- Ethereum whales jumped on the “dip” as prices slid to $2.3K.

- Despite a slight rebound, uncertainty still looms.

As a seasoned researcher with years of market analysis under my belt, I find myself cautiously optimistic about Ethereum [ETH]. The recent dip to $2.3K has indeed sparked interest among the whales, but their presence alone doesn’t guarantee immediate recovery.

Ethereum (ETH) is facing one of its most challenging market phases, experiencing a weekly drop exceeding 6%. Being the poorest performer among the leading five alternative coins, this dip raises significant concerns about its potential trajectory in the future.

In the upcoming weeks, Ethereum may experience a severe challenge due to intensifying competition from Solana (SOL) and shifting market conditions. This is particularly true given…

Too much leverage in the market

In historical context, an increase in the Margin Lending Ratio often leads to compulsory selling, which can cause prices to drop until the ratio stabilizes again at its usual level.

Putting it plainly, if this ratio significantly increases, it suggests that an excessive number of traders are taking loans to predict price hikes. This frequently precedes a market downturn or correction.

This pattern should prompt traders to exercise caution when trading, since it often signals an upcoming adjustment or downturn in the market.

Just now, the USDT borrowing rate jumped dramatically from 38 to 72. This sharp increase suggests substantial borrowing of USDT. Although holding long positions may reflect optimistic expectations, they can potentially lead to complications, especially in a turbulent market environment.

Should prices decrease, traders who had taken loans might find themselves compelled to swiftly liquidate their assets, which could lead to additional price decreases.

As a crypto investor, I’ve noticed that a sudden increase in borrowing can often indicate potential issues in the short term. If the bulls don’t manage to intervene and prop up Ethereum’s price, it might be at risk of further drops.

Ethereum is near a crucial support line

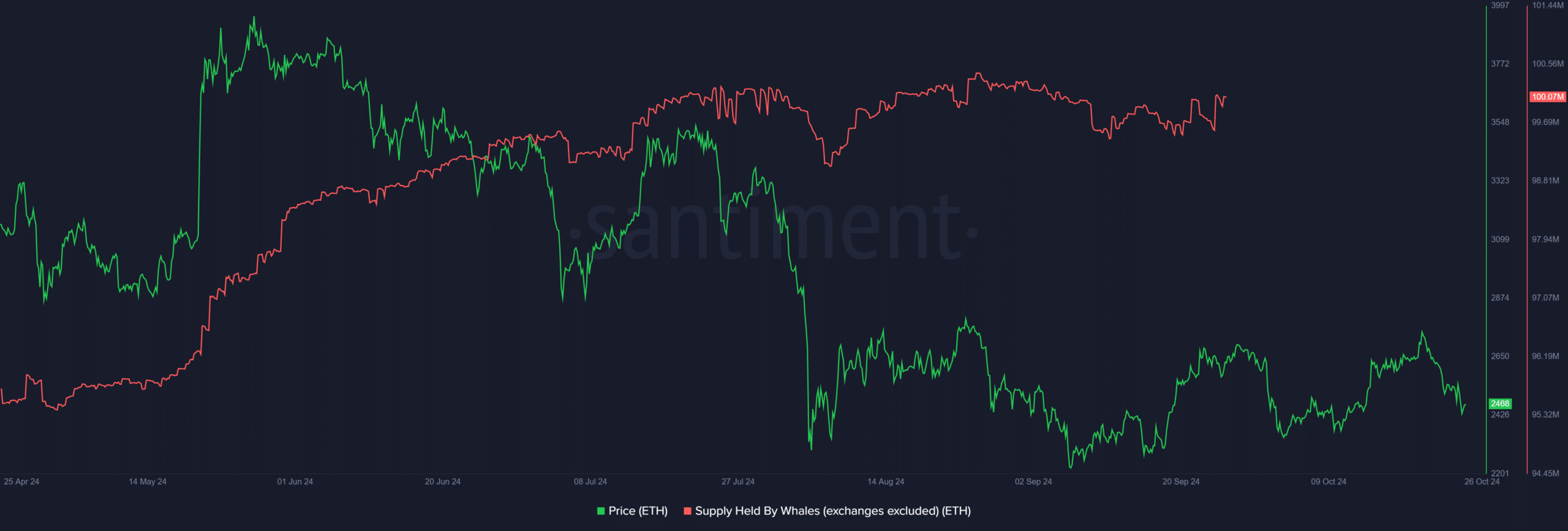

In a recent post on X (formerly Twitter), Santiment pointed out a vital development that could help Ethereum avoid a retracement.

At the moment of writing, I find myself observing Ethereum (ETH) trading at approximately $2,468. Notably, this cryptocurrency has encountered a substantial support level, tested on four occasions within the last two months.

Repeating these tests suggests that the current price could be a good time for investors to consider purchasing, as it might indicate a temporary drop in value.

It’s worth noting that the number of large Ethereum transactions (whale activity) has significantly increased recently, reaching a six-week high. This surge occurred as the price dropped to $2,380 on October 25th. This increase in whale transactions may suggest that prominent investors or major stakeholders with substantial capital are actively buying up Ethereum.

Although the present price might entice investors, it doesn’t automatically mean an instant rebound will occur. However, this ongoing pattern is undeniably promising.

Nevertheless, doubts persist as a result of extreme volatility stemming from an elevated open interest (OI) reaching $13 billion, making Ethereum more vulnerable to abrupt price fluctuations.

A significant increase in buy orders might occur, particularly if Bitcoin‘s price keeps falling.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Paying attention to the $2.4K support level is crucial as there’s a possibility of a divergence that might cause ETH to approach $2.3K. This move could signal a potential change in direction.

Influential Futures traders could determine Ethereum’s next action, depending on whether the current support level remains stable during upcoming trading periods.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- BLUR PREDICTION. BLUR cryptocurrency

2024-10-26 23:04