- Ethereum’s supply spiked last month.

- This has happened due to a decline in daily active addresses on the network.

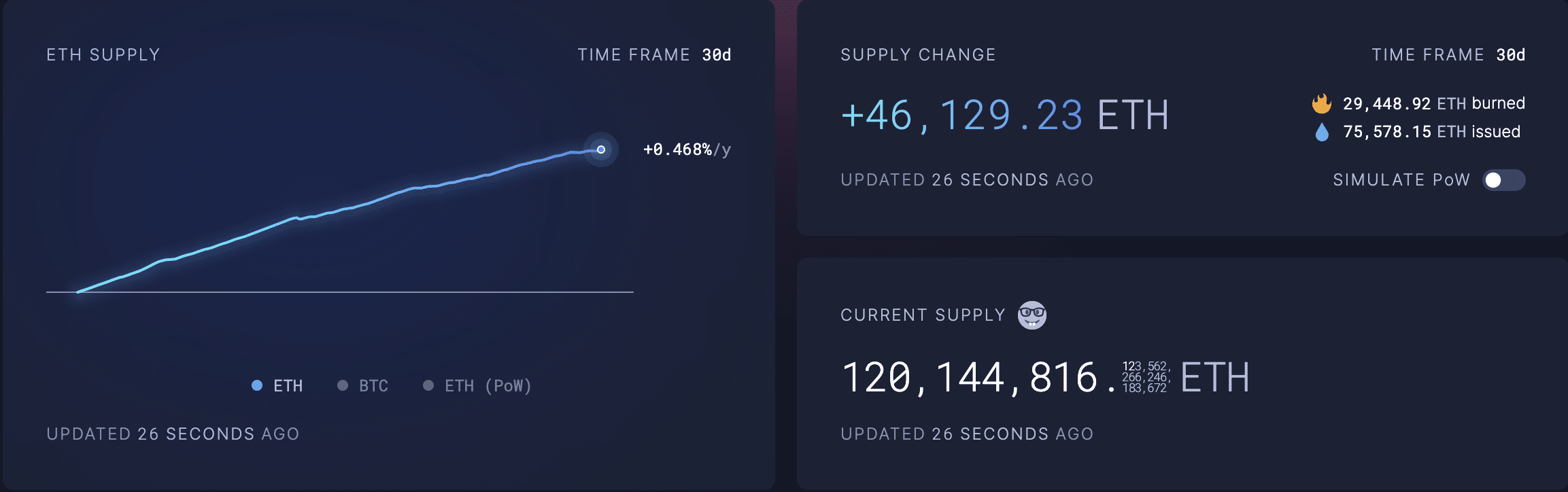

As a researcher with extensive experience in the cryptocurrency market, I’ve closely monitored the recent developments on Ethereum [ETH]. Last month, we witnessed a significant increase in Ethereum’s supply, which has pushed its circulating amount to a 30-day high of 120.14 million ETH. This inflationary trend is primarily due to a decline in daily active addresses on the network.

Approximately $176.22 million worth of Ethereum (ETH), equivalent to 46,138 units, have recently entered circulation, causing the Ethereum supply to reach a 30-day peak of 120.14 million ETH according to Ultrasound.money’s latest data.

The continuous increase in the circulating Ethereum coins implies that its supply is presently expanding, which occurs when the network experiences a decrease in usage by its users.

