- Ethereum’s futures open interest show that the coin will reclaim its all-time high in the mid-term.

- Its key indicators also confirmed the rise in bullish sentiment in the coin’s spot market.

In simpler terms, Ethereum (ETH), the front runner cryptocurrency, could experience a notable price surge in the near future according to an analysis by the anonymous expert at CryptoQuant named ShayanBTC.

The analysis of the report on the coin’s future market revealed that although the broader market experienced a contraction in March, Ethereum’s funding rates stayed favorable, and the open interest showed an upward trend.

In perpetual futures contracts, funding rates are employed to keep the contract’s price aligned with the current market price (spot price).

When an asset’s contract price is greater than its current market price, traders with buy orders (long positions) must compensate sellers with open sell orders (short positions). This payment, called funding, results in positive values for the funding rate.

Instead, when the contract price is less than the current market price (also known as the “spot” price), short traders must compensate long traders by paying a fee. This results in what’s called negative funding rates.

Based on the analysis, when Ethereum tries to reach the $4,000 price again, there is a noticeable increase in the “funding rates” measure.

The report added,

“This indicates an aggressive execution of long positions by participants.”

At the current moment, according to Coinglass data, the coin’s funding rate was a favorable 0.024%. An increasing positive funding rate implies that more traders are betting on the asset’s price increase rather than its decrease in the near future. In essence, this indicates that there are more buyers than sellers in the market, anticipating a positive price trend.

The significant price increase of the coin over the past week has led to a rise in its futures open interest as well. According to Coinglass, the current futures open interest for Ethereum is $15 billion, which represents a 7% growth in the last week.

According to the report:

Based on these measurements, the market seems ready for a notable shift in the medium term, possibly allowing for long-term investments to be restored in the everlasting market. This implies a positive perspective on Ethereum’s price trend, which could lead it closer to its record high.

Are the bulls regaining their strength?

In March, there were many investors with pessimistic views towards Ethereum (ETH), leading to a narrow price range for the cryptocurrency.

After analyzing the data from certain indicators on a daily chart, it appears that the recent price increase for the coin over the past week serves as evidence that bulls are making another attempt to buy back into the market.

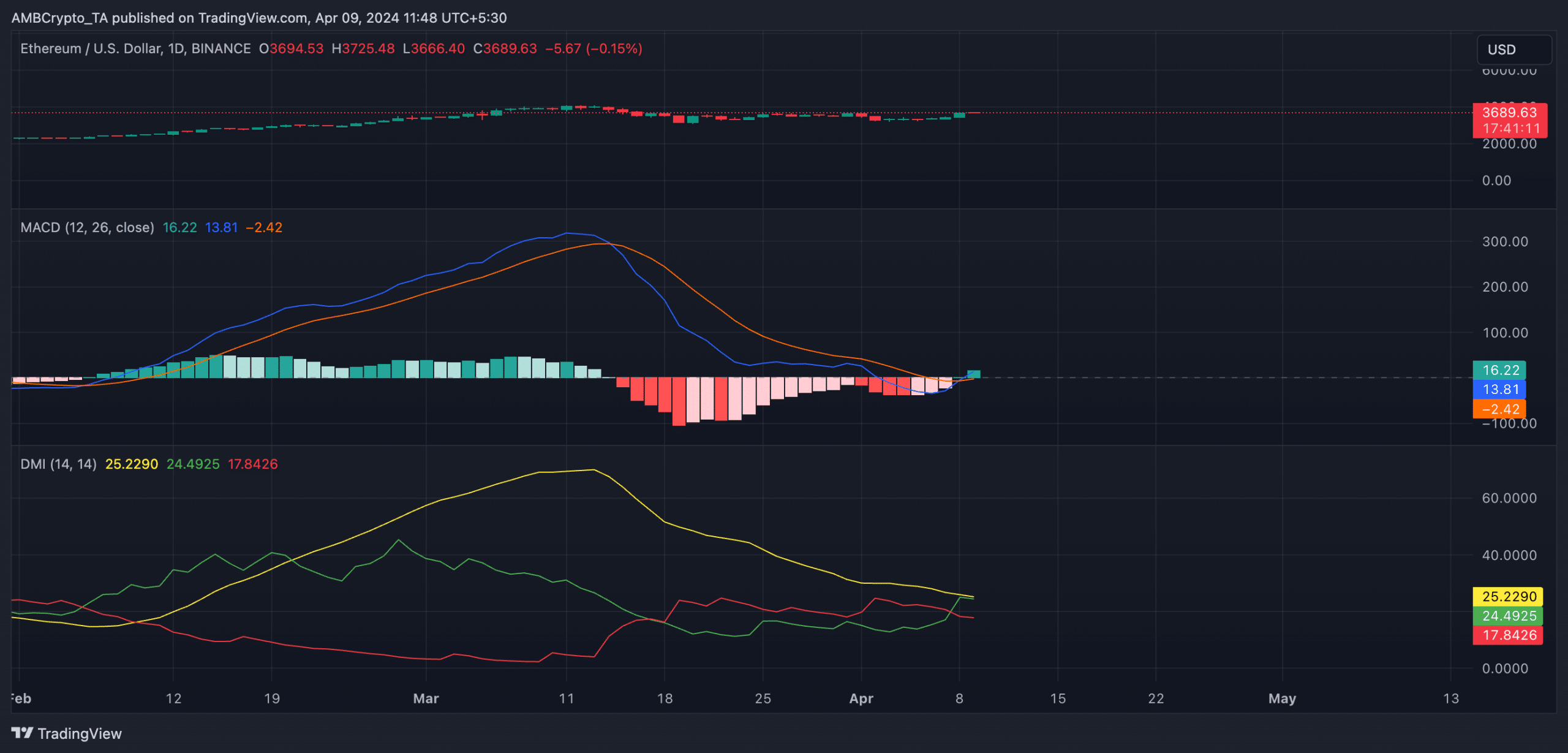

For example, for the first time since 15th March, ETH’s MACD line rested above its signal line.

An asset’s MACD line surpassing its signal line implies that the asset’s short-term moving average is gaining speed faster than its long-term moving average. It’s a sign of growing bullish energy in the near future.

Read Ethereum’s [ETH] Price Prediction 2024-25

Additionally, the Directional Movement Index (DMI) of Ethereum indicated a change in trend on April 7th when its positive index (represented by green) surpassed its negative index (denoted by red).

This confirmed the change in sentiment from bearish to bullish.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Ethereum ETF Day 1 beats ‘20% of BTC’ estimate – What’s next?

- Solana memecoin BODEN feels the heat after Biden’s exit: Will SOL suffer?

2024-04-09 13:11