-

Ethereum mirrors its 2019 pattern.

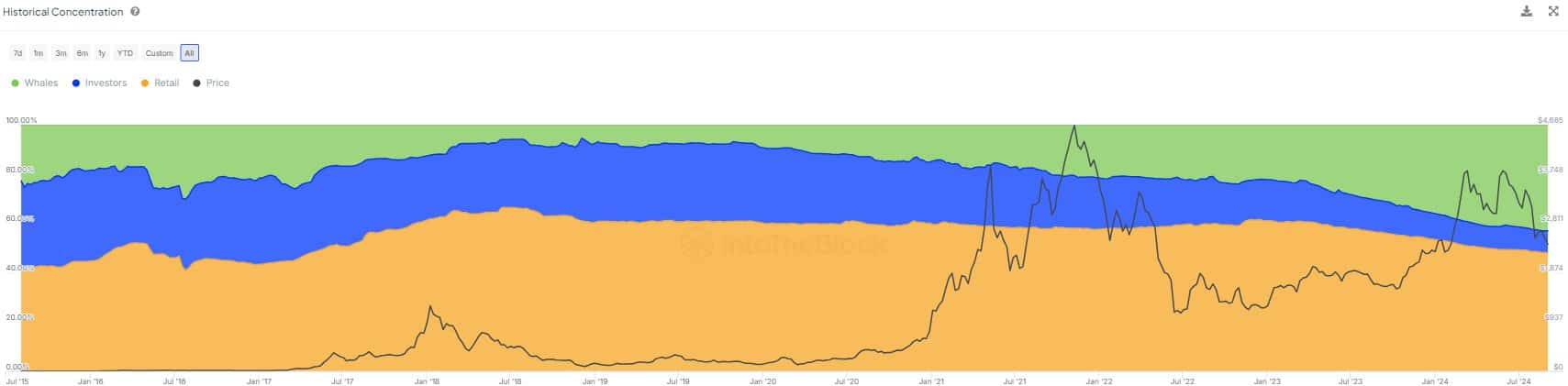

Largest holders of ETH have steadily accumulated more since 2019.

As a seasoned crypto investor with over a decade of experience under my belt, I have witnessed countless market cycles and trends. The current Ethereum [ETH] pattern mirroring its 2019 trajectory is something I’ve seen before, and it’s giving me a sense of déjà vu. However, this time around, the higher lows of the ascending wedge are significantly larger than those in 2019, which could potentially mean a more substantial price surge if history repeats itself.

As the end of 2024 approaches, Ethereum [ETH] continues to hold its position as the second-largest digital currency, with investors’ outlook transitioning from pessimistic to optimistic.

In simpler terms, the behavior of Ethereum’s price is following a pattern similar to what we saw in 2019 when it came to the Ethereum-to-U.S. dollar exchange rate. This pattern appears as an upward sloping triangle, or ascending wedge.

The higher lows of this cycle’s wedge were ten times larger than those seen in 2019.

In 2019, Ethereum’s price dipped under its rising trendline (wedge) prior to the initial Federal Reserve interest rate reduction, and the scenario seems reminiscent of 2024.

After the rate cut in 2019, ETH/USD and ETH/BTC both bottomed, forming a strong confluence.

As I analyze the market trends, it appears that we might see a repeat of past successes. The price is projected to dip beneath our current wedge formation, allowing us to capitalize on the liquidity before a potential upturn in late Q4 2024 or early Q1 2025.

In my role as a researcher, should the price persistently remain beneath the ascending wedge over an extended timeframe, it might be prudent to reconsider my strategies or implement measures to mitigate potential losses by delving deeper into further analysis.

Whales continue to accumulate

It’s been observed that whales (large Ethereum holders) have been gradually increasing their possession of ETH since 2019, and this accumulation has become more pronounced following the Shanghai update in early 2023. This could potentially lead to a surge or upward trend in the price of Ethereum.

Currently, it’s reported that whales, large-scale investors, own more than 43% of Ethereum’s total circulating coins. They are approaching the approximately 48% owned by individual retail investors.

Based on my extensive experience in the cryptocurrency market and observing trends for years, it appears that these major players anticipate Ethereum’s price to increase gradually over time. This prediction is derived from the accumulation of substantial holdings by these key influencers in the industry, which often signals a bullish outlook.