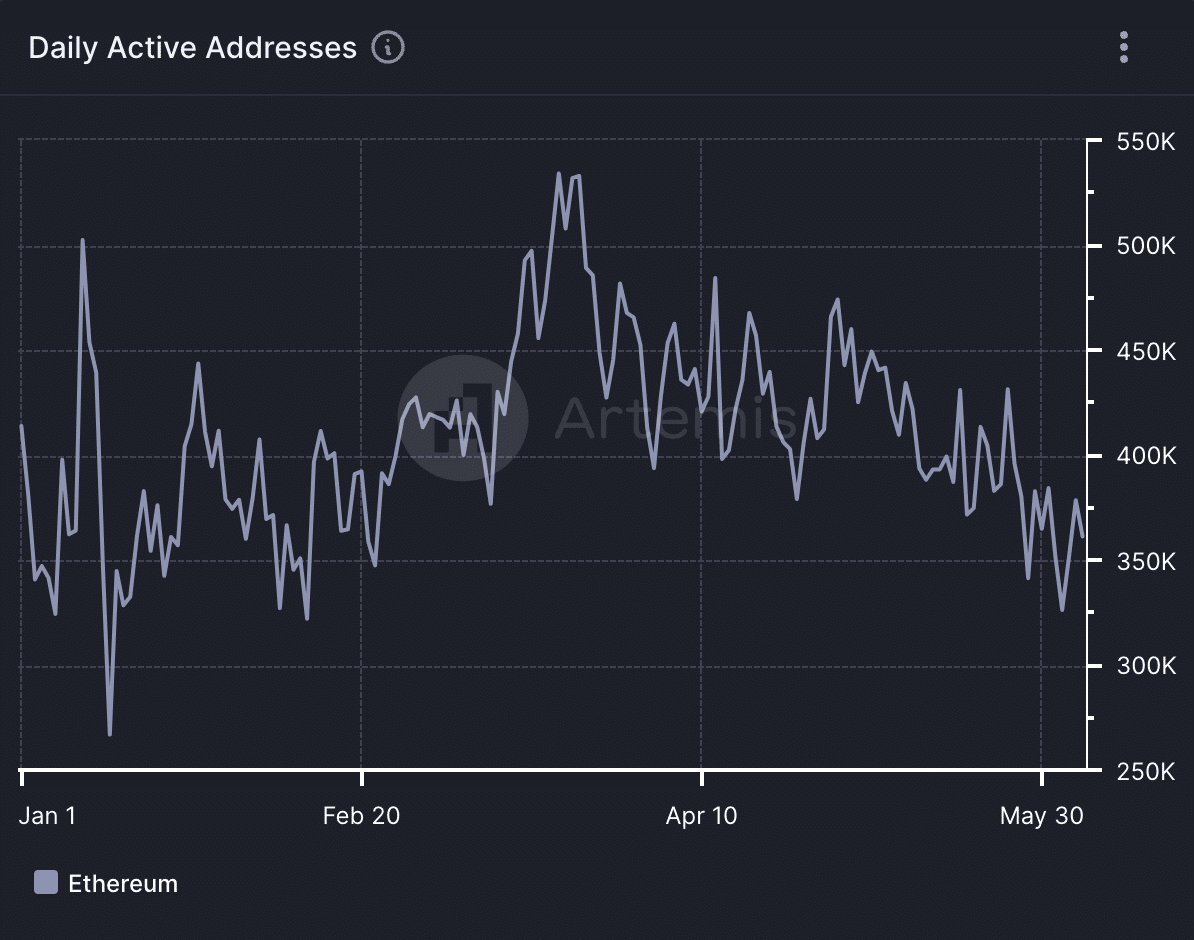

According to AMBCrypto’s confirmation, there has been a reduction in the number of distinct Ethereum blockchain users engaging in daily transactions over the past month, as indicated by data from Artemis.

Based on information from an on-chain data provider, there were approximately 361,200 distinct Ethereum addresses that executed at least one transaction by June 5. This figure represented a 14% decrease compared to the 421,000 unique addresses that carried out transactions on May 8.

During my investigation into the given timeframe, I discovered that the number of daily active cryptocurrency addresses reached a three-month minimum of 326,200 on the 2nd of June.

Based on Artemis’ information, the previous occurrence of such a low daily count for Ethereum’s active addresses can be traced back to 8th February.

