-

Ethereum formed similar structures on the price charts at similar times

ETH set to close the gap created after falling below the critical support band

As a seasoned analyst with over two decades of experience in the crypto market, I’ve witnessed numerous bull runs and bear markets. The current situation with Ethereum [ETH] reminds me eerily of its past successes in 2016 and 2019. If history repeats itself, we might just be on the verge of another epic rally in 2024.

The recent surge of Ethereum’s [ETH] price back above $2,100 has ignited discussions about the possibility that it could repeat its triumphs from 2016 and 2019, potentially achieving similar success in the year 2024.

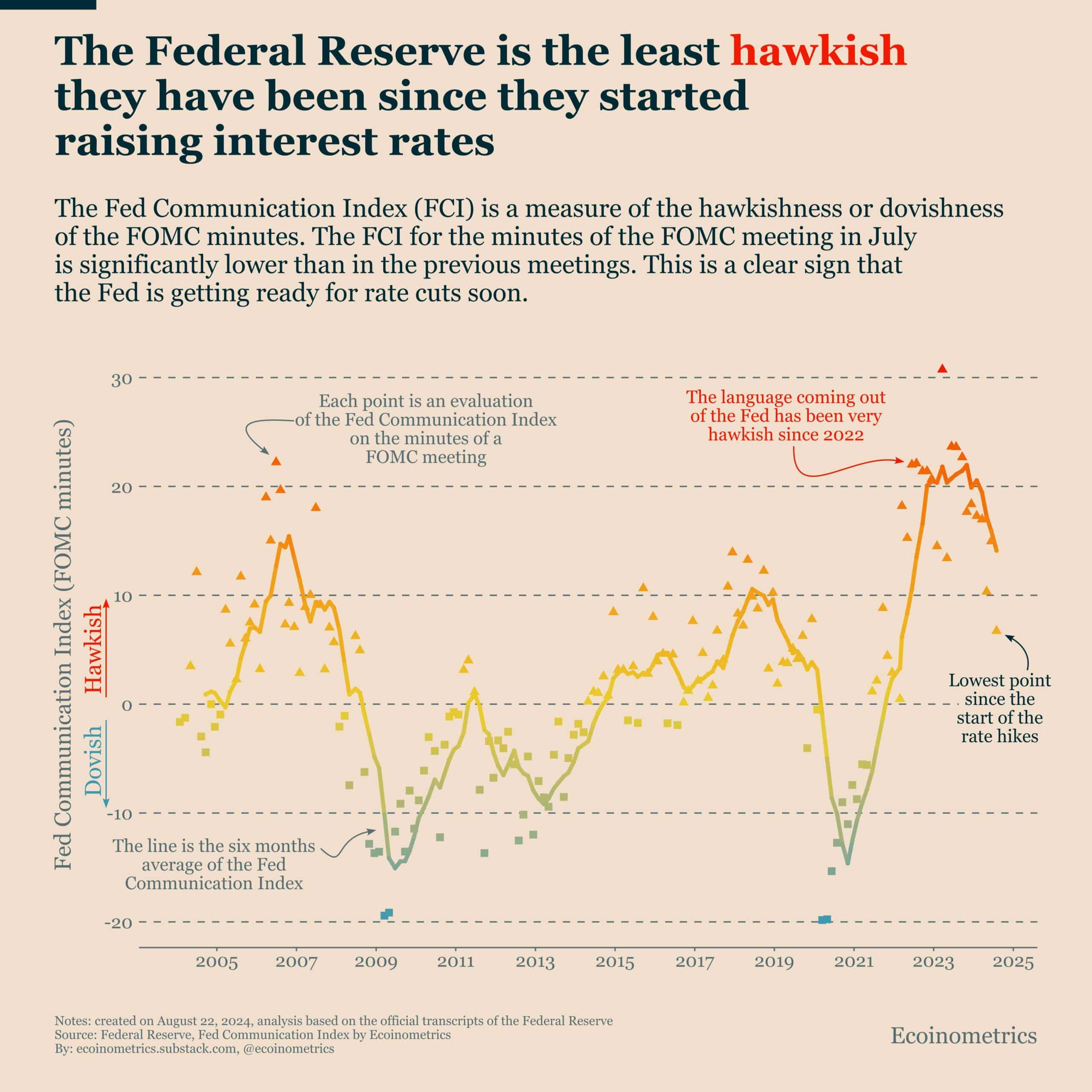

As Ethereum (ETH) appears set to finish the weekly chart above the $2,800-$2,900 zone, there’s a growing consensus that a price surge may be imminent. This optimism is further fueled by the anticipation of potential interest rate reductions by the Federal Reserve in September.

Indeed, a close look at past trends indicates that the ratio of ETH to BTC has seen significant drops in 2016, 2019, and this year, around 2024. These declines were often followed by surges in September.

It’s interesting to note that ETH reached its highest point in both 2016 and 2019 on or around the 19th and 20th of September. Remarkably, this timing is quite close to when the Federal Reserve is planning to lower interest rates next month (18th of September). It’s possible that this isn’t just a coincidence, as it might suggest potential growth for the largest altcoin in the world.

ETH/USD weekly outlook

Currently, when I’m typing this, the price of ETH/USD is still lower than its 20-week Simple Moving Average (SMA). However, Bitcoin (BTC) and a few other cryptocurrencies have surpassed their bull market support zones already.

Approaching the anticipated rate cut, I foresee Ethereum (ETH) potentially bridging the gap left after its dip below the support level, mirroring the bullish trends from 2016 and 2019. This pattern may serve to bolster the belief that ETH could replicate its past achievements.