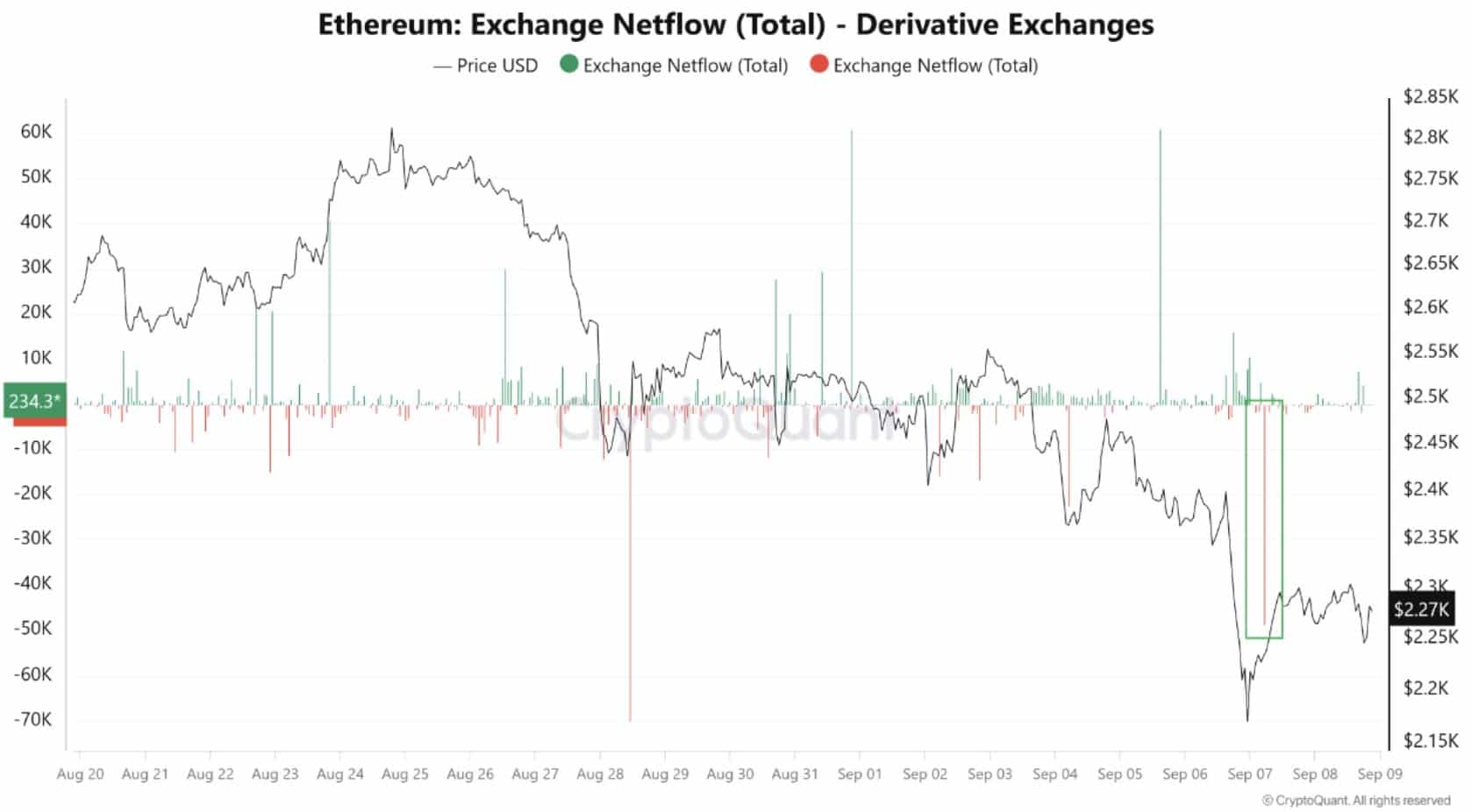

ETH exchange netflows

Analyzing the transactions between Ethereum exchanges, it’s been observed that the total amount of Ethereum withdrawn from derivative platforms exceeded 40,000 Ether.

It seems that a larger amount of ETH is moving from these exchanges into cold storage, suggesting less pressure for immediate selling.

Investors could possibly be readying themselves for long-term profits, implying that the recent drop in Ethereum’s value might just be a short-term adjustment, which could pave the way for a substantial price increase in the future.

