketCap, Ethereum (ETH) experienced a decrease of more than 1% in the previous week. Currently, ETH is being traded at $3,759.66, and its market capitalization exceeds $451 billion.

While the token’s price volatility remained high, whales made their move.

Recently, cryptanalysis expert Ali drew attention on Twitter to the significant rise in the number of Ethereum wallets containing over 10,000 Ether.

The rising number of addresses indicated that whales were shifting from dispersing their holdings to concentrating them.

According to AMBCrypto’s analysis of Glassnode’s data, there was an observed increase in Ethereum accumulation based on exchange balances. Specifically, a significant decrease in Ethereum holdings on exchanges occurred on May 30th, signaling robust buying demand.

The flip side of the story

According to previous data, it seemed that investors were purchasing Ethereum (ETH). However, an analysis by AMBCrypto of CryptoQuant’s data uncovered contrasting findings.

Based on our examination, Ethereum’s deposits into exchanges exceeded the previous week’s average, indicating a potential increase in selling activity.

As a researcher observing the market, I noticed that the premium on Ethereum’s Coinbase exchange was in the red. This indicated that the selling pressure from US investors was stronger than the buying pressure at the time.

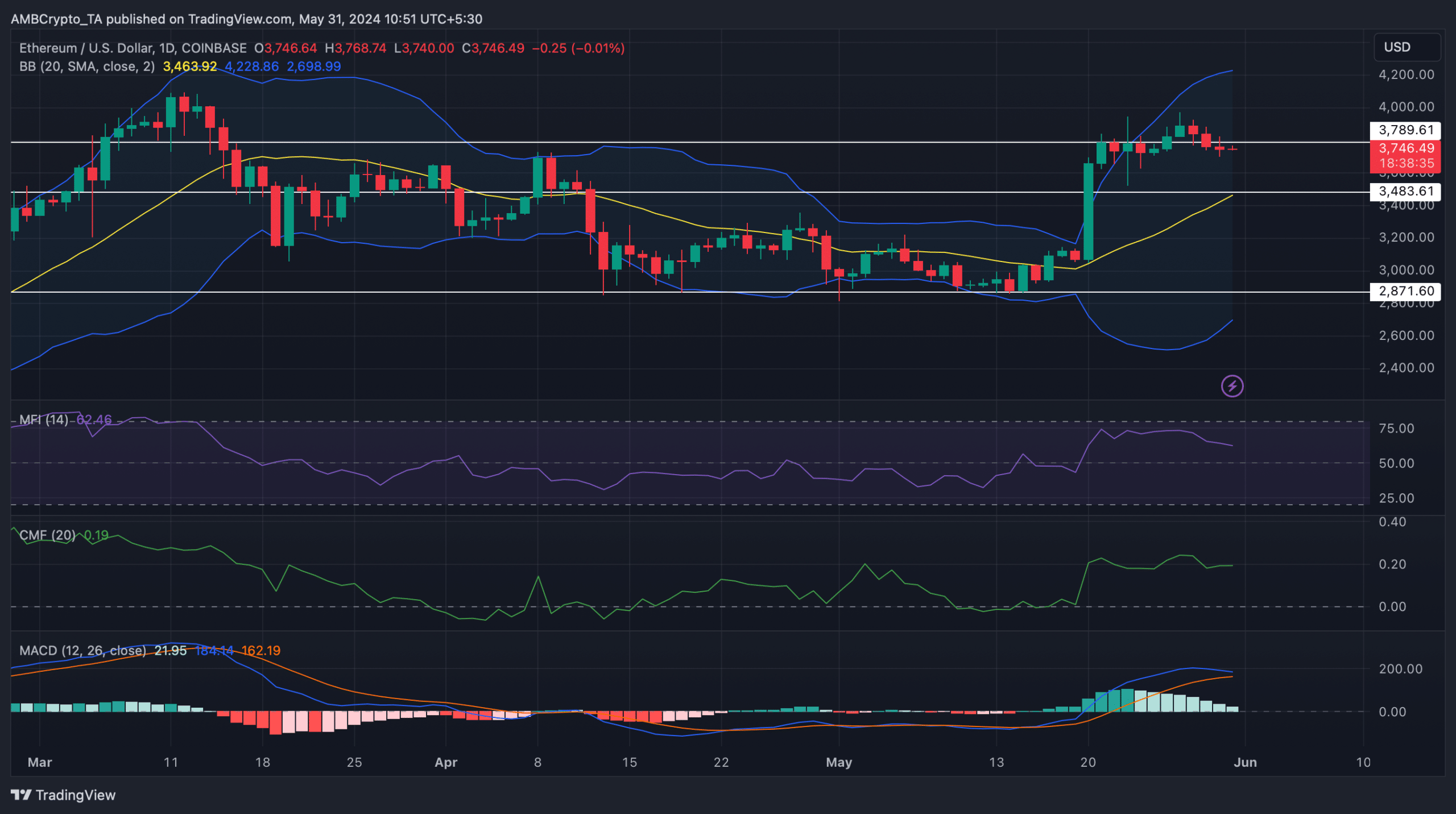

One potential explanation for the current situation is that Ethereum (ETH) may have been overbought based on its technical indicators. Specifically, both the Relative Strength Index (RSI) and stochastic readings for ETH signaled that it was in an overbought state.

An examination of Ethereum’s daily chart by AMBCrypto aimed to determine the potential influence of shifting buying and selling trends on its price in the near future.

In simpler terms, the MACD chart indicated a potential signal for a market reversal towards a downward trend, while the MFI showed a slight decrease.

According to Bollinger Bands analysis, the Ethereum price was exhibiting significant volatility and remained above its 20-day Simple Moving Average.

Is your portfolio green? Check the Ethereum Profit Calculator

If the downward trend in Ethereum’s price persists, it could initially fall to its moving average of the previous 20 days, following which a potential recovery may occur.

Despite the bullish signal from the Chaikin Money Flow indicator, which was on an upward trend, Ethereum’s price breaking above its resistance at $3,789 could happen earlier than anticipated.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-05-31 12:07