- Ethereum’s sell pressure from large holder flows outperformed inflows from the same category.

- A recap of the mixed signs, and why ETH could be on the verge of a retracement.

As a seasoned researcher with years of experience observing and analyzing cryptocurrency markets, I find myself cautiously optimistic about Ethereum [ETH]. While its bullish momentum seems to have cooled off somewhat, there are still reasons for hope.

Supporters remain optimistic that Ethereum (ETH) might surge past $4,000 by the year 2024’s close.

As the cryptocurrency continues to show indications of upholding the bullish trend it gained in November, a significant downturn might be on the horizon.

The increased whale activity suggests that there could be a growing urge to sell Ethereum. Given that the previous strong momentum appears to have slowed down, this development is not entirely unexpected.

Additionally, it’s worth noting that the number of significant Ethereum holders is on the rise, potentially fueling a downward trend.

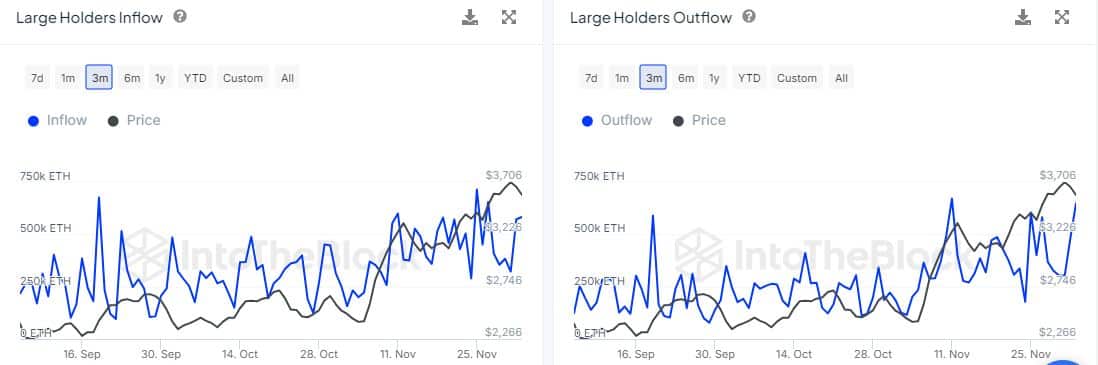

Data from IntoTheBlock indicates a significant outflow of Ethereum (647,220 ETH) by large holders on December 3rd. However, recent data shows that large holder inflows have also increased over the past three days, reaching a peak of 582,710 ETH.

The disparity between incoming and outgoing flows indicates that there was more selling activity by whales than buying interest, which wasn’t the sole indicator pointing towards a lack of bullish strength. Additionally, this wasn’t the only evidence suggesting a waning bull market.

This week’s Ethereum ETF investments have maintained a positive trend. Yet, the inflow rate has significantly decreased compared to the previous week.

On December 3rd, Ethereum ETF investments saw a significant boost, reaching approximately $132.6 million, a marked increase from the $24.2 million recorded the day before.

Last Friday, the value of Ethereum ETFs reached a peak of approximately $332.9 million. However, this significant increase indicates a substantial decrease in the inflow of funds into these ETFs.

Is bullish demand weakening?

It’s important to consider that what seems like a decrease in demand could just be a temporary fluctuation, as demand can either increase or decrease from day to day.

However, the above observations do highlight the slowdown in ETH bullish demand during the weekend.

Although significant movements by large investors and Ethereum ETFs may indicate a decrease in demand, transactions in the spot market presented a contrasting scenario.

Inflow rates reached a high of approximately $285 million over the past 24 hours, and they stood at around $252.69 million on November 3rd.

The positive spot flows were in tune with ETH’s price action. This bullish demand contributed to the cryptocurrency’s recovery in the last two days.

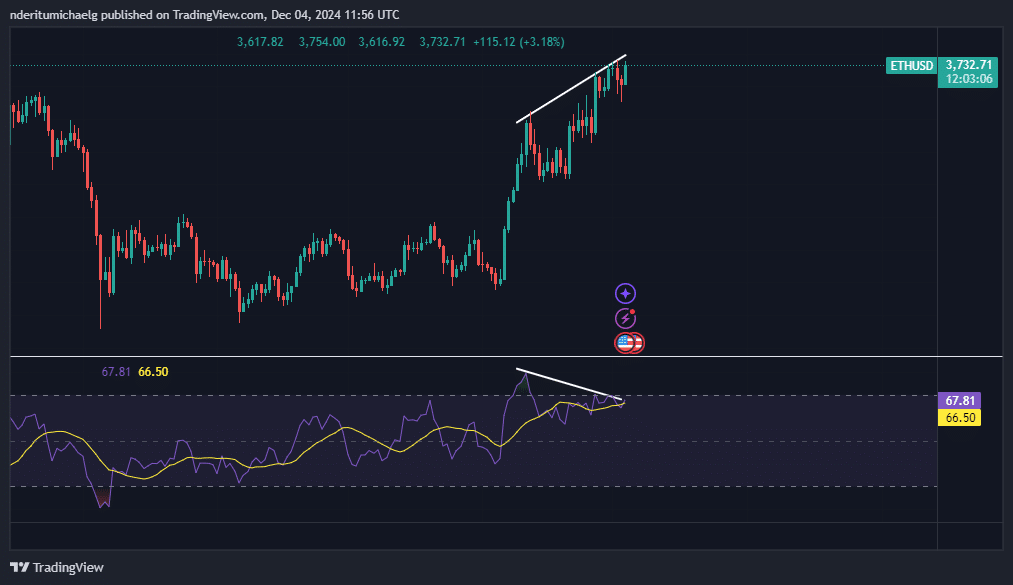

As I pen down these words, Ethereum (ETH) trades at approximately $3,731. It’s showing signs of recovery after an initial wave of selling pressure at the onset of this week. Yet, there’s one significant factor fueling the anticipation of a potential reversal.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The trend in Ethereum’s price seems to contrast with its Relative Strength Index (RSI), indicating a potential significant drop might occur.

Lowering from the present position might lead the price to fall down to approximately $3050. This is a relatively new level where the cryptocurrency has found support.

Read More

2024-12-05 01:50