Behold, the mighty Ethereum, like a weary worker, stands at the crossroads of fate, where the whispers of the Fed’s decision and the clinking of institutional coins echo through the market’s vast expanse. 🧠

As the Federal Reserve prepares to unveil its next rate decision, the market holds its breath, like a ship in a storm, awaiting the captain’s command. 🌊

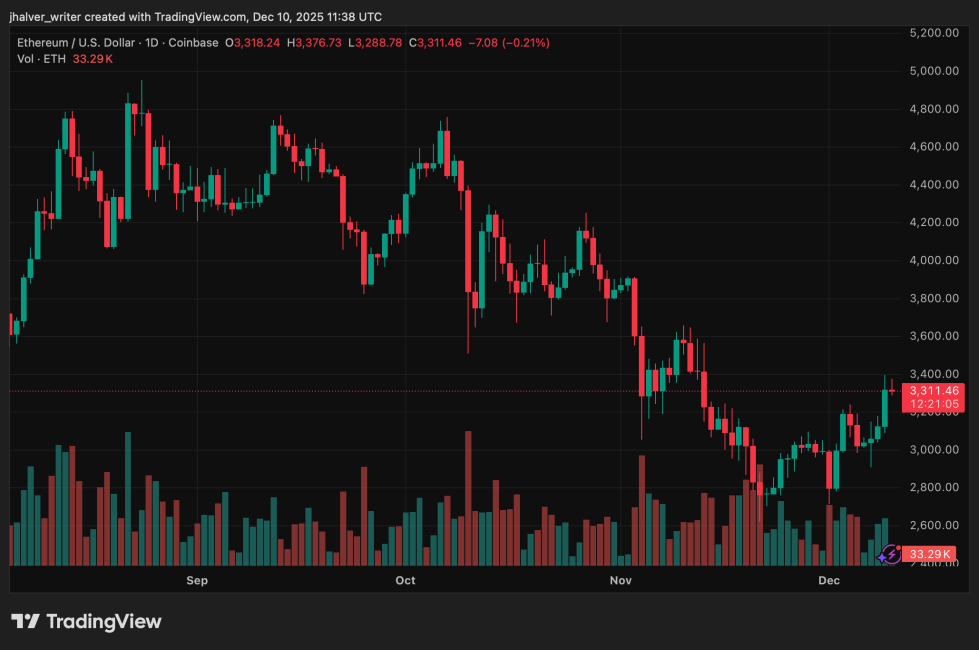

The second-largest cap cryptocurrency has staged a notable rebound, breaking key resistance levels with the tenacity of a desperate soul. 🧨

Fed Expectations Drive Ethereum Position Repricing

Ethereum surged past $3,300, a feat as audacious as a beggar claiming kingship. 🏺

The rally comes as traders price in a high probability, close to 90%, that the Federal Reserve will announce a 25-basis-point rate cut. Lower interest rates, a balm for liquidity, though one wonders if it’s a cure or a curse. 🧪

Bitcoin’s recovery above $94,000 added further confidence, though Ethereum outperformed on a relative basis. The ETH/BTC ratio reached its strongest point since late October-proof that even in chaos, some shine brighter. 🌟

Spot Ethereum ETFs also saw $177.7 million in inflows, surpassing Bitcoin’s on the same day. A tale of two coins, but Ethereum’s charm is undeniable. 🐍

Institutional Moves Add to Bullish Sentiment

BlackRock’s filing for the iShares Ethereum Staking Trust ETF is a move as bold as a lion tamer’s leap. 🦁

Analysts note that such products could increase liquidity inflows into Ethereum, though one might question if it’s a feast or a trap. 🕵️♂️

Large buyers, including Bitmine Immersion, have accumulated billions of dollars’ worth of ETH in recent months. A dance of supply and demand, where the curtain may soon rise. 🎭

Technical Breakouts Reinforce the Trend

Chart analysts highlight a breakout above a downward trendline, a rebellion against the old guard. 🗳️

Momentum indicators, including MACD and RSI, show increasing buyer strength. But beware, for overbought territory is a treacherous land. 🚩

Analysts such as Captain Faibik argue that a confirmed breakout could support a rally of up to 30%, targeting the $4,200-$4,300 region. Yet, the Fed’s upcoming decision remains a key variable-like a loaded gun in a crowded room. 🔫

Cover image from ChatGPT, ETHUSD chart from Tradingview

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- 10 Movies That Were Secretly Sequels

- These Are the 10 Best Stephen King Movies of All Time

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- USD JPY PREDICTION

2025-12-11 04:14