-

Whales continued to stockpile ETH despite being under water.

Majority of whale positions were longing ETH in derivatives markets.

As an observer with a background in cryptocurrency market analysis, I find the recent behavior of Ethereum [ETH] whales quite intriguing amidst the 4.73% price drop over the last 24 hours. Whales continued to accumulate ETH despite the bearish trend, as evidenced by two significant transactions: one involving a wallet buying 1,524 stETH for an estimated profit and another whale purchasing 7,128 ETH worth $22 million.

I’ve observed that Ethereum [ETH], the second largest cryptocurrency, dipped 4.73% in value over the past 24 hours of trading. This decline came after a period of bullish momentum following Bitcoin’s halving event. At present, Ethereum is being traded at $3,125 based on data from CoinMarketCap.

As a researcher studying the behavior of whale investors in the cryptocurrency market, I’ve observed that despite the recent market slump, these investors remained optimistic about Ethereum (ETH)’s future prospects. They continued to exhibit bullish tendencies in their investment strategies.

Whales buy ETH’s dip

Based on data from the on-chain monitoring tool Spot On Chain, large Ethereum holders have bought significant amounts of ETH within the past day.

The wallet identified by the address 0xe0b purchased 1,524 units of stETH for an average price of around $3,159 each. This transaction increased the wallet’s stETH holdings to more than $10 million, resulting in a profitable return of approximately 3.42%.

A substantial investor accumulated approximately 7,128 Ether in a large transaction, equating to around $22 million based on current market prices, with each Ether costing about $3,111. Reports indicate that this affluent individual held an impressive hoard of Ether valued at over $482 million.

As of this writing, the holder was in a state of unrealized loss.

