-

Ethereum community members had divergent views on ETH’s value and road map.

The mixed signals from Ethereum leadership could dent ETH’s sentiment.

As a seasoned researcher with a knack for deciphering the intricacies of the cryptocurrency market, I find myself constantly juggling contrasting views and opinions within the Ethereum [ETH] community. The latest debates surrounding ETH’s value and roadmap are no exception.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastThe leadership within Ethereum [ETH] has recently garnered attention due to their long-term plan and perspectives on the growth of ETH’s value. A member of the Ethereum community, Justin Drake, likened ETH to tech giants such as Nvidia and Apple, implying that it could potentially reach multi-trillion dollar valuations if its transaction fees are taken into account.

Drake stated,

As a researcher delving into the realm of digital currencies, I find Ethereum analogous to a global tech giant such as Nvidia or Apple. The value it holds can soar to multitrillion-dollar levels primarily due to transaction fees, or ‘flows’ in simpler terms. Yet, this is just the beginning. There’s an entirely separate discussion to be had regarding Ethereum’s potential as a medium of exchange, collateral, and foundation for decentralized stablecoins, which could further elevate its worth beyond these already astronomical trillions of dollars.

Mixed views on ETH’s value

Nonetheless, some individuals involved in the Ethereum ecosystem held differing opinions regarding these suggested leadership perspectives. Sam Kazemian, the founder of DeFi protocol Frax Finance, was among those expressing criticism.

Kazemian argued that evaluating Ethereum in relation to companies like Nvidia or Apple might restrict its growth potential relative to Bitcoin. In his view, such a valuation would not prove beneficial for Ethereum as an altcoin asset.

‘Currently, ETH generates about $1 billion in annual revenue. To reach the same level as Apple’s revenue, we would need to multiply ETH’s revenue by approximately 385 times. This would imply that ETH’s value would increase by around 11 times to match Apple’s valuation. Is this a realistic and beneficial path for ETH?’

He believed this was a flawed way for the leadership to gauge ETH’s value and might not compete with BTC.

Is Ethereum, with its valuation determined by the cash flow from transaction fees, capable of competing with or even surpassing Bitcoin in the market?

He added,

“Apple generates an annual revenue of $385 billion and has a market value of $3.3 trillion. On the other hand, Bitcoin doesn’t produce any annual revenue because it’s digital currency, yet it currently holds a market value of $1.1 trillion.

Just as many protocol creators do, Kazemian advocated that the fundamental worth of Ethereum should be rooted in its function as a ‘means of preserving value’ (SoV) and its Decentralized Finance (DeFi) infrastructure.

ETH leadership says…

Instead of Bitcoin being often referred to as “digital gold,” Ethereum has found it challenging to create a compelling and unified narrative that resonates with potential investors. The emphasis on Ethereum as “programmable money” and “digital oil” hasn’t generated the anticipated interest.

The vision for Decentralized Finance (DeFi) on Ethereum has sparked diverse perspectives among its leaders. To illustrate, Vitalik Buterin expresses reservations towards DeFi being the sole driving force behind cryptocurrency’s expansion.

In contrast to other community members such as Kazemian and Hayden Adams from Uniswap, this individual held a different perspective; they viewed Decentralized Finance (DeFi) as essential for Ethereum’s value expansion.

Based on insights from analysts at Coinbase, the differing perspectives regarding Ethereum’s Decentralized Finance (DeFi) have created confusion among new investors about the asset, negatively impacting its overall market perception.

