- Ethereum (ETH) seemed to be forming a bullish W-pattern on the weekly chart

- Altcoin’s Market Value to Realized Value (MVRV) ratio highlighted its fair valuation

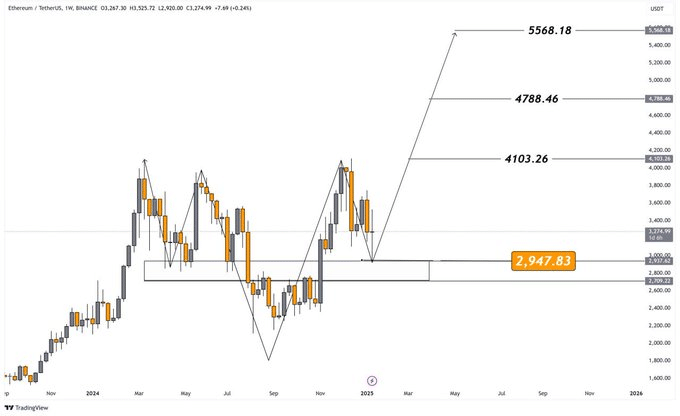

Currently, the cryptocurrency Ethereum (ETH) appears to be shaping a bullish ‘W’ pattern on its weekly chart, suggesting a possible shift in trend and substantial price increase. Notably, the altcoin has been maintaining itself above a crucial support level at approximately $2,947. This key level is now functioning as the neckline of this formation.

The crucial support area plays a key role in predicting Ethereum’s direction, with potential price goals marked at approximately $4,103, $4,788, and $5,568, as indicated on the graph. If Ethereum manages to surpass the resistance level at the neckline, it would signal a bullish trend, potentially leading to substantial profits.

The W-shaped pattern suggests Ethereum’s robustness, emphasizing a transition from negative to positive market trends. Notably, the graph of the cryptocurrency indicates that holding steady above $2,947 is essential for this pattern to unfold effectively.

If the price surpasses $3,200 significantly, it might trigger a swift advancement toward the potential resistance at $4,100.

Gauging Ethereum’s momentum

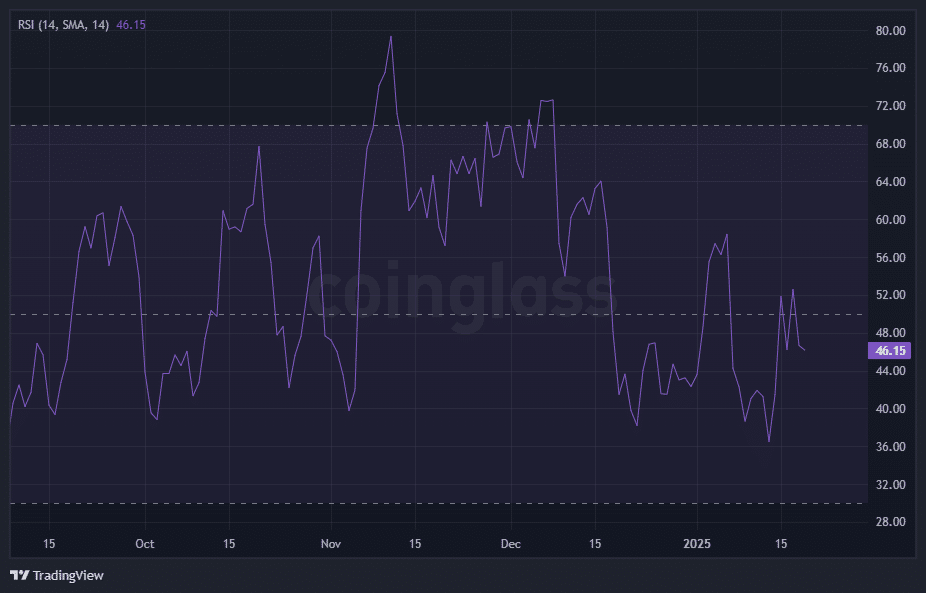

At the current moment, when considering momentum, the Relative Strength Index (RSI) stood at 46.15. This midpoint suggests an equilibrium between purchasing activity from buyers and selling activity from sellers within the altcoin’s market.

Yet, the RSI’s leveling around its central point suggests diminishing bearish influence. A clear surge beyond 50 might indicate resurgent bullish energy, possibly preceding a price spike.

Instead, if the price falls below $40, it could indicate a potential continued decline that may threaten the $2,947 support level.

