- Ethereum has a bearish market structure.

- The magnetic zone below $2.9k signaled further losses were likely.

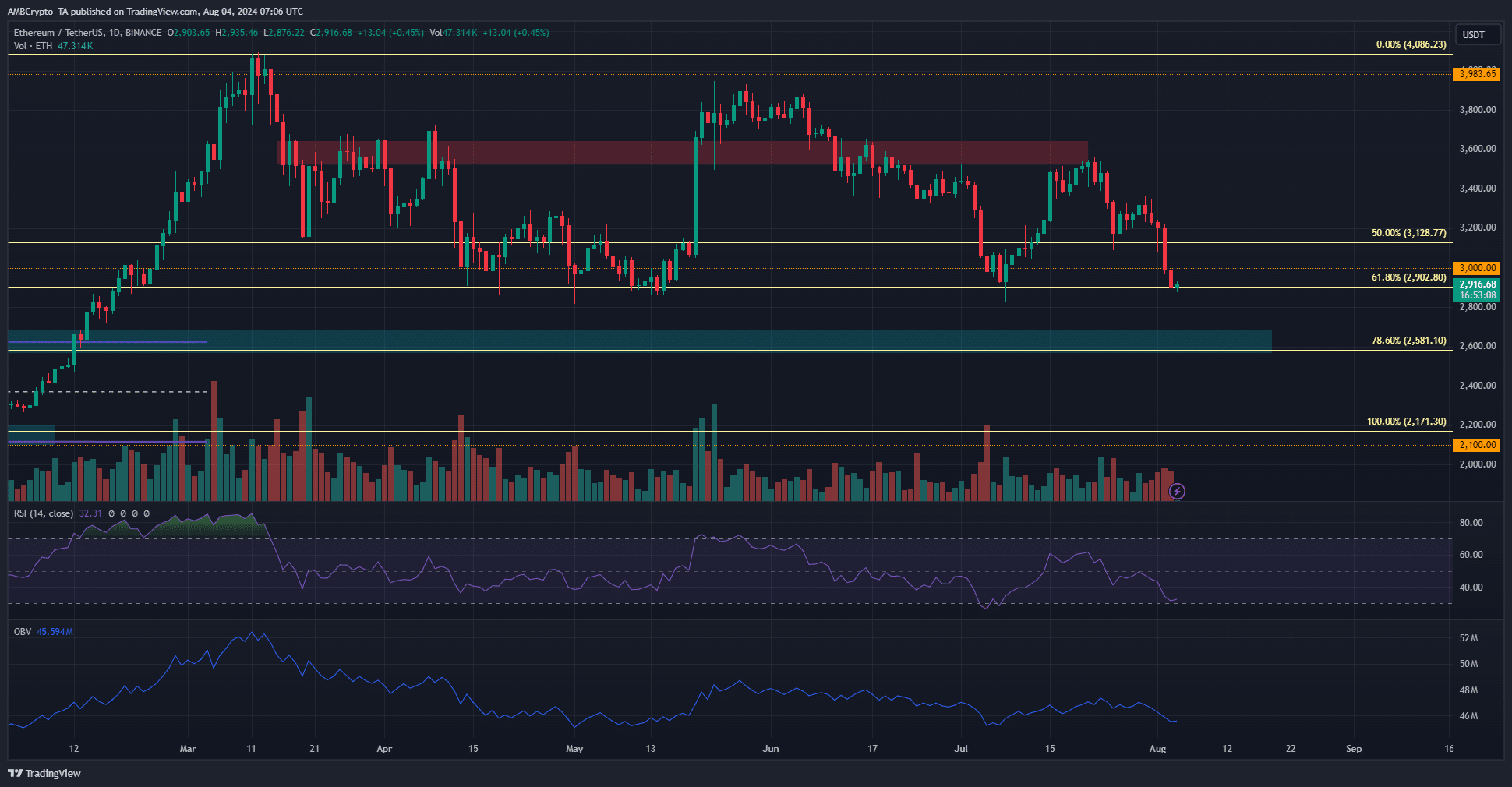

As a seasoned crypto investor with battle-scars etched from countless market cycles, I must admit that the current Ethereum [ETH] situation is a familiar dance of bulls and bears. The $2.9k level, having previously served as a strong support in July, now seems to be signaling further losses.

On July 5th, Ethereum [ETH] found support at approximately $2,900. Recently, it has returned to this same level. Afterward, bullish momentum propelled the price up to around $3,500, but it subsequently weakened.

Could we possibly see a rise towards $3.5k given the current circumstances? Although network activity has been decreasing lately, smart money actions suggest optimism. However, technical indicators are still predicting pessimism.

Potential for short-term volatility and an ETH dip below $2.9k

As of now, Ethereum is being exchanged for approximately $2916. On a daily scale, it exhibits a bearish trend. If it falls below $2.9k, the next notable support level can be found at $2.6k. The price movements suggest that such a drop could occur.