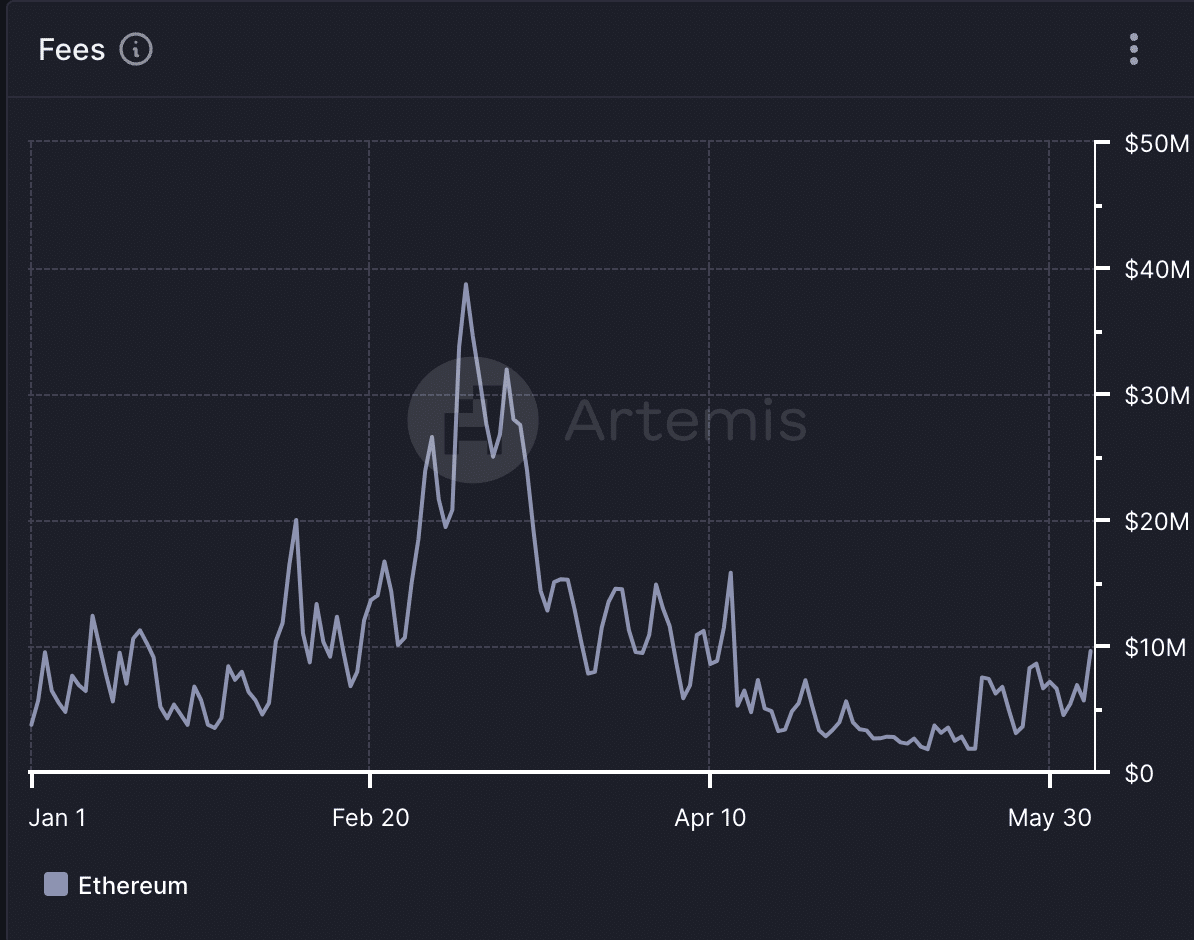

During the examined timeframe, Ethereum’s value experienced a notable 25% increase. Surprisingly, this surge did not lead to a decrease in overall transaction fees on the Ethereum network. Instead, fees continued to climb, despite a drop in user activity.

On 5th June, Ethereum’s transaction fees totaled $10 million, its highest since 13rd April.

A look at Ethereum’s DeFi and NFT verticals

As a researcher studying the recent trends of this particular blockchain network, I’ve noticed a decrease in user activity over the past month. However, I’m excited to report that the decentralized finance (DeFi) ecosystem embedded within it has experienced significant growth during this period.

As a researcher studying the Decentralized Finance (DeFi) landscape on Ethereum, I’ve observed an intriguing development: The combined value of assets locked across all DeFi protocols on Ethereum has experienced a significant surge of 25.38% over the past month. This growth places Ethereum as the second-ranked blockchain, following Arbitrum [ARB], in terms of TVL expansion during this time frame.

Read Ethereum (ETH) Price Prediction 2024-25

As a crypto investor, I’m excited to share that according to the latest data from DefiLlama, Ethereum’s Total Value Locked (TVL) has reached an impressive $66.33 billion at present moment. This is not only a year-to-date record but also marks Ethereum’s highest TVL level since May 2022.

The market for Ethereum’s non-fungible tokens (NFTs) hasn’t experienced the same level of success during this time frame. In fact, according to CryptoSlam, there has been a significant decrease of over 56% in NFT sales volume on Ethereum within the last month.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Gold Rate Forecast

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-06-07 22:15