In the annals of on-chain chronicles, one discerns that the illustrious metric known as Ethereum Daily Active Addresses has surged with an unexpected vigor. This sudden ascent, reminiscent of the fervent stirrings of a nation on the cusp of transformation, suggests that the realm of cryptocurrency is, once again, abuzz with renewed activity. Indeed, dear reader, such a phenomenon is as unpredictable as the caprices of fate itself—😏

The Epoch of Ethereum’s Daily Addresses: An Unprecedented Apex in Two Years

According to the esteemed institution Sentora—renowned for its forays into the labyrinthine world of decentralized finance—the Ethereum blockchain has been imbued with a fresh vigor. The “Daily Active Addresses” serves as a meticulous ledger, chronicling the ceaseless comings and goings of innumerable ETH addresses engaged daily in the transfer of assets. This metric, though but a number, stands as a faithful chronicle of the ceaseless human endeavor in the digital sphere.

When one observes an elevation in this metric, it is as if a multitude of souls has converged upon the network, each contributing to the vibrant tapestry of commerce. In the realm of cryptocurrency, such burgeoning activity often heralds an increase in trading interest, much like the gathering storm that precedes a grand battle. 🌩️

Conversely, should the indicator descend, it portends a quietening of the fervent activity upon the blockchain—a sign that the hearts and minds of investors may be drifting away from this digital asset. As with the ebb and flow of human passions, the market’s pulse is as fickle as the wind.

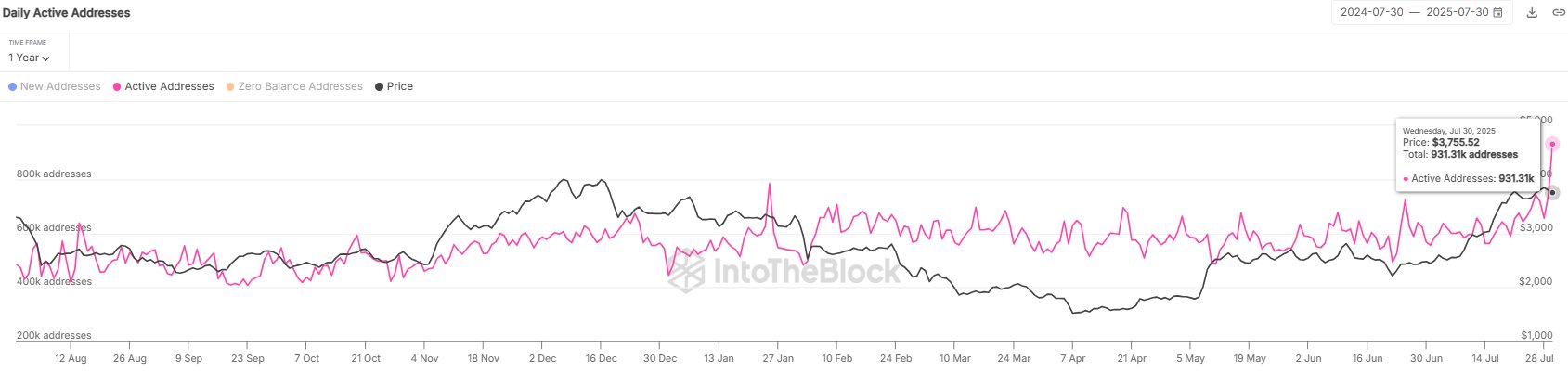

Behold, the chart that chronicles the fluctuating fortunes of Ethereum’s Daily Active Addresses over the span of a year—a tapestry woven with the threads of digital commerce.

As the graph above reveals, the Ethereum Daily Active Addresses have, in their latest rally, soared beyond the familiar consolidation around the figure of 600,000. This deviation is not merely a numerical anomaly but a harbinger of renewed interest, much like the stirring of a nation on the brink of change. Indeed, such a departure from the norm is as beguiling as it is foreboding.

In a twist as sudden as fate’s caprice, the trend has recently accelerated, culminating in a precipitous spike that has thrust the indicator to the remarkable figure of 931,310—the highest daily level observed in nearly two years. Such a rapid ascent is a spectacle that evokes both wonder and a touch of skepticism. 😲

Historically, an eruption of transactional activity among the denizens of the network has frequently served as the harbinger of volatility. For the Daily Active Addresses, a mere count of transactions betrays no secrets as to whether fortune favors buyers or sellers—it merely attests that the market is alive with motion, as unpredictable as the tides. Indeed, in this digital age, one finds that even the most stalwart metrics are subject to the whims of fortune.