Every day, the Relative Strength Index (RSI) slightly exceeded the oversold territory, suggesting it might continue to do so. Meanwhile, the On-Balance Volume (OBV) has been steadily decreasing since June, hinting at potential additional declines in the future.

The significant level of $2.9k corresponds to the 61.8% Fibonacci retracement point and has held strong since April. Consequently, it’s likely that the buyers will attempt to maintain this level once more.

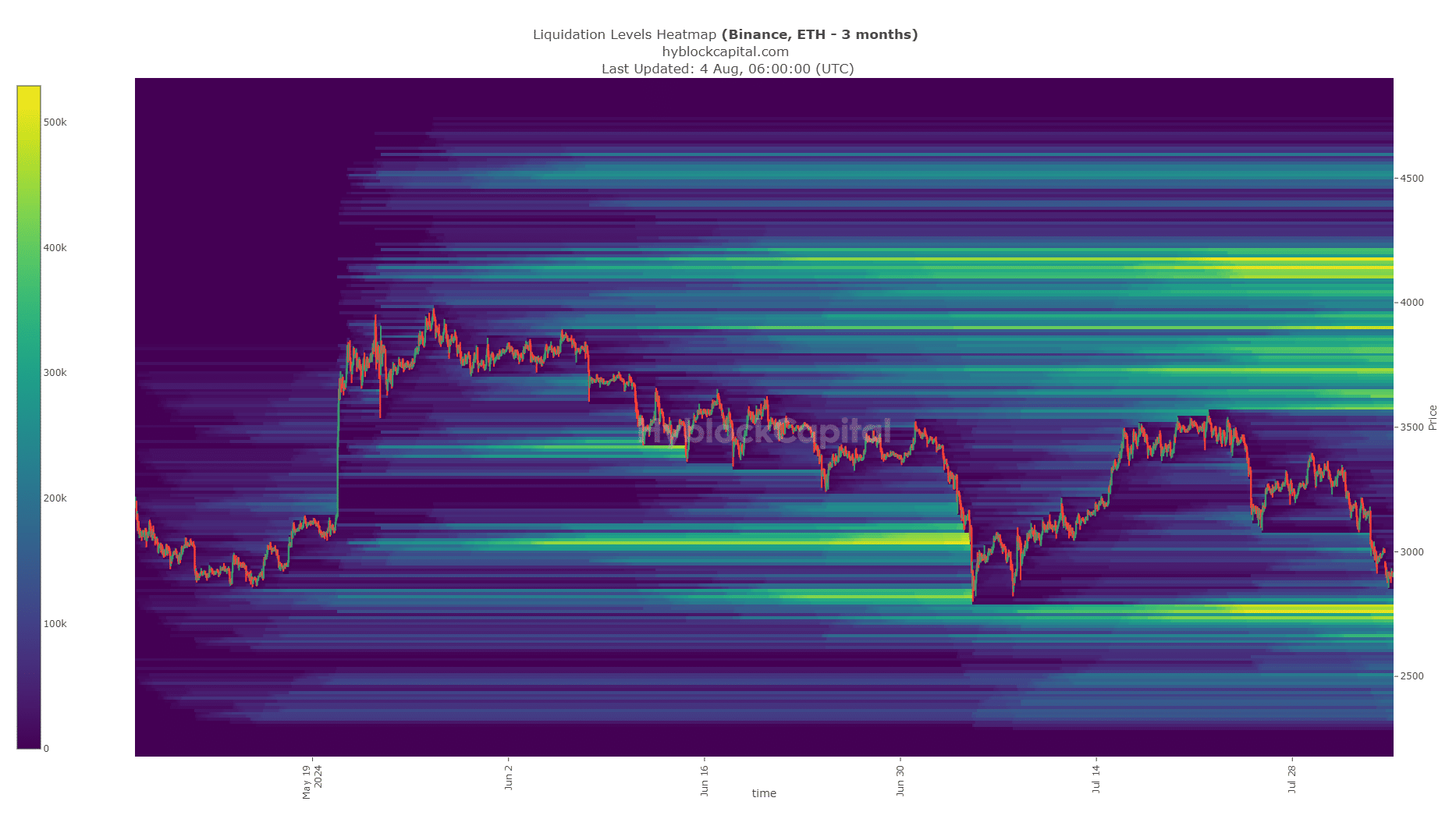

Potential for volatility due to a liquidation cascade

Over the last six weeks, there’s been an expansion of areas with high liquidation points around the $2.8k area. These spots are like magnets for prices due to their liquidity pools. Despite $2.9k offering strong support, it’s quite probable that we’ll see price movements within the range of $2740-$2800.

Read Ethereum [ETH] Price Prediction 2024-25

Anticipate a turnaround towards optimism from this point, but keep in mind the potential for heightened volatility on shorter trading intervals.

In the next couple of days, if we see a period of trading that solidifies the price range between $2.7k and $2.8k as a stable level, due to increased buying activity, it might persuade swing traders to consider making bullish (long) positions.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-04 20:07