-

ETH has declined by 6.18% in 24 hours.

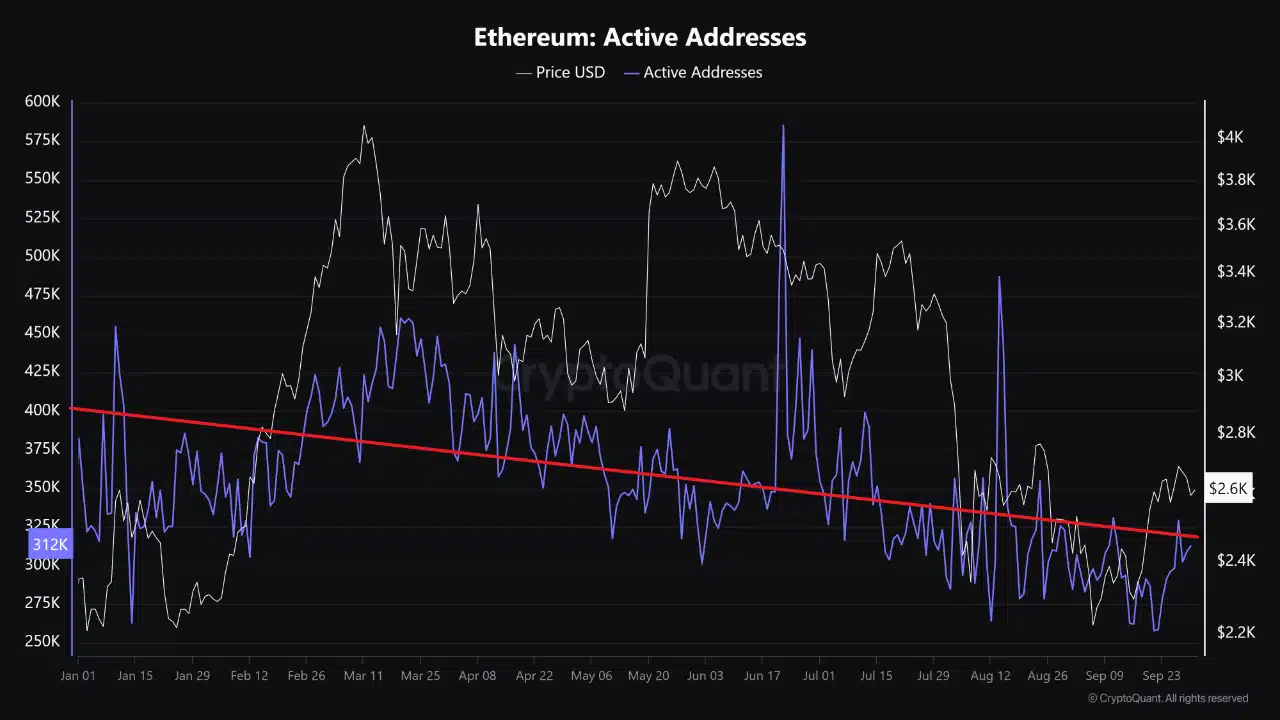

Ethereum daily active addresses have declined by 18.32% from 382k to 312k YTD.

As a seasoned analyst with a decade of experience in the crypto market under my belt, I must say that the recent downturn in Ethereum (ETH) has caught my attention. The 6.18% decline over the past day and the consistent decline in daily active addresses from 382k to 312k YTD are concerning indicators. However, it’s essential to delve deeper into these statistics to fully understand the market dynamics.

Ethereum [ETH] has experienced a sharp decline over the past week. Over this period, ETH has declined by 5.46%. In fact, as of this writing, Ethereum was trading at $2480. This marked a 6.18% decline over the past day.

Previously, ETH had been steadily increasing, rising by approximately 1.57% on monthly graphs. But after reaching a peak of $2729, it hasn’t been able to sustain an upward trend. Consequently, the recent declines are almost overpowering the gains made during the past month.

The current drop in prices isn’t a unique occurrence, as the altcoin has also experienced declines in other key areas such as the number of active users or addresses involved.

Ethereum daily active addresses decline

Based on Cryptoquant’s findings, Ethereum has seen a continuous decrease in active user addresses throughout the year, similar to Bitcoin.

Based on this data, Ethereum’s daily active addresses have declined from a high of 382k to 312k.

According to experts, the primary reason for the downturn was a scarcity of fresh investment. Despite an influx of liquidity in 2024 due to the approval of Ethereum ETFs, on-chain actions do not appear to mirror this increase.

Similarly, unlike what was expected, the market didn’t show a surge after the Fed reduced interest rates. Consequently, it seems that no fresh investors are joining the market at this time.

