-

ETH faces sell-off fears amidst increased whale activity.

Ethereum dump continues as large holders transfers $538.5 million worth of ETH.

As an analyst with over a decade of experience in the financial markets, I’ve seen my fair share of market fluctuations and whale activities. Looking at Ethereum’s current situation, it seems we’re standing at a critical juncture. The recent surge in whale activity, as evidenced by massive ETH transfers to exchanges, is indeed concerning.

Currently, Ethereum (ETH), the second-largest cryptocurrency by market value, is seeing a modest rebound in its price. At present, it’s being traded at approximately $2366, representing a 1.76% rise over the last day.

Previously, the price of ETH had been on a slide and hit a recent low of $2150 just last week. In the past 40 days, this cryptocurrency has dropped by approximately 11.09%.

Even though ETH showed increases on a day-to-day basis, it still hasn’t reached significant heights compared to its most recent peak of $2820 and is also far from its all-time high of $4878, standing at 51% below that level.

Despite an increase in value for the altcoin yesterday, concerns about a marketwide sell-off persist due to unusual whale activity. Notably, as reported by Whale Alert, there have been significant transactions involving Ethereum moving into exchange platforms.

Ethereum whales are on the move

Through multiple financial transactions, Whale Alert has discovered enormous Ethereum transfers directed towards several cryptocurrency platforms. The combined value of these transactions amounts to an astounding $538 million, with recipients such as Kraken, Binance, Arbitrum, and Coinbase receiving significant portions.

According to the data in the report, Binance took in approximately $188.6 million in Ethereum (ETH), followed by Kraken with around $127.2 million. Meanwhile, Coinbase received roughly $34 million and Arbitrum recorded a similar amount as Binance, about $188.6 million.

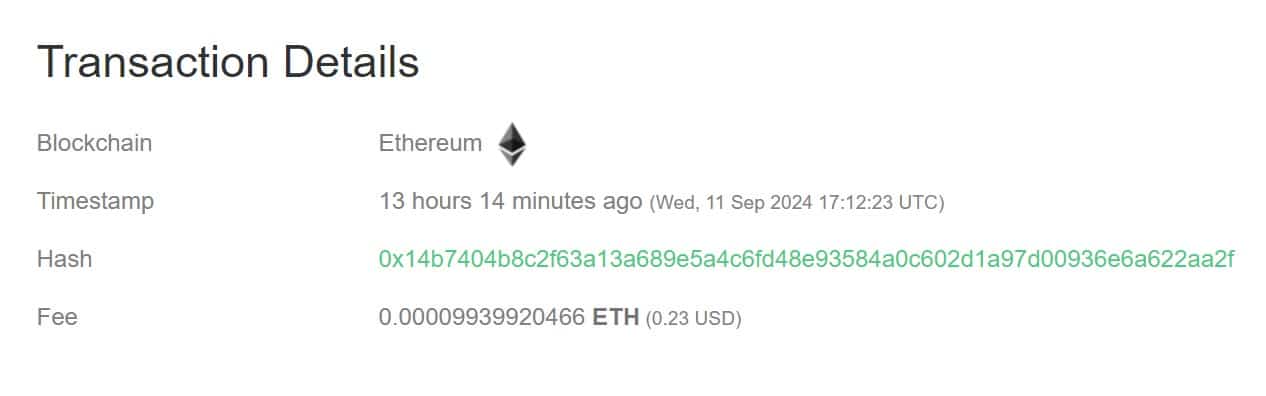

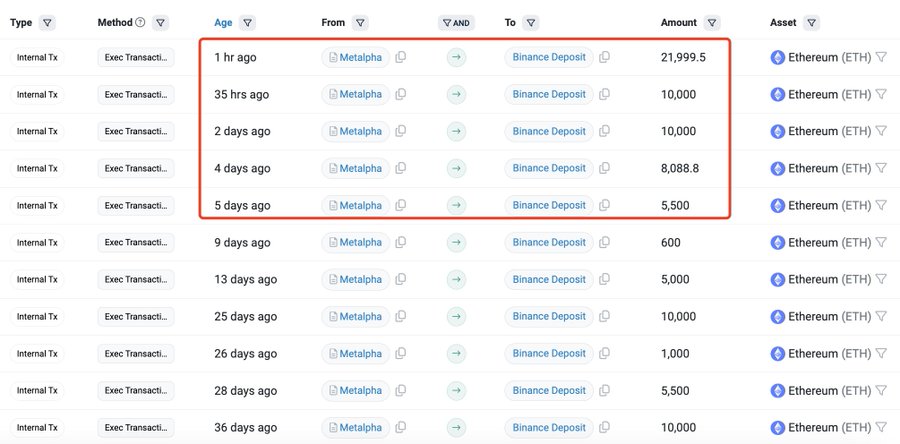

Over the last few days, Metalpha has been actively adding funds, specifically $51.16 million in Ethereum, as per Lookonchain’s recent reports.

