- Ethereum’s price fell by nearly 10% in a week.

- Technical analysis suggested a possible short-term recovery, with key metrics indicating reduced investor interest.

As a researcher with a background in cryptocurrency and market analysis, I’ve been closely monitoring Ethereum’s price action over the past week. The sudden 10% drop in Ethereum’s value to $2,868 is concerning, especially when compared to Bitcoin’s resilience during the same period.

As a researcher studying the cryptocurrency market, I’ve observed a notable decrease in Ethereum’s [ETH] value recently. Over the past week, there has been a nearly 10% price drop, while in just the previous day, the price declined by an additional 1%, reaching a new 24-hour low of $2,868.

As an analyst, I would put it this way: The downturn in Ethereum’s price is more significant than that of Bitcoin [BTC]. While Bitcoin has broken through important price thresholds amidst the present market scenario, Ethereum’s decline stands out more distinctly.

As a crypto investor, I’ve noticed that Ethereum’s market has taken a hit recently due to some significant interventions by large investors, or “whales,” as they are called in the community. These whales have introduced a considerable amount of volatility and selling pressure into the market with their massive transactions.

Indicators of declining investor interest in Ethereum

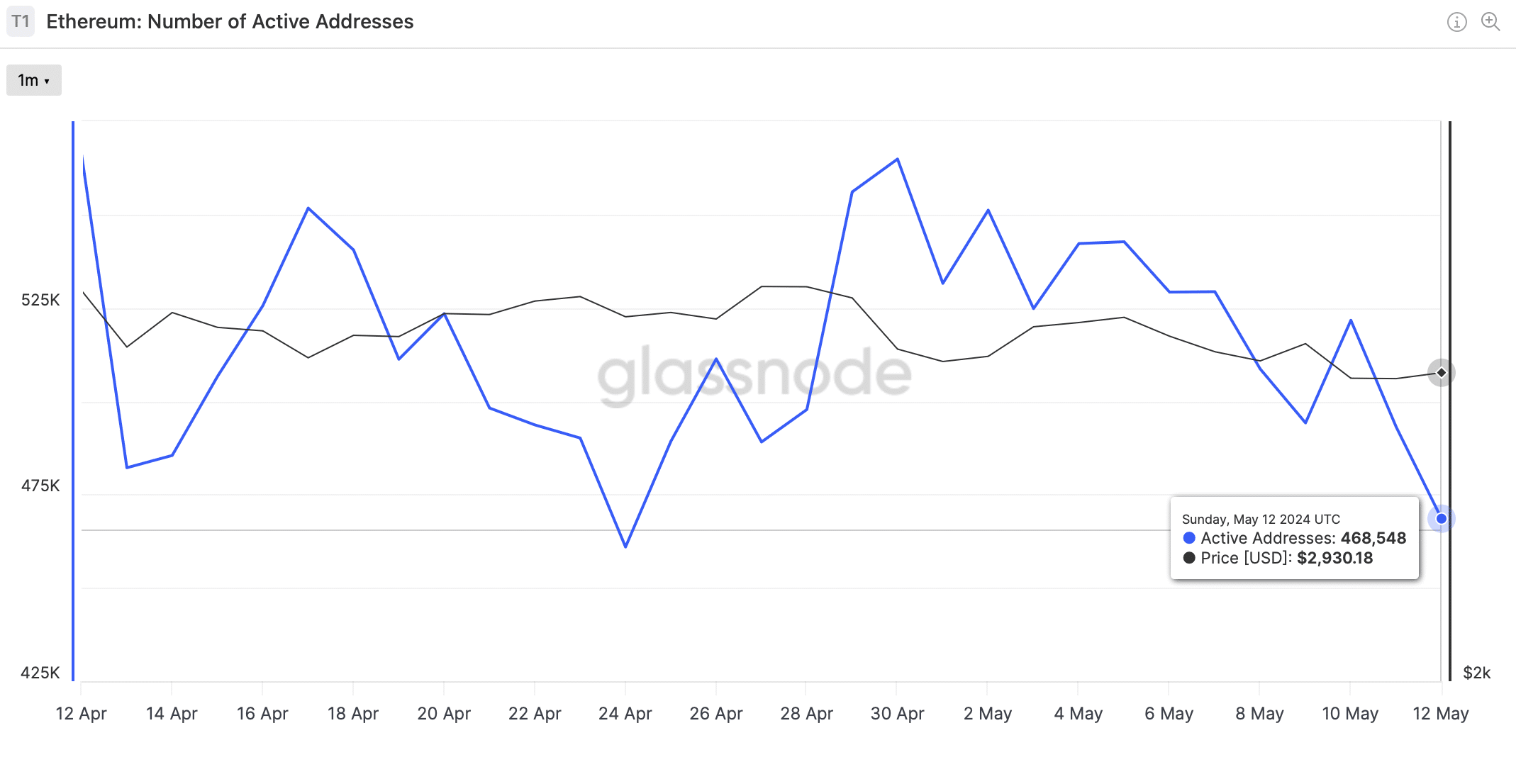

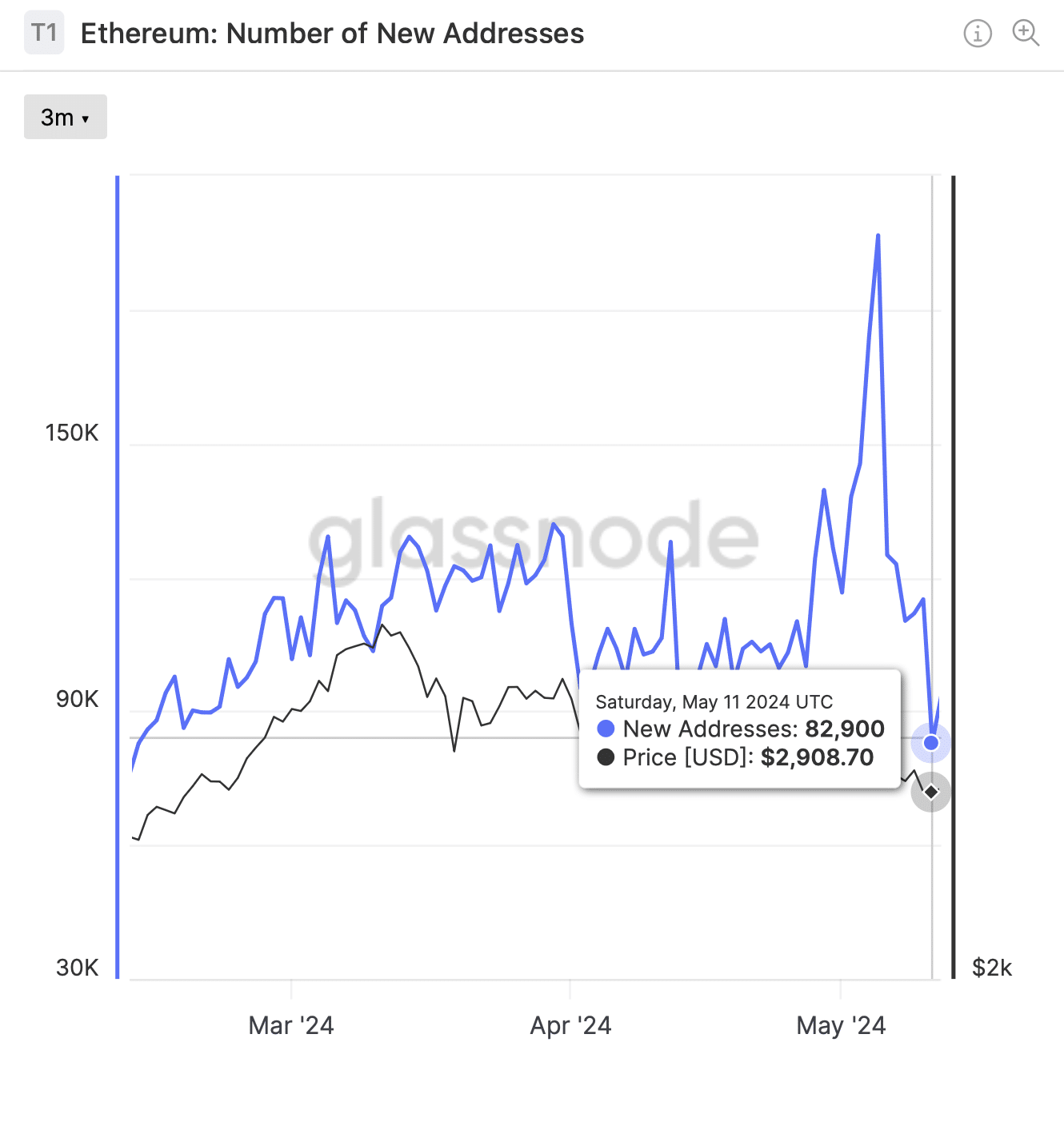

Further compounding Ethereum’s market woes are the declining metrics of network activity.

Based on the analysis by AMBCrypto using Glassnode’s data, the number of active Ethereum addresses has dropped from over half a million (564,868) in late April to currently stand at approximately 468,548 as we speak.

I’ve observed a significant decrease in the number of active cryptocurrency addresses, which is reflected in the drop from approximately 196,629 early in the month to under 85,000 on the 11th of May. Similarly, the formation of new addresses has declined notably, falling from around 197,000 new addresses per day earlier in the month to under 87,000 on the 11th.

These metrics highlight a waning investor interest in Ethereum during this period.

