- Oh, the tragedy! Ethereum’s exchange supply has plummeted to its lowest level in nine long years.

- Could this dramatic supply squeeze be the spark for a price surge? Or just a cruel joke? 😏

Alas! The supply of Ethereum [ETH] on exchanges has descended to depths unseen since 2016, heralding a liquidity squeeze that might just support a medium-term bullish outlook. Or is it merely a mirage in the desert of despair?

With the sell-side pressure easing like a gentle breeze and accumulation rising like a loaf of bread in the oven, could ETH reclaim the critical $3.5K resistance in the near term? Or will it trip over its own feet? 🤷♂️

Key technicals flash bullish

Despite the absence of signs of overheating, Ethereum remains a staggering 32% below its post-election peak of $4,016, having formed four consecutive lower lows. A true masterpiece of decline!

This time, however, the RSI has bottomed out, and a bullish MACD crossover is taking shape – suggesting ETH’s consolidation could be building momentum for a breakout. Or perhaps just a fancy dance move? 💃

Yet, historical patterns whisper caution. Previous recoveries have failed to breach key resistance as demand struggled to absorb sell pressure. A tragic comedy, indeed!

However, Ethereum’s spot exchange supply has plunged to a 9-year low of 8.2 million ETH. A dramatic fall worthy of a stage play!

With tightening liquidity and potential demand acceleration, conditions are aligning for a supply shock – one that could fuel a breakout past key resistance levels. Or just a puff of smoke? 🎭

Mapping Ethereum’s next major resistance zone

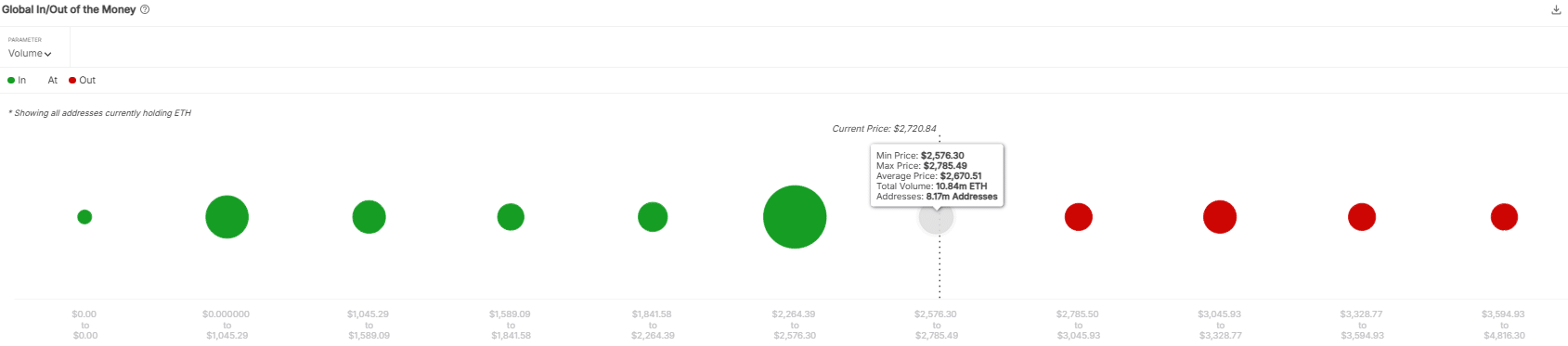

Ethereum faces a critical resistance at $2,785, where 8.10 million addresses would flip profitable, exposing $20 billion to potential sell pressure. A veritable treasure chest, or a Pandora’s box? 💰

While spot reserves hit a 9-month low, signaling accumulation, investors offloaded over 2 million ETH into exchanges in February, raising concerns about mounting sell pressure. A classic case of “what goes up must come down!”

Weak demand from U.S. and Korean investors further threatens upside momentum, potentially trapping leveraged longs in the futures market. A tangled web of financial intrigue!

If demand fails to recover, Ethereum could face a pullback toward $2,264, where 62.38 million ETH is concentrated. A dramatic cliffhanger, indeed!

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2025-02-20 02:18