Read Ethereum’s [ETH] Price Prediction 2024–2025

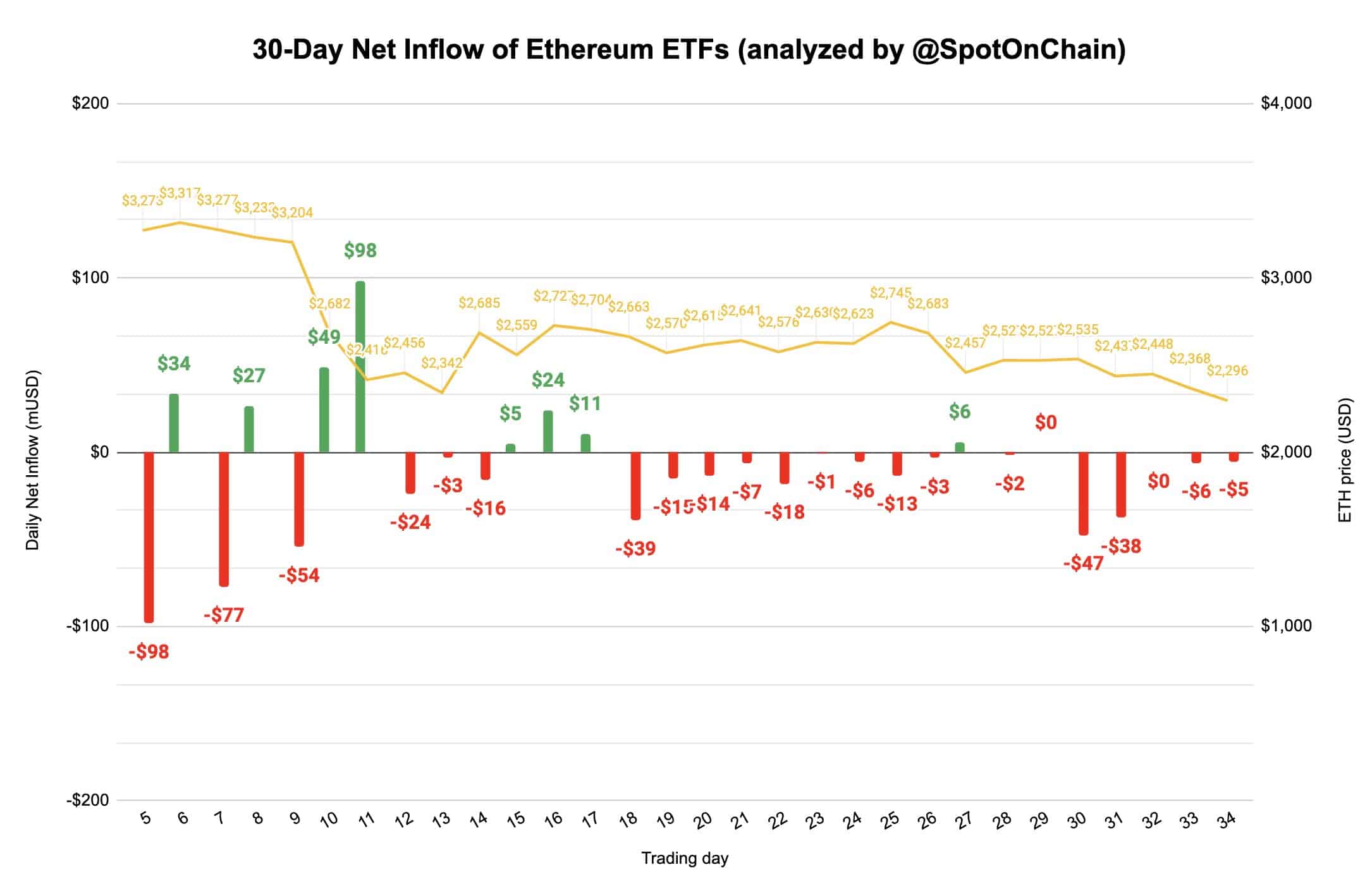

Ethereum ETF update

Although Ethereum ETFs have been experiencing some negative net-inflows, there are encouraging signs. For instance, ETH ETFs like Fidelity’s have seen inflows within the past 24 hours. However, Grayscale’s ETHE was the only one to experience an outflow, and it was the largest one recorded.

Yet, the generally favorable opinion towards Exchange-Traded Funds (ETFs) could potentially boost Ethereum’s future price increase.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-11 00:08