-

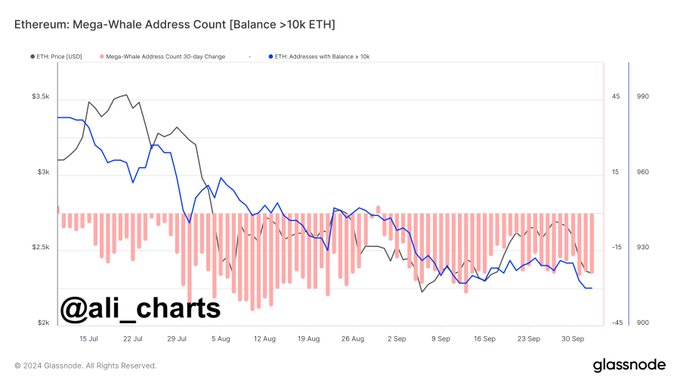

Ethereum whales holding more than 10,000 ETH have fallen by over 7% since July.

62% of Ethereum holders are in profit as the net inflow is primed for a probable increase.

As a seasoned analyst with years of market observation under my belt, I find myself intrigued by the recent developments in the Ethereum [ETH] space. The decline in whale holdings (10,000 ETH and above) is indeed a noteworthy shift, suggesting potential changes in strategy among high-net-worth investors. However, it’s essential to remember that the market is like a living organism, and every organ has its role. Even if whales decide to swim elsewhere for a while, the overall health of Ethereum might still be robust, thanks to the 62% of profitable holders who are more likely to stay put.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastSince July, it’s been evident that the number of Ethereum [ETH] holders with over 10,000 ETH has shown a consistent decrease, or put another way, there’s been a clear decline in the amount of large-scale Ethereum holdings since July.

As a seasoned trader with over two decades of experience under my belt, I can confidently say that a drop of more than 7% is quite significant, especially when it comes to market movements. Large holders often have the power to influence and guide market directions, having learned this lesson the hard way through years of observing and participating in various market cycles. In fact, one particularly memorable instance left me with a hefty loss due to a sudden shift in market direction orchestrated by these large players.

A significant decrease in whale participation suggests shifts in investor sentiment and strategies among the wealthy.

This is indeed a shift worth keeping track of, particularly for those monitoring the king of altcoin’s long-term market outlook.

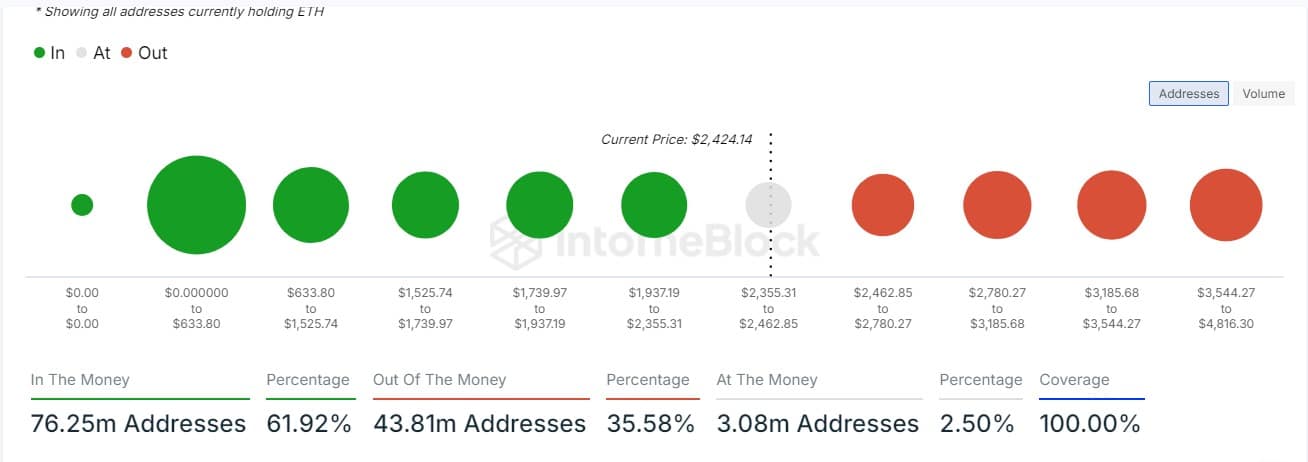

Majority of Ethereum holders are still in profit

Despite the whale activity reduction, 62% of Ethereum holders are still in profit.

It seems that even with some ups and downs over the last few months, the market remains generally favorable for most investors.

Investors who are making a profit tend to keep their investments longer, reducing the chances of abrupt selling sprees. This prolonged holding can provide a sense of market stability.