Over the past five days, Metalpha has deposited $128.7 million worth of Ethereum to Binance.

It’s been noticed that these large-scale transactions have sparked interest within the Ethereum community, as moving funds into exchanges often suggests a readiness to offload or sell the assets involved.

Should these holders decide to offload their assets, an increase in selling activity might ensue. This surge in sellers could put downward pressure on the market, causing prices to potentially fall even more due to a rise in available supplies on trading platforms.

What ETH charts suggest

Although increases on daily graphs can be encouraging, recent significant transactions by ‘whales’ have put the market at a critical juncture. These large-scale transactions suggest doubt among the whales about the altcoin’s trajectory – a trend we’ve observed in the last seven days.

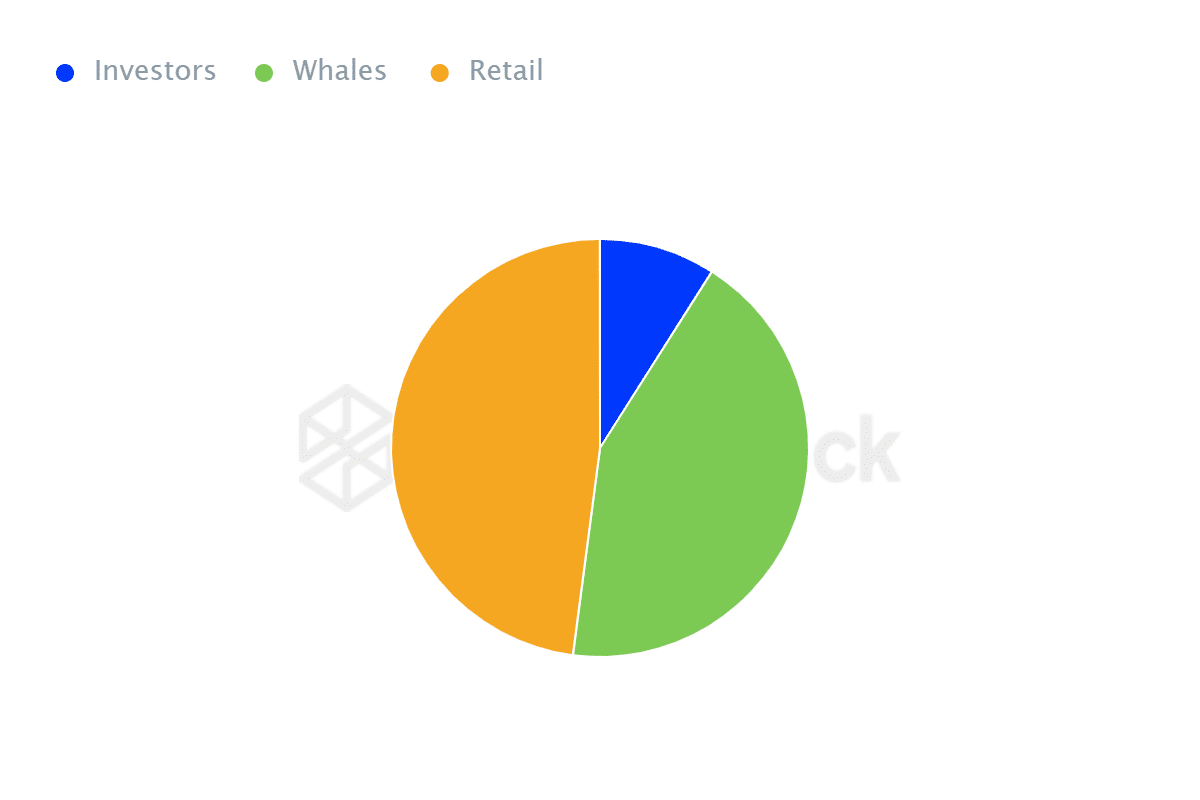

Initially, there’s been a significant shift in who owns Ethereum, with retail traders now holding a larger portion compared to earlier times when a few entities dominated the market.

Based on data from IntoTheBlock, approximately half (47.93%) of the Ethereum market is managed by individual traders, while a slightly larger portion (43.07%) is in the hands of large investors known as whales. This suggests that if whales decide to sell more of their holdings, there could be further decreases in ETH‘s price due to retail traders tending to sell emotionally.

