- Whales bought 340,000 ETH in the last 3 days worth more than $1 billion.

- ETH might have completed its correction as the Long Term Trend Directions is strongly bullish.

As a seasoned researcher with years of experience tracking crypto market movements, I must admit that I find it intriguing when whales make strategic bulk purchases during downturns. The recent acquisition of 340,000 ETH by these whales for over $1 billion is a clear indication of their confidence in Ethereum‘s potential recovery.

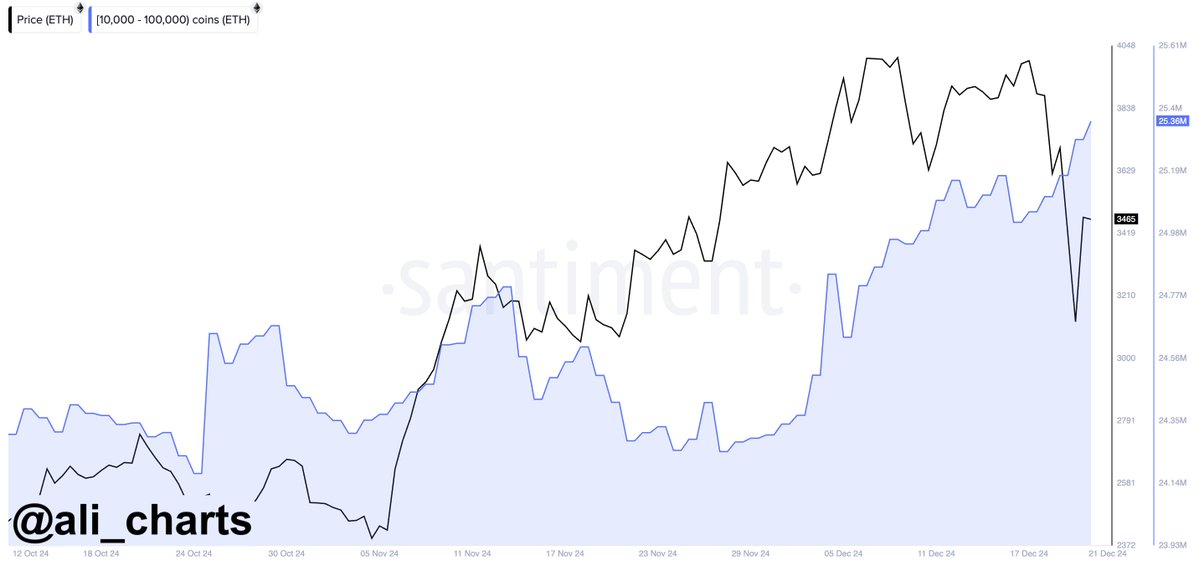

The buying behavior of large Ethereum investors (whales) stands out against its price trend, indicating increased purchases during market downturns.

In a span of three days, whales amassed approximately 340,000 units of Ethereum (ETH), worth more than one billion dollars, hinting at calculated large-scale acquisitions during market downturns.

Amidst the widespread drop in cryptocurrencies, this pattern fueled discussions about a possible market recovery.

In other words, the pattern from history suggests that significant purchases typically occur before market rebounds. If this trend continues, it could mean an increase in the price of ETH.

Is correction over amid long term trend directions?