Implications for ETH price charts

Notably, a decline in daily active addresses as pointed out above usually leads to price dips.

Nevertheless, even though there’s been a decrease in active Ethereum addresses, the present market situation might pave the way for a substantial rebound in its price charts.

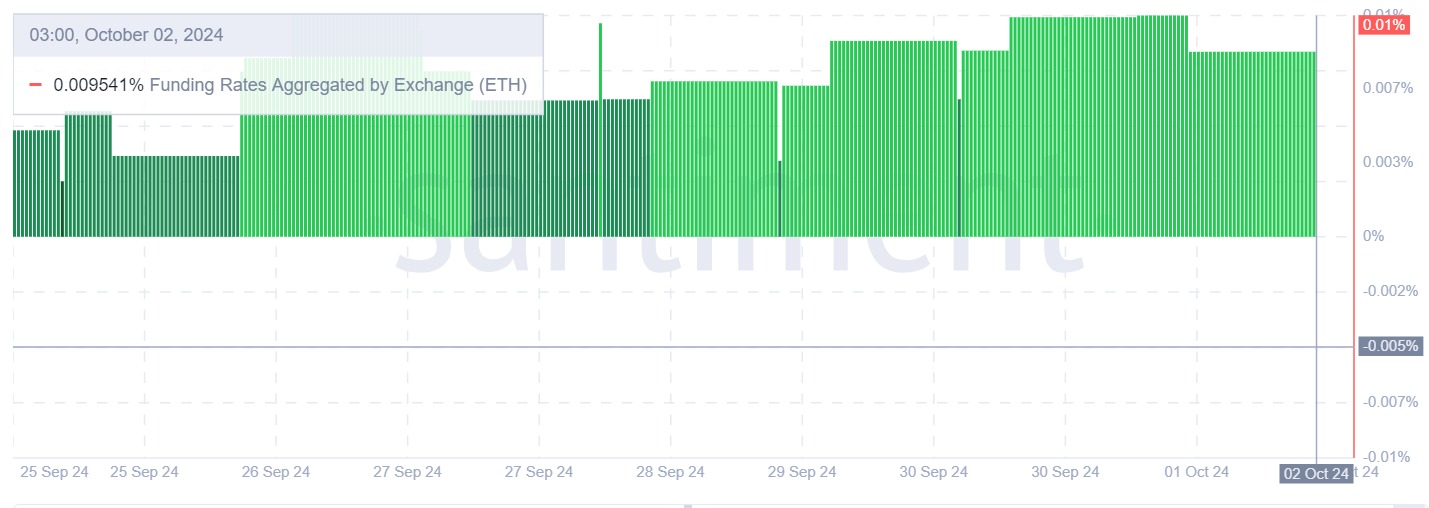

In simpler terms, the combined funding rate for Ethereum across exchanges has been steadily increasing and staying above zero during the last week. This trend suggests that more investors are buying into long-term positions, predicting additional profits in the near future.

The continued holding of long positions by investors, even amid a falling price trend, indicates a strong sense of market optimism or confidence.