Similarly, when the number of whales (large holders) decreases, it often indicates that these influential investors are not confident about the future trajectory of the altcoin.

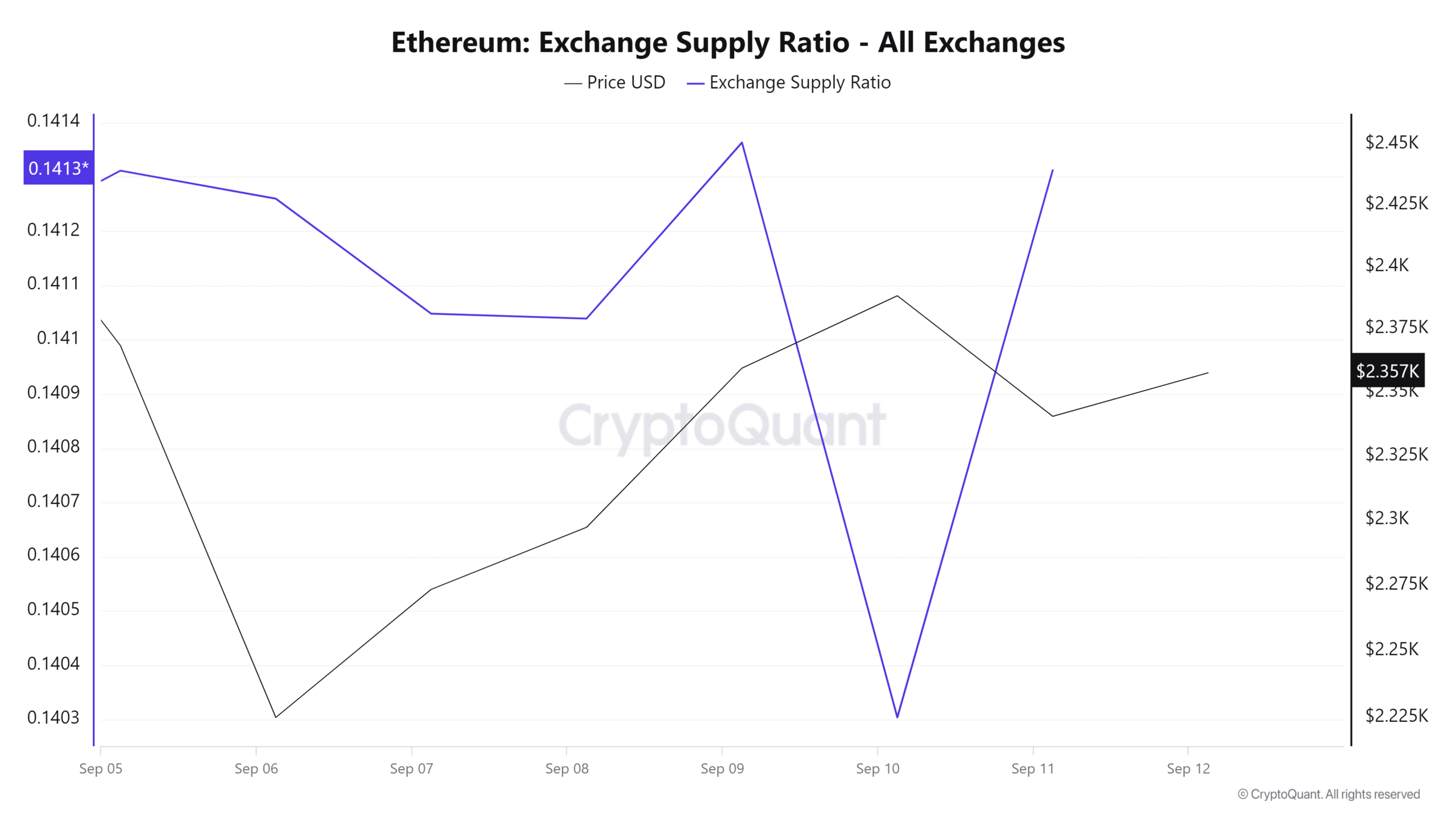

Moreover, a surge in the exchange supply ratio indicates that there’s been an increase in available supply on trading platforms over the last day.

An increase in the supply ratio as more assets move to exchanges implies that holders might be getting ready to sell due to a predicted decrease in price. In other words, when more assets are being deposited into exchanges, it could be a sign that sellers expect prices to fall soon.

Thus, the whale transactions imply that significant investors may be planning to offload their Ethereum, indicating a decrease in faith regarding its potential price increases.

Should these whale transactions occur, the price of Ethereum may experience significant downward pressure, potentially leading it to touch its lowest point in eight months at approximately $2114.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

2024-09-12 14:48