- Ethereum experiences its second-largest buying day, with long-term holders accumulating significantly.

- Market indicators show mixed signals, with decreases in open interest and exchange reserves hitting an eight-year low.

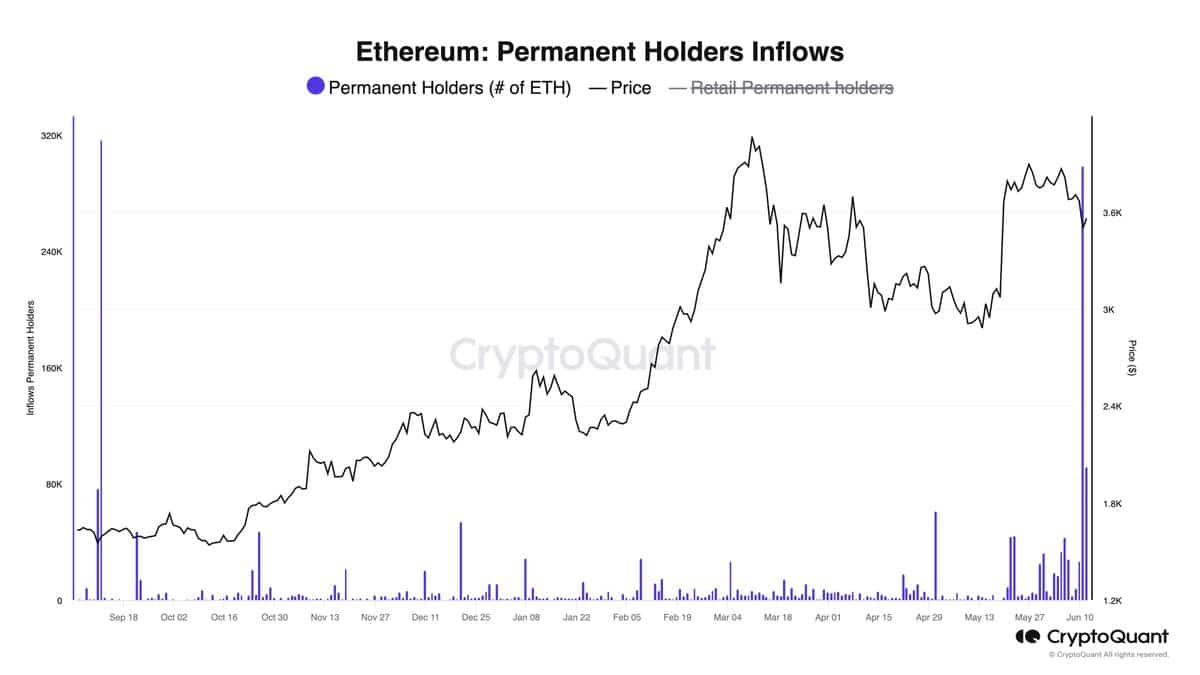

As an analyst with extensive experience in cryptocurrency market analysis, I find the recent Ethereum [ETH] market movements intriguing. Long-term holders have taken advantage of slight dips to accumulate significantly, as evidenced by the second-largest buying day on record, with approximately 298,000 Ethereum tokens purchased on June 12th. This strategic buying behavior indicates a high level of confidence in Ethereum’s long-term value.

As a cryptocurrency market analyst, I’ve noticed some intriguing price fluctuations in Ethereum [ETH], currently the second largest digital currency by market cap.

Over the past week, Ethereum experienced a decrease of 8%. However, there was a minor increase of 0.3% in the last 24 hours, which lifted its current market value to $3,519.

As an analyst, I’ve observed a slight uptick in the market amidst a broader atmosphere of uncertainty. This development occurs post-May, when the U.S. Securities and Exchange Commission gave its green light to spot Ethereum ETFs.

Long-term holders capitalize on market dips

During the recent price fluctuations, there has been a notable increase in Ethereum hoarding by long-term investors. As reported by Julio Moreno, the research head at CryptoQuant, Ethereum underwent one of its second largest buying sprees by long-term holders.

