-

The number of addresses holding more than 10,000 ETH has declined.

ETH’s price has been unable to reclaim the $3,000 price level.

As a researcher who has witnessed the rollercoaster ride that is the crypto market, I must admit I am not entirely surprised by the recent developments in Ethereum [ETH]. The decline in large address holdings and the struggle to reclaim the $3,000 price level are indicators of a shifting market sentiment.

As Ethereum [ETH] battles to regain its previous price of around $3,000, the current struggle makes that price point seem increasingly remote.

Regardless of efforts to regain momentum, Ethereum (ETH) has persistently failed to meet expectations, causing increasing unease among investors and market participants.

In the midst of this continuous battle, some significant investors, commonly known as “whales,” are now decreasing the amount they own.

Ethereum whales reduce holdings

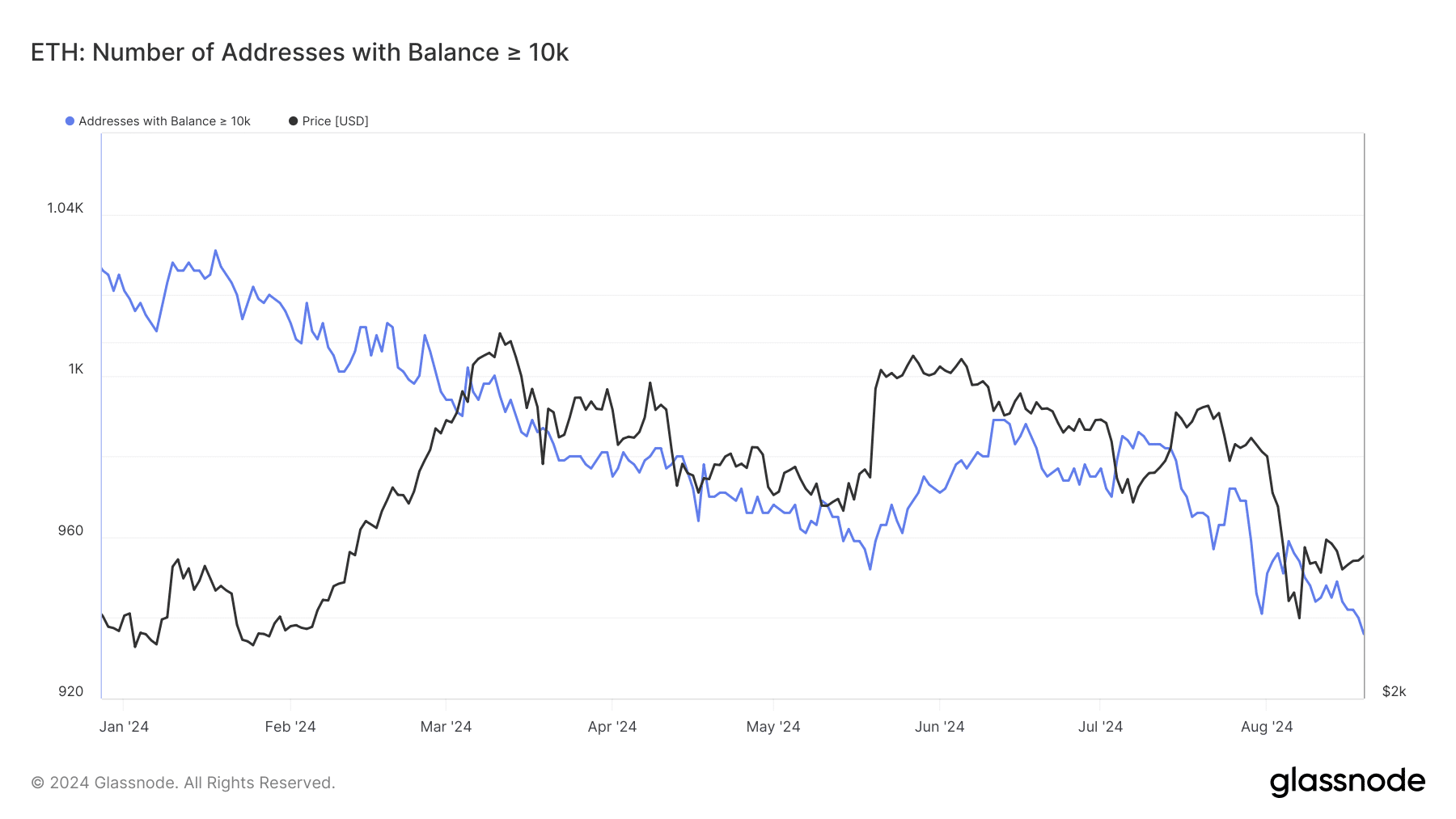

A look at Ethereum wallets with 10,000 or more Ether on Glassnode has shown a notable drop in numbers during the last several weeks.

2024 has shown a significant reduction in the number of large market participants, suggesting a possible change in their overall attitude or opinion. Notably, this decrease has been more pronounced in recent times, with a marked drop observed especially during the last few months.

Initially in the year, approximately 1,020 addresses held 10,000 or more Ether. Over time, this number has been gradually decreasing and dropped below 960 by August 2024, which is the lowest point since 2017.

The steady decrease in the number of large ETH addresses could be interpreted as a bearish signal.