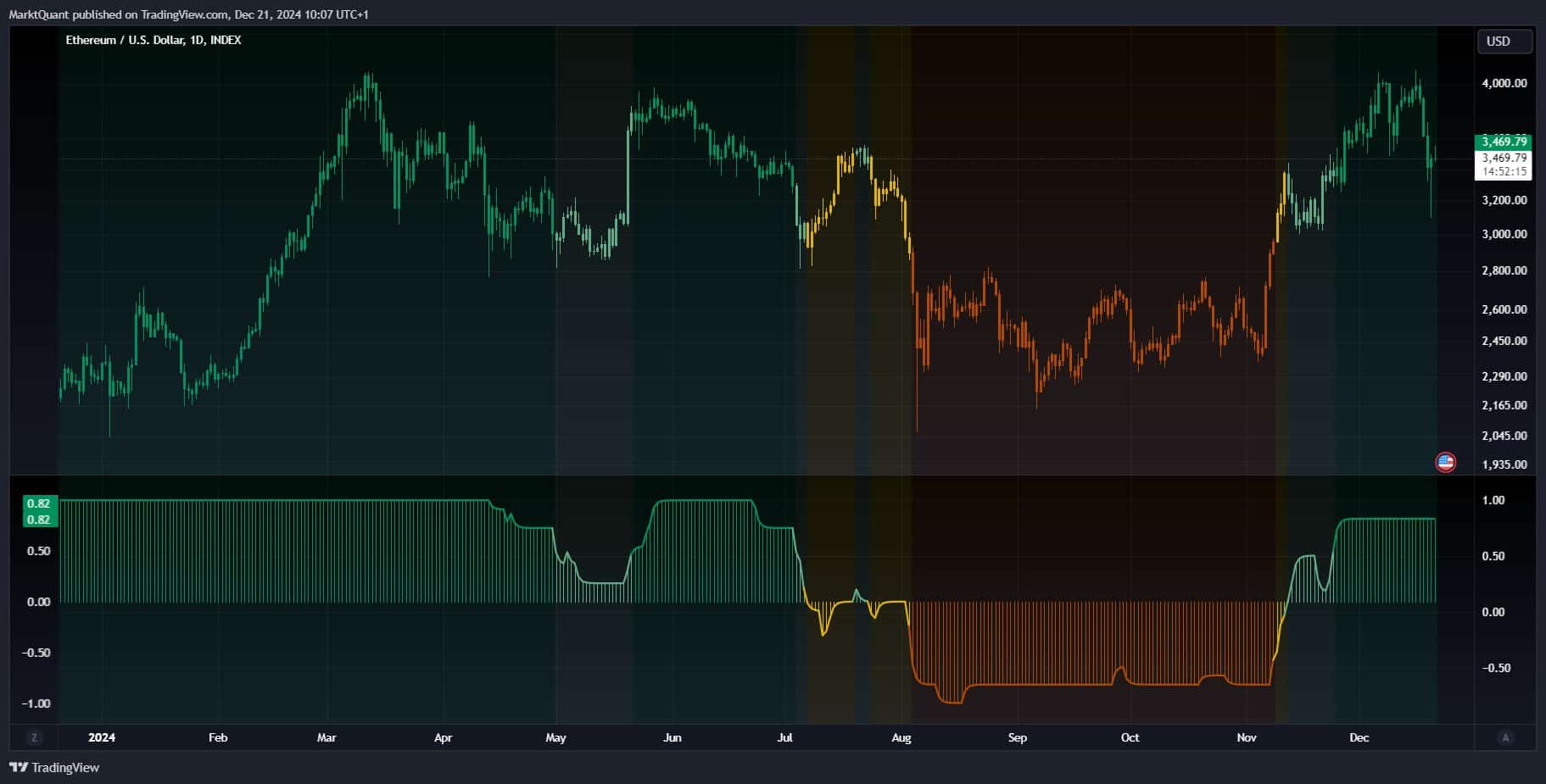

Ethereum weekly chart indicated a potential completion of its correction.

The price repeatedly checked the Tenkan and Kijun levels on the Ichimoku Kinko Hyo chart, hinting at a potential period of stability.

As an analyst, I observed further evidence of strengthening trends when Ethereum (ETH) interacts with Senkou Span A on Kumo Cloud. Initially perceived as a potential resistance level, it appears to have transitioned into a supportive zone for ETH.

Furthermore, the lagging span has moved back to its Tenkan line, suggesting the strength of the current price levels. However, despite this bullish indication, there is still a sense of caution as the price may test the boundary of the Kumo Cloud’s Senko Span B.

As an analyst, if I observe Ethereum’s price approaching a particular level, it suggests a significant challenge to the current market sentiment and resilience, which could potentially indicate a turning point in its price trend.

This year, the Long Term Trend Directions (LTTD) might finish at a robustly optimistic level of 0.82, indicating a favorable long-term perspective.

Despite a brief dip in mid-year, the LTTD returned to bullish territory.

Over the past period, Ethereum has steadily ascended, aligning with the LTTD score consistently staying over 0.5, which suggests ongoing buyer enthusiasm remains high.

As a researcher, I noticed a significant decrease in LTTD scores during July that seemed to coincide with a price drop, suggesting a brief, bearish market trend.

Instead, the swift rebound seen in LTTD by October and the subsequent price surge implied that the corrective phase had finished, with ETH once more moving towards its prolonged uptrend.

