-

Historical design shown by the MVRV ratio, led ETH to bounce.

While traders booked some profits, the OI indicated that more was close.

On April 8th, Ethereum [ETH] bucked the trend of being considered a sluggish performer in this market cycle. Its market value surged by more than 9%, reaching a staggering $440 billion.

In the meantime, the value of the altcoin reached over $3,700, only to experience a minor decline later on. However, this price movement wasn’t the most significant aspect.

The past is sometimes the present

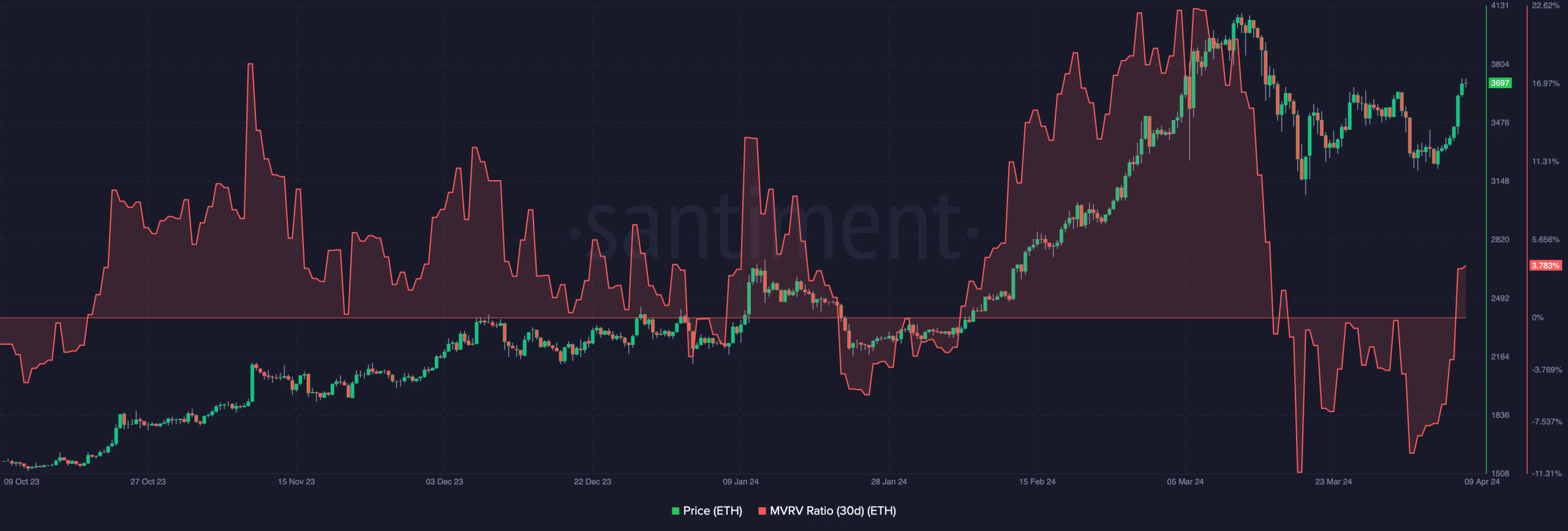

AMBCrypto examined Ethereum‘s on-chain situation, looking specifically at the Market Value to Realized Value (MVRV) indicator. This metric offers insights into the trading activities of market participants. It can also serve as a useful tool for identifying potential buy and sell opportunities, helping to determine the peaks and troughs of an asset’s value.

From April 1st to the 7th, the 30-day MVRV ratio of Ethereum showed a negative value. This signified an uncommon chance for purchase in that price range, as per Ethereum’s past trends.

In October 2023, the ratio stood at -4.90 when Ethereum was priced at around $1,566. Later on, its price surpassed $2,000. A comparable situation unfolded in January where Ethereum shifted from a price of $2,237 to reaching $4,088.

On the two previous instances, the Ethereum price surged by 21.7% and subsequently by 45.27%. In contrast, there has only been an increase of 7.89% this time around. If history repeats itself, we can expect the price to climb towards $4,648 in the coming weeks.

If the market remains stable and doesn’t undergo severe price swings, the bullish forecast may hold true. However, if market volatility leads to significant price drops, this optimistic view could be called into question.

Is it time for surplus gains?