If whales start selling substantial amounts of their Ethereum, it might signal a decrease in their belief about the near-to-mid term value increase of Ethereum.

Based on my years of experience in the financial markets, I believe this trend could signal that these large investors are either cashing out their gains, shifting their investments to other assets, or gearing up for a possible market downturn. As someone who has seen multiple market cycles, I’ve learned that it’s important to stay vigilant and adaptable in the face of changing conditions. It’s always essential to keep a close eye on market trends and make informed decisions to protect your investments.

Potential impact on the market

With big investors persistently unloading their Ethereum (ETH), the market might experience an escalating surge of selling activity. If there’s not enough buying interest from newcomers to offset this growing supply, the value of Ethereum may drop even more.

Conversely, should the pattern in significant addresses show signs of leveling off or even reversing, this might indicate that big investors are once again amassing their holdings, suggesting a new accumulation stage.

Based on my personal observation and years of experience in the cryptocurrency market, this reversal might suggest that these entities consider Ethereum’s current price to be a good value. This could lead to increased buying activity due to their belief that Ethereum is poised for growth, given its potential and proven track record. I have noticed similar patterns in the past where a significant drop in price was quickly followed by a surge in demand as investors saw it as an opportunity to buy at a discount.

Slight puff in the Ethereum price

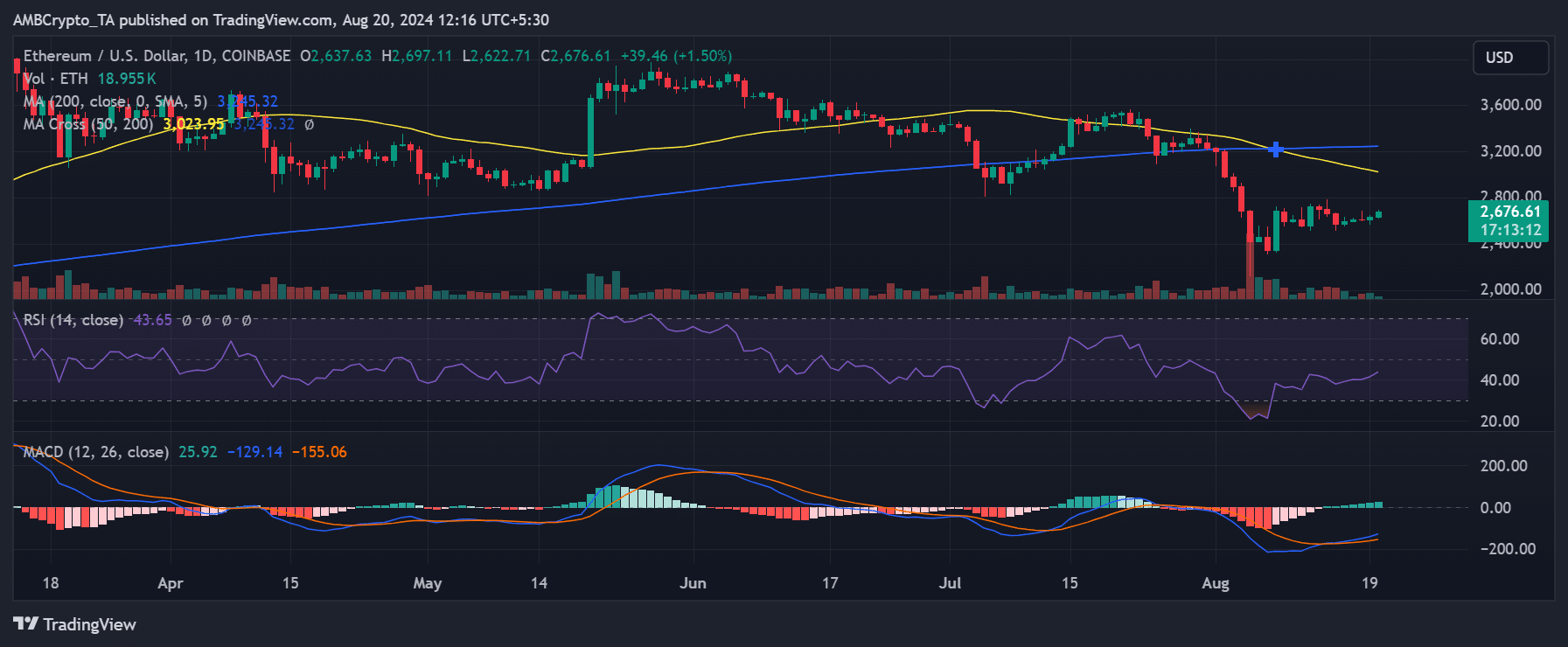

In my recent observations during the previous trading period, I noticed a modest upward trend for Ethereum, as indicated by AMBCrypto’s analysis, with approximately a 1% rise.

At present, ETH‘s price has risen by more than 1%, currently hovering around $2,637. This rise has pushed the value up towards this figure.

Read Ethereum (ETH) Price Prediction 2024-25

2024 saw Ethereum’s value going through considerable ups and downs. The journey started with a robust uptrend, reaching its highest point approximately in March.

After reaching that high point, its value has been steadily falling for several months following. This decline has continued through August 2024, and it’s been observed to parallel the drop in the count of large Ethereum wallets.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-08-20 18:16