It now seems that this meteoric spike in the Daily Active Addresses has, in its wake, ushered in a period of volatility; for as the indicator soared, so too has the price of Ethereum experienced a precipitous decline—a development as ironic as it is inevitable. One might say that the market, much like life itself, is an endless dance of peaks and troughs. 💃

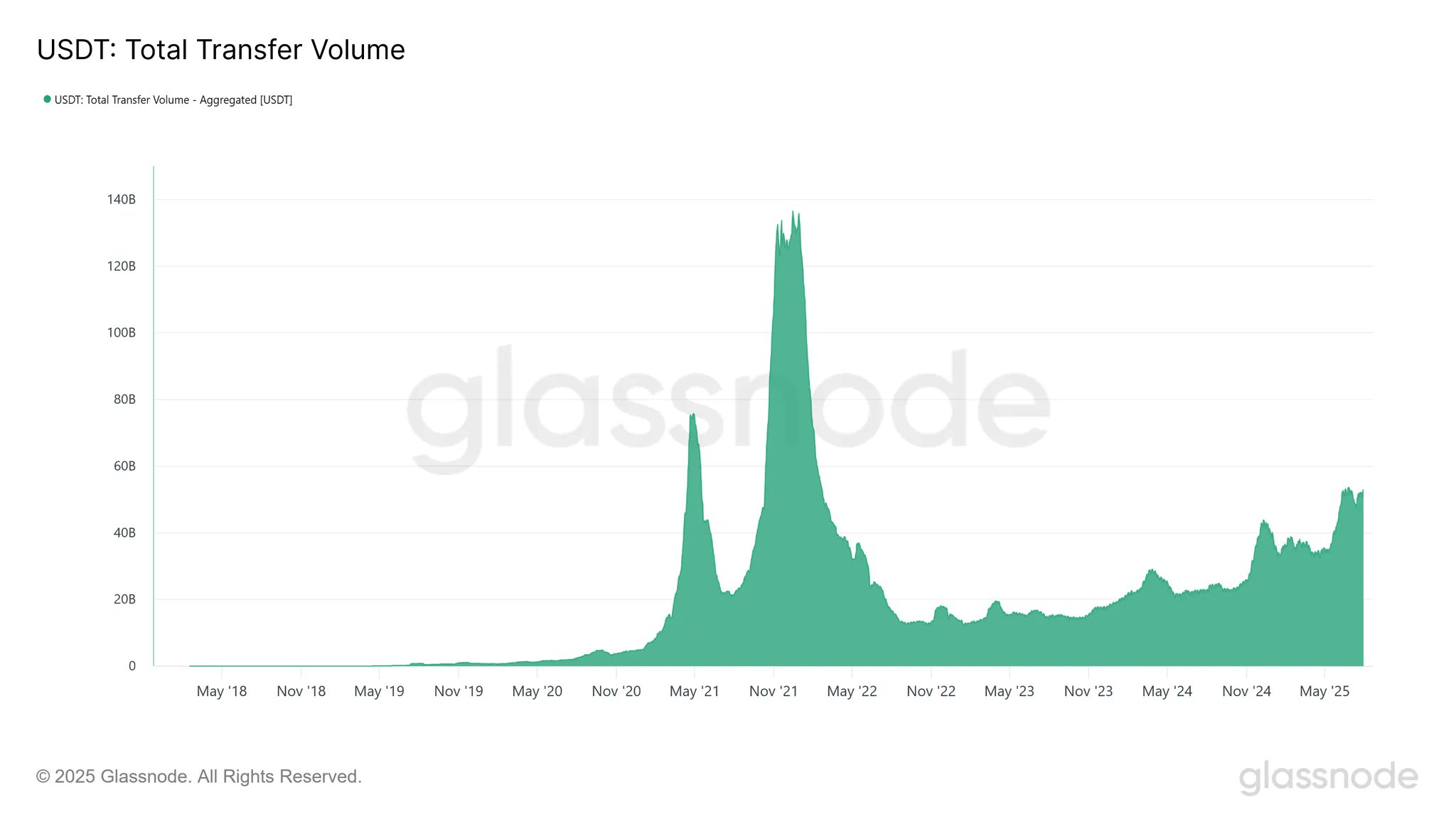

In an amusing twist of the digital saga, the venerable stablecoin USDT has witnessed its 30-day moving average transfer volume make a triumphant return to the lofty sum of $52.9 billion—a development elucidated by the perspicacious analysts at Glassnode in a recent X post. One might remark, with a wry smile, that even in the realm of stablecoins, fortunes are as changeable as the seasons. 🤪

The accompanying graph bears witness to the gradual resurgence of USDT’s transfer volume since the calamitous crash of 2022. “This gradual climb reflects a slow but consistent recovery in stablecoin velocity and market activity,” observes the sagacious Glassnode, much like a phoenix rising from the ashes of economic despair.