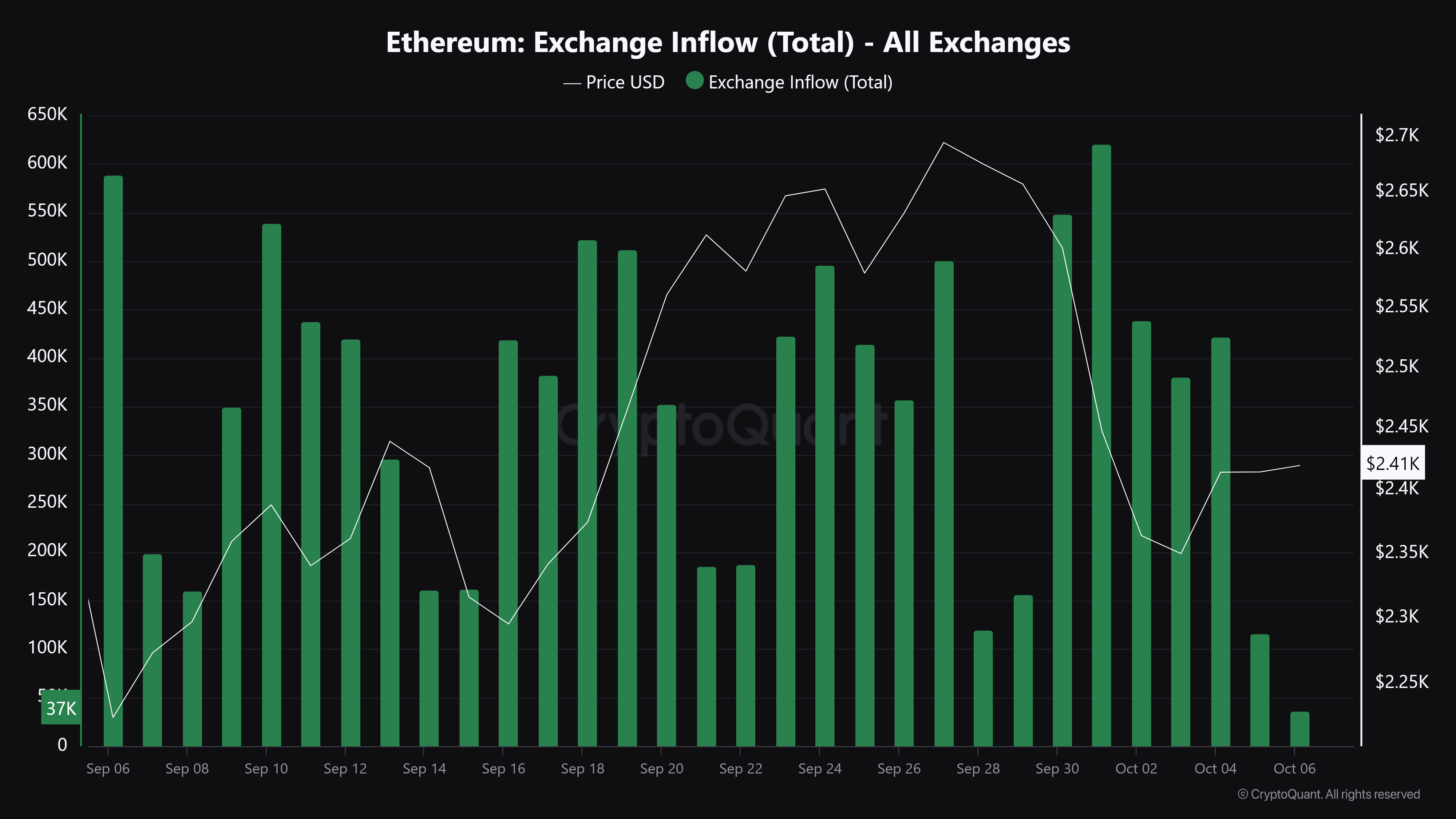

Rising net inflows signal increased market activity

On Ethereum, there have been multiple instances where there’s been an increase in net inflows, signaling a rising interest and usage of the network. Yesterday saw a drop, but today, it appears that inflow is picking up speed again.

Actions such as these often signal a more intense price movement to come, since the increased investments pouring in might lead to elevated demand and higher buying pressure.

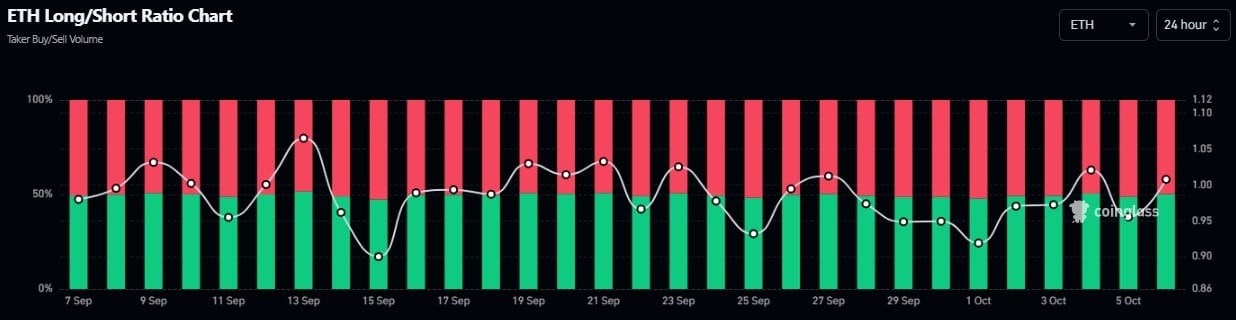

A battle between bulls and bears

AMBCrypto delved deeper into Coinglass’ Long/Short Ratio to gauge market trends, and the findings showed a series of shifts between holding and selling positions.

At the moment, the ratio is currently at 1.01, suggesting a shift towards more long positions taking over the market.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Although the drop in Ethereum whales is notable, the broader market sentiment remains positive.

Given that about two out of three Ethereum owners are currently seeing profits, and the influx of funds has been on the rise following recent drops, there’s a strong possibility that Ethereum might soon experience a larger price spike.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-06 23:03