-

ETH bears believe that low fees, L2 fragmentation, and competition from BTC and SOL could dent price prospects.

However, ETH bulls foresee a long-term demand and value appreciation for the altcoin.

As a seasoned crypto investor with a decade of experience under my belt, I’ve witnessed firsthand the wild rollercoaster ride that is the cryptocurrency market. In the case of Ethereum [ETH], it’s been an exciting journey to say the least.

In the ongoing market trend, Ethereum (ETH) has experienced a mix of positive and negative price movements. During the period spanning late 2023 to early 2024, the leading altcoin saw a significant surge, increasing more than 150% from $1600 to $4K.

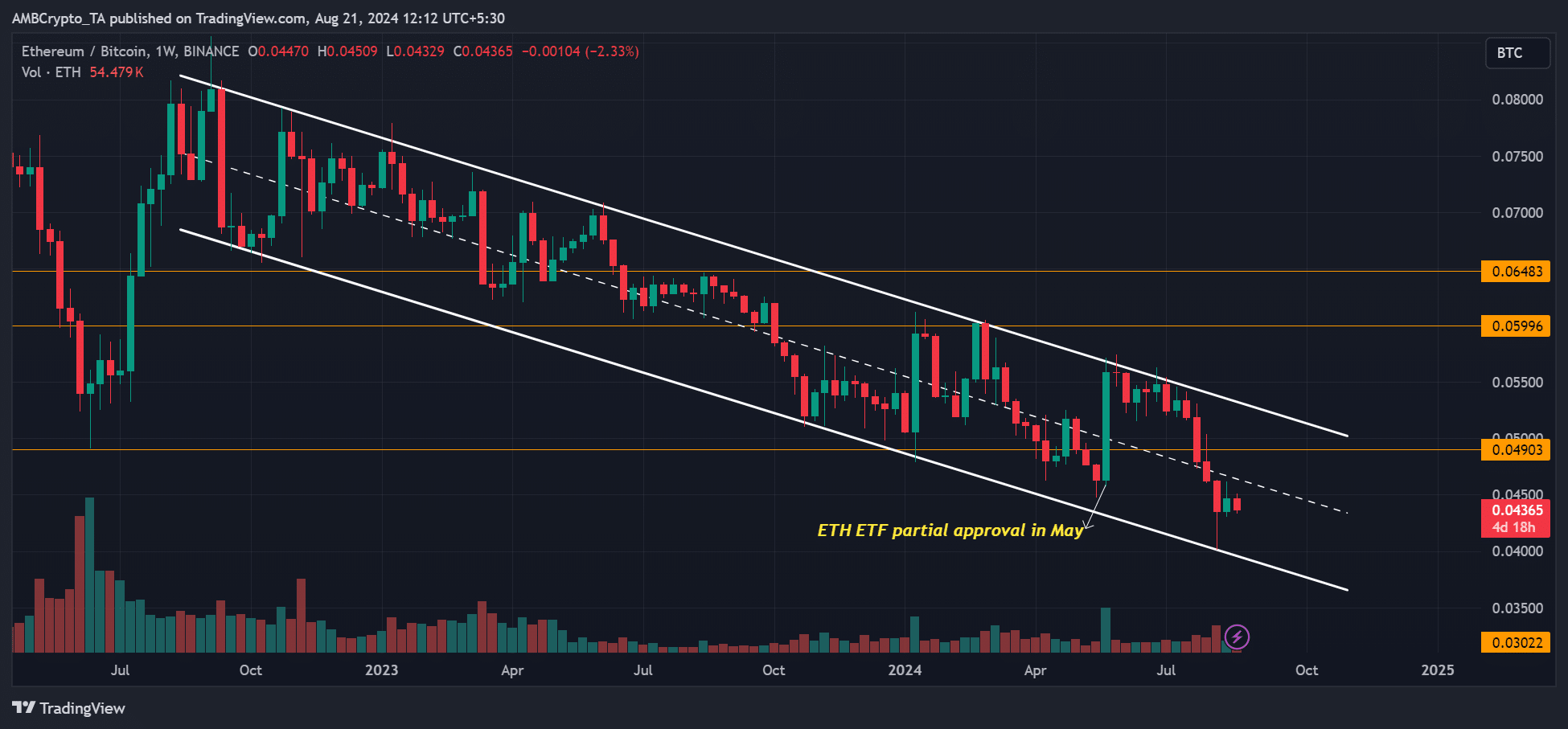

However, overall market headwinds and the SEC’s mixed signals on ETH’s security status in Q2 2024 dented its sentiment. Despite a last-minute pivot by the SEC and the successful launch of US spot ETH ETF, the altcoin’s price has remained muted.

ETH’s bull vs bear case

Currently, when I’m typing this out, Ethereum (ETH) was valued under $3,000, and it appears that the cryptocurrency community is split about its future value predictions. As pointed out by Flip Research, both the optimistic (bull) and pessimistic (bear) groups present convincing cases for their views.

ETH’s bear case

For the bear case camp, the market research analyst noted that ETH’s reduced profits, L2 fragmentation, and direct competition from Bitcoin [BTC] and Solana [SOL] didn’t bode well for the altcoin’s value.

For context, after the Dencun upgrade, fees dropped, and more users migrated to L2s.

‘Profitability has dropped off a cliff post-Dencun, and it doesn’t look like that will change soon’

On the other hand, the division among L2 (Layer 2) systems has become more pronounced, which advantageously positions Solana’s unified blockchain and potentially impacts Ethereum’s future price forecast as per Flip Research’s analysis.

At present, account @l2beat is monitoring 71 layer 2s, 20 layer 3s, and an astounding 82 upcoming launches. This overwhelming amount is negatively impacting user experience and poses a major obstacle for widespread acceptance. On the other hand, Solana (SOL) has demonstrated the power of a unified chain and ecosystem.