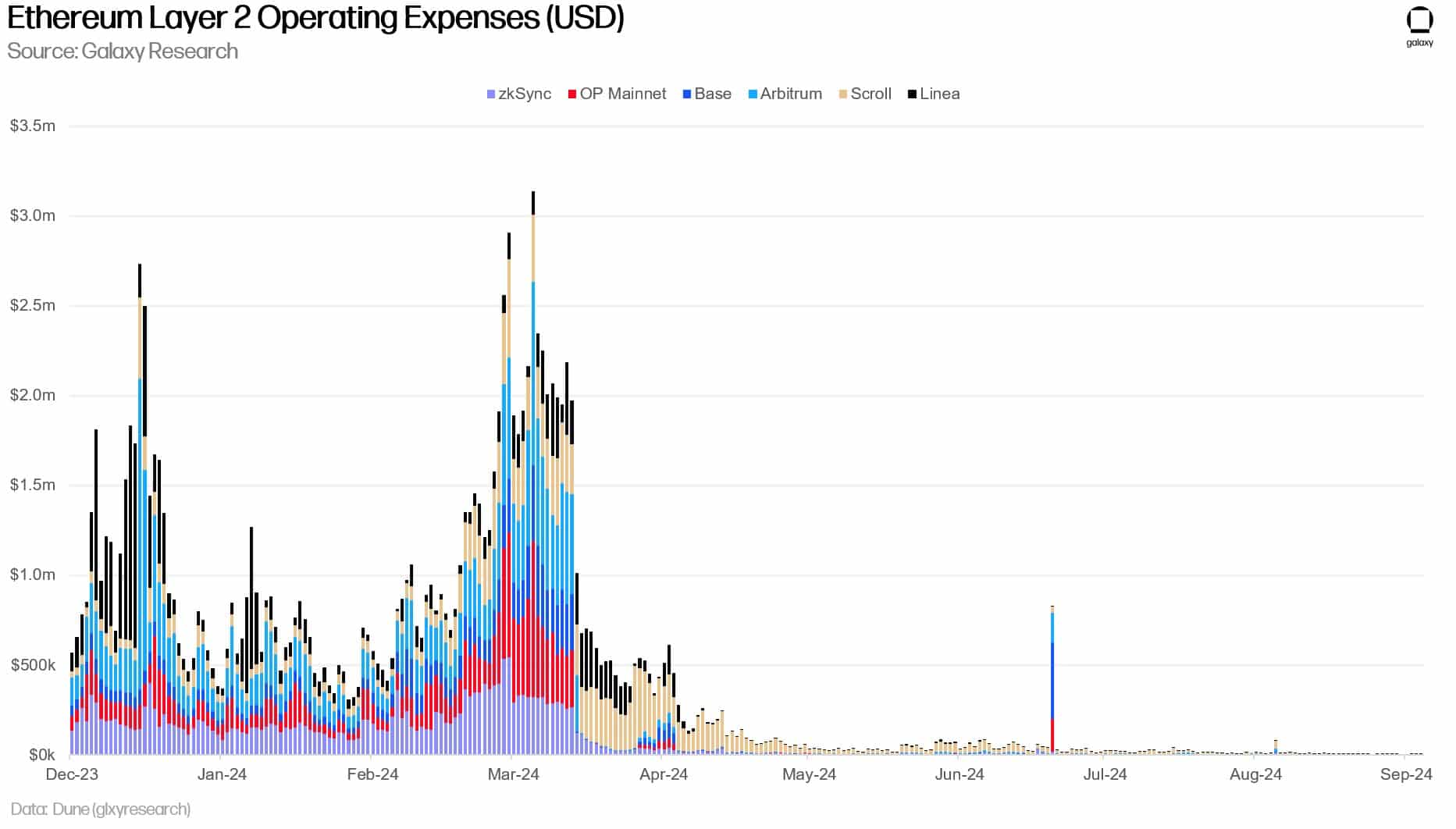

Additionally, Ethereum’s transaction fees have significantly decreased following the Dencun update in March, due largely to the introduction of cheap data structures that encouraged users to move to Layer 2 solutions.

As a crypto investor, I’ve been pondering over the ongoing debate within our community about adjusting Blob fees to boost Ethereum L1’s worth from L2s, given that Ethereum’s inflation issue seems to intensify following the Dencun upgrade. The question at hand is whether we should tweak these fees to address this challenge and leverage the value Ethereum could gain from layer-2 solutions.

The above community issues have shattered investor sentiment around ETH even further.

In simpler terms, over the last two years, Ethereum (ETH) has fallen behind Bitcoin (BTC). This is evident when looking at the Ethereum/Bitcoin ratio, which measures ETH’s price performance versus BTC. Specifically, ETH’s value has decreased by 44% compared to that of Bitcoin.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-09-08 20:08