- Ethereum faces bearish pressure as liquidations and ETF outflows surge, key support at $2,000 becomes crucial. (Because who doesn’t love aggressive unpredictability?)

- ETH needs to break above $2,250 to regain bullish momentum, while a drop below $2,000 could trigger further sell-offs. (Who knew suspense could be so mathematical?)

Ah, Ethereum [ETH], the digital cryptocurrency equivalent of walking a financial tightrope. At press time, it was tiptoeing way too close to disaster at $2,139.60, having slid 1.59% in the last 24 hours. A round of applause for Ethereum for keeping us so delightfully stressed. 👏

Despite a valiant attempt to look busy, Ethereum’s market cap still flexes a hefty $258.04 billion, which, if we’re honest, is more money than most of us will ever see but feels vaguely concerning in this context. Trading volumes shot up 136%, suggesting investors are either very interested or just very bored. Who’s to say? 🤷♂️

Yes, ETH clawed its way back from earlier lows, hinting—just hinting, mind you—at a momentum shift. But not so fast. Ethereum’s situation is dripping with drama, having annoyingly erased every bit of progress since the November 2024 U.S. Presidential election. (Apparently, elections and Ethereum now follow the same mood swings.)

Analysts suggest Ethereum is slipping from a parallel channel, a term that sounds thrillingly cryptic but essentially means: watch your wallet, this could go south… fast. A failure to keep hold of its $2,000 security blanket could send ETH plummeting like a bungee jumper forgetting the cord, potentially losing 75% of its value and landing at a not-so-cozy $1,250. Lovable, isn’t it? 😂

Liquidations Are the Financial Equivalent of “Oops”

ETH’s latest drama includes $230 million worth of long positions vanishing into thin air, which is the financial world’s way of saying, “Run for the hills!” Analyst Ali Martinez pointed out that this shakeout left overleveraged traders with a painful dose of humility. If Ethereum were a reality show, this episode would be called “When Leverage Attacks.”

The price recently dipped to $2,025, serving as a rude wake-up call that maybe, just maybe, using giant piles of leverage in a volatile market isn’t the best idea. Meanwhile, institutional investors, presumably just as rattled, decided to quietly sneak out the side door, pulling over $120 million from Ethereum ETFs. Oh, how the mighty institutions crumble in the face of turbulence. 😅

Open Interest Sounds Less Exciting Than It Is

According to Coinglass—which, one assumes, is the data-stained monocle of the crypto world—Ethereum’s Open Interest (essentially, the number of outstanding futures contracts) has dropped 2.14%, settling at $19.12 billion. Lower OI often means fewer traders are taking part in the betting frenzy, which could lead to reduced market drama. Or, it might just be the last calm before the storm.

Historically, dropping OI looks like a market deciding, “Eh, we’ve had enough excitement for now.” Meanwhile, trader participation cooled enough to make seasoned investors nervously check for signs of life. Behold: the complicated, fickle dance of human emotions written in the language of money.

On the brighter side (spoiler: it’s not that bright), Ethereum ETFs saw over $120 million in outflows last week. Apparently, giving up has become fashionable among institutional investors who are retreating faster than a celebrity stuck in a PR scandal. 🏃♂️💨

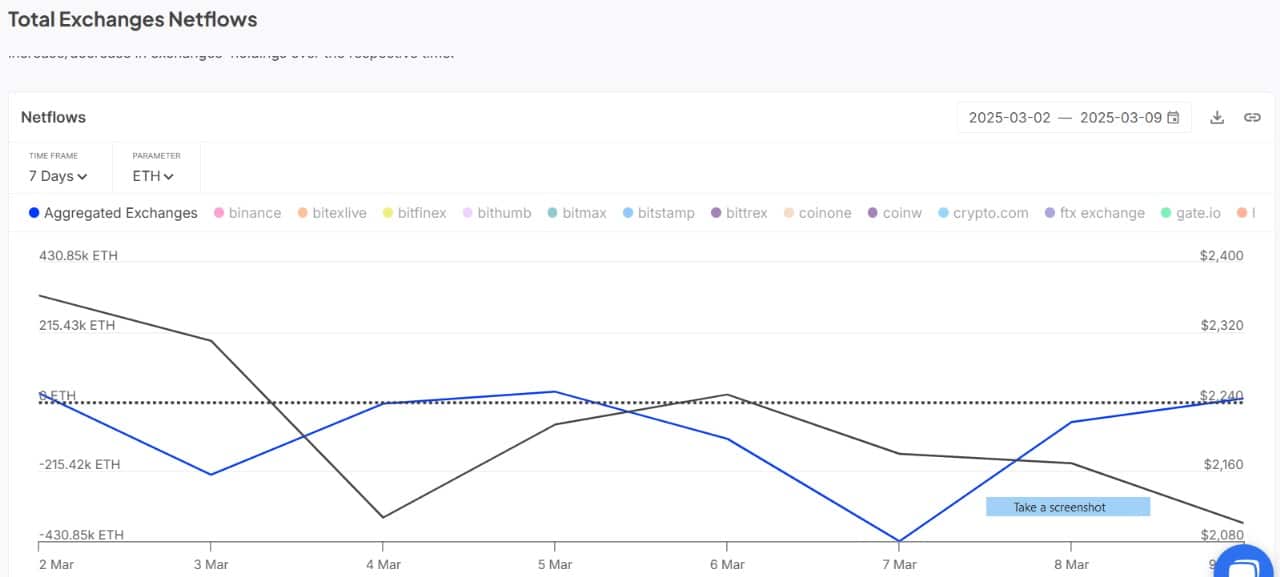

Still, the ETH netflows chart from March 2–9 offered a little drama: massive early-week outflows (yay, bullish signals!) followed by equally enthusiastic inflows (uh-oh, sell-offs incoming!) and a lovely, almost bored plateau by the week’s end. If nothing else, Ethereum keeps us guessing.

Volatility: Ethereum’s Favorite Hobby

As it currently enjoys a delightful phase of consolidation (read: “we’re safe for now, maybe”), Ethereum finds itself teetering between a bearish nudge and a bullish whisper. The Relative Strength Index (RSI) sits at 46.98, which in crypto linguistics translates to: “Yeah, this could go either way, good luck!” Meanwhile, the MACD indicator stubbornly stays negative, suggesting the current bearish momentum isn’t packing its bags just yet. Classic MACD. 🙄

But wait! A MACD crossover could indicate a surge of buying pressure—basically crypto’s version of finding long-lost hope in a drawer. That said, ETH will need to punch through resistance at $2,250 before even dreaming of bullish momentum, an event that might feel like watching someone win the lottery while riding a rollercoaster backwards.

If ETH fails this test, prepare for a revisit to $2,050, or worse, dropping below the dreaded $2,000 line and heading south to $1,850 quicker than you can say, “What happened to my portfolio?” On the flip side, clearing $2,250 could give Ethereum wings strong enough to aim for $2,700–$3,000. Truly, it’s a market with a flair for the dramatic.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-03-11 12:05