- Ethereum consolidation reveals diminished interest from whales as the market struggles with uncertainty.

- Assessing the state of demand as exchange flows drop to 2024 lows.

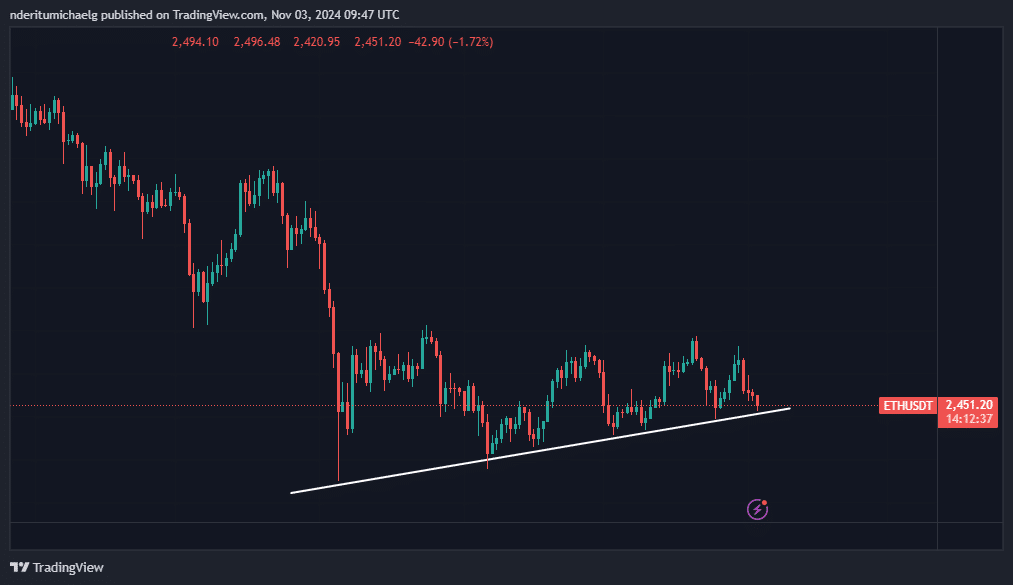

As a seasoned crypto investor with years of experience under my belt, I have seen market cycles come and go. The current consolidation phase of Ethereum [ETH] has left me both intrigued and slightly anxious. While the higher lows suggest that significant accumulation is taking place, the struggle to break above $2,800 indicates a lackluster demand, especially from the whale category.

Over the past three months, Ethereum (ETH) has been experiencing a period of consolidation. Could we potentially see a breakthrough from this consolidation area in November? Let’s examine how ETH has performed thus far.

Ethereum didn’t meet optimistic predictions as expected since August, with the price not bouncing back substantially after the crash in May. Yet, the fact that its highest prices have been decreasing since August indicates that there may have been a considerable buildup of holdings over the past three months.

Over the past three months, I’ve noticed that despite occasional spikes, the price has found it challenging to surpass the $2,800 mark consistently. This struggle mirrors the prevailing dynamics in the market, particularly the lower demand from significant market players, often referred to as ‘whales’.

