-

Ethereum on a steady decline since dropping below $3400.

The crowd is losing interest in ETH during this mild crypto slump.

As a seasoned crypto investor with scars from the 2017 bull run and the subsequent bear market, I can’t help but feel a mix of anticipation and apprehension when observing Ethereum’s current trajectory. The steady decline below $3400 is a stark reminder of the rollercoaster ride that is crypto investing.

It appears that despite recent increases in Ethereum’s [ETH] value, which didn’t manage to surpass $3,400, the cryptocurrency is showing some signs of vulnerability. This has sparked worries among investors that Ethereum could potentially enter a brief period of decline or correction, as indicated by several analytical tools.

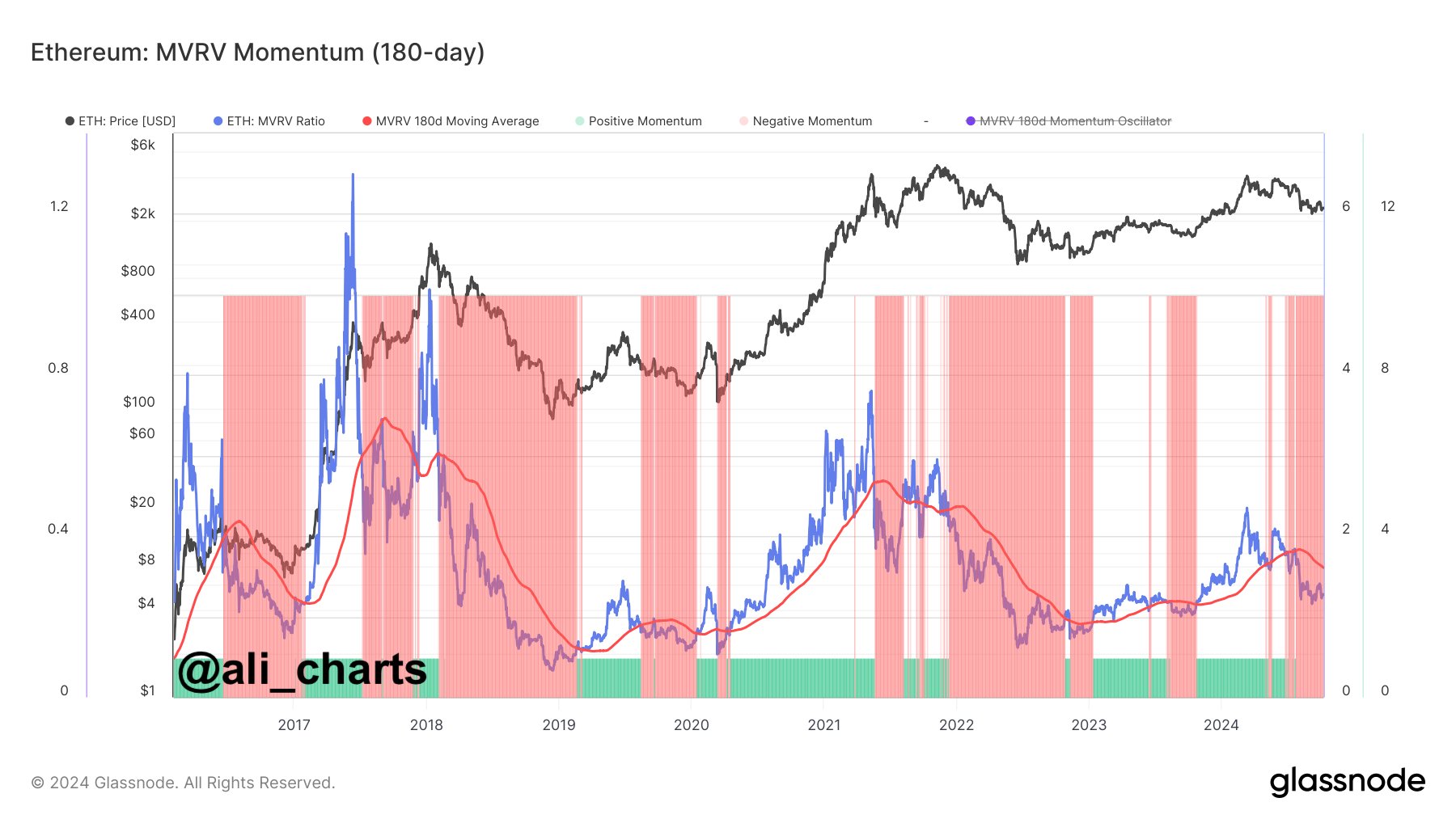

One significant signal, the MVRV Momentum, suggests that Ethereum has been gradually decreasing in value ever since it dipped below $3,400 on June 23rd, 2024.

Such a pattern might suggest an upcoming decrease in the value of ETH, which underscores the importance for traders to exercise caution. Simultaneously, they should keep an eye out for potential chances to buy long-term if ETH alters its present direction.

