-

ETH was trading at a significant support level.

Key technical indicators hint at the possibility of a continued decline in ETH’s value.

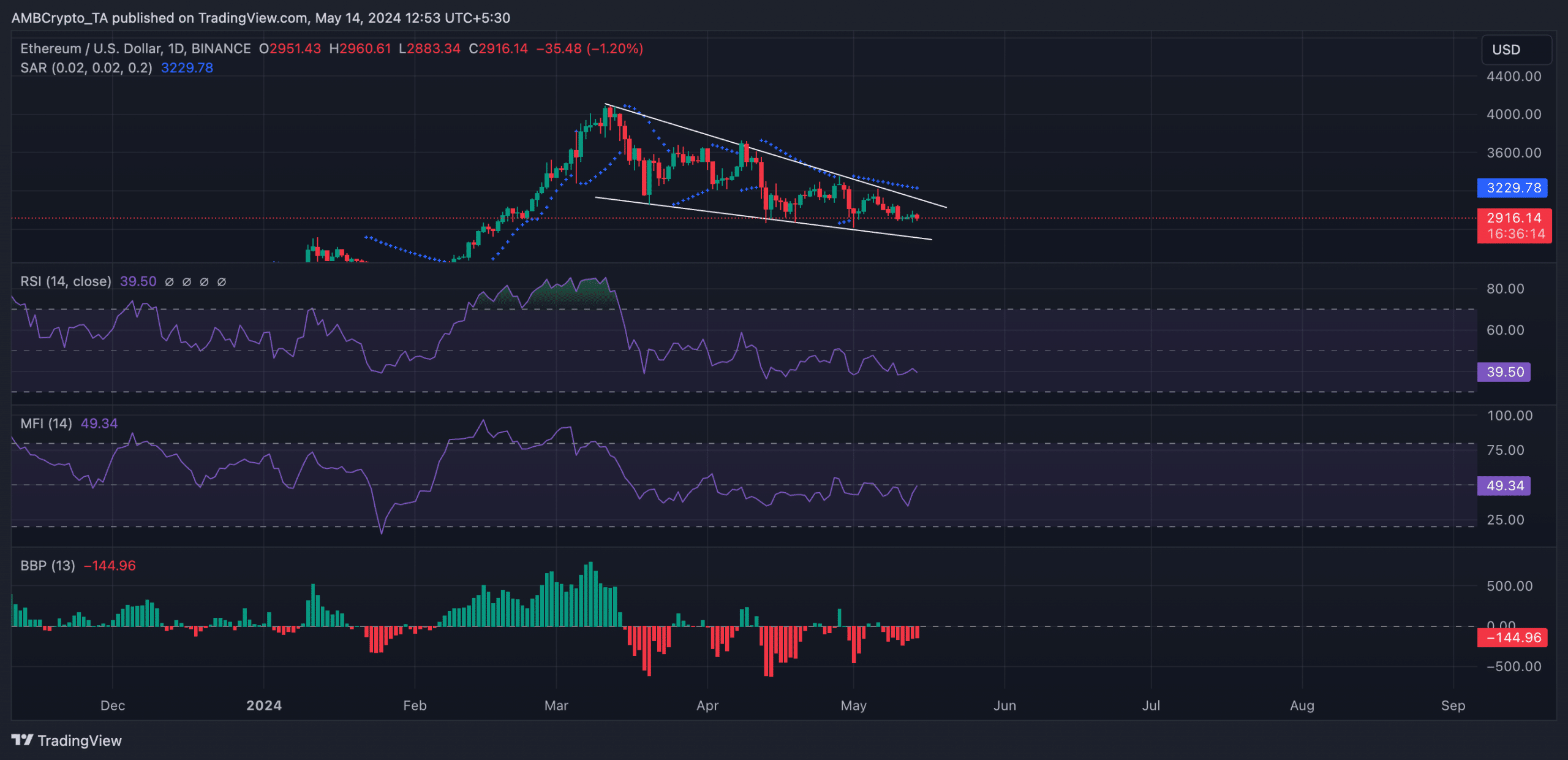

As a researcher with extensive experience in cryptocurrency markets, I’ve closely observed Ethereum [ETH] and its current price trend. ETH is currently trading at a significant support level of around $2,850 within a descending channel. If the bulls fail to defend this level, the altcoin might decline below the lower trendline of the channel, potentially reaching a low of $2600.

As a researcher studying the cryptocurrency market, I can observe that Ethereum [ETH], a major altcoin, is holding on to a vital support point amidst its price movement inside a downward trending channel.

As a crypto investor, I’ve observed that when an asset’s price forms a descending channel, it means that with each new peak, the highs are successively lower than the previous ones, while the troughs also follow a similar pattern of being lower than the preceding lows. This downward trend is a clear signal that the market sentiment is bearish and that I should consider taking protective measures in my investment portfolio.

On March 12th, an analysis of Ethereum’s daily price trends uncovered the emergence of this channel. Subsequently, the cryptocurrency experienced a decrease in value amounting to 28%.

According to CoinMarketCap’s data, the altcoin exchanged hands at $2915 as of this writing.

A break below or a break above?

If the supporters of Ethereum (ETH) are unable to keep its price above the current support of $2,850, there’s a risk that the cryptocurrency may start to decrease and fall beneath the lower boundary of the downward trendline in its channel.

If this happens, the altcoin will exchange hands at the $2600 level.

As a technical analyst, I’d interpret AMBCrypto’s assessment this way: The analysis of certain technical indicators by AMBCrypto suggests a potential downside break from the current support level.

The signals from Ethereum’s technical indicators showed that traders were selling off more ETH coins than they were buying, indicating a dominant trend of sell-offs among market participants.

At the current moment, the RSI and Money Flow Index (MFI) values for the Ethereum coin were lower than their neutral thresholds. Specifically, the RSI stood at 39.52, and the MFI reading was 49.39.

As a researcher studying the Ethereum (ETH) market, I’ve observed that the Elder-Ray Index has shown a negative reading. This finding underscores the prevailing bearish trend, indicating that selling pressure currently outweighs buying pressure within the market.

When it returns a negative value, it means that bear power is dominant in the market.

In a similar fashion, the dots representing ETH‘s Parabolic SAR have been observed sitting above its current value. This placement of dots has been maintained since the start of May.

The Parabolic SAR (Stop and Reverse) indicator serves to determine possible trends and trend reversals in financial markets. When its dotted lines lie above a given asset’s price, it implies that the market is experiencing a downtrend.

Read Ethereum’s [ETH] Price Prediction 2024-25

It indicates that the asset’s price has been falling and may continue.

If ETH‘s current support level gives way to bears, my expectation is that the coin could potentially drop to around $2780. But, should this bearish outlook prove incorrect, Ethereum may instead surge past $3000.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-05-15 03:03