Furthermore, Ethereum (ETH) has been lagging behind Solana (SOL) and Bitcoin (BTC), a trend that is evident in the decreasing SOLETH and ETHBTC values. This suggests a less optimistic outlook for Ethereum according to Flip Research.

Even though approval for a U.S. spot ETH ETF was granted, the comparison between ETH and BTC (ETHBTC ratio) still showed a decline. This indicates that during the same timeframe, ETH didn’t perform as well as Bitcoin.

ETH’s bull case

On the other hand, advocates for Ethereum (ETH) have met the bearish perspective with strong reasoning. According to Flip Research, memes have outshone the DeFi discourse, but there was a changing storyline in progress.

As someone who has closely followed the cryptocurrency market for several years now, I have seen trends ebb and flow with remarkable speed. This year, my observation is that Ethereum (ETH) has underperformed compared to other digital assets, a phenomenon that has coincided with a shift in investor focus from DeFi (Decentralized Finance) to meme-based coins. However, I sense a change in the narrative recently.

Another critical point was that ETH was the only institutional-grade and battle-tested chain. BlackRock’s interest in the chain for on-chain tokenization further supported this argument.

‘A significant number of brilliant thinkers in the field are working together to design the Ethereum (ETH) blueprint. Institutions looking to join will do so via Ethereum, including derivatives and on-chain asset tokenization, as well as forecasting markets.’

According to experts at Coinbase, there’s likely to be ongoing interest in Ethereum over the long term due to increasing usage within layer 2 (L2) protocols.

‘It appears that the current patterns suggest a lasting increase in Ethereum (ETH) demand, primarily driven by its usage as collateral in lending markets and for trading pairings within Decentralized Exchanges (DEXs).’

Conversely, Ali Muneeb, a key player in Bitcoin DeFi and creator of Stacks [STX], expressed his preference for Solana over Ethereum.

‘I’d pick Solana over Ethereum any day.’

For two consecutive weeks now, Ethereum (ETH) has maintained its position above $2500, reflecting a period of consolidation. The general mood in the crypto market is subdued, but whether the sentiment for ETH will brighten up or continue to be gloomy is yet uncertain, with compelling reasons on both sides.

Read More

2024-08-21 18:48