Assessing Ethereum’s valuation

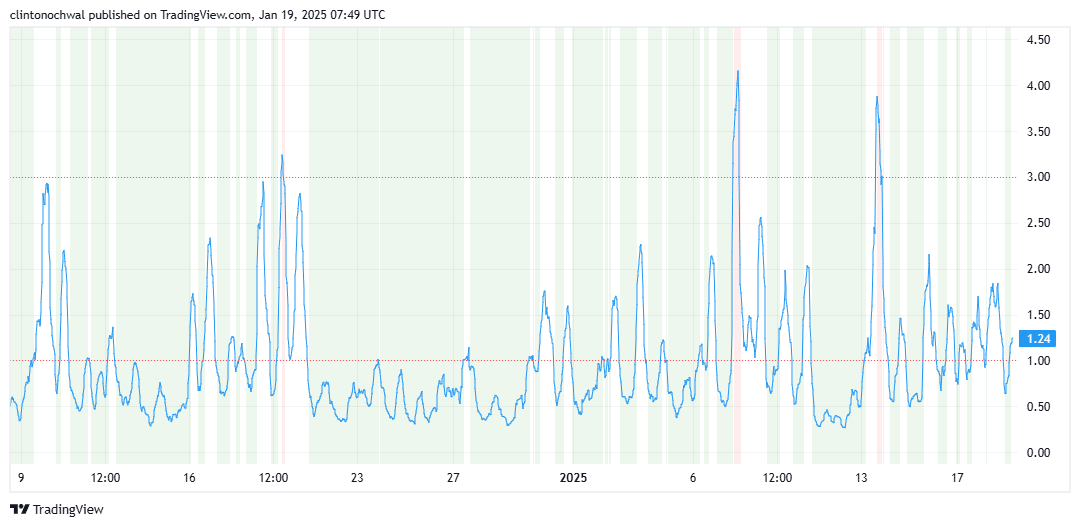

It’s also beneficial to examine Ethereum’s Market Value to Realized Value (MVRV) ratio for further understanding. At the moment, this ratio suggests a fair market valuation, as it’s close to its neutral levels – Indicating that ETH is neither overpriced nor underpriced.

Historically, when the MVRV (Market Value to Realized Value) ratio exceeds 1.2, it has led to a surge in selling pressure. Conversely, ratios below 0.8 tend to draw in buyers. As ETH moves towards higher price levels, there’s a possibility that this ratio might indicate overvaluation, which could warrant caution for long-term investors.

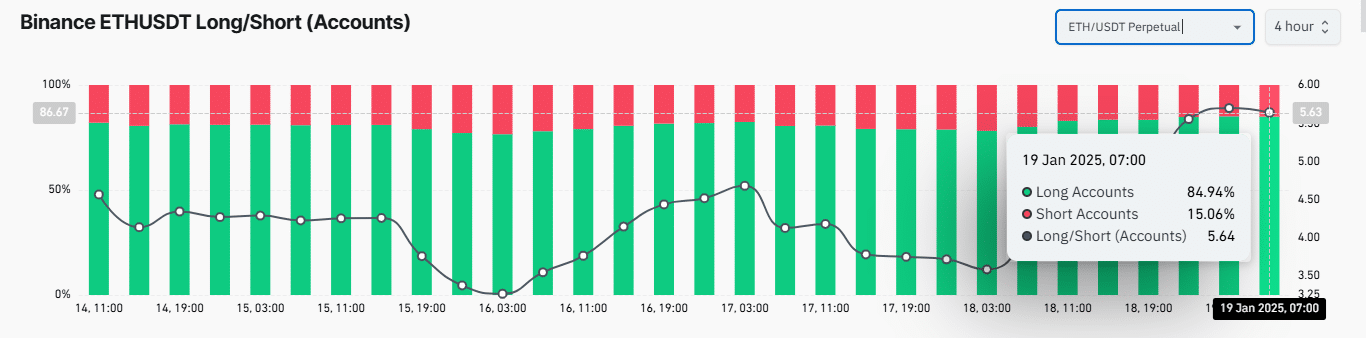

As a crypto investor, I recently noticed an intriguing finding: The long/short ratio showed that a staggering 84.94% of accounts are holding Ethereum in a long position. This suggests a robustly optimistic outlook among investors towards Ethereum, indicating potentially strong bullish sentiment.

This significant bias towards buying suggests a possible increase in prices, given that buyers have been in control up until now. Yet, an overabundance of buy orders could lead to sudden price drops as well. This risk becomes more prominent when the market mood changes or large sell-offs happen during turbulent periods.

The trends on Ethereum’s weekly chart and its technical indicators suggested a crucial turning point for the cryptocurrency. With the formation of a W-pattern, along with a neutral Relative Strength Index (RSI) and an equilibrated Market Value to Realized Value (MVRV) ratio, there was a strong possibility that Ethereum could experience a bullish surge if it maintains its critical levels.

Read More

2025-01-19 22:16