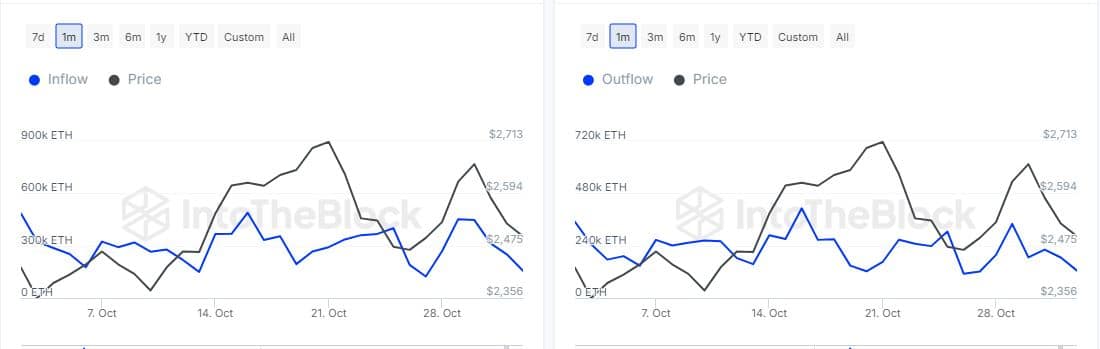

Since late October, there’s been a steady decrease in the amount of Ethereum held by major investors. Interestingly, outgoing transactions (outflows) have been comparatively less than incoming ones (inflows), suggesting that the current supply trend might soon switch from sell pressure to demand.

One reason for this could be that the strong selling activity over the past few days forced ETH to revisit its rising support level during the same period.

The decrease in large investors selling (outflows) might mean that the selling pressure from big players, such as whales, is diminishing. This could be an indication of a possible shift or reversal (pivot). Yet, it’s important to note that the reduction in large investors buying (inflows) also signals less enthusiasm among these big players.

Is Ethereum demand making a comeback?