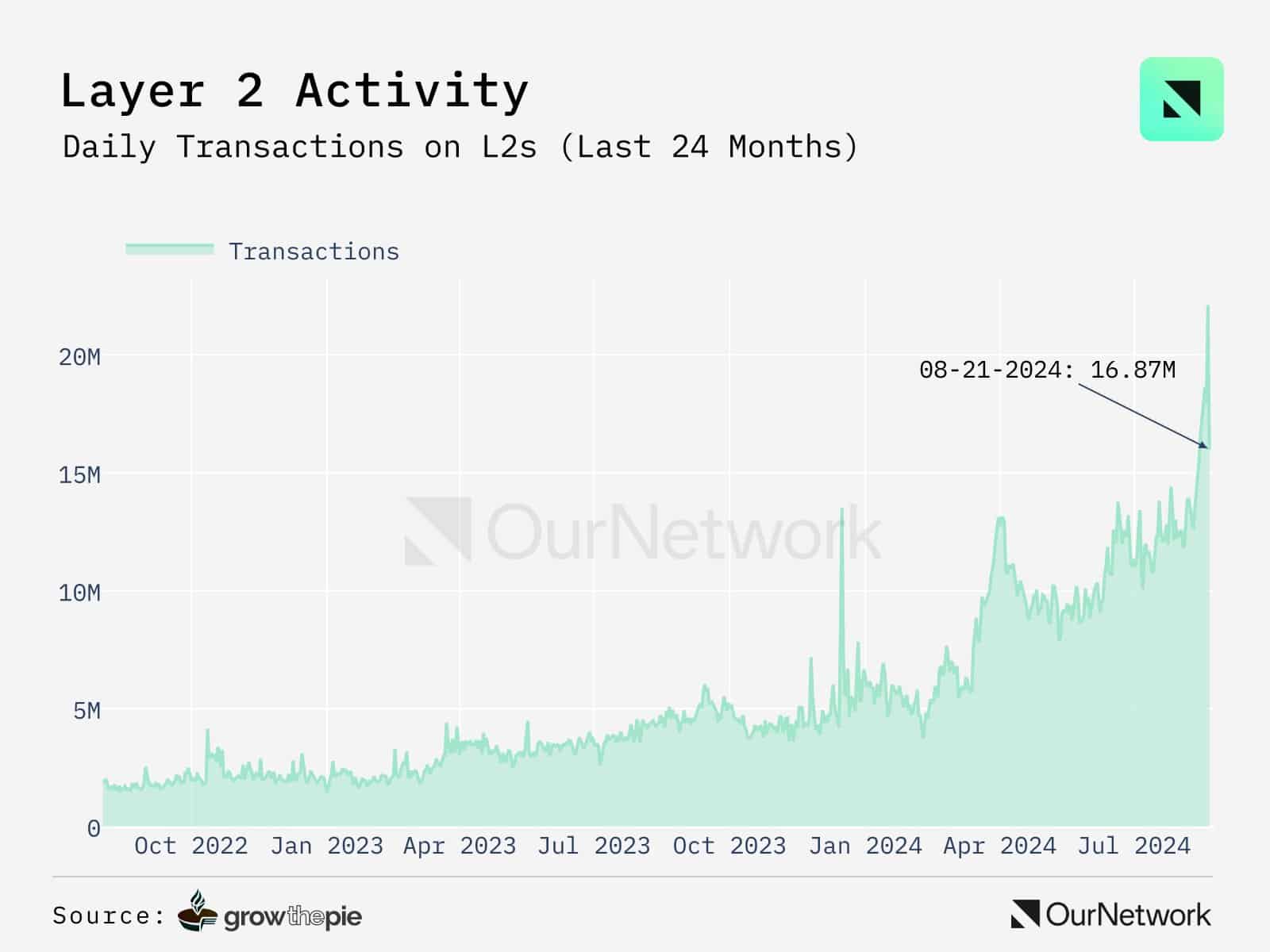

Ethereum Layer 2 daily transactions surge

As a crypto investor, I’ve been thrilled by the remarkable expansion of Ethereum’s Layer 2 solutions lately. Just recently, on August 21st, daily transactions skyrocketed to an astounding 16.87 million, as reported by OurNetwork. It’s exciting to be part of this dynamic growth in the Ethereum network!

The Ethereum network is expanding swiftly, marked by significant milestones such as Sony’s foray into the Web3 realm via their newly established division – Soneium.

On this platform, which is fueled by Optimism’s OP Stack and linked with Astar, Chainlink, and USDC, we strive to popularize blockchain gaming.

The surge in transactions on the Ethereum blockchain as a result of new developments might push prices up, similar to the price surges seen during the 2016 and 2019 market rallies.

Impact of the broader crypto market and USD

1. Following hints from Federal Reserve Chair Jerome Powell about a potential September interest rate reduction, the wider cryptocurrency market has seen a spurt of growth recently. This trend is expected to persist as ETH, a significant player in the crypto sector, appears to be gearing up for a price increase based on chart analysis.

Additionally, if the US Dollar weakens due to the Federal Reserve adopting a more accommodating monetary policy, it might lead to an increase in the value of Ethereum.

In simpler terms, the Federal Reserve – which was more aggressive in increasing interest rates than at any time since it started doing so – is now expected to lower them. Historically, this has weakened the U.S. dollar. Given that similar circumstances have previously boosted Ethereum (ETH) prices, many believe this trend could repeat itself during the upcoming bull runs.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-25 01:11