Supply held by top addresses increase

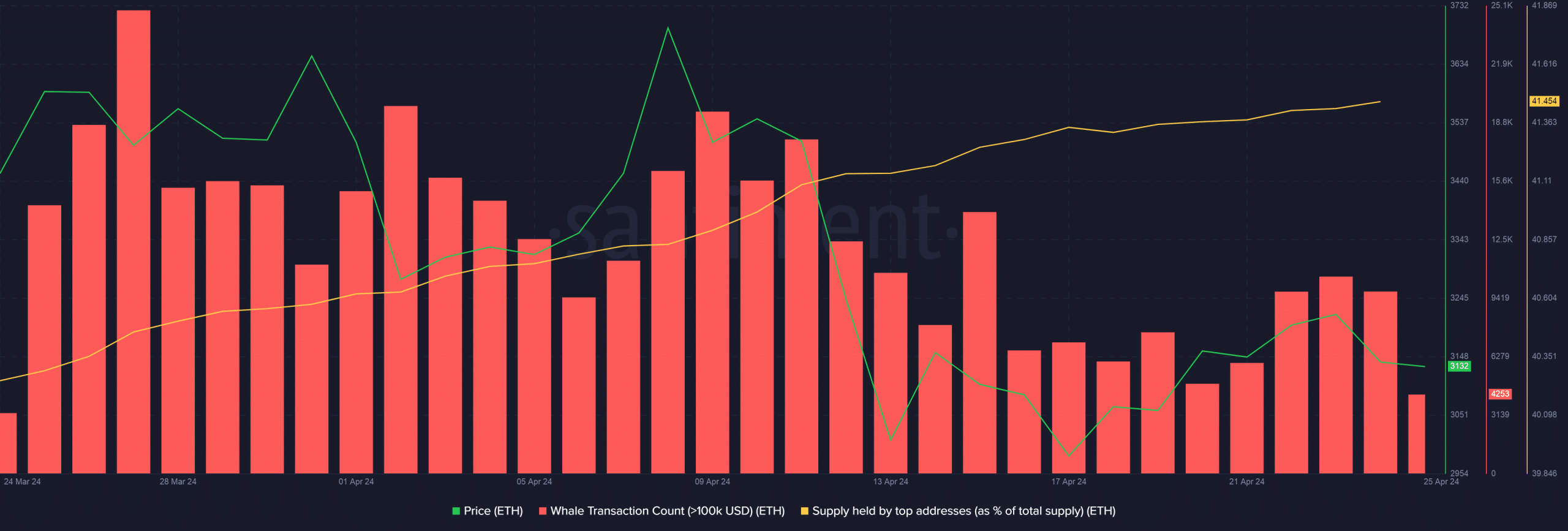

In the past few days, significant increases in Ethereum (ETH) transactions by large investors, or “whales,” have been observed, based on AMBCrypto’s interpretation of Santiment’s data. This is evident from the noticeable uptick in large transfers valued over $100,000.

On the halving day, the top addresses owned 41.37% of the total supply. By the 24th of April, their share had increased slightly to 41.45%. This growth indicates that large holders, or “whales,” may have been buying more coins.

Whales still betting on ETH’s rise

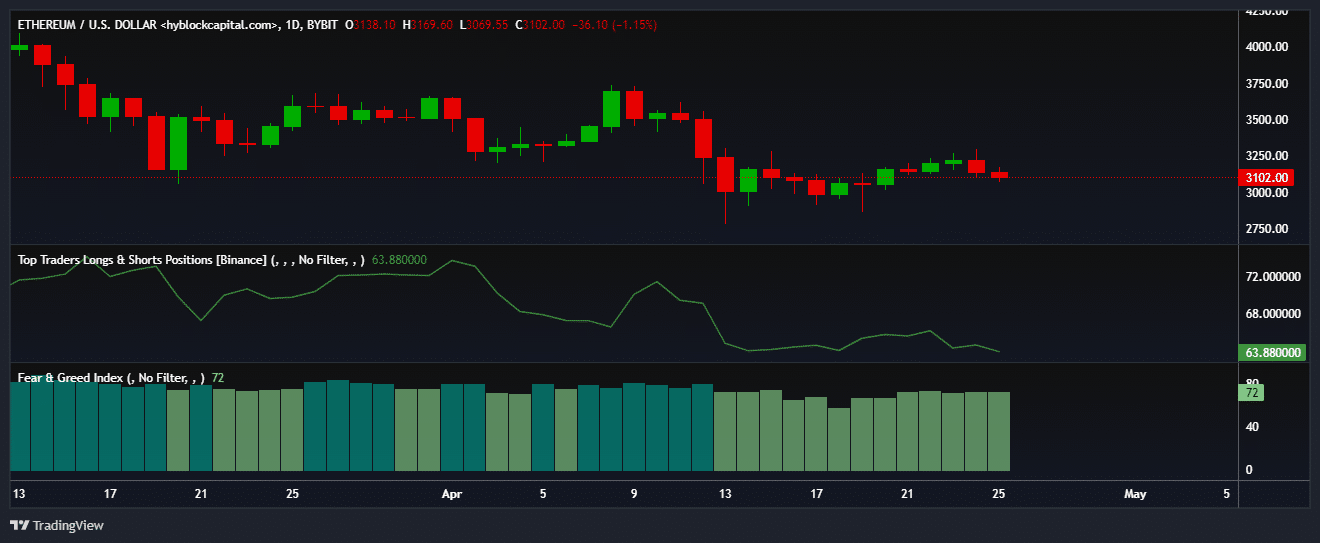

In the derivatives sector as well, a large percentage of the major investors (whales) held bullish stances towards Ethereum (ETH). According to AMBCrypto’s examination of information from Hyblock Capital, around 63% of their whale positions on Binance were long positions in ETH.

Though, it was worth mentioning that the long exposure came down after the halving.

The prevailing attitude among investors showed a strong desire for gains, suggesting that purchasing activity may intensify in the near future. This optimistic outlook might contribute to Ethereum’s potential recovery.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

2024-04-26 10:53