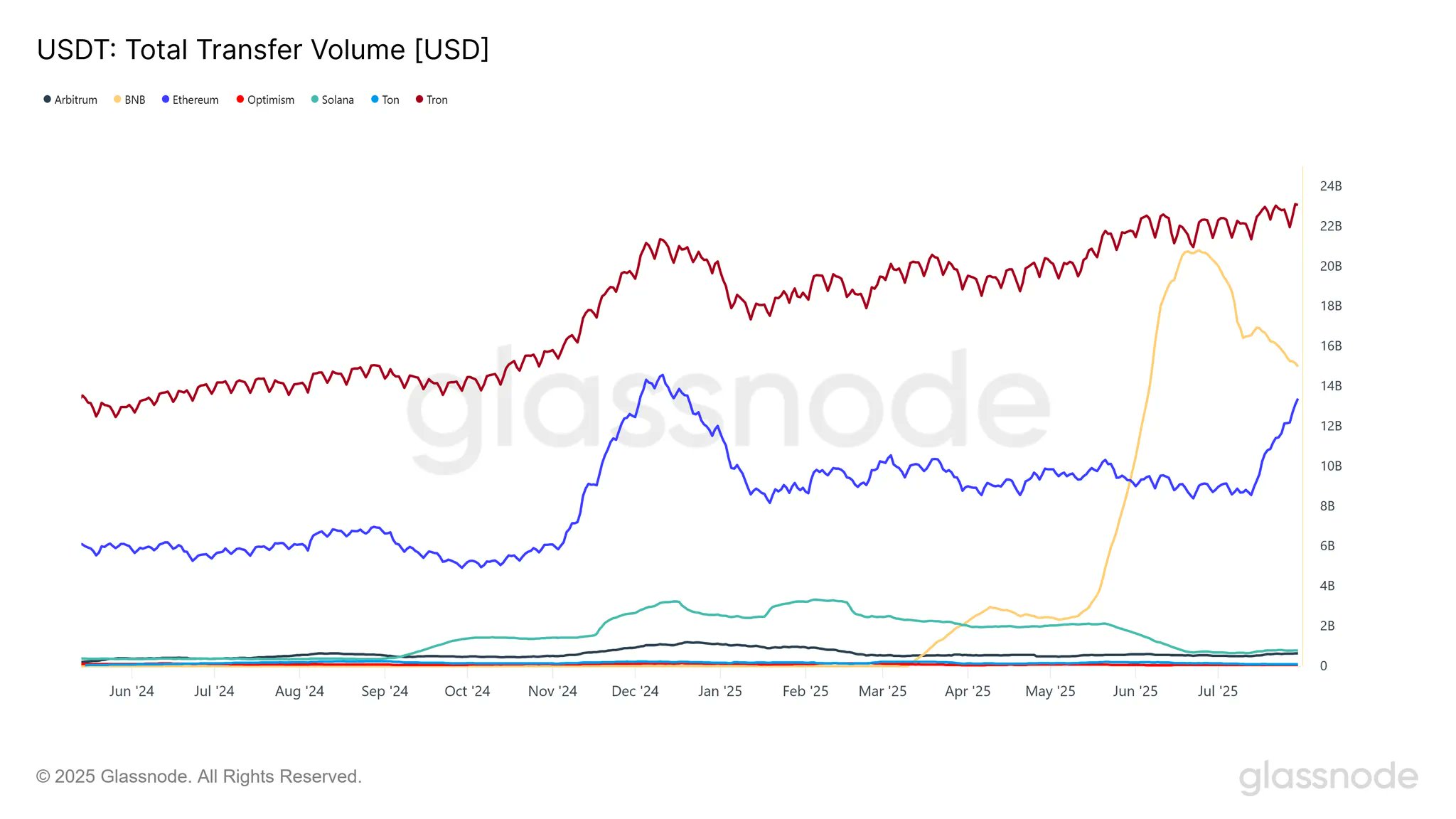

It is a curious, perhaps even ironic, observation that Ethereum does not grace the list of the top two networks commanding the lion’s share of this stable’s volume—a twist that reminds one of life’s unpredictable turns. Indeed, who would have thought that the stalwart Ethereum might be outshone in this arena? 😅

Indeed, it is the networks of Tron and BNB that have ascended to the pinnacle of USDT volume, commanding shares of $23 billion and $14.9 billion respectively. One cannot help but marvel at the digital coliseum where fortunes are won and lost with the caprice of a gambler’s dice roll. 🎲

The Current Valuation of Ethereum

As of this moment, Ethereum finds itself trading in the vicinity of $3,650—a decline of approximately 3.5% over the preceding day. Such fluctuations are as inevitable as the changing seasons, a constant reminder of the market’s mercurial temperament. In this digital age, one must always be prepared for the unexpected. 😎

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Controller Settings for ARC Raiders

- Goat 2 Release Date Estimate, News & Updates

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Werewolf Movies (October 2025)

- 10 Movies That Were Secretly Sequels

2025-08-02 12:16