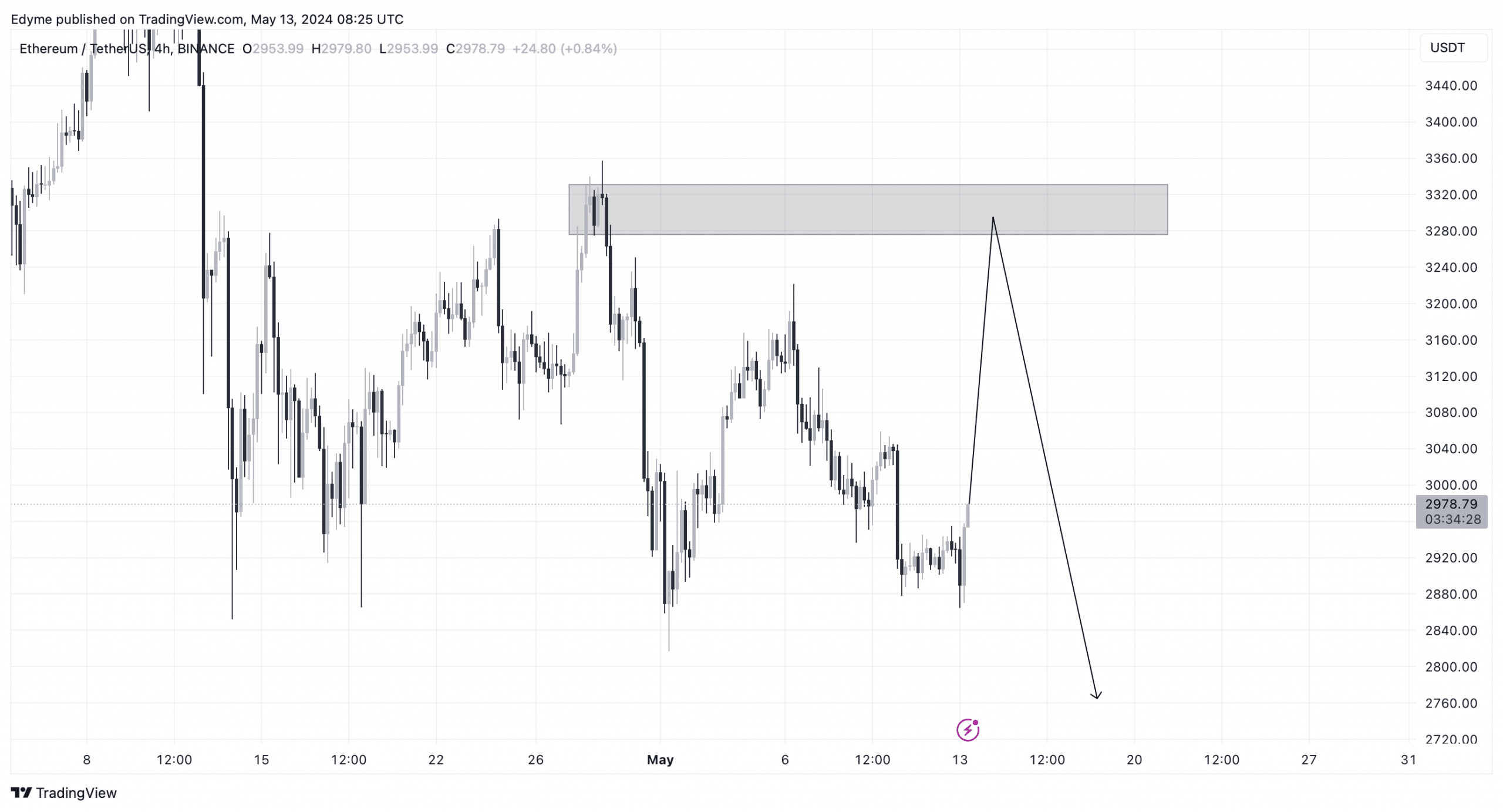

Based on technical analysis, Ethereum has breached key support levels on its daily chart, signaling potential downward pressure.

At a glance on the 4-hour chart, it appears that around $3,200, there existed significant buying or selling activity, essential for any potential substantial price drop to ensue.

Ethereum might momentarily surge past $3,000 in the near term, only to possibly dip down to approximately $2,800. This temporary decline could pave the way for a subsequent upward trend.

Read Ethereum’s [ETH] Price Prediction 2024-25

Significantly, the transfer of Ethereum into the exchange occurred concurrently with the revival of two previously inactive Bitcoin wallets, which had lain dormant for approximately eleven years.

As a researcher studying the cryptocurrency market, I’ve observed that each wallet containing 500 Bitcoins made the decision to sell off their entire holdings. This mass selling represented an unwelcome development for Bitcoin investors.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-05-14 06:15