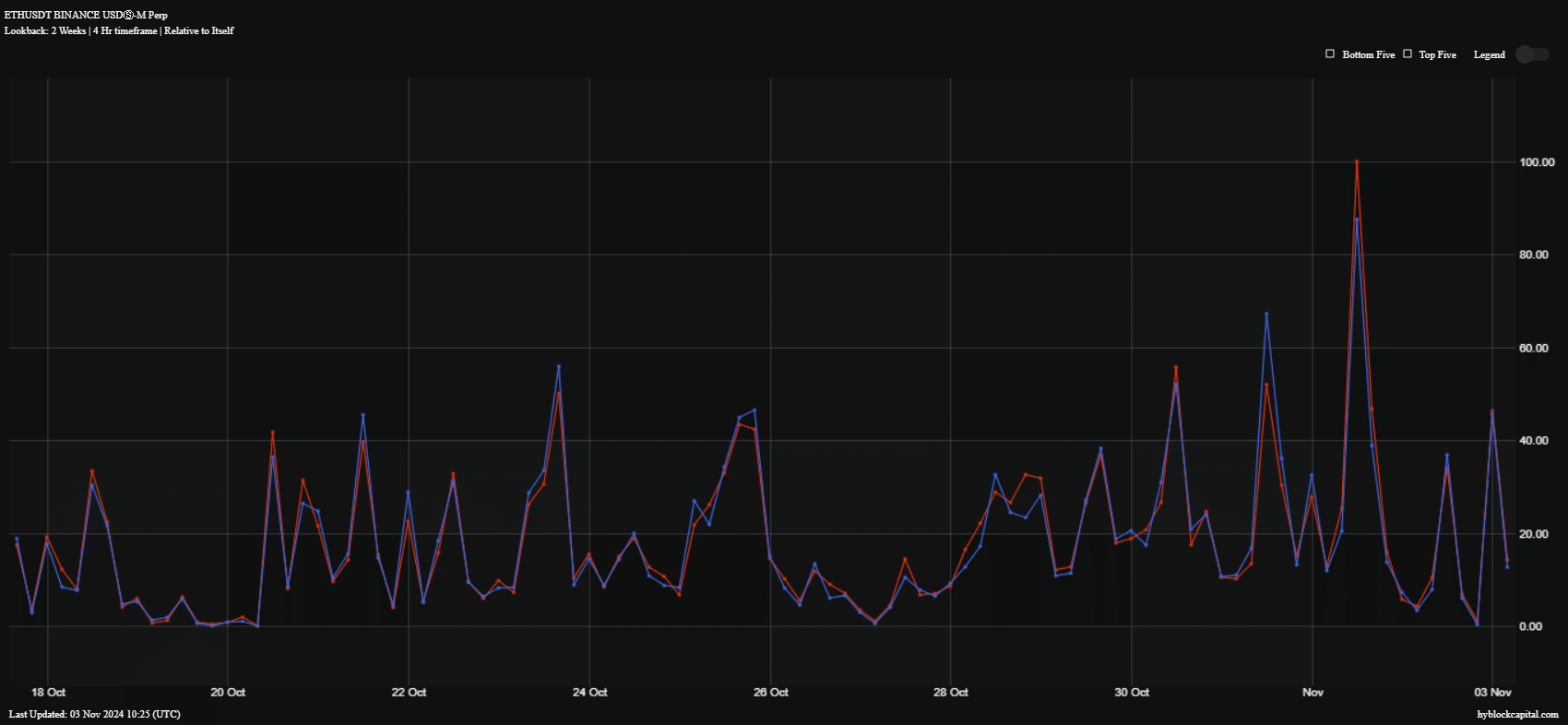

On November 1st, there was a significant increase in both buying and selling activity for Ethereum, but it was the buy volume that stood out as particularly high, suggesting heightened interest or demand.

An increase in purchasing activity suggests a potential resurgence of interest in Ethereum (ETH) this month, but it remains to be verified. This theory is partly based on the assumption that some investors have been hesitant to invest because of uncertainties surrounding the election season.

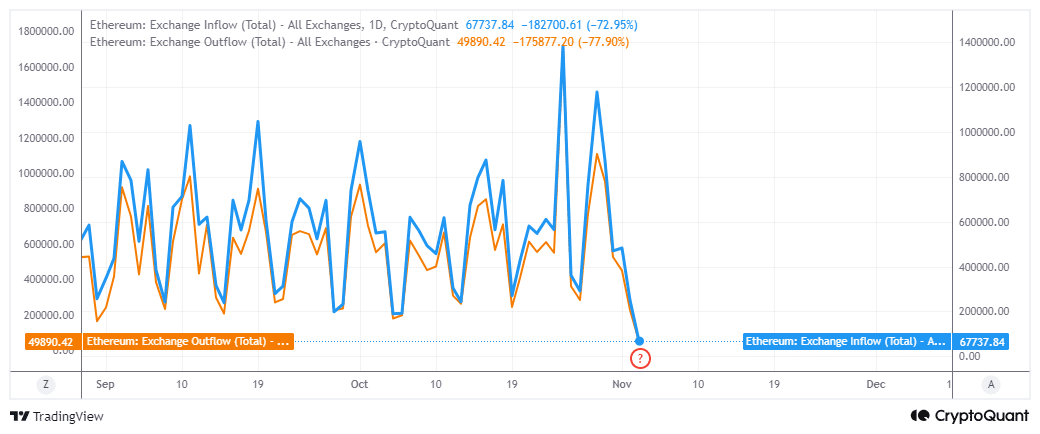

2024’s lowest uncertainties yet caused exchange flows to dip down to their minimum levels.

Inflow transactions significantly surpassed outflow transactions in the last 24 hours. Specifically, inflows accounted for 67,737 ETH, compared to 49,890 ETH in outflows.

Read Ethereum’s [ETH] Price Prediction 2024–2025

From the information given, it’s apparent that the fluctuations in Ethereum prices were directly linked to decreased investor enthusiasm. However, the current period of stabilization might indicate a surge of fresh interest following the U.S elections.

The election’s result could potentially have either a favorable or unfavorable effect, contingent upon who emerges victorious.

Read More

- OM PREDICTION. OM cryptocurrency

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What You NEED to Know!

- Moo Deng’s Adorable Encounter with White Lotus Stars Will Melt Your Heart!

- Billy Ray Cyrus’ Family Drama Explodes: Trace’s Heartbreaking Plea Reveals Shocking Family Secrets

- Discover How Brittany Mahomes Fuels Patrick’s Super Bowl Spirit!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-11-04 04:07