On June 12, I observed that around 298,000 Ethereum tokens, equivalent to roughly $1.34 billion, were snapped up by determined investors. This occurred during a brief 2% price downturn within the same 24-hour timeframe.

The significant collection of Ethereum tokens, totaling nearly 317,000, was just a stone’s throw away from the record high on September 11, 2023, when 317,000 Ether tokens were bought as prices fell beneath $1,600.

As a market analyst, I’ve noticed a consistent trend among long-term investors in Ethereum. Whenever there are price drops, these investors seize the opportunity to buy more of the cryptocurrency. This buying pattern underscores their strong conviction in Ethereum’s value and belief that it will rebound in the future.

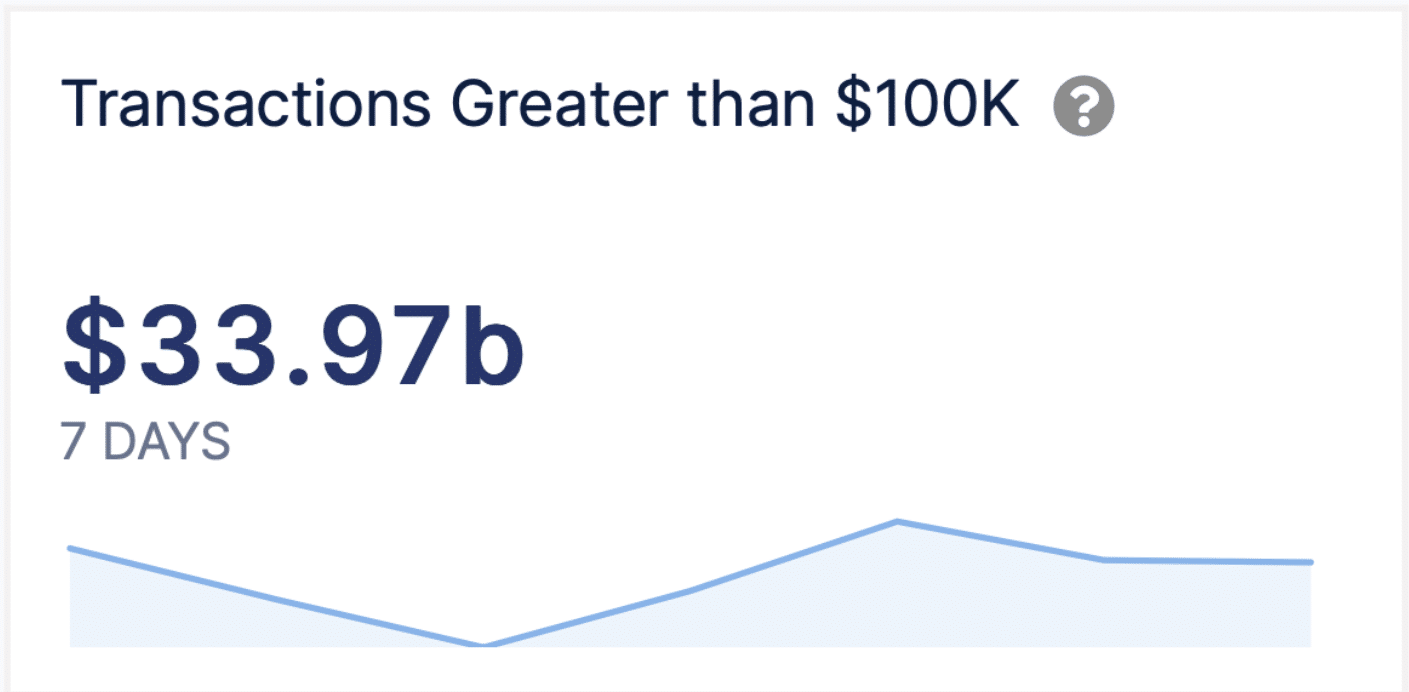

Additionally, this pattern aligns with a surge in significant transactions exceeding $100,000. According to IntoTheBlock’s data, these types of transactions have grown significantly, increasing from under 4,000 initially in the week to over 6,000.