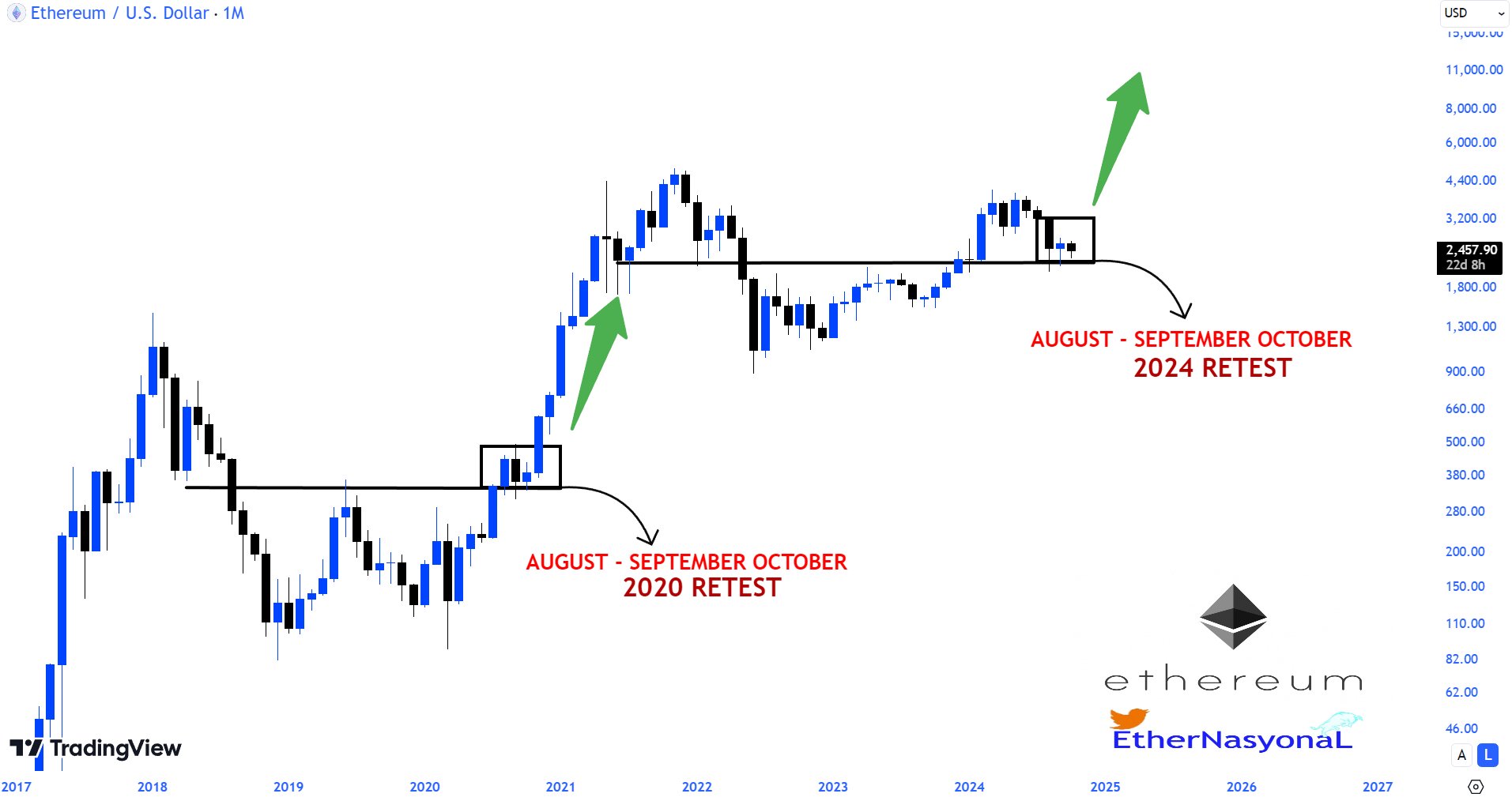

As an analyst, I’m observing signs that suggest Ethereum could be gearing up for a significant bull run by 2025. Reminiscent of the 2021 market surge, Ethereum exhibited a pattern of retesting and accumulation phases from August to October last year, similar to what we saw prior to its major price increase.

This year, ETH seems to be in a similar stage of retest and accumulation during these same months.

The trend indicates that Ethereum might continue to drop in October; however, there’s a possibility it will begin recovering towards the end of the year, paving the way for potential expansion in the future.

ETH valuation and social sentiment

Looking at Ethereum’s performance against Bitcoin (BTC), it appears the downtrend may continue.

The value comparison of ETH versus BTC has plummeted to 0.000295, falling below the 0.0004 threshold that was considered a significant support level in the past.

This supports the notion that Ethereum could see more drops in the near future, given Bitcoin’s consistent outperformance of Ethereum over various periods.

Another factor adding to Ethereum’s bearish outlook is its place in social sentiment rankings.

During this time of market turmoil, Ethereum found itself in the second spot on the list of assets with the highest degree of negative public opinion, trailing only Chainlink.

Historically, assets that show a dominant negative outlook (bearish sentiment) tend to have the greatest opportunities for a price surge. However, this downward trend might continue with more price decreases. Yet, it also signals the possibility of a reversal or recovery.

Should the negative feelings about bears decrease, this could ignite a surge that pushes Ethereum towards greater heights, potentially attaining new peaks by the year 2025.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Right now, Ethereum seems to be going down, but there’s a good chance it could turn around, especially considering the approaching bull market in 2025.

Investors should exercise caution for now, yet stay vigilant about crucial support points. Those support levels may offer initial indications of a potential upturn.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-10-10 18:15