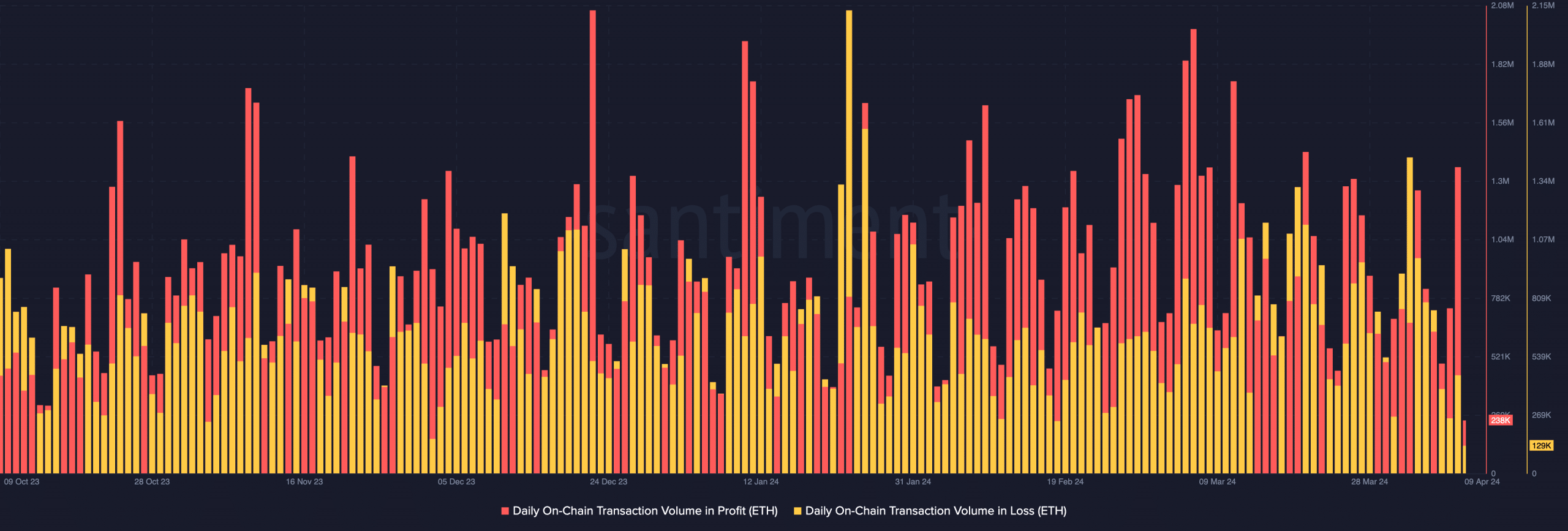

During this time, traders seized the opportunity to sell their ETH at higher prices, earning profits. However, Ethereum owners had struggled to do so in the past few weeks.

The amount of daily on-chain transactions involving losses was approximately $129,000. In contrast, the number of transactions resulting in profits came in at around 238,000.

If Ethereum’s cryptocurrency price keeps climbing, the earnings could potentially be twice as much as the losses. However, it remains to be seen if Ethereum will yield to the upward trend.

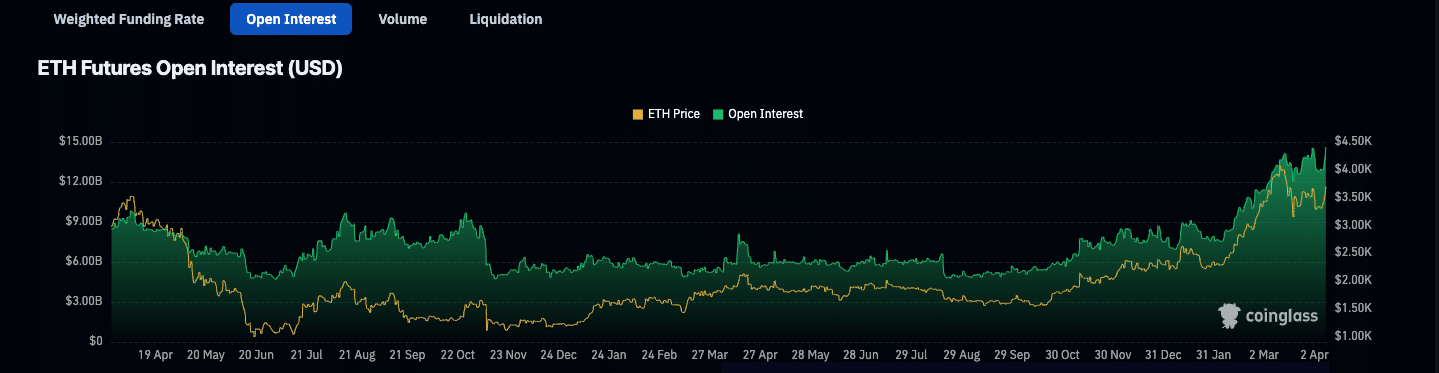

To confirm this potential, AMBCrypto examined the Open Interest (OI) figure. Based on Coinglass’ data, Ethereum’s OI reached an impressive level of $14.41 billion.

The Open Interest (OI) indicator reflects the total number of open positions held by traders. A decrease in OI signifies more positions have been closed, while an uptick indicates new liquidity being introduced to existing positions.

As a result, there was a surge in new contracts during the past 24 hours, with buyers taking the initiative.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Based on current Ethereum (ETH) pricing and open interest (OI), it appears that when these values converge, we could witness a substantial price shift.

If we consider the trading standpoint, the substantial open interest combined with the increasing value may result in a price breakthrough. In such a scenario, Ethereum surpassing $4,000 might follow.

Read More

2024-04-10 00:07