This indicates active accumulation by whales regardless of the prevailing market conditions.

Market caution and technical outlook

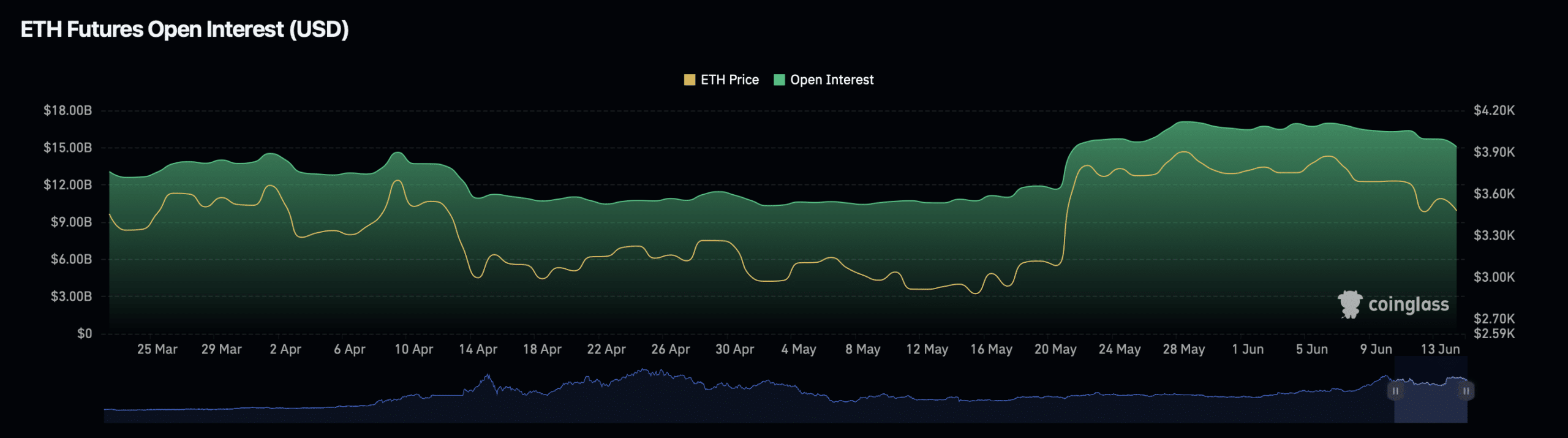

Despite the buying frenzy indicated by Ethereum’s accumulation, its market metrics like open interest and trading volume suggest a more restrained perspective.

The interest in Ethereum has dropped by approximately 2% to reach $15.41 billion, while trading volume has noticeably decreased by 25.77%, amounting to $24.19 billion. This data indicates a more reserved approach from certain investors, possibly hinting at expectations for potential price modifications.