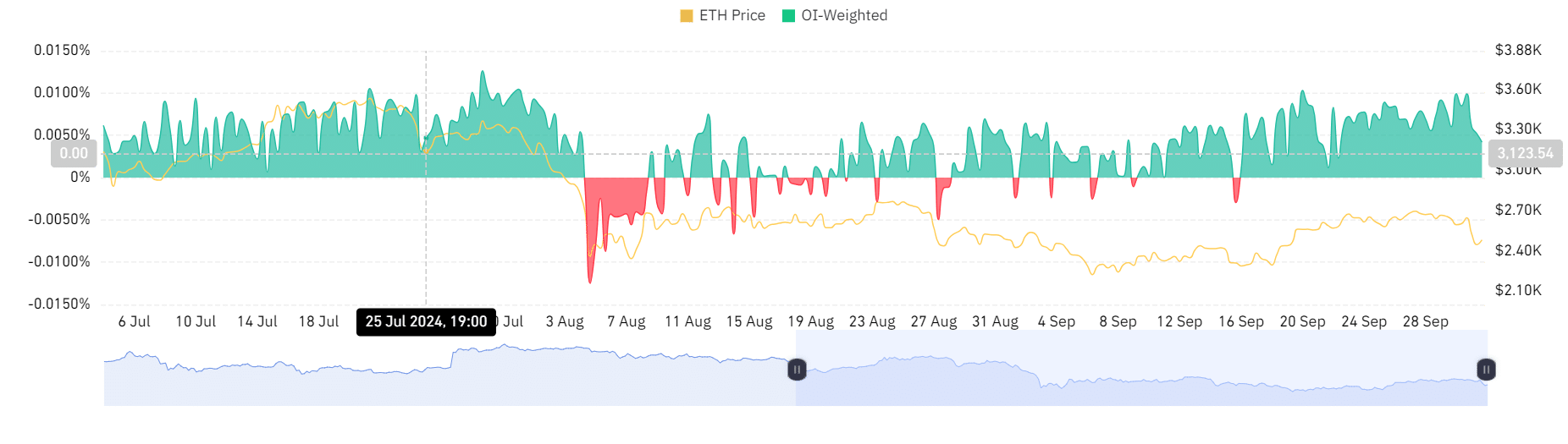

The increased need for long positions is also reinforced by a favorable combined impact of open interest and funding rates.

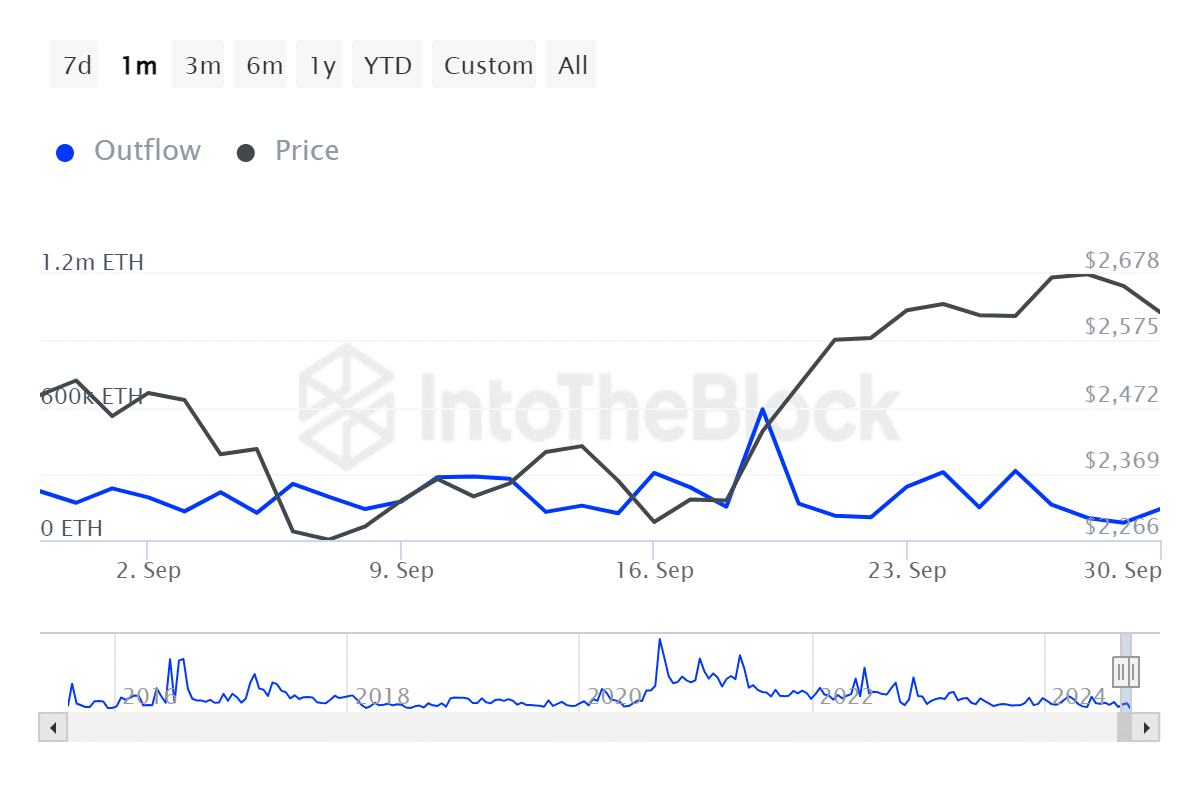

Furthermore, the outflow of large Ethereum holdings has decreased significantly, falling from a peak of 311,950 to 139,390. This indicates that these major investors are still amassing their assets and maintaining their investment positions, even during market declines.

Such holding behavior suggest confidence with the altcoin’s future.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Consequently, even though there’s a drop in active Ethereum addresses, its price performance remains robust. This suggests that the market is generally optimistic.

If things continue as they are, Ethereum (ETH) might regain and surpass the next notable resistance point at approximately $2668. But should the current downtrend persist, Ethereum could find a supportive base around $2728.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-10-03 00:07