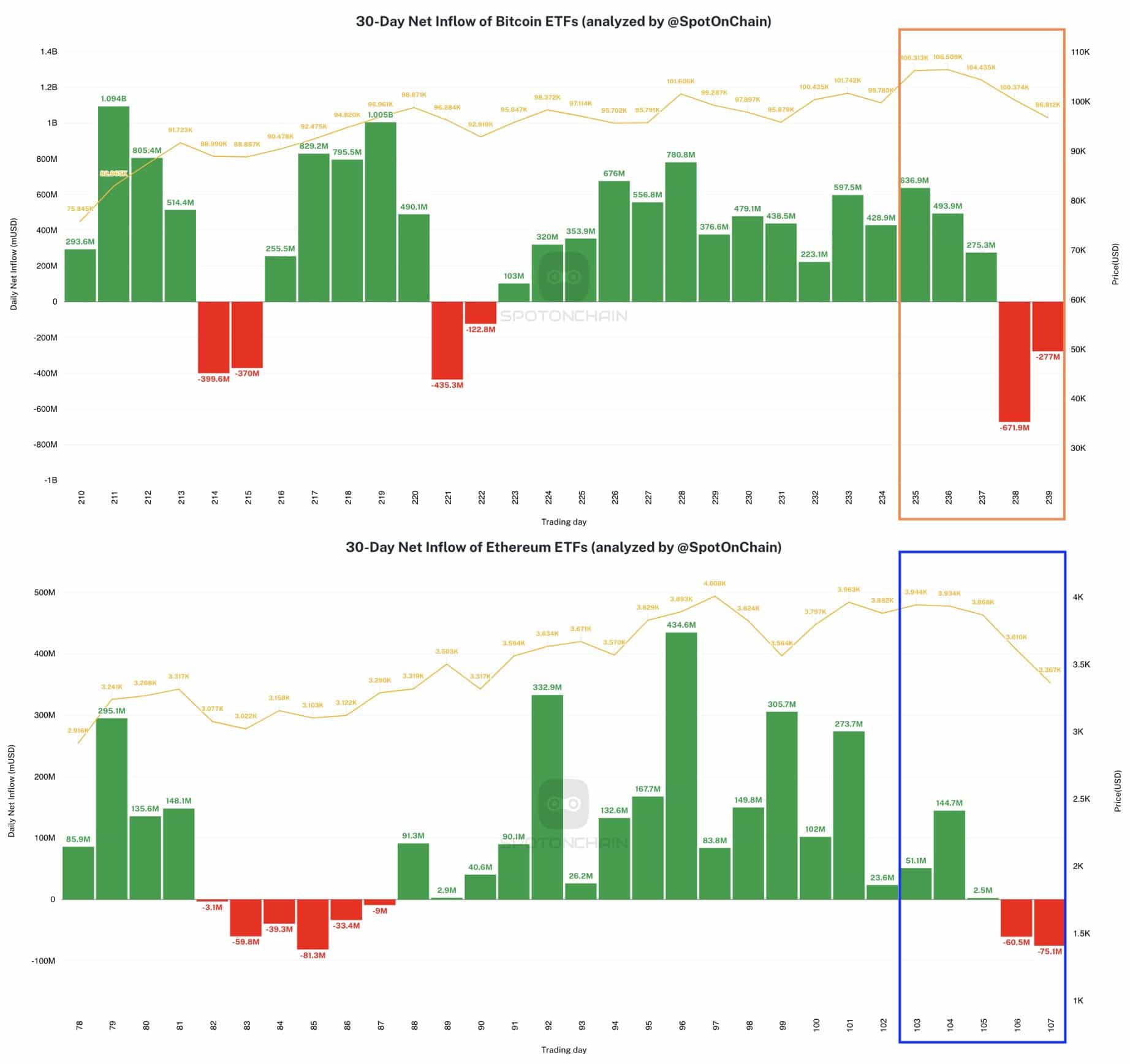

Spot ETH ETFs flow

During a week that saw market decreases, there were significant withdrawals from Ethereum-based ETFs, with BlackRock’s ETHA recording its biggest ever outflow of approximately $103.7 million.

On the other hand, there was a substantial withdrawal from Bitcoin ETFs, amounting to approximately $671.9 million – the largest since they were launched.

This reversal ended two consecutive weeks of inflows for both Bitcoin and Ethereum ETFs.

Significantly, even with the withdrawals, BlackRock significantly increased its holdings, acquiring 13,700 Bitcoin worth approximately $1.45 billion and 33,900 Ether valued at around $143.7 million.

These actions suggest substantial changes in Exchange-Traded Fund (ETF) behaviors, mirroring overall market opinions and possibly predicting upcoming tendencies in crypto investment patterns.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-12-22 17:11