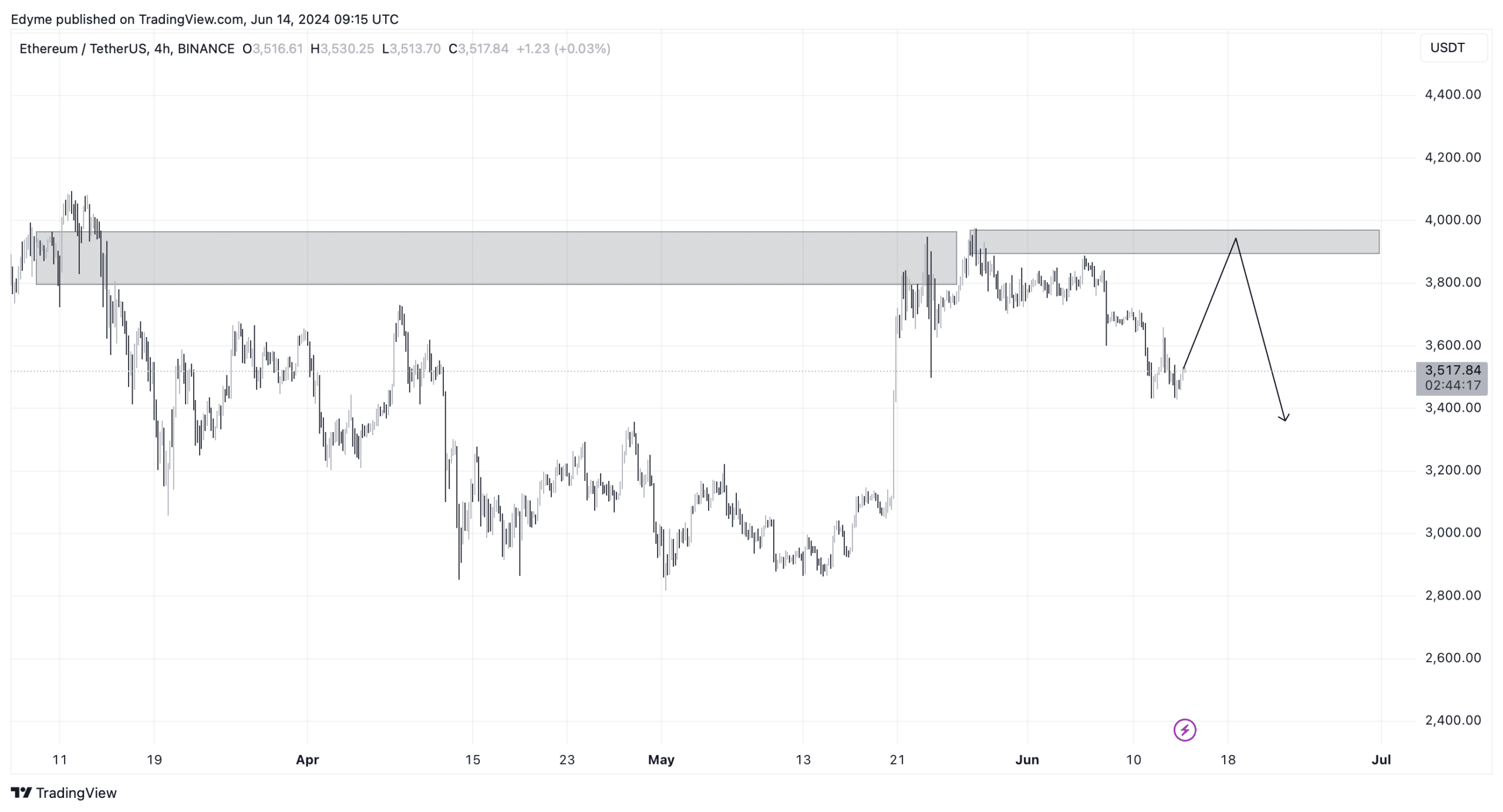

From a technical perspective, Ethereum’s failure to exceed its previous highs in March has triggered a selling signal on its daily chart, implying potential further price decreases.

From my analysis of the price action on the 4-hour chart, it appears that we could experience a brief surge towards the $3,800 mark in the near term. This uptick might offer traders an opportunity to exit positions or secure profits before the trend resumes its downward trajectory.

Read Ethereum’s [ETH] Price Prediction 2024-25

As a crypto investor keeping a close eye on market trends, I’ve observed an intriguing development regarding Ethereum’s exchange reserves. According to AMBCrypto’s latest analysis, the quantity of Ethereum stored in exchanges has reached a new eight-year low. This could potentially indicate increased holder confidence and reduced selling pressure, which might contribute to Ethereum’s price stability or potential growth.

As a crypto investor, I’ve noticed that there has been a decrease in the amount of Ethereum held by exchanges recently. Adding to this, the launch of spot Ethereum Exchange-Traded Funds (ETFs) is imminent. These developments could result in a substantial reduction in the available supply of Ethereum in the market. Consequently, this supply shock may cause a sudden price surge for Ethereum.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-14 23:04